Lots going on in the economy and markets.

I have kind of lost the place with LDI and it's real impact on my DB pension, not sure what happens next.

Not sure where UK and USA equities and earnings are about to go.

The energy market is battling between HC and Green Energy policy and I'm not too sure where this is going to end up.

I think that UK society is going to have a very, very severe time financially in the next two or three years. Particularly pensioners and those dependent on crumbling State support.

Lots of calm, clever and methodical folkies here on TLF. Whither goeth the UK ?

I would really like to get your informed and measured views.

On the plus side, it was a beautiful day today and I hit some great golf shots.......Ah, life is good !!

Many thanks.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Where are we now ?

-

doolally

- Lemon Slice

- Posts: 651

- Joined: February 8th, 2021, 10:55 am

- Has thanked: 108 times

- Been thanked: 528 times

Re: Where are we now ?

scotview wrote:

On the plus side, it was a beautiful day today and I hit some great golf shots.......Ah, life is good !!

Many thanks.

Every shot finished up in the 19th hole?

doolally

-

Nimrod103

- Lemon Half

- Posts: 6656

- Joined: November 4th, 2016, 6:10 pm

- Has thanked: 1004 times

- Been thanked: 2347 times

Re: Where are we now ?

scotview wrote:Lots going on in the economy and markets.

I have kind of lost the place with LDI and it's real impact on my DB pension, not sure what happens next.

Not sure where UK and USA equities and earnings are about to go.

The energy market is battling between HC and Green Energy policy and I'm not too sure where this is going to end up.

I think that UK society is going to have a very, very severe time financially in the next two or three years. Particularly pensioners and those dependent on crumbling State support.

Lots of calm, clever and methodical folkies here on TLF. Whither goeth the UK ?

I would really like to get your informed and measured views.

On the plus side, it was a beautiful day today and I hit some great golf shots.......Ah, life is good !!

Many thanks.

All IMHO:

LDI - I still don't really understand it, but I suspect some badly underfunded DB schemes will be shown up to have been sailing very close to the wind. In general, higher inflation seems to be good for DB schemes, and the managers will be looking forward to a better future, and it is only the speed with which bonds fell in value which caused the problem. The BoE looks mightily incompetent, and I have no idea whether they will need to continue intervention beyond Friday (and I suspect neither does the BoE).

Whoever in the civil service wrote the contracts for offshore wind companies should be hung, drawn and quartered, as the early ones were clearly far too generous. However, renewables and nuclear are not going to replace fossil fuels in a meaningful way for 20 years, so I remain heavily invested in O&G. As soon as people start feeling cold, or realizing they will have to do without their flights to the Mediterranean, green causes will be backtracked on rapidly.

In many posts I have said that as QE ends and QT imposed, the UK will experience a very bad economic hangover. However, I am beginning to wonder whether this Parliament (or the next) will have any stomach for tough economic medicine. Hence I foresee taxes rising inexorably so that instead of levelling up, the middle classes will be ground down to be the same as those below. Not an attractive prospect for most posters on Lemonfool I would imagine.

OTOH I suspect the pain will be inflicted worse on relatively narrow groups of 1) heavily mortgaged, mainly young and middle aged, 2) ordinary pensioners without an inflation proofed pension, 3) motorists or anyone trying to move around or go about their lawful business, 4) landlords, 5) anyone working in retail, as I imagine selling stuff without massive discounts will become very hard.

OTOOH I suspect that the interest tightening cycle is approaching its peak and maybe interest rates will not be rising as much as the pessimists believe, although they are almost certain to remain high for a long time. If so, earnings might remain OK.

PS Golf, a good walk spoiled (sorry, I have absolutely no aptitude for ball games of any kind)

-

vand

- Lemon Slice

- Posts: 766

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 175 times

- Been thanked: 353 times

Re: Where are we now ?

Does it really matter?

So long as you have a long term strategy in place and continue to execute it then you should welcome these dips as they are when you will earn a higher return.

Nobody can tell the future. If things didn't feel bad right now then guess what - stocks wouldn't be on sale!

So long as you have a long term strategy in place and continue to execute it then you should welcome these dips as they are when you will earn a higher return.

Nobody can tell the future. If things didn't feel bad right now then guess what - stocks wouldn't be on sale!

-

dealtn

- Lemon Half

- Posts: 6101

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Where are we now ?

vand wrote:Does it really matter?

So long as you have a long term strategy in place and continue to execute it then you should welcome these dips as they are when you will earn a higher return.

Nobody can tell the future. If things didn't feel bad right now then guess what - stocks wouldn't be on sale!

This is the economy board, and I assume that's what the OP is referring to. Investment strategies are a different discussion.

-

Hallucigenia

- Lemon Quarter

- Posts: 2711

- Joined: November 5th, 2016, 3:03 am

- Has thanked: 172 times

- Been thanked: 1802 times

Re: Where are we now ?

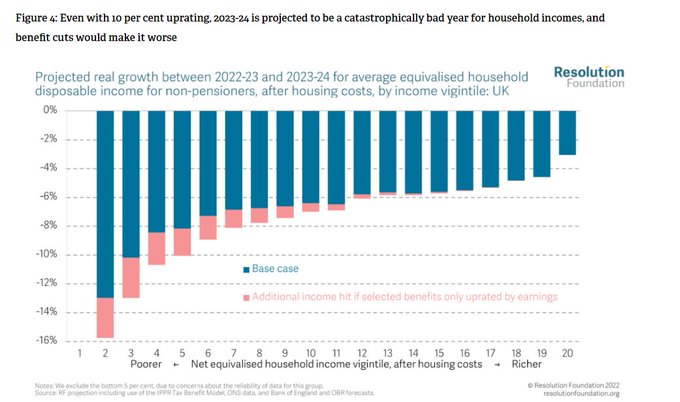

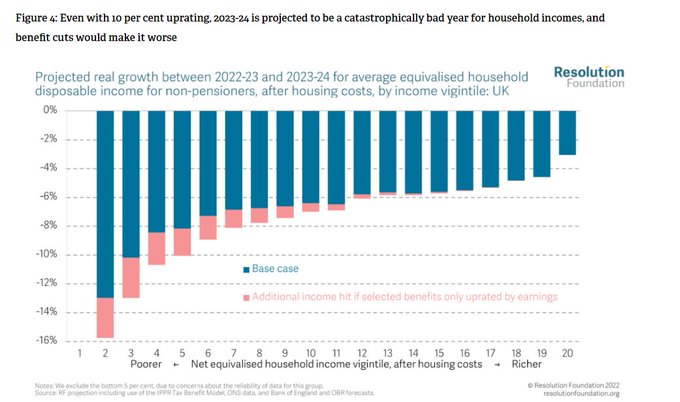

This looks pretty terrible for consumer spending in the UK, coupled with the current futures curve for natural gas which implies high energy costs until at least 2024, probably 2025 :

https://www.resolutionfoundation.org/pu ... g-squeeze/

https://www.resolutionfoundation.org/pu ... g-squeeze/

Who is online

Users browsing this forum: No registered users and 18 guests