Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Why isn't everyone panicking more?

-

zico

- Lemon Quarter

- Posts: 2145

- Joined: November 4th, 2016, 12:12 pm

- Has thanked: 1078 times

- Been thanked: 1091 times

Why isn't everyone panicking more?

I'd really appreciate your insights and reasoning into the current outlook. I'm pessimistic and have listed the reasons below, but would very much like to hear views from the optimistic camp.

First, a bit of background. I'm a Long-Term Buy & Hold type when it comes to shares, but I'm currently kicking myself hard, because back in February I could see how Covid-19 was inevitably spreading all around the world, and people were totally underestimating the impact of the disease and its ramifications (with all the references to low numbers and "flu"). However, all the relevant info was out there in the public domain, and I knew the market was full of very bright people, so thought they must know all about exponential curves, and the impact of a pandemic on company profits, and they knew what they were doing for markets to only be 10% off the market highs, so I didn't sell when I really, really should have done.

But yesterday, I sold about 40% of my share holding to buy bonds/fixed interest gilts in my pension scheme, because it still seems to me that even though I missed the boat in a big way, there's still lots of further downside to come, and indeed Wall St had a further tumble just after I sold.

Would be really interested in people's views on just how much risk is still out there, and what is already priced into the indices.

My reasoning is that this is likely to be even worse than the 2008 financial crisis for the following reasons -

- World-wide and long-lasting economic uncertainty and disruption (absolute minimum of 6 months, unless either a vaccine is produced and widely distributed, or world economies decide to "take it on the chin" and allow Covid-19 to go through their populations.

- Likelihood that this shock will causes nations to move away from globalisation and into more nationalistic protectionism.

- Lack of US leadership, causing mass unemployment, leading to more company failures and potential social unrest - and as ever USA has huge knock-on effects on the global economy.

- Possibility of further follow-up pandemics in future months and years, which may be more deadly or just different, so new vaccines needed.

- Disproportionate effects on small businesses which are much more likely to go under

- Permanent lost demand (and hence lower company profits) in restaurants, holiday spending.

- Blow for unfettered capitalism as societies think "hey, this looking after everyone is the way to go". I'd expect some resistance from populations to simply going back to the way things were before.

- People will spend much less during the crisis, but after it's gone, will they just turn on the spending taps again, or will they be wary of the next possible wave of virus.

Upsides?

- Warm summer weather kills off all the virus (though it's currently pretty active in hot countries)

- Vaccine testing short-circuited dramatically, so world is back up and running as normal within a few months

- Other scientific breakthroughs, such as quicker and more-focused testing, again allowing quick recovery

- All governments adopting similar strategies to manage the situation, and return to growth (or to put it another way, Trump sees sense).

There must be more upsides, but I just can't see them at the moment.

First, a bit of background. I'm a Long-Term Buy & Hold type when it comes to shares, but I'm currently kicking myself hard, because back in February I could see how Covid-19 was inevitably spreading all around the world, and people were totally underestimating the impact of the disease and its ramifications (with all the references to low numbers and "flu"). However, all the relevant info was out there in the public domain, and I knew the market was full of very bright people, so thought they must know all about exponential curves, and the impact of a pandemic on company profits, and they knew what they were doing for markets to only be 10% off the market highs, so I didn't sell when I really, really should have done.

But yesterday, I sold about 40% of my share holding to buy bonds/fixed interest gilts in my pension scheme, because it still seems to me that even though I missed the boat in a big way, there's still lots of further downside to come, and indeed Wall St had a further tumble just after I sold.

Would be really interested in people's views on just how much risk is still out there, and what is already priced into the indices.

My reasoning is that this is likely to be even worse than the 2008 financial crisis for the following reasons -

- World-wide and long-lasting economic uncertainty and disruption (absolute minimum of 6 months, unless either a vaccine is produced and widely distributed, or world economies decide to "take it on the chin" and allow Covid-19 to go through their populations.

- Likelihood that this shock will causes nations to move away from globalisation and into more nationalistic protectionism.

- Lack of US leadership, causing mass unemployment, leading to more company failures and potential social unrest - and as ever USA has huge knock-on effects on the global economy.

- Possibility of further follow-up pandemics in future months and years, which may be more deadly or just different, so new vaccines needed.

- Disproportionate effects on small businesses which are much more likely to go under

- Permanent lost demand (and hence lower company profits) in restaurants, holiday spending.

