Arborbridge wrote:I must say I am shocked at the gold figure you come up with. I haven't looked at gold since I started investing, but it always seemed back then, a useless thing to buy. It shows how risk averse the world became at some stage, that it would treat such a lump of metal which produces nothing as worth having

Has the world gone barking mad when it considers this material to be worth more than real companies producing stuff we all need to survive. Even more remarkable is Bitcoin.

Money is backed by nothing, the US can print/spend pretty much as much as it likes nowadays. It's not that gold has spiked, rather that paper money (fiat currencies) have dropped significantly in value (each new note printed/spent is a form of micro-taxation upon all other notes in existence that benefits the 'counterfeiter' at others expense. The rise of bitcoin is also a reflection of the disdain for the counterfeiting extremes.

You can capture gains via price appreciation, income production or volatility capture. A Options trader who focuses upon just volatility can broadly achieve similar rewards to that of another who focuses on growth/price appreciation. Golds 'dividends' come more via volatility capture.

Broadly compares to holding cash deposits, but without the taxation risks. Also is more protective such as being more off-radar.

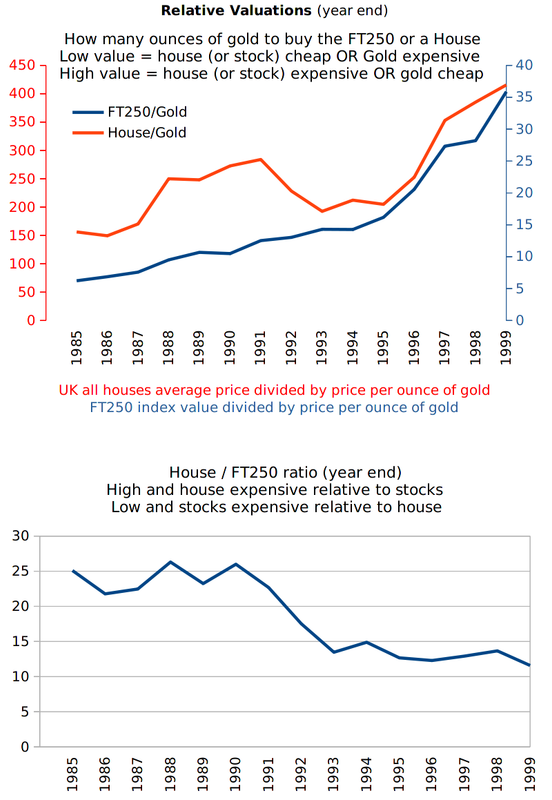

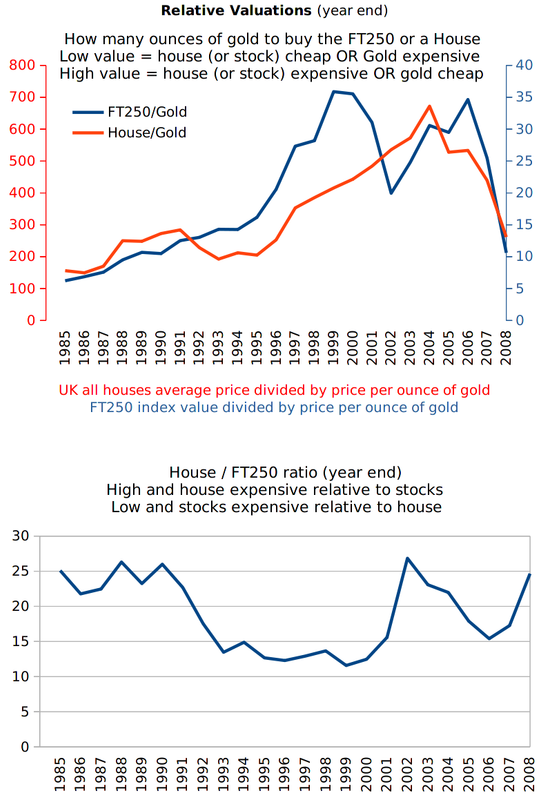

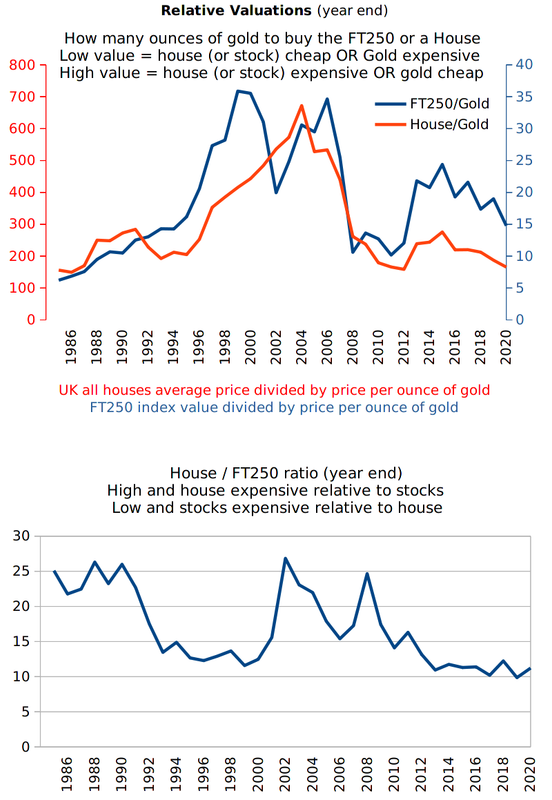

But the cycles are long, extended periods of lagging where typically you might accumulate more ounces, periods of relative strength when ounces are deployed to buy other assets. Consider for instance 1980 Dow/Gold ratio near 1.0, 1999 Dow/Gold around 40. 1980's and 1990's was a bad era for gold, broadly progressively declined in nominal terms. 50/50 stock/gold across those years saw something like 6 to 10 times more ounces of gold being accumulated (of the order 10% annualised more ounces of gold being accumulated). Since 2000's you'd be given back/deploying ounces of gold to buy more stock shares.

Another thing to look at is yearly best/worst values for stock and gold, and then average those best cases and average the worst cases, perhaps for each decade, and you'd see something like the best averaging a reasonable gain that more often offset and more the worst performing asset. Inflation adjusted wise and across time you'd see around a 5% to 6% average positive bias, relatively consistently. In some decades it might have been stocks that mostly were the yearly best asset, in others gold might have dominated the best asset position. Either way the odds are reasonably good. For instance 50/50 stock from here for a year and likely one or the other will do OK and be the potential source of income (sell down the best asset to rebalance the holdings back towards 50/50 weights).

