Page 1 of 2

Inflation rates released today.

Posted: September 15th, 2021, 10:40 am

by stevensfo

Re: Inflation rates released today.

Posted: September 15th, 2021, 10:48 am

by pje16

Enforcing the reason not to save your spare cash (above your emergency fund)

Re: Inflation rates released today.

Posted: September 15th, 2021, 12:22 pm

by mc2fool

pje16 wrote:Enforcing the reason not to save your spare cash (above your emergency fund)

Yup, if we all went out and spent any spare cash that'd definitely help the economy.

Alternatively:

"

Cash as inflation protection

The best protection against an inflation scare might well be to hold more cash.

- Serious inflation scares can cause losses on equities, gold and bonds. Cash protects us from these.

- The Bank of England might eventually raise real interest rates if it becomes more worried about inflation – meaning better returns on cash.

What’s the best way to protect ourselves against an inflation scare? The answer, surprisingly, might be to hold cash.

One reason I say this is simply that inflation is worse for other assets."

https://www.investorschronicle.co.uk/news/2021/07/30/cash-as-inflation-protection/ for those with (free) registration on the IC

https://www.google.com/search?q="Cash+as+inflation+protection" for those without.

Discuss.

Re: Inflation rates released today.

Posted: September 15th, 2021, 12:32 pm

by ursaminortaur

mc2fool wrote:pje16 wrote:Enforcing the reason not to save your spare cash (above your emergency fund)

Yup, if we all went out and spent any spare cash that'd definitely help the economy.

Alternatively:

"

Cash as inflation protection

The best protection against an inflation scare might well be to hold more cash.

- Serious inflation scares can cause losses on equities, gold and bonds. Cash protects us from these.

- The Bank of England might eventually raise real interest rates if it becomes more worried about inflation – meaning better returns on cash.

What’s the best way to protect ourselves against an inflation scare? The answer, surprisingly, might be to hold cash.

One reason I say this is simply that inflation is worse for other assets."

https://www.investorschronicle.co.uk/news/2021/07/30/cash-as-inflation-protection/ for those with (free) registration on the IC

https://www.google.com/search?q="Cash+as+inflation+protection" for those without.

Discuss.

Inflation's effect on cash is permanent - equities, providing the firms you invest in don't actually fail, tend to eventually recover.

Re: Inflation rates released today.

Posted: September 15th, 2021, 1:01 pm

by TUK020

Inflation erodes the value of cash over time.

Cash, counter-intuitively, is not a bad place to be as the environment transitions from low inflation to higher inflation, as other assets get re-priced.

So think of a strong cash position not as a permanent strategy, but as a temporary staging post.

Re: Inflation rates released today.

Posted: September 15th, 2021, 1:16 pm

by dealtn

TUK020 wrote:Inflation erodes the value of cash over time.

Cash, counter-intuitively, is not a bad place to be as the environment transitions from low inflation to higher inflation, as other assets get re-priced.

So think of a strong cash position not as a permanent strategy, but as a temporary staging post.

Well that depends on how long other it takes for those other assets to get re-priced (or at least one's opinion on how long that takes). One might argue that re-pricing is over a short period (if not the instantaneously some market theories dictate).

Re: Inflation rates released today.

Posted: September 15th, 2021, 1:20 pm

by mc2fool

ursaminortaur wrote:Inflation's effect on cash is permanent - equities, providing the firms you invest in don't actually fail, tend to eventually recover.

TUK020 wrote:Cash, counter-intuitively, is not a bad place to be as the environment transitions from low inflation to higher inflation, as other assets get re-priced.

So think of a strong cash position not as a permanent strategy, but as a temporary staging post.

dealtn wrote:Well that depends on how long other it takes for those other assets to get re-priced (or at least one's opinion on how long that takes). One might argue that re-pricing is over a short period

Well the article does finish with:

"

And of course, I am only considering short-term asset allocation – by which I mean a year or two. In the long term we protect our wealth with assets that offer positive real returns. And equities are our least-worst hope here.

Nevertheless, if you are worried by the possibility of another inflation scare, you should hold at least some cash."

Re: Inflation rates released today.