- Blow for unfettered capitalism as societies think "hey, this looking after everyone is the way to go". I'd expect some resistance from populations to simply going back to the way things were before.

- People will spend much less during the crisis, but after it's gone, will they just turn on the spending taps again, or will they be wary of the next possible wave of virus.

Upsides?

- Warm summer weather kills off all the virus (though it's currently pretty active in hot countries)

- Vaccine testing short-circuited dramatically, so world is back up and running as normal within a few months

- Other scientific breakthroughs, such as quicker and more-focused testing, again allowing quick recovery

- All governments adopting similar strategies to manage the situation, and return to growth (or to put it another way, Trump sees sense).

There must be more upsides, but I just can't see them at the moment.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10025 times

Re: Why isn't everyone panicking more?

zico wrote:

There must be more upsides, but I just can't see them at the moment...

Might one upside be that at some point, everyone who's likely to sell has already done so, and at some point there will be an equilibrium between money entering the market to take advantage of the discounts available, and those sales still going through from those dwindling numbers that have not previously sold.

I'm not in any way trying to suggest that we're there yet, and you're quite right that there might well be further big market drops to come, but I think at some point the above equilibrium will more or less match, and that might well begin to form some sort of market-bottom to this issue.

I'm very interested to see if the much more stringent social controls now in place around the globe begin to have an effect on the spread of this virus. I'm also interested to see that most Governments look quite willing to force people into full 'lock-down' mode if and when required, and whilst it's completely understandable that this will be unpalatable for those involved, that ultimate end-game is likely to have a quite dramatic effect on the spread of the virus in those areas involved...The figures coming out of China are encouraging on this specific point...

I have not sold into the dropping market, but I'm lucky in that I am still working and can drip-feed fresh capital and incoming dividends into this now-lower market, taking some advantage of these lower prices.

I should add that my approach to this issue may well have been different had this not been the case..

Cheers,

Itsallaguess

-

Walkeia

- 2 Lemon pips

- Posts: 134

- Joined: April 27th, 2019, 8:03 am

- Has thanked: 35 times

- Been thanked: 70 times

Re: Why isn't everyone panicking more?

I am perhaps naive but I hope not. What's going on is horrible as we all know, but I feel we should be sceptical of 'this time it is different' which can occur at the top of booms but also at the bottom of busts.

I don't think this virus will cause fundamental change to the long term bull case for global equities etc. I take small optimism from three things - 1. China case path 2. from the actions taken by policy makers already - a bigger stimulus than '08 within 4 weeks is impressive and 3. European social distancing policies taken - I hope will start causing a change to the case path in the coming 10 days as hoped for.

It is debatable if my head is in the sand. But given the above I look to historical recessions and pullbacks. dotcom and '08 = 50% top to bottom in equities. Average recession I was reading was in the mid 30% pullback area for equities. S&P 500 is down 32% from its peak so I feel we have a lot of the negative news in the price. I agree we can fall further but like IAG I am still working so continue to feed cash into the market at these levels.

All the best,

I don't think this virus will cause fundamental change to the long term bull case for global equities etc. I take small optimism from three things - 1. China case path 2. from the actions taken by policy makers already - a bigger stimulus than '08 within 4 weeks is impressive and 3. European social distancing policies taken - I hope will start causing a change to the case path in the coming 10 days as hoped for.

It is debatable if my head is in the sand. But given the above I look to historical recessions and pullbacks. dotcom and '08 = 50% top to bottom in equities. Average recession I was reading was in the mid 30% pullback area for equities. S&P 500 is down 32% from its peak so I feel we have a lot of the negative news in the price. I agree we can fall further but like IAG I am still working so continue to feed cash into the market at these levels.

All the best,

Re: Why isn't everyone panicking more?

It’s not a world war. We may have 12 months of total disruption but we were heading for recession anyway. We’ve brought it forward. We’ll deal with it, central banks will pump money into it. We’ll forget it happened in 10 years (If we make it). It might bring forward some real action on climate change which is the next big thing, having sharpened the mind of baby boomers who’ve had it all until now.

You’ve just sold at low prices (may not be the bottom, but It could be) and bought bonds that will almost certainly lose you money in real terms. Ouch.

You’ve still got time to get back in.

You’ve just sold at low prices (may not be the bottom, but It could be) and bought bonds that will almost certainly lose you money in real terms. Ouch.

You’ve still got time to get back in.

