Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

I'll show you mine if you show me yours - your portfolio!

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

I'll show you mine if you show me yours - your portfolio!

It's been a few months since I last did this but it's worth looking at what you hold and why.

Comments welcome but I'm more interested in seeing what other people hold.

It's about 50% held in tax shelters (ISA and SIPPs) and the rest is going in over time.

Also hold cash and cash equivalents (NS&I products) equal to about 30% of the value of the share portfolio.

So 70:30 shares to cash.

Table formatting done here: http://lemonfoolfinancialsoftware.weebly.com/tableformat.html

What's in your portfolio and why?

Comments welcome but I'm more interested in seeing what other people hold.

It's about 50% held in tax shelters (ISA and SIPPs) and the rest is going in over time.

Also hold cash and cash equivalents (NS&I products) equal to about 30% of the value of the share portfolio.

So 70:30 shares to cash.

Table formatting done here: http://lemonfoolfinancialsoftware.weebly.com/tableformat.html

What's in your portfolio and why?

-

doug2500

- Lemon Slice

- Posts: 664

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 288 times

- Been thanked: 249 times

Re: I'll show you mine if you show me yours - your portfolio!

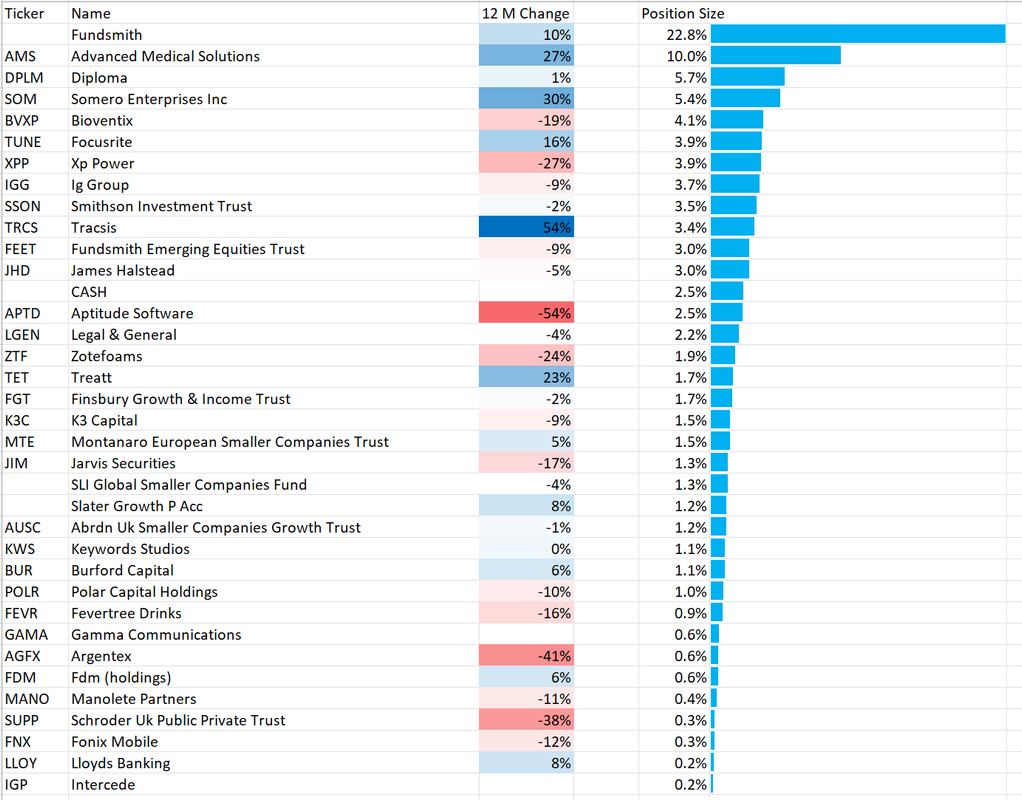

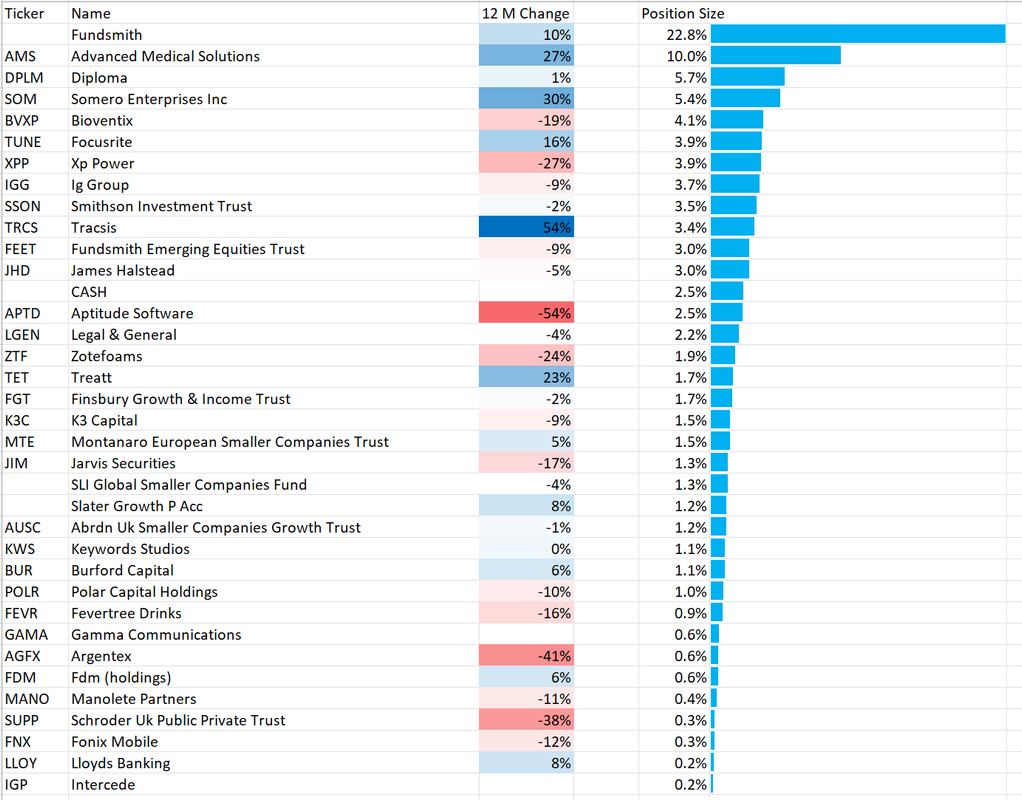

It would take a bit of time to add reasons, but here's one I made earlier to kick you off:

You can assume income is not the focus, although some pay out quite nicely.

You can assume income is not the focus, although some pay out quite nicely.

-

Aminatidi

- Lemon Slice

- Posts: 428

- Joined: March 4th, 2018, 8:22 pm

- Has thanked: 61 times

- Been thanked: 116 times

Re: I'll show you mine if you show me yours - your portfolio!

This represents around £290K.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: I'll show you mine if you show me yours - your portfolio!

Aminatidi wrote:This represents around £290K.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

Someone looks defensive here!

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: I'll show you mine if you show me yours - your portfolio!

