Re: Musk endeavours

Posted: February 23rd, 2021, 11:07 am

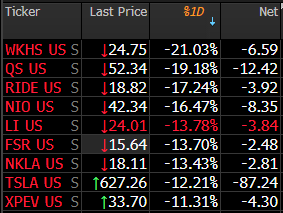

I am ambivalent on the recent weakness in Tesla equity and wonder if we are now seeing a rotation out of tech and into more basic industries as the propaganda on the war with Covid has become more positive. This is the scenario that happened in the tech crash of 2000, although in that case there was no Covid component. We are also seeing several business raising cash such as shop and twlo.

Add to this is what will Powell do? Will he raise rates to add to the rises in the 10 year that started 2021 at 0.93% and are now around 1.3%, a large increase for bonds.

Bill Maurer has done a piece on Tesla that imho is too Tesla specific and misses the overall market picture;

https://seekingalpha.com/article/440812 ... king_alpha

Yesterday Tesla gapped down and sold off 8.55%, the Nasdaq was off 2.46%, so clear relative weakness in Tesla and no obvious short term catalyst to cause a recovery.

From a competitor perspective, Tesla has come through the recent months strongly with serious troubles for Hyundai and a major recall underway that will also hurt their battery supplier and reduce the amounts of batteries available for other business.

The competitiveness of the ID3 is also far from clear due to various troubles and as far as i know they have not issued a denial about VW to VW sales being counted as general sales.

Maurer also cites increasing raw material costs in particular Nickel and Copper and he estimates that these will add several hundred $ to each Tesla.

Price action on the 27th of January suggested to me that investor interest in Tesla could be waning and rather than just noting it i ought to have sold at least a substantial amount of my holding. The low of $801 contrasts with yesterdays low of $710.20, but that is water under the bridge and the question is what to do going forwards.

My overall impression is that Tesla are still the leaders in BEV, but if we are seeing sector rotation the equity price can weaken from here. There is a clear reversal on the monthly chart and the exciting moves in bitcoin will also have sucked some funds from Tesla even though Tesla’s bitcoin holding has so far proved an inspired move.

There is also the mood music and lots of folk, such as Scotty Kilmer who I linked a few posts ago giving many arguments as to why the US are not ready for BEV. All of his arguments ignore co2 emission and although his comments on hydrogen have some sense, that technology is still a long way away.

The extreme cold weather in the US and particularly Texas is being taken to show that Global warming is not real, whereas extreme weather volatility is what global warming predicts.

One can expect the entire Texas power grid to be substantially upgraded after the murderous freeze, although there are news stories that Texas requested permission to increase power output and was refused by Washington:

https://twitter.com/DJcalligraphy/statu ... 63488?s=20

The failure of the Texas power grid is also likely good news for roof top solar sales and power walls.

I have two potential approaches in my mind. One is to ignore the current price falls and simply hold through to what in a few years time will be a much stronger Tesla. The second is to return to a more active trading approach with the danger that if there is a reversal I might not be able to buy back to the size I now have.

As often Tesla is a difficult stock to fathom.

Regards,

Add to this is what will Powell do? Will he raise rates to add to the rises in the 10 year that started 2021 at 0.93% and are now around 1.3%, a large increase for bonds.

Bill Maurer has done a piece on Tesla that imho is too Tesla specific and misses the overall market picture;

https://seekingalpha.com/article/440812 ... king_alpha

Yesterday Tesla gapped down and sold off 8.55%, the Nasdaq was off 2.46%, so clear relative weakness in Tesla and no obvious short term catalyst to cause a recovery.

From a competitor perspective, Tesla has come through the recent months strongly with serious troubles for Hyundai and a major recall underway that will also hurt their battery supplier and reduce the amounts of batteries available for other business.

The competitiveness of the ID3 is also far from clear due to various troubles and as far as i know they have not issued a denial about VW to VW sales being counted as general sales.

Maurer also cites increasing raw material costs in particular Nickel and Copper and he estimates that these will add several hundred $ to each Tesla.

Price action on the 27th of January suggested to me that investor interest in Tesla could be waning and rather than just noting it i ought to have sold at least a substantial amount of my holding. The low of $801 contrasts with yesterdays low of $710.20, but that is water under the bridge and the question is what to do going forwards.

My overall impression is that Tesla are still the leaders in BEV, but if we are seeing sector rotation the equity price can weaken from here. There is a clear reversal on the monthly chart and the exciting moves in bitcoin will also have sucked some funds from Tesla even though Tesla’s bitcoin holding has so far proved an inspired move.

There is also the mood music and lots of folk, such as Scotty Kilmer who I linked a few posts ago giving many arguments as to why the US are not ready for BEV. All of his arguments ignore co2 emission and although his comments on hydrogen have some sense, that technology is still a long way away.

The extreme cold weather in the US and particularly Texas is being taken to show that Global warming is not real, whereas extreme weather volatility is what global warming predicts.

One can expect the entire Texas power grid to be substantially upgraded after the murderous freeze, although there are news stories that Texas requested permission to increase power output and was refused by Washington:

https://twitter.com/DJcalligraphy/statu ... 63488?s=20

The failure of the Texas power grid is also likely good news for roof top solar sales and power walls.

I have two potential approaches in my mind. One is to ignore the current price falls and simply hold through to what in a few years time will be a much stronger Tesla. The second is to return to a more active trading approach with the danger that if there is a reversal I might not be able to buy back to the size I now have.

As often Tesla is a difficult stock to fathom.

Regards,