-

monabri

- Lemon Half

- Posts: 8415

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

-

ursaminortaur

- Lemon Half

- Posts: 7035

- Joined: November 4th, 2016, 3:26 pm

- Has thanked: 455 times

- Been thanked: 1746 times

Re: Why isn't everyone panicking more?

Walkeia wrote:I am perhaps naive but I hope not. What's going on is horrible as we all know, but I feel we should be sceptical of 'this time it is different' which can occur at the top of booms but also at the bottom of busts.

I don't think this virus will cause fundamental change to the long term bull case for global equities etc. I take small optimism from three things - 1. China case path 2. from the actions taken by policy makers already - a bigger stimulus than '08 within 4 weeks is impressive and 3. European social distancing policies taken - I hope will start causing a change to the case path in the coming 10 days as hoped for.

It is debatable if my head is in the sand. But given the above I look to historical recessions and pullbacks. dotcom and '08 = 50% top to bottom in equities. Average recession I was reading was in the mid 30% pullback area for equities. S&P 500 is down 32% from its peak so I feel we have a lot of the negative news in the price. I agree we can fall further but like IAG I am still working so continue to feed cash into the market at these levels.

All the best,

Up until the crash of 1929 the stock markets during the 1920s boomed and that was despite the preceding first world war and Spanish flu epidemic.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10025 times

Re: Why isn't everyone panicking more?

Mememe wrote:

We’ll forget it happened in 10 years

Whilst I'm not looking to currently sell out of my investments due to the issue, I've got to say that when I read that one Italian is currently dying every two minutes from the virus, I also don't consider this to be something that we'll easily forget in such a hurry either...

Cheers,

Itsallaguess

-

Avantegarde

- Lemon Slice

- Posts: 269

- Joined: January 29th, 2018, 10:13 pm

- Been thanked: 159 times

Re: Why isn't everyone panicking more?

I agree with the view of the OP that things could get worse, very much worse. Panicking as an individual won't help much but I'd like the govt to panic. Otherwise what lies ahead is a depression rather than a recession, with mass unemployment and a huge drop in living standards, lasting a decade, let alone a huge number of deaths. I expect unemployment in the UK to shoot up by hundreds of thousands and then millions in the next few months anyway, even if the worst spike in deaths is averted. If that spike is not averted society will more or less freeze, and normal economic and social activity with it. If you think this won't affect the prospects for investors in shares, or won't last long, wait until lots of big companies go bust or stop issuing dividends. Personally I'm taking out £250 a day on my debit card to build up a modest cash hoard at home. As for restraining unfettered capitalism, that is just about the only benefit I can see to all this. Just look at the lack of action in the USA led by a deranged nutter. Millions are likely to die there thanks to the lack of a decent public health care system funded out of taxes. Where would you rather be: there or here?

-

zico

- Lemon Quarter

- Posts: 2145

- Joined: November 4th, 2016, 12:12 pm

- Has thanked: 1078 times

- Been thanked: 1091 times

Re: Why isn't everyone panicking more?

Just to clarify, when I say "panicking" on this board, I'm referring to the stock markets, and wondering why there haven't been even bigger drops. We are in a genuinely new situation (because the world today is very different to the 1918 pandemic) and stock markets are supposed to particularly hate uncertainty.

It seems that USA have already created mass unemployment by firms simply firing staff, but this simply causes a huge slump in demand, hence more unemployment causing further cuts in demand etc etc etc.

At a time like this, I'm particularly glad I live in the UK rather than the USA, and the old saying now seems particularly appropriate "USA is a great place to live as long as you don't lose your job, get sick or get old".

Avantegarde wrote:I agree with the view of the OP that things could get worse, very much worse. Panicking as an individual won't help much but I'd like the govt to panic. Otherwise what lies ahead is a depression rather than a recession, with mass unemployment and a huge drop in living standards, lasting a decade, let alone a huge number of deaths. I expect unemployment in the UK to shoot up by hundreds of thousands and then millions in the next few months anyway, even if the worst spike in deaths is averted. If that spike is not averted society will more or less freeze, and normal economic and social activity with it. If you think this won't affect the prospects for investors in shares, or won't last long, wait until lots of big companies go bust or stop issuing dividends. Personally I'm taking out £250 a day on my debit card to build up a modest cash hoard at home. As for restraining unfettered capitalism, that is just about the only benefit I can see to all this. Just look at the lack of action in the USA led by a deranged nutter. Millions are likely to die there thanks to the lack of a decent public health care system funded out of taxes. Where would you rather be: there or here?