Interesting portfolio. I'd be interested in your reasoning - if not for each holding, the general/main ideas.

I do like that barchart in Excel! Conditional formatting bars?

Also, from the red, I assume you don't use stop losses, so how do you decide to sell?

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: I'll show you mine if you show me yours - your portfolio!

absolutezero wrote:

Interesting portfolio. I'd be interested in your reasoning - if not for each holding, the general/main ideas.

I do like that barchart in Excel! Conditional formatting bars?

Also, from the red, I assume you don't use stop losses, so how do you decide to sell?

I would be inclined to call that portfolio, adventurous.

Does he sell?

Dod

-

Aminatidi

- Lemon Slice

- Posts: 428

- Joined: March 4th, 2018, 8:22 pm

- Has thanked: 61 times

- Been thanked: 116 times

Re: I'll show you mine if you show me yours - your portfolio!

absolutezero wrote:Aminatidi wrote:This represents around £290K.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

Someone looks defensive here!

Defensive or balanced depending on your perspective I guess

I worked hard for it and I don't want to lose it and I'm happy to get rich slowly by not losing.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: I'll show you mine if you show me yours - your portfolio!

Aminatidi wrote:absolutezero wrote:Aminatidi wrote:This represents around £290K.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

Someone looks defensive here!

Defensive or balanced depending on your perspective I guess

I worked hard for it and I don't want to lose it and I'm happy to get rich slowly by not losing.

"Winning the losers' game"

-

stevie1912

- Posts: 13

- Joined: March 9th, 2019, 7:40 pm

- Has thanked: 11 times

- Been thanked: 5 times

Re: I'll show you mine if you show me yours - your portfolio!

Some context - I want to retire within 2 years, no FS provision.

Difficult to know what to do for non equity part. Have been reluctant to invest in bonds, so have held cash as a proxy to short term gilts. This has helped this year, despite value of cash dwindling due to high level of inflation.

ITs have recently underperformed trackers .

