Ask people what the greatest era for the stock market has been.

Some will say the great bull of 1982-1999

Some will say the postwar period 1949-1966

Some might even say the roaring 1920s

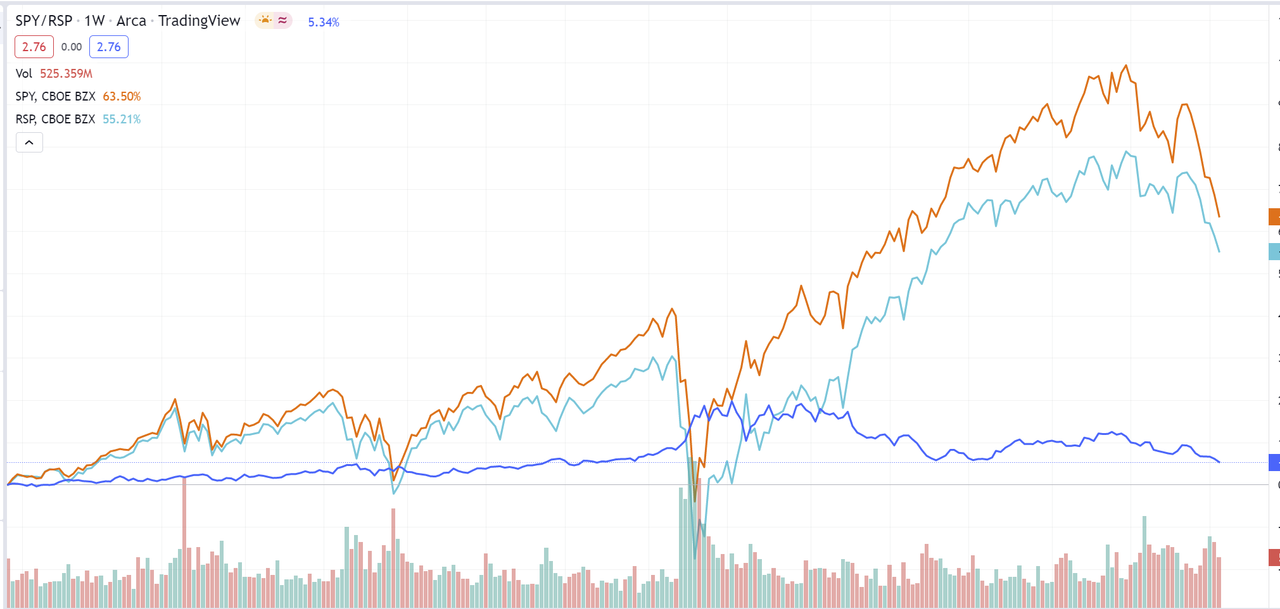

My own take on this is that it's the current run we still in, 2009-current. Why? Because the amount of return that the market has returned to investors per unit of risk (ie, in risk-adjusted terms) is simply off the scale.

Using Portfoliovisualizer, I pulled the monthly return data of the US total stock market for various timeframes since 1972:

Period Sharpe Ratio Sortino Ratio Nominla CAGR

Last Trailing 10yrs 1.14 1.86 16.11%

May 2009 - Current 1.11 1.85 16.37%

Jul 1982-Dec1999 0.81 1.23 18.33%

Overall (1972-present) 0.46 0.67 10.93%

If we make the reasonable assumption that inflation averaged 1-2% higher over the course of 1982-1999, then the current bull market has almost matched the real returns of the 80s/90s bull but with much lower risk, meaning that the ride has been smoother for investors of today compared to those of the past.

In terms of risk adjusted returns, this current bull market stands head and shoulders above anything we've ever seen in living memory. Investing is not meant to be this easy. Investing has never been this easy.

Of course, all good things must come to and end.. eventually. I don't know if the current run is at or near its end, but when it eventually does roll over then personally I would not be surprised if we never again see such the market perform with better risk adjusted characteristics over such a long 10+yr stretch for the rest of my life...it has been a golden period for investors.