It seems that USA have already created mass unemployment by firms simply firing staff, but this simply causes a huge slump in demand, hence more unemployment causing further cuts in demand etc etc etc.

At a time like this, I'm particularly glad I live in the UK rather than the USA, and the old saying now seems particularly appropriate "USA is a great place to live as long as you don't lose your job, get sick or get old".

-

JohnW

- Lemon Slice

- Posts: 517

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 184 times

Re: Why isn't everyone panicking more?

zico wrote:I'd really appreciate your insights and reasoning into the current outlook.

- World-wide and long-lasting economic uncertainty and disruption (absolute minimum of 6 months, unless either a vaccine is produced and widely distributed, or world economies decide to "take it on the chin" and allow Covid-19 to go through their populations.

I think you mean 'unless a vaccine comes EARLY', because there's seems no doubt we'll get one but not for 12 months or so.

We're starting to see the maths explained which I think I understand.

This disease spreads at a rate of ~2.2 (call it exactly 2), meaning each victim gives it to two other people, which is why the numbers are rising so dramatically. To stop the numbers increasing from whatever they are, the spread rate needs to be 1. If you want the disease to disappear, the spread rate needs to be <1 (the lower, the quicker covid19 disappears). When 50% of us are immune (vaccinated or have had the disease), the spread rate will be 1, because each time a victim offers it to 2 people, one is already immune. (The spread rate could be even lower with effective isolation/hygiene.)

I think we have numbers doubling every 4 days. Any number that doubles in a certain time period, gets bigger by 2 raised to the power of the number of doubling periods. So in 2 doubling periods (8 days), the number gets bigger by 2 squared; in 3 periods (12 days), bigger by 2 cubed ie 8.

We now have 5000 cases. 33 million need to be immune if we want 50% of us immune. How long will that take? If doubling continues every 4 days, 5000 must be multiplied by 6600 to get 33 million. 2 raised to what power gives 6600? answer: about 12. So in 12 time periods of 4 days (ie 7 weeks) half the population would be immune, and we've turned the corner. But try not to even think about the misery involved for 33 million sick people, each needing a couple of weeks to recover. Undoubtedly stricter social isolation will increase the doubling rate (slowing the spread), so you can do your own calculations.

But it seems that a vaccine will arrive before we get, or even want, 50% of the country sick in bed (with 10% of them in hospital!!!). So I can't see 6 months of the economic disruption as an absolute minimum, unless we 'take it on the chin' which won't be allowed to happen. It surely has to be until we get a vaccine. This might be why SAGE said on 16 March:

'It was agreed that a policy of alternating between periods of more and less strict social distancing measures could plausibly be effective at keeping the number of critical care cases within capacity. These would need to be in place for at least most of a year. Under such as policy, at least half of the year would be spent under the stricter social distancing measures.' https://www.gov.uk/government/groups/sc ... 9-response

-

redsturgeon

- Lemon Half

- Posts: 8946

- Joined: November 4th, 2016, 9:06 am

- Has thanked: 1313 times

- Been thanked: 3688 times

Re: Why isn't everyone panicking more?

zico wrote:Just to clarify, when I say "panicking" on this board, I'm referring to the stock markets, and wondering why there haven't been even bigger drops. We are in a genuinely new situation (because the world today is very different to the 1918 pandemic) and stock markets are supposed to particularly hate uncertainty.Avantegarde wrote:I agree with the view of the OP that things could get worse, very much worse. Panicking as an individual won't help much but I'd like the govt to panic. Otherwise what lies ahead is a depression rather than a recession, with mass unemployment and a huge drop in living standards, lasting a decade, let alone a huge number of deaths. I expect unemployment in the UK to shoot up by hundreds of thousands and then millions in the next few months anyway, even if the worst spike in deaths is averted. If that spike is not averted society will more or less freeze, and normal economic and social activity with it. If you think this won't affect the prospects for investors in shares, or won't last long, wait until lots of big companies go bust or stop issuing dividends. Personally I'm taking out £250 a day on my debit card to build up a modest cash hoard at home. As for restraining unfettered capitalism, that is just about the only benefit I can see to all this. Just look at the lack of action in the USA led by a deranged nutter. Millions are likely to die there thanks to the lack of a decent public health care system funded out of taxes. Where would you rather be: there or here?

It seems that USA have already created mass unemployment by firms simply firing staff, but this simply causes a huge slump in demand, hence more unemployment causing further cuts in demand etc etc etc.