Difficult to know what to do for non equity part. Have been reluctant to invest in bonds, so have held cash as a proxy to short term gilts. This has helped this year, despite value of cash dwindling due to high level of inflation.

ITs have recently underperformed trackers .

-

doug2500

- Lemon Slice

- Posts: 664

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 288 times

- Been thanked: 249 times

Re: I'll show you mine if you show me yours - your portfolio!

I suppose it is adventurous, but pretty much all holdings have strong BS's and are unlikely to run into financial trouble / distressed fundraises etc. They aren't particularly likely to multibag in a year either, but hopefully they will compound away to generate above average returns. So far this has been working. Certainly not adventurous like tesla or crypto / blockchain. Arguably not as adventurous as some O & G or mining either.

I can afford to be a bit adventurous (hence I tolerate the unbalanced pf) as my cake is my family business, and my pf is my cherry on top.

I do sell but seldom on valuation, much to my cost the last year. I try to sell on trouble or profit warnings, when the investment case changes etc. But once I've built up a holding I tend to sit on it and give it space and time. My bigger holdings are mostly my longest held (very roughly speaking) so DPLM was first bought in 2011 and AMS in 2009. Doing nothing through covid worked okay and I recognised valuations were high last year but did nothing, with some small regret.

The aim is to maximise long term total return without too much risk (total loss, I can stand volatility). I think the biggest risk was possibly the high valuations and that's largely resolved now!

More detail here if anyone wants it:

viewtopic.php?f=56&t=4511&start=20

I can afford to be a bit adventurous (hence I tolerate the unbalanced pf) as my cake is my family business, and my pf is my cherry on top.

I do sell but seldom on valuation, much to my cost the last year. I try to sell on trouble or profit warnings, when the investment case changes etc. But once I've built up a holding I tend to sit on it and give it space and time. My bigger holdings are mostly my longest held (very roughly speaking) so DPLM was first bought in 2011 and AMS in 2009. Doing nothing through covid worked okay and I recognised valuations were high last year but did nothing, with some small regret.

The aim is to maximise long term total return without too much risk (total loss, I can stand volatility). I think the biggest risk was possibly the high valuations and that's largely resolved now!

More detail here if anyone wants it:

viewtopic.php?f=56&t=4511&start=20

-

Aminatidi

- Lemon Slice

- Posts: 428

- Joined: March 4th, 2018, 8:22 pm

- Has thanked: 61 times

- Been thanked: 116 times

Re: I'll show you mine if you show me yours - your portfolio!

absolutezero wrote:Aminatidi wrote:absolutezero wrote:Aminatidi wrote:This represents around £290K.

Stock name % Weight Sector

1 Capital Gearing Trust Plc Ord GBP0.25 37.9% [N/A]

2 Ruffer Investment Company Red Ptg Pref Shs GBP0.0001 37.2% [N/A]

3 Vanguard ETFs FTSE All-World UCITS ETF (Dist.) (USD) Distributing 12.5% Global

4 Cash 12.4% [N/A]

Reasoning is I dislike volatility and prefer to leave the bulk of it to (so far) trusted hands.

Someone looks defensive here!

Defensive or balanced depending on your perspective I guess

I worked hard for it and I don't want to lose it and I'm happy to get rich slowly by not losing.

"Winning the losers' game"

Something like that.

Offense wins games... defense wins championships etc.

-

Newroad

- Lemon Quarter

- Posts: 1095

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 343 times

Re: I'll show you mine if you show me yours - your portfolio!

Hi AbsoluteZero.

I had to add some columns in to answer your question. In overall terms

To clarify further

The above is managed broadly as follows

It may sound sort of complex, but really, it's not - just plug the numbers in once per month (end of month for the record, mid-month again to determine the regular investments) and only "manually" rebalance other than via the regular investments if 5% or more off target. Each sub-portfolio is unitised (two ISAs, two SIPPs and two JISAs, one pseudo-HYP) with 24 measurements per year as per the above.

