The portfolio is predominately biased towards "income", comprising Investment Trusts 32%, HYP shares 47% and a small holding in Prefs and Bonds. at 3%. The Pickering rule of "ish" applies.

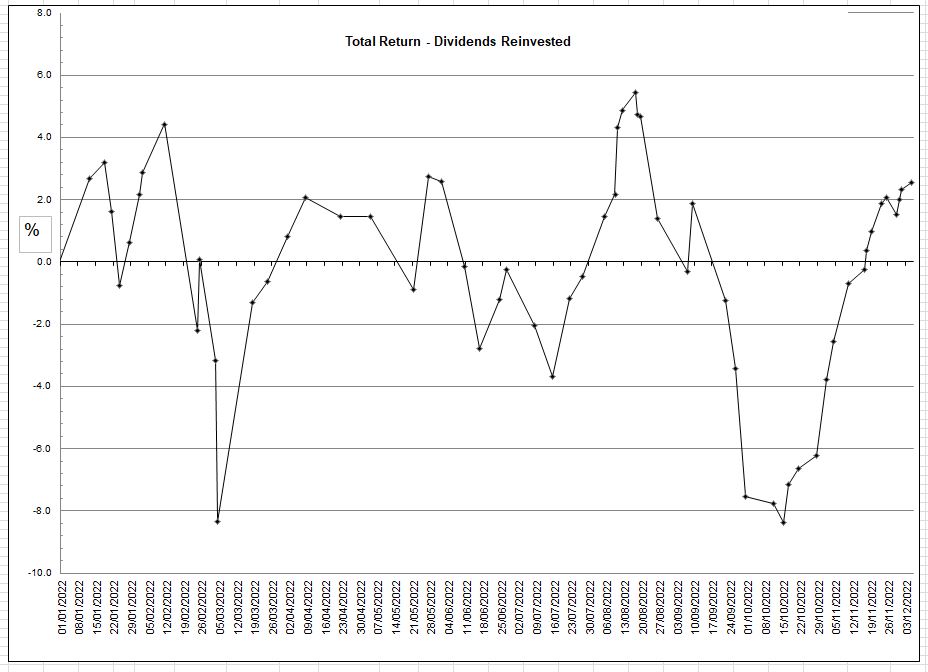

Total Return This Year

All dividends are being reinvested.

It looks roller coaster-ish but the variation is +/- 8% max.

Whilst the total return (TR) has been overall slightly positive at +1.7% as measured from the end of 2022 one notes that the TR includes a chunk of dividends.If I were to strip out the dividends received, the TR would be -4.4%.

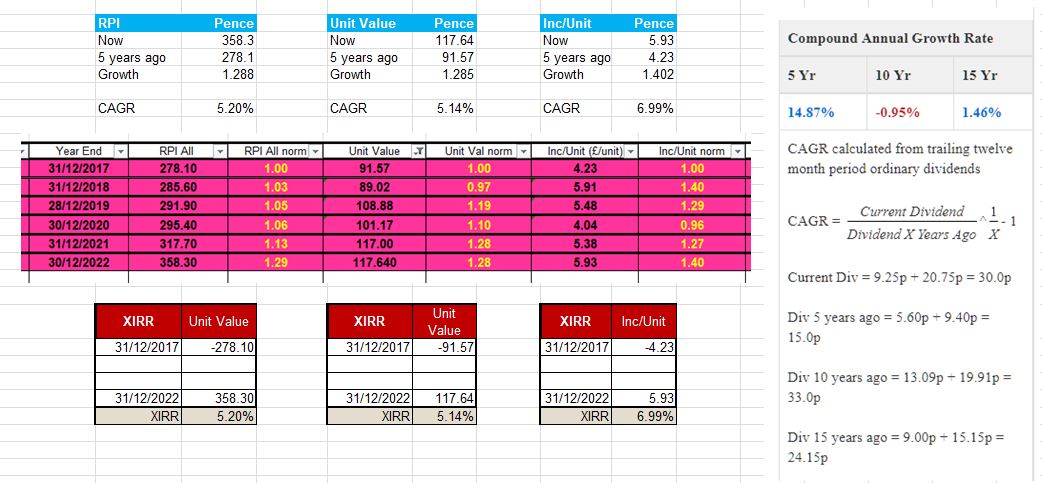

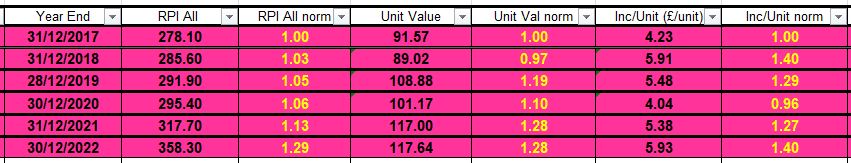

Performance Since Inception

I'm using RPI All items as a measure. I noted the RPI index and have normalised the values. The final RPI all items for Dec 2022 is not stated yet so I've gone with November's figure.

The unit value is ~keeping pace with RPI All Index...more or less.

More pleasing is the progression in dividends as measured by income per unit which seems (fingers crossed) to have shaken off the Covid blues when a lot of dividends were culled/held back/stopped etc. I am predicting a possible (small) reduction in dividends (amount received) for 2023 but who knows (I've zeroed out Specials for things like ADM, BHP & RIO and thus one might expect these big hitters might play a part in dragging overall income down despite hoped for increases in ordinary dividends.