Page 20 of 22

Re: Investing in Green Infrastructure Funds (ITs)

Posted: February 18th, 2021, 11:58 am

by Dod101

Thanks for that sunnyjoe. I was involved in a discussion about TRIG last year when I was considering an investment. I was put off by some comments about volatility and so it has proved. Mind you a held dividend with a yield of 5.3% is not too bad.

Dod

Re: Investing in Green Infrastructure Funds (ITs)

Posted: February 18th, 2021, 4:00 pm

by mc2fool

Dod101 wrote:Thanks for that sunnyjoe. I was involved in a discussion about TRIG last year when I was considering an investment. I was put off by some comments about volatility and so it has proved. Mind you a held dividend with a yield of 5.3% is not too bad.

Dod

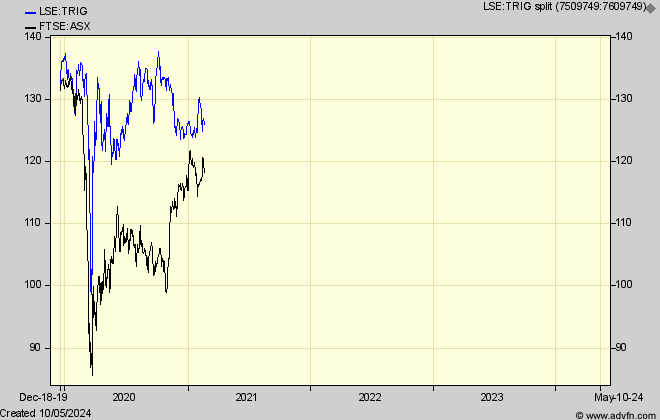

Volatility? Aside from the dip last Feb when all markets plunged, it's been more or less trading sideways within a ~15% range since the middle of 2019 ... and recovered faster than the market in general. Here's TRIG vs the FTSE All Share over the last 18 months.

https://uk.advfn.com/stock-market/london/the-renewables-infrastru-TRIG/share-price

https://uk.advfn.com/stock-market/london/the-renewables-infrastru-TRIG/share-price

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 5th, 2021, 3:20 pm

by jonesa1

ReallyVeryFoolish wrote:Noticed INRG is below 1000p again. Gravity is indeed your friend for a volatile investment like this one. Those interested might care to think about buying in while it's in the sales?

RVF

On the other hand, it's still quite a way above the level at which it traded for many years prior to last year's rocket. Bull or bear?

Andrew

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 5th, 2021, 3:40 pm

by richfool

jonesa1 wrote:ReallyVeryFoolish wrote:Noticed INRG is below 1000p again. Gravity is indeed your friend for a volatile investment like this one. Those interested might care to think about buying in while it's in the sales?

RVF

On the other hand, it's still quite a way above the level at which it traded for many years prior to last year's rocket. Bull or bear?

Andrew

A negligible dividend (c 0.5%) to act as a carrot or oil the wheels of volatility!

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 5th, 2021, 8:57 pm

by richfool

Just came across this affecting renewables and infrastructure trusts, like TRIG and INPP:

3 March 2021

The corporation tax hike will hit the valuation of listed infrastructure funds, including those investing in renewable energy assets, says stockbroker Stifel.

The chancellor’s decision to hike corporation tax in today’s budget will hit the valuation of listed infrastructure funds, including those investing in renewable energy assets, according to stockbroker Stifel.

Rishi Sunak announced corporation tax would increase from its current level of 19% to 25% from April 2023, one of a number of moves aimed at reining in the ballooning UK deficit.

That will see infrastructure funds pay a higher rate of tax on the income they derive from their assets. The change will not just result in a smaller pool of income to pay shareholders dividends but will hit their underlying valuations, which are linked to their future cashflows.

https://www.theaic.co.uk/aic/news/cityw ... n-tax-hike

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 6th, 2021, 12:56 pm

by jonesa1

ReallyVeryFoolish wrote:Very true. A lot has happened in a very short space of time in renewable energy. Much more than I had ever imagined. We're still at the early stages of a multi decade worldwide transformation of energy generation and storage. There's critical mass behind a complete change in how energy is generated at least in Western economies, if not the entire world. I seem to belong in the bull corner. That's not to say INRG price won't head lower yet, but the future looks good to me.