Regards, Newroad

I had to add some columns in to answer your question. In overall terms

- Mr N Equities: 20.26%

Mr N Bonds: 6.55%

Mrs N Equities: 26.28%

Mrs N Bonds: 10.77%

Mstr N Equities: 9.68%

Mstr N Bonds: 2.59%

Miss N Equities: 7.81%

Miss N Bonds: 1.94%

Mr & Mrs N Pseudo-HYP: 0.58%

Mr & Mrs N Cash: 13.56%

plus

Mr N Final Salary Pension nominally (at present) 1.90% pa of the above totals, if and when realised

To clarify further

- The equities in each case are split roughly 50% Passive (VWRL or VWRP) & 50% Active (MWY, ATST or FCIT)

The bonds each case are split roughly 65% Passive and Investment Grade (VAGP) & 35% Active and mostly not Investment Grade (HDIV or BIPS)

Mr N has a fixed component he does not alter through work, about 77% equities

Mrs N has a fixed component she does not alter through work, about 75% equities

Mstr N and Miss have a fixed contribution per month (into MNP) from one set of grandparents

The pseudo-HYP is a recent initiative and currently only has two holdings, RIO and BATS

The above is managed broadly as follows

- First and foremost, target the equity percentages (the "North Star") - these calibrate by age (78% at birth, 48% if we make 100)

All equity holdings are taken into account in the above, e.g. even the fixed work/grandparental ones we don't have complete control over

The rest of the tax sheltered investments go into bonds

Cash is first used to fund the tax sheltered investments above

Excess cash (to help target equity weighting) is now gradually being diverted to the pseudo-HYP (one purchase per month). You can find details of this elsewhere on this site, but in approximate terms ... it is being built up as a risk-weighted portfolio in each of the (11) sectors, taking the highest yielding FTSE100 stock first in each sector that has adequate dividend cover, consistent rising dividend payments and adequate free cash flow

I haven't yet found a sensible way to value the Final Salary Pension. Probably the best way I've found to consider it is as above - basically adding a 1.9% yield to the overall portfolio when realised (though it would actually be higher, as the JISA's will be separate by then). Until that point in time, I'm ignoring it for investment purposes.

It may sound sort of complex, but really, it's not - just plug the numbers in once per month (end of month for the record, mid-month again to determine the regular investments) and only "manually" rebalance other than via the regular investments if 5% or more off target. Each sub-portfolio is unitised (two ISAs, two SIPPs and two JISAs, one pseudo-HYP) with 24 measurements per year as per the above.

Regards, Newroad

-

paulnumbers

- Lemon Slice

- Posts: 445

- Joined: November 4th, 2016, 2:15 am

- Has thanked: 32 times

- Been thanked: 112 times

Re: I'll show you mine if you show me yours - your portfolio!

The first section - essentially a global tracker when held together. A bit cheaper than VWRL or Global All Cap

Vanguard FTSE Developed World VEVE ETF - 56.98%

iShares Core MSCI EM IMI UCITS ETF - 6.12%

2nd section - my workplace pension, as close as I could get to a world tracker. Every so often I transfer out to my SIPP and change the funds

Fidelity BlackRock UK Equity Index Fund Class 5 - 0.48%

Fidelity BlackRock World (ex-UK) Equity Fund Class 5 - 9%

3rd Section - I toggle between thinking a world tracker is best, and perhaps I'm better off just buying the S&P500. Fortunately with investing you can just hedge your bets a little.,

IShares Core S&P 500 GBP - 15.58%

4th Section - individual shares. Quite sparse nowadays! I couldn't say no to buying BRK-B at the start of the pandemic.

Berkshire Hathaway - 11.84%

Vanguard FTSE Developed World VEVE ETF - 56.98%

iShares Core MSCI EM IMI UCITS ETF - 6.12%

2nd section - my workplace pension, as close as I could get to a world tracker. Every so often I transfer out to my SIPP and change the funds

Fidelity BlackRock UK Equity Index Fund Class 5 - 0.48%

Fidelity BlackRock World (ex-UK) Equity Fund Class 5 - 9%

3rd Section - I toggle between thinking a world tracker is best, and perhaps I'm better off just buying the S&P500. Fortunately with investing you can just hedge your bets a little.,

IShares Core S&P 500 GBP - 15.58%

4th Section - individual shares. Quite sparse nowadays! I couldn't say no to buying BRK-B at the start of the pandemic.

Berkshire Hathaway - 11.84%

-

moorfield

- Lemon Quarter

- Posts: 3549

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1581 times

- Been thanked: 1414 times

Re: I'll show you mine if you show me yours - your portfolio!

absolutezero wrote:What's in your portfolio and why?

I'll answer this in reverse ....

why?

The ultimate goal of my portfolio is quite simple - a natural yield income exceeding the higher rate income tax threshold by the early 2030s, £50270 in today's money. (I figure that's about as much as one wants to draw from a SIPP wrapper before being clobbered hard with tax.)

What's in your portfolio?