Posted: September 15th, 2021, 2:57 pm

by Laughton

Potential for big increases in wages - make the Triple Lock a Double Lock

Oh dear - surprise increase in inflation - "can we get away with limiting pension increase to 2.5% - just for this year, obviously"

Re: Inflation rates released today.

Posted: September 15th, 2021, 3:22 pm

by scrumpyjack

Yes do hold cash in spite of inflation, but don't assume Sterling cash is best. The pound has a very long track record of relative weakness. So do consider holding at least some of the cash in other currencies. It is a lot easier to do than it used to be.

Re: Inflation rates released today.

Posted: September 15th, 2021, 3:38 pm

by 1nvest

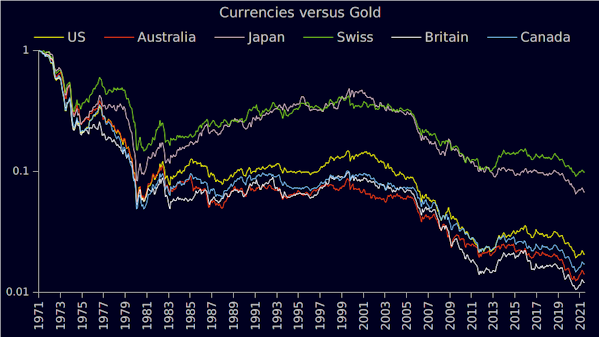

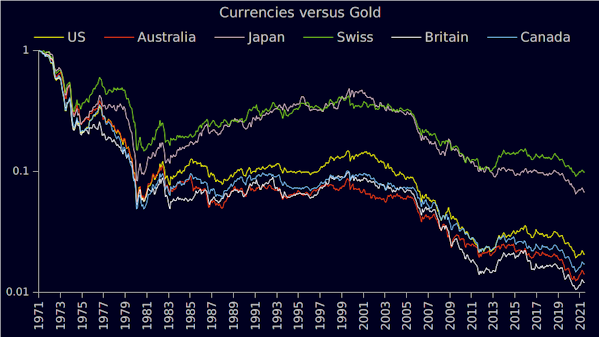

scrumpyjack wrote:Yes do hold cash in spite of inflation, but don't assume Sterling cash is best. The pound has a very long track record of relative weakness. So do consider holding at least some of the cash in other currencies. It is a lot easier to do than it used to be.

Whilst this visually suggests Japanese Yen and/or Swiss Franc, when rebased to a later start date more generally currencies have tended to decline somewhat in alignment (Swiss remained on a gold standard for much longer than most)