RVF

Hopefully there will be the level of investment in renewable energy which will be required to meet climate change targets. I'm not convinced that automatically makes any company involved in it a good long term commercial investment, especially at prices representing a large premium to fair value. In particular I think there are plenty of risks for operating companies, such as politics (e.g. increases in corporation tax), faster than expected depreciation of investments in "old" technology (given the potential for improvements in price / performance), short / medium term periods of over-capacity (e.g. OPEC dumping oil into the market to retain market share by driving down fossil energy prices or capacity increases being too far ahead of the improvements in distribution required for the shift to EVs). In the short / medium term companies manufacturing, installing and maintaining the equipment should do very well, longer term the demand will increase but margins may be much lower (unless companies can create effective technology moats).

Andrew

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 6th, 2021, 3:24 pm

by richfool

ReallyVeryFoolish wrote:jonesa1 wrote:ReallyVeryFoolish wrote:Very true. A lot has happened in a very short space of time in renewable energy. Much more than I had ever imagined. We're still at the early stages of a multi decade worldwide transformation of energy generation and storage. There's critical mass behind a complete change in how energy is generated at least in Western economies, if not the entire world. I seem to belong in the bull corner. That's not to say INRG price won't head lower yet, but the future looks good to me.

RVF

Hopefully there will be the level of investment in renewable energy which will be required to meet climate change targets. I'm not convinced that automatically makes any company involved in it a good long term commercial investment, especially at prices representing a large premium to fair value. In particular I think there are plenty of risks for operating companies, such as politics (e.g. increases in corporation tax), faster than expected depreciation of investments in "old" technology (given the potential for improvements in price / performance), short / medium term periods of over-capacity (e.g. OPEC dumping oil into the market to retain market share by driving down fossil energy prices or capacity increases being too far ahead of the improvements in distribution required for the shift to EVs). In the short / medium term companies manufacturing, installing and maintaining the equipment should do very well, longer term the demand will increase but margins may be much lower (unless companies can create effective technology moats).

Andrew

Quite agree with you. If you haven't already, I suggest you look at the holdings inside INRG. I have no concerns regarding the pot of underlying investments.

RVF

Or IEM?!

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 8th, 2021, 5:36 pm

by sunnyjoe

richfool wrote:Just came across this affecting renewables and infrastructure trusts, like TRIG and INPP:

3 March 2021

The corporation tax hike will hit the valuation of listed infrastructure funds, including those investing in renewable energy assets, says stockbroker Stifel.

The chancellor’s decision to hike corporation tax in today’s budget will hit the valuation of listed infrastructure funds, including those investing in renewable energy assets, according to stockbroker Stifel.

Rishi Sunak announced corporation tax would increase from its current level of 19% to 25% from April 2023, one of a number of moves aimed at reining in the ballooning UK deficit.

That will see infrastructure funds pay a higher rate of tax on the income they derive from their assets. The change will not just result in a smaller pool of income to pay shareholders dividends but will hit their underlying valuations, which are linked to their future cashflows.

https://www.theaic.co.uk/aic/news/cityw ... n-tax-hike

TRIG has the benefit of some international diversification, so may be less affected than others

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 8th, 2021, 5:40 pm

by sunnyjoe

TRIG is raising money again

https://otp.tools.investis.com/clients/ ... 92&cid=669Share Issuance Programme and Initial Issue

5 March 2021

The Renewables Infrastructure Group Limited, the FTSE 250 renewable infrastructure investment company with a diversified portfolio of 77 renewable energy investments (including commitments) across Europe, announces that it will shortly publish a prospectus and circular to put in place a new 12 month share issuance programme in respect of up to 600 million New Shares (the Share Issuance Programme).

Pursuant to the Share Issuance Programme, the Company also announces the launch of the Initial Issue, which will comprise the Initial Open Offer, the Initial Intermediaries Offer, the Initial Offer for Subscription, and the Initial Placing (the Initial Issue) at an issue price of 123 pence per Ordinary Share (the Initial Issue Price). The Board believes that it is important to offer all investors the opportunity to participate in the Company's growth, including smaller private shareholders who are not permitted to participate in institutional placings.

The Board intends to use the net proceeds of each Issue under the Share Issuance Programme (including the Initial Issue) towards making investments into renewable energy infrastructure assets in accordance with the Company's investment policy, including outstanding commitments and repaying debt drawn under the Revolving Credit Facility in acquiring assets.

Key highlights of the Initial Issue

· Existing Shareholders are entitled to subscribe for 1 New Ordinary Share for every 10 Ordinary Shares held on the Record Date (being 3 March 2021), as well as further New Ordinary Shares if they so wish through the Excess Application Facility.

· The Initial Issue Price of 123 pence per Ordinary Share represents a discount of 5.7 per cent. to the closing mid-market share price of an Ordinary Share of 130.4p as at 4 March 2021 (being the Latest Practicable Date).

