It's a bit discouraging but the income is holding up (Direct Line Group excepted). I wonder if we are to see further drops until interest rates are under control?

(* not even close to a HYP, not even if I squint!).

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Newroad wrote:Hi Vand.

It depends on who or what you mean by otherwise. If you follow my link, the global 60/40'ish portfolio (64.87% equities at time of writing) is doing fine over the same period (though not as good as cash or short term bonds) at about 2% down.

However, my experiment is long term and at about 3% of my portfolio, is not that dangerous. I think it would need to be assessed over at least 5 years and more likely 10 to form a view. It is near the latter I have in mind, as it will then in part help form a view to my retirement finances strategy.

Regards, Newroad

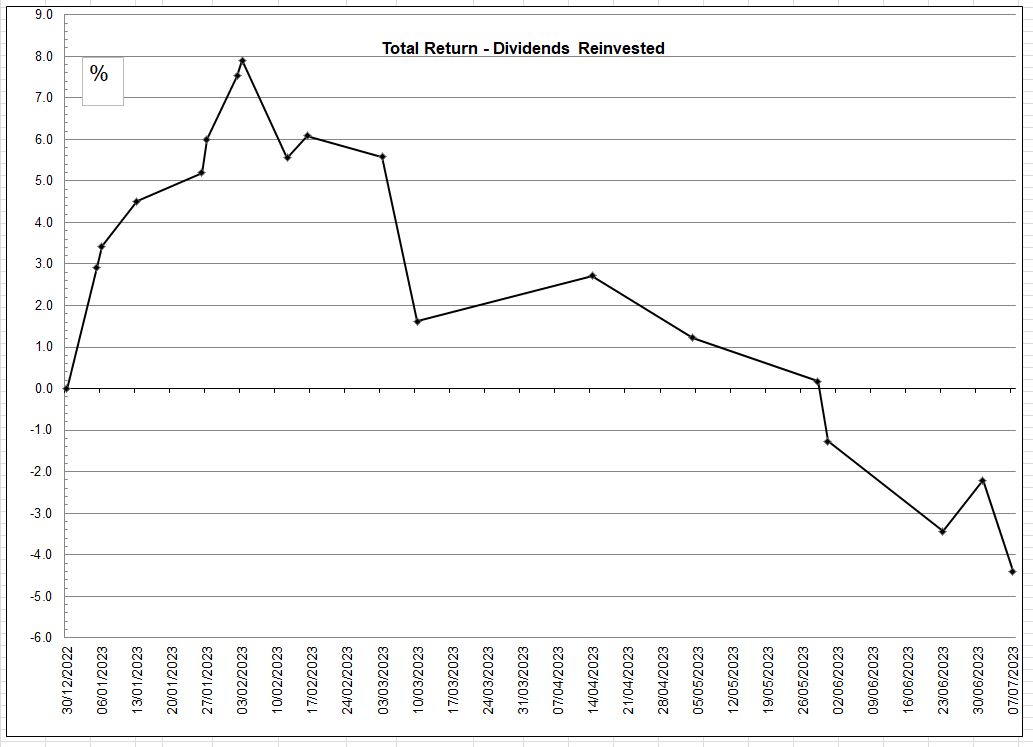

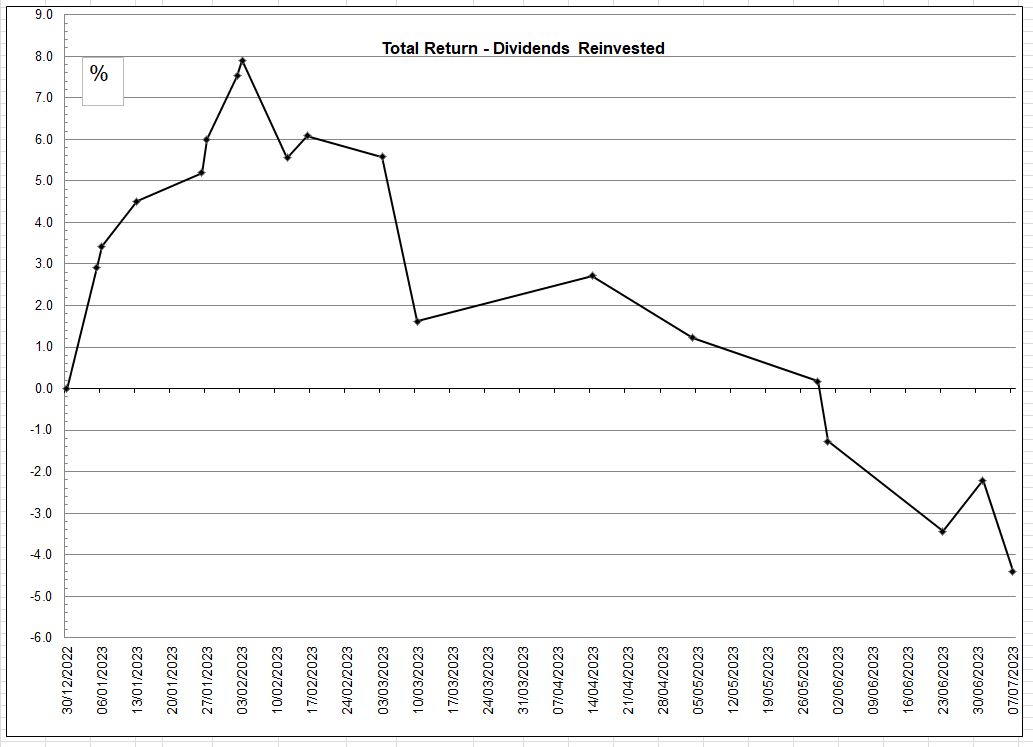

monabri wrote:The year started off well and my portfolio actually started to show some reasonable gains....and then.... The overall drop in total return since the peak is ~12.5%...maybe if I rephrase it as a drop of 4.5% from the start of the year it might sound better or rename the portfolio as "monabri's HYP * "?

It's a bit discouraging but the income is holding up (Direct Line Group excepted). I wonder if we are to see further drops until interest rates are under control?

tjh290633 wrote:If you are an advocate of total return, a fall in the market will always upset you. Those who advocate life styling will not benefit from increases in income from the portion not invested in equities. On the other hand they will benefit if dividends fall to any extent, like in 2008-9.

Falling dividends usually lead to falling prices in any case. This is why investing in reliable dividend payers is a worthwhile tactic.

TJH

simoan wrote:tjh290633 wrote:If you are an advocate of total return, a fall in the market will always upset you. Those who advocate life styling will not benefit from increases in income from the portion not invested in equities. On the other hand they will benefit if dividends fall to any extent, like in 2008-9.

Falling dividends usually lead to falling prices in any case. This is why investing in reliable dividend payers is a worthwhile tactic.

TJH

I don't think you understand what Total Return investing means. Dividends are a key part of the total return approach.