At a time like this, I'm particularly glad I live in the UK rather than the USA, and the old saying now seems particularly appropriate "USA is a great place to live as long as you don't lose your job, get sick or get old".

Bigger drops?

This has been pretty much the fastest drop off of the stock market ever!

Personally, I think the stock market has been irrationally exuberant for a while and the issues of the last recession were not properly deal with. Unnaturally low interest rates and QE measures have been in place for too long in order to prop us the market leading to the "buy the dip" mentality and unproductive share buy backs. The reset is overdue and while we should have taken a smaller hit a while ago we now will take a bigger one.

This bull market has been going on longer than it should, maintained by central bank intervention doing "whatever it takes" to prop it up at any cost.

The coronavirus has many more months to run, things will definitely get worse before they get better. The central banks have fired their big guns, it has had no effect on the markets and they have little if any ammo left.

For all of the above reasons I believe that we are only half way there in terms of drops and although we may have some pull backs I would not be surprised to see FTSE 3500 or lower over the next 18 months.

Have a look at this chart if you think it is all over.

https://cdn.digg.com/wp-content/uploads ... ap4n41.png

I am 100% in cash, I have been for nearly a year and at the moment that's where it is staying.

John

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: Why isn't everyone panicking more?

Due to Corona virus some stocks (firms) will go bust, a above average number. With a broad large cap stock index those that fall out of the index are replaced by others. There's a very good chance the S&P500, FT100, whatever stock index will still be around in 20 years time.

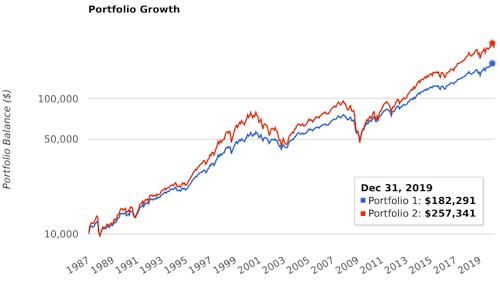

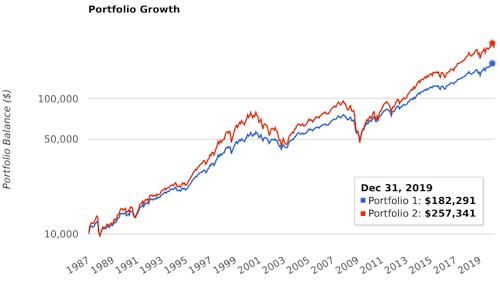

Year end 2019 and stock prices were relatively high. Compare 67/33 US stock/bond (blue line) to 100% stock (red line) since 1987 for instance

and the indications are that stocks were around 40% over-stretched at the end of 2019. Year to date and the two have more realigned with each other. So you might say year start 2020 and stocks were over-priced, more recently they're more fairly price.

Stocks are for the longer term, say 20 years. If stocks broadly reward 4% real (after inflation - pick any other number you might consider to be more fitting) then 4% real compounded for 20 years yields a 2.19 real gain factor. If however you paid 40% over the top for stock as per the start of year then that drops the 4% down to 2.2% annualised real (2.19 / 1.4)^(1/20). At current 'fair' price levels you hit the 4% annualised figure. If stocks continue on down a further -33% then that rises to 6.2% annualised (2.19 / 0.66)^(1/20).

Yes stocks may see earnings and hence prices decline over the next year or two but in 20 years time likely that will just have been a downward blip period on some chart. Outside of that and likely we wont be around anyway.

From (recent) fair price levels there will be greater tendency to see more downside resistance as average 4% annualised real potential rewards stretch towards 6% potential type real rewards. The more rapid year to date decline was more of correcting out relatively high prices.

If you hold some gold as part of your portfolio and sold some of that to buy more FT250 stock index, then as gold is +12.5% up year to date, FT250 is down -38%, then the proceeds from gold buys 80% more FT250 shares compared to at the start of the year. Even cash stuffed into a mattress recently buys over 60% more shares than at the start of the year. Gold and cash in stock purchase power terms have had a great year so far.

Selling shares at present levels may be to have missed the boat (selling at a fair mid to longer term return in the hope of being able to buy back in again later at a above average mid to longer term return rate). Buying shares at recent levels is more like buying in at a fair mid to longer term rate. Or you can hold out further yet in anticipation of perhaps being able to buy in at a greater discount, but in so doing might end up having to buy at a even higher price than present levels. A reasonable tact might be to deploy half now, keep half back in reserves in anticipation of lower prices in perhaps a years time.

