moorfield wrote:jaizan wrote:In my view, one of the main reasons to buy physical gold is for the long term AND just in case we have very unpleasant economic issues. Like hyperinflation or extreme levels of taxation.

If you follow the Dow-Gold ratio (*) then gold is relatively (17x) very cheap currently, but you will need the patience of a saint before you start buying stocks again.

(*) see https://www.bullionvault.co.uk/gold-new ... buy%20gold.

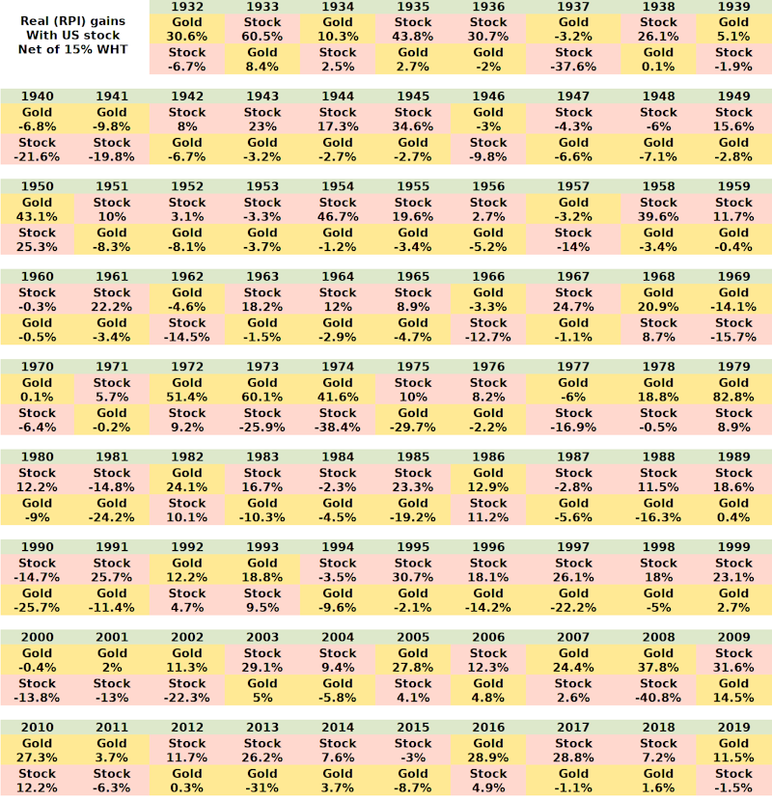

Rather than being all in stock for x years, all in gold for y years, averaging x / ( x + y ) time averaged stock exposure, just holding 50/50 or whatever is less concentration risk and can work out much the same. Own a UK home (£), opt to hold 50/50 US stock/Gold ... where all three are around equal £££ value, and for just the stock/gold 50/50 yearly rebalanced that yielded the same total return as the UK FT All Share between 1896 and 2022. Whilst being diversified across Pounds, Dollars and Global (gold) currencies, and asset diversity of land, stocks, commodity.

A nice feature with 50/50 stock/gold is that in some years stocks are the best, other years gold is the best, and where the average of the two in real terms is positive. You in effect are more inclined to capture the arithmetic average than the geometric annualised. Stocks up +25% gold down -20% one year, stocks down -20% gold up +25% the next, and both individually compound to 0%, whilst 50/50 of the two actually captures the 2.5% positive arithmetic average. Stocks pay dividends, gold doesn't, so attribute that 2.5% 'trading' gain to gold, and that's like the 50% gold weighting having paid a 5% dividend, much the same as the 5% stock dividend. Not as clear cut as that in practice, but along those lines

2008 financial crisis for instance, gold up near +40% when stocks down -40%, so you drew income such as SWR from gold that year, whilst also having sold some gold to buy more stock shares. More often one or the other is up that year, so you're selling some out of gains to source a income, that's not always the case however and in some years both can be down (or both up), often when such a year occurs a adjacent year tends to have one or the other having done better than usual (compensates). So more broadly you get a smoother growth progression line than either gold, or stocks alone. Similar reward to stocks, but with less volatility (higher Sharpe/better risk adjusted reward).