A exception was the WW1 decade where very high inflation pretty much stuffed all assets. House prices halved in real terms as did pretty much all assets ...etc. Provided you got through that decade however and the subsequent decade 'compensated'.

Counted as 'bonds' and there's no income produced, so de-risks taxation risk. Blended a third each Home, US stock, gold and if US stock is Berkshire Hathaway there's zero income produced. Held as legal tender coins and there's no capital gains tax either. Imputed rent benefit from owning a home isn't taxed (the rent you'd otherwise have to find/pay, perhaps out of taxed income). Yes high BRK concentration risk (single stock risk factor), but some situations can see a chunk of wealth lost anyway. House bombed during a war with act of war insurance exclusion, divorce, high taxation eras ...etc. Having a third of wealth in a physical portable asset provides a degree of insurance.

Rather than the typical all-world stock/bond 67/33 or whatever, or variants such as third each S&P500/FT All Share/Bonds ... I rather like the US stock, UK home, gold variant. Stock, Land, Commodity assets diversified across US$, £, global (gold) currencies. No fund fees, low taxation risk, more defensive overall IMO. But it takes a certain kind to repeatedly add more ounces of gold out of stock gains for extended periods (possibly decades). I see it as the odds being reasonably good and more aligned to 'Old Money' that advocates land, art, gold; And also similar to the ancient Talmud advocated third each in land, commerce, reserves.

Note that in the above Callan Table/image that is actual gold throughout. In practice pre 1931 when the US and UK ended the gold pegging/conversion of money at a fixed rate to/from gold a real world investor would more inclined to have held money deposited earning interest that at any time could be drawn along with the interest to buy back gold. If deposited into interest paying treasury bills that was very much like the state paying you for it to securely store your gold.

But I accept that many consider gold to be a barbaric relic and they'd much rather hold the likes of all-world-stock/bond blend along with the fees/taxes that entails. Personally I wouldn't hold bitcoins, physical in hand is better IMO. But as physical gold spreads can be quite wide I like to use other peoples money to fund that i.e. paper gold (ETF such as SGLN) until reasonable portfolio gains occur and then use some of those gains to migrate paper gold over to physical gold and just record it as a lower portfolio gain that year.