Year end 2019 and stock prices were relatively high. Compare 67/33 US stock/bond (blue line) to 100% stock (red line) since 1987 for instance

and the indications are that stocks were around 40% over-stretched at the end of 2019. Year to date and the two have more realigned with each other. So you might say year start 2020 and stocks were over-priced, more recently they're more fairly price.

Stocks are for the longer term, say 20 years. If stocks broadly reward 4% real (after inflation - pick any other number you might consider to be more fitting) then 4% real compounded for 20 years yields a 2.19 real gain factor. If however you paid 40% over the top for stock as per the start of year then that drops the 4% down to 2.2% annualised real (2.19 / 1.4)^(1/20). At current 'fair' price levels you hit the 4% annualised figure. If stocks continue on down a further -33% then that rises to 6.2% annualised (2.19 / 0.66)^(1/20).

Yes stocks may see earnings and hence prices decline over the next year or two but in 20 years time likely that will just have been a downward blip period on some chart. Outside of that and likely we wont be around anyway.

From (recent) fair price levels there will be greater tendency to see more downside resistance as average 4% annualised real potential rewards stretch towards 6% potential type real rewards. The more rapid year to date decline was more of correcting out relatively high prices.

If you hold some gold as part of your portfolio and sold some of that to buy more FT250 stock index, then as gold is +12.5% up year to date, FT250 is down -38%, then the proceeds from gold buys 80% more FT250 shares compared to at the start of the year. Even cash stuffed into a mattress recently buys over 60% more shares than at the start of the year. Gold and cash in stock purchase power terms have had a great year so far.

Selling shares at present levels may be to have missed the boat (selling at a fair mid to longer term return in the hope of being able to buy back in again later at a above average mid to longer term return rate). Buying shares at recent levels is more like buying in at a fair mid to longer term rate. Or you can hold out further yet in anticipation of perhaps being able to buy in at a greater discount, but in so doing might end up having to buy at a even higher price than present levels. A reasonable tact might be to deploy half now, keep half back in reserves in anticipation of lower prices in perhaps a years time.

-

dealtn

- Lemon Half

- Posts: 6090

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2336 times

Re: Why isn't everyone panicking more?

zico wrote:

But yesterday, I sold about 40% of my share holding to buy bonds/fixed interest gilts in my pension scheme, because it still seems to me that even though I missed the boat in a big way, there's still lots of further downside to come, and indeed Wall St had a further tumble just after I sold.

You do know that your capital is at risk in "bonds/fixed interest gilts" too? You may be diversifying, but might not be avoiding that "...lots of further downside to come..."

-

GoSeigen

- Lemon Quarter

- Posts: 4406

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Why isn't everyone panicking more?

dealtn wrote:zico wrote:

But yesterday, I sold about 40% of my share holding to buy bonds/fixed interest gilts in my pension scheme, because it still seems to me that even though I missed the boat in a big way, there's still lots of further downside to come, and indeed Wall St had a further tumble just after I sold.

You do know that your capital is at risk in "bonds/fixed interest gilts" too? You may be diversifying, but might not be avoiding that "...lots of further downside to come..."

Bond duration?

Stocks down 30%, gilts unchanged?

zico: if your hunch turns out right then I don't think your approach is bad at all. You'll need to think about switching back though. I doubt gilts are offer a great long-term return at current yields.

GS

-

dealtn

- Lemon Half

- Posts: 6090

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2336 times

Re: Why isn't everyone panicking more?

GoSeigen wrote:dealtn wrote:zico wrote:

But yesterday, I sold about 40% of my share holding to buy bonds/fixed interest gilts in my pension scheme, because it still seems to me that even though I missed the boat in a big way, there's still lots of further downside to come, and indeed Wall St had a further tumble just after I sold.

You do know that your capital is at risk in "bonds/fixed interest gilts" too? You may be diversifying, but might not be avoiding that "...lots of further downside to come..."

Bond duration?

Stocks down 30%, gilts unchanged?

zico: if your hunch turns out right then I don't think your approach is bad at all. You'll need to think about switching back though. I doubt gilts are offer a great long-term return at current yields.

GS

Not sure what you mean.

Its what happens to prices from here that matters surely? Gilts have been pretty volatile this week, any reason to expect them not to continue to be? Then you suggest gilts also don't offer a great long-term return, which suggest you are agreeing with me.