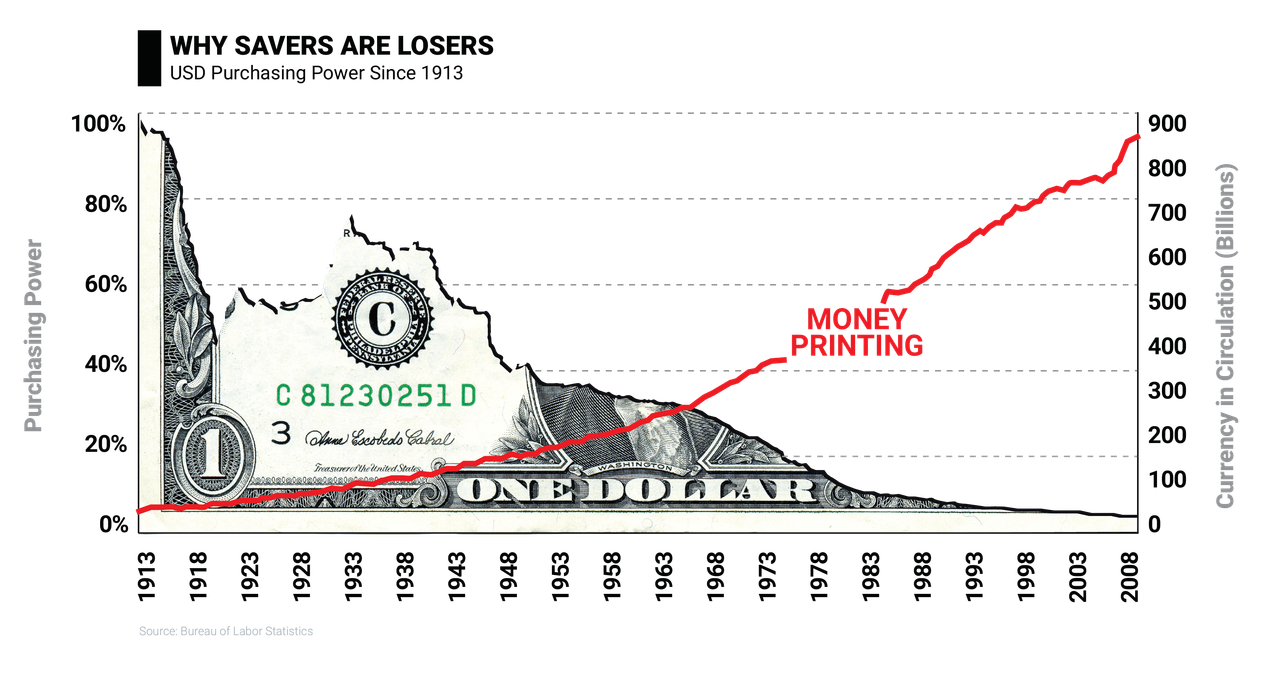

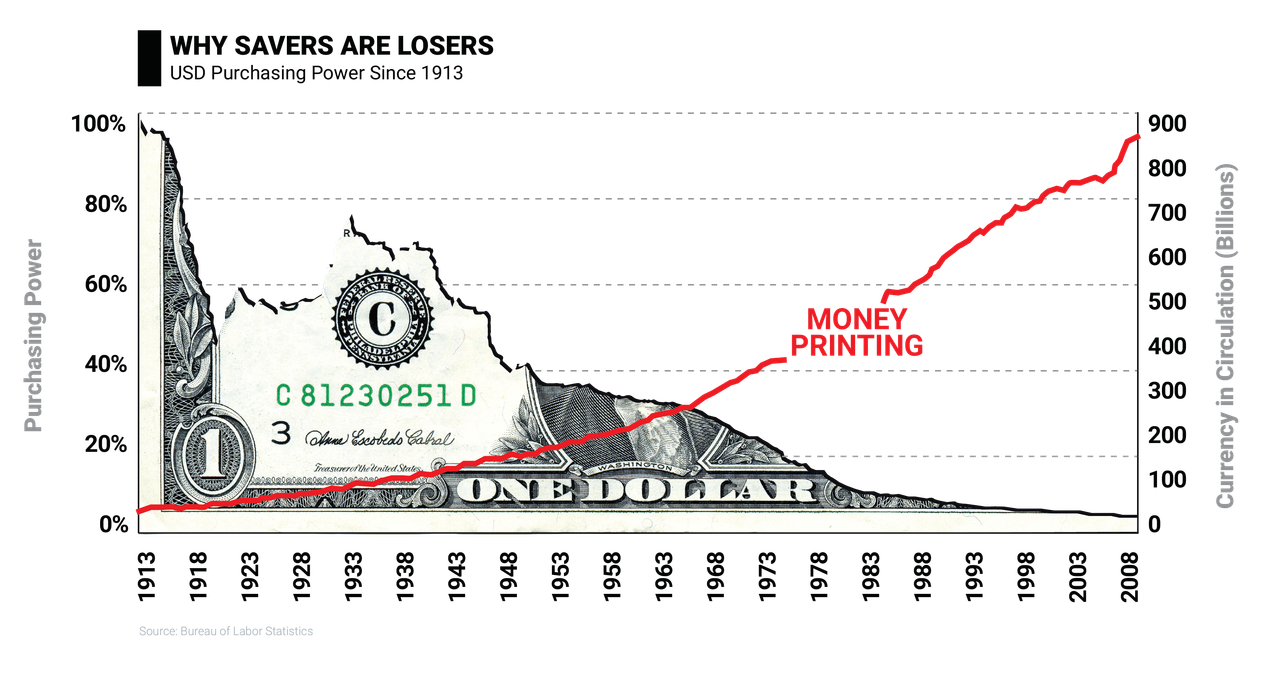

When the world swapped out using finite gold as currency for the US$ and the US promised to conservatively/responsibly print/spend

they were lying.

Re: Inflation rates released today.