· New Ordinary Shares issued pursuant to the Initial Issue will be entitled to receive the first quarterly interim dividend of 1.69 pence per Ordinary Share with respect to the three months to 31 March 2021, which is expected to be declared in May 2021 and paid in June 2021. The target dividend set by the Board for financial year 2021 is 6.76 pence[1].

The Directors have reserved the right, in consultation with the Joint Bookrunners and the Investment Manager, to increase the size of the Initial Issue in the event that overall demand for the New Ordinary Shares exceeds the target size.

The Initial Issue is being conducted in accordance with the terms and conditions as set out in the Prospectus.

Investec Bank plc is acting as Sole Sponsor and Joint Bookrunner with Liberum Capital Limited in respect of the Share Issuance Programme and the Initial Issue.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: March 16th, 2021, 1:46 pm

by richfool

I came across this update from Gore Street Energy (GSF) and giving advance warning of its intention to raise capital.

December NAV Update

As at 31 December 2020, the estimated unaudited NAV increased to 99.6 pence per share, representing an uplift of 2.3 pence per share (+2.36%) over the previous quarter. During the quarter, the Company also paid a dividend of 2.0 pence per share.

The increase in the latest quarterly NAV in respect of the period from 30 September 2020 to 31 December 2020, is attributable to both the strong performance of the Company's GB assets and the increasing participation of the Company's assets in the UK's new Dynamic Containment service introduced by the National Grid in September 2020.

As previously disclosed on the 3 March, the Company expects to have over 90MW portfolio of operational assets benefiting from Dynamic Containment from April 2021. This new revenue stream is expected to lead to a strong uplift in anticipated revenue[1].

Dividend Declaration

The Board of Directors (the "Board") of Gore Street is today pleased to declare an interim dividend of 2.0 pence per share for the period 1 October 2020 to 31 December 2020. The dividend will be paid on or around 9 April 2021 to shareholders on the register on 18 March 2021.

Since the last audited NAV as at 31 March 2020, the Company's NAV appreciated from 94.6 pence per share to 99.6 pence per share, an increase of 5.0 pence per share or 5.29%. During the last twelve months of wider equity market uncertainty, the Company has announced 7 pence per share in dividends as targeted. Total NAV return, including the 7.0 pence paid in dividends, was 10.9%. .

https://www.investegate.co.uk/gore-stre ... 00154024R/https://www.investegate.co.uk/gore-stre ... 46170229S/

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 7th, 2021, 12:09 pm

by richfool

For those holding, or interested in Impax Environmental Markets (IEM), their Final Results are out today:

Wednesday 07 April, 2021

Impax Environ Mkts

Final Results

RNS Number : 5894U

Impax Environmental Markets PLC

07 April 2021

https://www.investegate.co.uk/impax-env ... 00075894U/

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 7th, 2021, 7:30 pm

by billG

Hello,

Please can you help me out here? From a pure financial position (ignoring the green issues of trying to save the planet) does this investment make sense? I admit I am lazy and have not read the company reports so hoping to get the raison d'être from this forum. I come from the point of view of a long only equity investor with avoidance of high management costs. So have a portfolio of mainly trackers and IT’s for less well researched areas and themes.

I have looked at the renewable section on the aic website briefly and a few thoughts came to mind.

1. The dividend is high looks and probably unsustainable to me.

2. The wind turbines and solar panel have a life span of maybe 20 years. So at some point a lot more money will have to be raised to replace a lot of the kit. Is this being factored into the NAV? Are buy and hold forever investors in for a big shock at some point? Or is this some kind of pseudo Ponzi scheme that the trust has to keep raising new funds to pay out the dividends?

3. Maybe this dividend level relies on some sort of government subsidiary so there is a fair bit of political risk attached to this sort of investment.

4. If something looks too good to be true it almost certainly is. With these yield and returns everyone would want to invest in this. There is something I do not see.

5. Maybe there is no a strong long term business here and it is all sustained by fashion, short term investors and traders?

6. Some of those management fees look a bit high too me.

7. This sector is hot I could get my fingers burnt. I do not understand it. Move on.

Does anyone have to time to help me out and attempt to answer some of my questions?

Thanks in advance.

BillG

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 13th, 2021, 5:35 pm

by JuanDB

richfool wrote:I came across this update from Gore Street Energy (GSF) and giving advance warning of its intention to raise capital.

December NAV Update

As at 31 December 2020, the estimated unaudited NAV increased to 99.6 pence per share, representing an uplift of 2.3 pence per share (+2.36%) over the previous quarter. During the quarter, the Company also paid a dividend of 2.0 pence per share.