I don't have a crystal ball, for equities or gilts, just pointing out that gilts, let alone "bonds" are far from certain to preserve capital in the short, medium or long term. If you disagree perhaps you can quantify why you think that might not be a true statement.

-

zico

- Lemon Quarter

- Posts: 2145

- Joined: November 4th, 2016, 12:12 pm

- Has thanked: 1078 times

- Been thanked: 1091 times

Re: Why isn't everyone panicking more?

Thanks for the helpful comments and advice. I know gilts/fixed interest aren't the same as cash, but in my pension fund, that's the nearest category available to "Sticking the money under the bed" which is my preferred option for a % of my assets, while I wait to see what happens next.

My investments here are in a Moneypurchase Pension Fund (which is much smaller beer than my final salary pension, but still significant enough that I don't want to lose a lot of money in it).

After my Friday trades, my fund now has 40% Gilts/Fixed Interest (up from 10%) so I'm thinking that whatever happens, the effect is proportionately less, and I've "damped down" my fund from the vagaries of the market.

But this is definitely not a one-off trade, because after a very expensive few months of neglecting the markets, I'm now going to watch the markets like a hawk, and planning to sell more share-based funds on a rise, and to start buying into the market on further falls, but in a phased way.

Psychologically, I'm now in a better position to make rational decisions, because if I'd stayed fully invested, then on further falls, I'd have lost even more money, so would have been particularly wary of potentially trying to catch falling knives, whereas now I'm in a good place to take the chance without feeling over-committed.

Although people have started to realise how serious this is, I think there's still a long, long way to go especially when you look at the lack of the general public's response to the crisis in the UK.

The spread of the disease is doubling probably about every 7 days, and if it stays like this, then over 50% of the population will be infected in the next 10 weeks. If all the government measures slow this down to doubling only every 10 days, then that only buys us an extra 4 weeks before over 50% are infected. If (and it's a huge "if") we could slow the spread to only doubling every 14 days, then the peak would come in 20 weeks.

We've already seen panic buying, and as the weeks go by, this will come every closer to home for people.

The idea that Covid-19 is only dangerous for old people isn't right either.

Assuming same death rates as seen in China, and assuming 70% of the population are infected with Covid-19, we'd get the following deaths.

Age 10-19 10,500 deaths

Age 20-29 12,000

Age 30-39 12,000

Age 40-49 17,000

Age 50-59 81,000

(That's 50,000 deaths amongst people aged under 50). Even if we can halve the death rates, that's still 25,000 people aged under 50). I think this is going to cause some serious panic when people realise, and this will be made worse by the fact that it'll be too late to do anything much about it.

John, I agree with your comments below.

My investments here are in a Moneypurchase Pension Fund (which is much smaller beer than my final salary pension, but still significant enough that I don't want to lose a lot of money in it).

After my Friday trades, my fund now has 40% Gilts/Fixed Interest (up from 10%) so I'm thinking that whatever happens, the effect is proportionately less, and I've "damped down" my fund from the vagaries of the market.

But this is definitely not a one-off trade, because after a very expensive few months of neglecting the markets, I'm now going to watch the markets like a hawk, and planning to sell more share-based funds on a rise, and to start buying into the market on further falls, but in a phased way.

Psychologically, I'm now in a better position to make rational decisions, because if I'd stayed fully invested, then on further falls, I'd have lost even more money, so would have been particularly wary of potentially trying to catch falling knives, whereas now I'm in a good place to take the chance without feeling over-committed.

Although people have started to realise how serious this is, I think there's still a long, long way to go especially when you look at the lack of the general public's response to the crisis in the UK.

The spread of the disease is doubling probably about every 7 days, and if it stays like this, then over 50% of the population will be infected in the next 10 weeks. If all the government measures slow this down to doubling only every 10 days, then that only buys us an extra 4 weeks before over 50% are infected. If (and it's a huge "if") we could slow the spread to only doubling every 14 days, then the peak would come in 20 weeks.

We've already seen panic buying, and as the weeks go by, this will come every closer to home for people.

The idea that Covid-19 is only dangerous for old people isn't right either.

Assuming same death rates as seen in China, and assuming 70% of the population are infected with Covid-19, we'd get the following deaths.

Age 10-19 10,500 deaths

Age 20-29 12,000

Age 30-39 12,000

Age 40-49 17,000

Age 50-59 81,000

(That's 50,000 deaths amongst people aged under 50). Even if we can halve the death rates, that's still 25,000 people aged under 50). I think this is going to cause some serious panic when people realise, and this will be made worse by the fact that it'll be too late to do anything much about it.

John, I agree with your comments below.

redsturgeon wrote:Bigger drops?

This has been pretty much the fastest drop off of the stock market ever!

Personally, I think the stock market has been irrationally exuberant for a while and the issues of the last recession were not properly deal with. Unnaturally low interest rates and QE measures have been in place for too long in order to prop us the market leading to the "buy the dip" mentality and unproductive share buy backs. The reset is overdue and while we should have taken a smaller hit a while ago we now will take a bigger one.

This bull market has been going on longer than it should, maintained by central bank intervention doing "whatever it takes" to prop it up at any cost.

The coronavirus has many more months to run, things will definitely get worse before they get better. The central banks have fired their big guns, it has had no effect on the markets and they have little if any ammo left.

For all of the above reasons I believe that we are only half way there in terms of drops and although we may have some pull backs I would not be surprised to see FTSE 3500 or lower over the next 18 months.

Have a look at this chart if you think it is all over.

https://cdn.digg.com/wp-content/uploads ... ap4n41.png

I am 100% in cash, I have been for nearly a year and at the moment that's where it is staying.

John

-

Bubblesofearth

- Lemon Quarter

- Posts: 1096

- Joined: November 8th, 2016, 7:32 am

- Has thanked: 12 times

- Been thanked: 450 times

Re: Why isn't everyone panicking more?

zico wrote:I'd really appreciate your insights and reasoning into the current outlook. I'm pessimistic and have listed the reasons below, but would very much like to hear views from the optimistic camp.

Not sure I'd class myself as an optimist just now but there are at least some boundaries around the uncertainty, or at least there probably are!

Firstly we know the scale of the economic impact - a cessation of all economic activity that does not relate to the supply of essential goods and services.

Secondly we have a reasonable idea of the time-line, major disruption for about a year. Up to the time when a vaccine or herd immunity arrive.

Thirdly we know governments are prepared to intervene to whatever extent necessary to try to prop up the Global economy.

On the pessimistic side there has never been a social or economic situation like this so no-one really knows the consequences longer term. Even during wars people still traded in most sectors of the economy. Remembering the travel and leisure industry was in its infancy back then.

For myself I've always held a portion of my wealth in equities that I have no need to sell short-term and have other asset classes. Most individuals who are panicking are, I suspect, those who need access to their money short-term, have too high an allocation to stocks for their comfort level, or have not sat through previous bear markets.

Furthermore an over-riding assumption of mine is that I do not know more than the market. Also worth remembering that stock markets are leading indicators and the biggest falls are usually early on in crises when uncertainty is at its highest. Strikes me that that could be around now?

BoE

-

redsturgeon

- Lemon Half

- Posts: 8946

- Joined: November 4th, 2016, 9:06 am

- Has thanked: 1313 times

- Been thanked: 3688 times

Re: Why isn't everyone panicking more?

zico,

some assumptions look a bit 'wonky'.

The testing kits are becoming more available at an increasing rate and are being used to verify likely cases.

No-one appears to get better.

No diminishing spread with build up of immunity.

Exponential growth continuing past the point where we start to run out of already poorly old people.

Reference to Chinese data on any level.

W.

some assumptions look a bit 'wonky'.

The testing kits are becoming more available at an increasing rate and are being used to verify likely cases.

No-one appears to get better.

No diminishing spread with build up of immunity.

Exponential growth continuing past the point where we start to run out of already poorly old people.

Reference to Chinese data on any level.

W.

-

zico

- Lemon Quarter

- Posts: 2145

- Joined: November 4th, 2016, 12:12 pm

- Has thanked: 1078 times

- Been thanked: 1091 times

Re: Why isn't everyone panicking more?

Wuffle wrote:zico,

some assumptions look a bit 'wonky'.

The testing kits are becoming more available at an increasing rate and are being used to verify likely cases.

No-one appears to get better.

No diminishing spread with build up of immunity.

Exponential growth continuing past the point where we start to run out of already poorly old people.

Reference to Chinese data on any level.

W.

There may be some wonky assumptions, but I'm focusing on the people below age 60 as being the ones most likely to be infected.

Yes, beyond a certain point exponential growth obviously can't continue at the same rate as earlier, but that doesn't really kick in until you get to around 20-30% of the population infected. The general point is that it's inevitably going to spread very widely very quickly in the population, and the NHS will be overwhelmed for at least several weeks.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 50 guests