Posted: September 15th, 2021, 3:54 pm

by scrumpyjack

When I first went to Switzerland in the 1960s there were about 13 swiss francs to the pound. Now it is 1.27

I know which currency I think will be a safer bet!

Re: Inflation rates released today.

Posted: September 15th, 2021, 3:57 pm

by pje16

and a pound in 1960 is worth not short of £200 today

Re: Inflation rates released today.

Posted: September 15th, 2021, 4:05 pm

by Alaric

pje16 wrote:and a pound in 1960 is worth not short of £200 today

I don't think that's right. My personal benchmark is that 1960s pre decimal prices can be compared to today's prices by replacing the price in shillings by the price in pounds. So typically you might pay two to three shillings for a pint of beer at the end of the decade and the 2010s price was two to three pounds (more now, outside of Wetherspoons or supermarkets). Thus a twenty times multiplier rather than two hundred.

Re: Inflation rates released today.

Posted: September 15th, 2021, 4:12 pm

by scrumpyjack

The RPI has gone from (adjusted) 12.6 in 1960 to 295.4 in 2020, well over 20 times. Obviously the prices of different goods change at different rates.

I suspect the rate of inflation in house prices would be a lot higher whilst for electrical goods a lot lower.

Nevertheless the swiss franc would have been a much better currency to hold over that period than the pound (by a factor of about 10!)

Re: Inflation rates released today.

Posted: September 15th, 2021, 4:17 pm

by Boots

It clearly matters exactly what item you are looking at in any comparison, but in terms of RPI, in 1965 the index was at 11.4, todays index for August was 307.4. That's a multiplier of a shade below 27.

Re: Inflation rates released today.

Posted: September 15th, 2021, 4:31 pm

by pje16

pje16 wrote:and a pound in 1960 is worth not short of £200 today

my gaff - £20

sorry folks

Re: Inflation rates released today.

Posted: September 15th, 2021, 4:47 pm

by 1nvest

scrumpyjack wrote:When I first went to Switzerland in the 1960s there were about 13 swiss francs to the pound. Now it is 1.27

I know which currency I think will be a safer bet!

Each currency can have its time with and against the wind, diversification helps reduce such risks. As can assets have their times. Three currencies (CHF, US$, global (gold)), three assets (stocks, bonds (cash) and commodity (gold)) ...

This is in US$ nominal terms, the Pound has relatively declined compared to the US$ (but equally UK inflation has been higher than US inflation)

Since 1972 UK inflation = 5.5% annualised compared to 4% for the US.

Re: Inflation rates released today.

Posted: September 15th, 2021, 5:09 pm

by Arborbridge

You can see why HMG like CPI and ordinary folk prefer RPI. CPI is a good wheeze for the government to put its hand in your pocket (notwithstanding the "known defects" in RPI - where known defects probably = disadvantage to HMG)

Arb.

Re: Inflation rates released today.

Posted: September 15th, 2021, 5:56 pm

by tjh290633

Alaric wrote:pje16 wrote:and a pound in 1960 is worth not short of £200 today

I don't think that's right. My personal benchmark is that 1960s pre decimal prices can be compared to today's prices by replacing the price in shillings by the price in pounds. So typically you might pay two to three shillings for a pint of beer at the end of the decade and the 2010s price was two to three pounds (more now, outside of Wetherspoons or supermarkets). Thus a twenty times multiplier rather than two hundred.

I have a couple of benchmarks, the price of petrol and the price of beer. Back in 1956 before Suez, petrol was 4/= a gallon, now £1.34 per litre, over £6 a gallon, so a 30 times multiplier.

Beer was about 1/3d a pint then, £4.90 a typical price now. something like 80 times.

Board and lodging is different, 10/= (50p) a night for DB&B then, about £40 a night now (say Premier Inn) which again is 80 fold increase.

I didn't realise that petrol was relatively so cheap.

TJH

Re: Inflation rates released today.

Posted: September 15th, 2021, 6:05 pm

by pje16

I thought there was and

there is....

The Mars Bar standard

https://www.ft.com/content/34859346-b02 ... 4bdda92ca2

https://www.ft.com/content/34859346-b02 ... 4bdda92ca2

Alternatively: