BT63 wrote:1nvest wrote:Gold is also possibly relatively high

I agree that gold isn't cheap, but there are so many financial risks ahead and it has a tendency to do well when other assets are doing badly, so I think it will perform better than most assets.

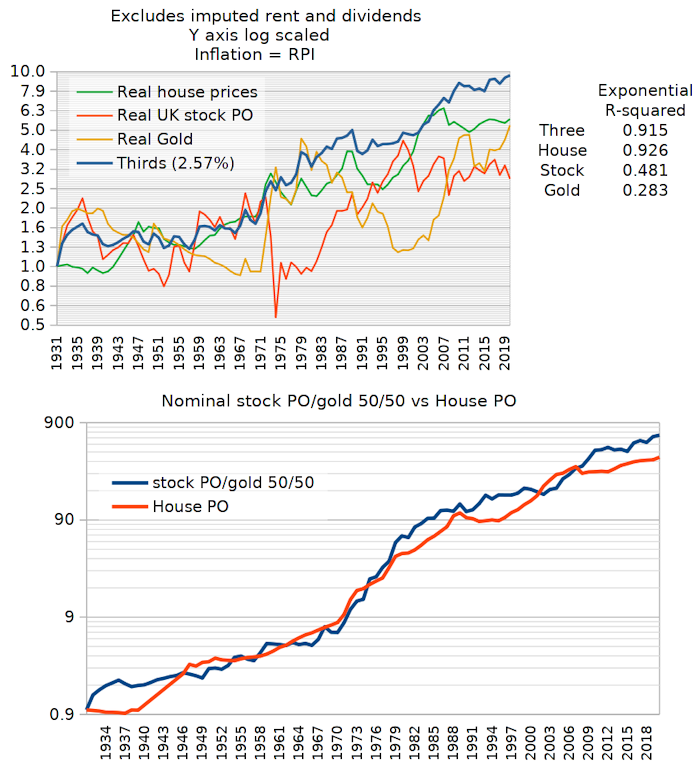

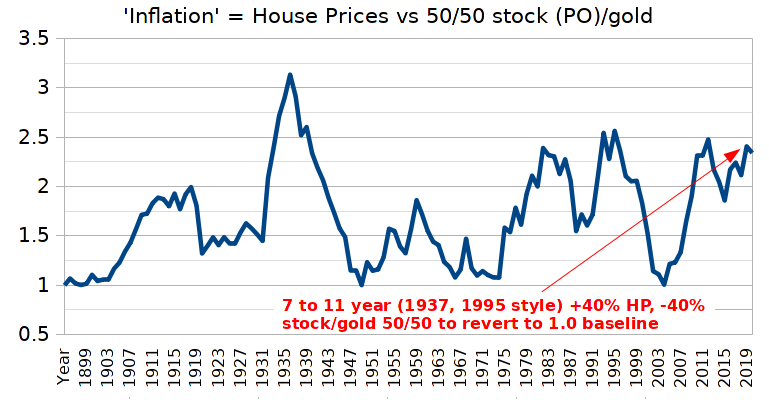

In the late 1970s and early 1980s inflation it took less than 100oz of gold to buy an average UK house and about 100oz to buy an average US house. If anything, housing supply has increased more than gold supply since then, so it could cost more like 75oz in the future.

Average UK house is currently £270k and US is around $375k, both being around 200oz at current prices. If economies and inflation go bad, gold has room to at least double relative to house prices.

Dow/Gold of around 20 recent levels (in effect 20 ounces of gold to buy one Dow stock index share) is by no means as high as the 40 ounces it took back in late 1999, but way more than the near 1 ounce in 1980.

If we do endure a Bunny decade forward time then 33% each in home value, small cap value stocks (being more volatile = better for volatility capture/trading) and gold might be a reasonable asset-allocation. Imputed rent from the home, some stock dividends, some volatility trading capture (rebalancing between stock and gold).

US gold/SCV since 1972Given 33% £ (home value), gold (global/non-fiat commodity currency) then US$ for the SCV holdings would seem appropriate, three currencies (2 fiat, one commodity), three assets (land, stock, commodity).

As direct buying of US ETF's such as VISVX is nowadays pretty much a no-go, I see BMO (who also manage FCIT, formerly foreign and colonial) also have a

BGSC small cap investment trust product (recently -10% discount to NAV, 4% gearing). Not being familiar IT's however striking is that its largest holdings contain other IT's so some multi-layering of costs involved. Maybe as the FT250 already has around 50%+ of earnings foreign sourced, and it contains 50 odd IT's (and is small in US scale), the likes of VMID might suffice.