The increase in the latest quarterly NAV in respect of the period from 30 September 2020 to 31 December 2020, is attributable to both the strong performance of the Company's GB assets and the increasing participation of the Company's assets in the UK's new Dynamic Containment service introduced by the National Grid in September 2020.

As previously disclosed on the 3 March, the Company expects to have over 90MW portfolio of operational assets benefiting from Dynamic Containment from April 2021. This new revenue stream is expected to lead to a strong uplift in anticipated revenue[1].

Dividend Declaration

The Board of Directors (the "Board") of Gore Street is today pleased to declare an interim dividend of 2.0 pence per share for the period 1 October 2020 to 31 December 2020. The dividend will be paid on or around 9 April 2021 to shareholders on the register on 18 March 2021.

Since the last audited NAV as at 31 March 2020, the Company's NAV appreciated from 94.6 pence per share to 99.6 pence per share, an increase of 5.0 pence per share or 5.29%. During the last twelve months of wider equity market uncertainty, the Company has announced 7 pence per share in dividends as targeted. Total NAV return, including the 7.0 pence paid in dividends, was 10.9%. .

https://www.investegate.co.uk/gore-stre ... 00154024R/https://www.investegate.co.uk/gore-stre ... 46170229S/

I had been looking at investing in GSF (and GRID for that matter) but was put off by the ~7% discount. The price of this offer at £1.02 vs a NAV of 99.6p and a closing price today of £1.07 makes the offer reasonably attractive. Short history but all other measures seem attractive. Decent yield, yield growth, some capital growth. I think I’ll dip a toe in. Anyone else buying?

Cheers,

Juan.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 16th, 2021, 2:00 pm

by JuanDB

Placed a small order (5k shares) in the GSF (Gore street energy fund) offer on PrimaryBid this morning. Around 6% discount to current price, and on a 7.82% yield, and avoids Stamp duty and dealing fees. Pretty pleased with that, offer closes next week.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 23rd, 2021, 7:32 pm

by JuanDB

JuanDB wrote:Placed a small order (5k shares) in the GSF (Gore street energy fund) offer on PrimaryBid this morning. Around 6% discount to current price, and on a 7.82% yield, and avoids Stamp duty and dealing fees. Pretty pleased with that, offer closes next week.

Received notice from PrimaryBid that I’ve been allocated the full subscription of 5k shares. They should be transferred to my wife’s dealing account 27/4. Experience with PrimaryBid has been pretty smooth thus far. This is my first purchase using them.

Cheers,

Juan.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 23rd, 2021, 9:27 pm

by airbus330

Anybody got an thoughts or opinions on JLEN ENVIRONMENTAL ASSETS GROUP LTD (JLEN). Had it a couple of years for the reasonable income but both SP and NAV just seem to be in permanent drift down. I can't see anything particularly that is causing it.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 23rd, 2021, 10:34 pm

by richfool

I sold JLEN a few months back because of concerns about its scope for capital growth.

I bought into GSF (though haven't increased my original holding - see previous post above) for exposure to storage, and SEIT for exposure to US and European energy projects.

Re: Investing in Green Infrastructure Funds (ITs)

Posted: April 24th, 2021, 6:48 pm

by richfool

Spotted this on the AIC website:

Renewables have now reached a tipping point”

19 April 2021

Managers discuss key opportunities and risks.

Investment companies in the Renewable Energy Infrastructure sector have raised £7.7bn1 over the past five years, ahead of every other AIC sector. Investors have been attracted to the strong yields and opportunity to invest in a greener future, and with more countries and businesses targeting net-zero around the world, the prospects for renewable infrastructure look bright.

But this is also a fast-changing sector, with the uncertainty of power prices presenting risks. The Association of Investment Companies (AIC) has spoken to managers from the Renewable Energy Infrastructure sector about the main themes, opportunities and challenges facing investors.

https://www.theaic.co.uk/aic/news/press ... ping-point

Re: Investing in Green Infrastructure Funds (ITs)

Posted: May 6th, 2021, 8:25 pm

by GrahamPlatt

Re: Investing in Green Infrastructure Funds (ITs)

Posted: May 12th, 2021, 7:37 pm

by UncleEbenezer

ReallyVeryFoolish wrote:INRG looks to be heading towards 800p. Big drop in a couple or so months from 1400p-ish. I know INRG has changed its underlying investments somewhat fairly recently. But such a drop says either the wheels gave fallen off something (of which I am blissfully unaware) or it might be a good time for those looking for an entry point to buy in?

RVF

Do you have any idea what drove the big spike?

If you look at the curve pre-lockdown, 800p today looks like a healthy rise!