tjh290633 wrote:simoan wrote:I don't think you understand what Total Return investing means. Dividends are a key part of the total return approach.

On the contrary, I understand perfectly.

TJH

Newroad wrote:Hi SteveAM.

For me, since I have started by pseudo-HYP, theGlobal 60/40'ish portfolios are down just under 2%, and the

UK Pseudo-HYP is down just over 16%

You can see this visually on the post linked to earlier. I don't think these moves are mostly or wholly with FX moves - I judge Simoan was closer earlier.

The key point for me, though, is being intellectually honest - and to do my (pseudo-HYP) experiment with real money. If I don't, it's of little use to me as a potential strategy in retirement.

Regards, Newroad

Newroad wrote:Hi SteveAM.

What's the transmission mechanism as you see it? Is the hypothesis that the UK equities in HYP's (or perhaps simply your own holdings) in general earn predominantly/near 100% in USD and that since the cable rate has risen 7%, one should expect capital values of the same UK equities to have reduced by a similar percentage due to being quoted in GBP?

Regards, Newroad

simoan wrote:I find threads like this depressingly parochial. If you're under water this year it is because you are over-invested in the UK. To me that indicates poor capital allocation. It is so easy to invest at low cost in overseas markets these days that there's really no excuse. Just about every other global stock market is in positive territory, and some quite significantly so e.g. NIKKEI +24% YTD, DAX +12% YTD, CAC40 +10% YTD. It's not just the US that has been doing well.

vand wrote:simoan wrote:I find threads like this depressingly parochial. If you're under water this year it is because you are over-invested in the UK. To me that indicates poor capital allocation. It is so easy to invest at low cost in overseas markets these days that there's really no excuse. Just about every other global stock market is in positive territory, and some quite significantly so e.g. NIKKEI +24% YTD, DAX +12% YTD, CAC40 +10% YTD. It's not just the US that has been doing well.

Definitely some truth to that, and it's the reason why most "common sense" investing should start off at a globally diversified portfolio.

However, also worth bearing in mind that some of those figures are a bit inflated unless you are currency-hedged too. GBPJPY is up 15% YTD, as an example.

Return to “Portfolio Management & Review”

Users browsing this forum: No registered users and 46 guests