With that in mind, I have realised I do not need to be so introspective about the "Whys?", viz. "Income. Inflation hedge.", "Property exposure. Likely to buy more.", "Uranium price exposure. Politicians will catch up.", or so dogmatic about the method, viz. HYP, and so on - the goal is an overall income, by an means necessary, reasonably well diversified. I have also recently (finally!) made a strategic decision not to hold for income individual companies yielding less than mid/low yield investment trusts. I just don't see the point, and I have had my fill of car crashes thank you (CLLN, CNA, TUI, RAVP, WPP).

As a result, my portfolio is going to change from this, to something at its core resembling this over the next two to three years - more ITs, less FTSE350 shares (particularly low yield ones). I have "gamed" this on paper already and with continuing reinvestment of dividends think I may reach my target by 2025 or 26, a good five years earlier than planned.

In the meantime, the portfolio will look a little messy, and I'll probably hold off publishing it again until I get closer to that point.

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: I'll show you mine if you show me yours - your portfolio!

Aminatidi wrote:Something like that.

Offense wins games... defense wins championships etc.

I think your portfolio will outperform absolutezero's over the next 2 - 5 years

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: I'll show you mine if you show me yours - your portfolio!

BT63 wrote:Aminatidi wrote:Something like that.

Offense wins games... defense wins championships etc.

I think your portfolio will outperform absolutezero's over the next 2 - 5 years

Yes but the question is outperform in what way? Income or total return? It is not that difficult to produce a decent income, but to produce a sustainable income and one where the income is not killing much chance of capital gain is more difficult. See HFEL in particular but also of course the much espoused City of London and quite a number of high yielding shares (the ones that moorfield appears to be going for) I am not saying he is wrong; it sounds like a good plan and not altogether unlike what I do, but as I have got older I appreciate total return much more these days.

Dod

-

Aminatidi

- Lemon Slice

- Posts: 428

- Joined: March 4th, 2018, 8:22 pm

- Has thanked: 61 times

- Been thanked: 116 times

Re: I'll show you mine if you show me yours - your portfolio!

BT63 wrote:Aminatidi wrote:Something like that.

Offense wins games... defense wins championships etc.

I think your portfolio will outperform absolutezero's over the next 2 - 5 years

No idea.

But I know if I can compound slowly at a reasonable rate and keep contributing I' should do alright so why risk waking up and seeing 50% of my capital eroded?

Each to their own though and if taking on more risk for more reward or "jam today" works for others fair enough - there does seem to be a bit of an income focus on this place (presume it's the age/demographic) so what works in one scenario probably doesn't work for another

-

Adamski

- Lemon Quarter

- Posts: 1100

- Joined: July 13th, 2020, 1:39 pm

- Has thanked: 1484 times

- Been thanked: 566 times

Re: I'll show you mine if you show me yours - your portfolio!

My portfolio is a mix of world trackers and defensive. Reason being in my short 'career' of 4 years investing not been able to beat the market. Also like to try to dampen volatility and inflation protection when markets go down.

Absolute zero, how'd your portfolio 1,3 year return compare to the market (vwrl)? Have you thought of consolidating into less holdings, if small amounts don't add anything? Cheers

Absolute zero, how'd your portfolio 1,3 year return compare to the market (vwrl)? Have you thought of consolidating into less holdings, if small amounts don't add anything? Cheers

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: I'll show you mine if you show me yours - your portfolio!

Dod101 wrote:BT63 wrote:Aminatidi wrote:Something like that.

Offense wins games... defense wins championships etc.

I think your portfolio will outperform absolutezero's over the next 2 - 5 years

Yes but the question is outperform in what way? Income or total return? It is not that difficult to produce a decent income, but to produce a sustainable income and one where the income is not killing much chance of capital gain is more difficult. See HFEL in particular but also of course the much espoused City of London and quite a number of high yielding shares (the ones that moorfield appears to be going for) I am not saying he is wrong; it sounds like a good plan and not altogether unlike what I do, but as I have got older I appreciate total return much more these days.

Dod

£s are fungible. A £ is a £ is a £. So only total return matters if we are doing any kind of comparison.

See also 'dividends are only giving back some of your own money'.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: I'll show you mine if you show me yours - your portfolio!

Adamski wrote:My portfolio is a mix of world trackers and defensive. Reason being in my short 'career' of 4 years investing not been able to beat the market. Also like to try to dampen volatility and inflation protection when markets go down.

The evidence is overwhelming that most investors can't consistently BEAT the market so they might as well BE the market. (And hold a tracker).

Absolute zero, how'd your portfolio 1,3 year return compare to the market (vwrl)? Have you thought of consolidating into less holdings, if small amounts don't add anything? Cheers

Short answer. Massively trailing VWRL because I was (but no longer only) a UK based HYP investor and missed out on exposure to the S&P 500.

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 32 guests