Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

Netwealth 4 year returns.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 514 times

Netwealth 4 year returns.

I watched with interest a webinar from Netwealth today, a so called "Robo-Advisor", using passive investments but with human asset allocation, adapting to the market outlook as they see it. They were giving performance figures for their 4 years returns, they don't generally publish return figures, hence my interest and a quick recap here.

I have always thought that when I lose interest in investment matters I might use a passive investment product such as Vanguard Life Strategy, or mimic with ETFs a similar policy. The Robo Advisors are interesting, online risk assessment to help in choosing an appropriate portfolio.

The fees from Netwealth are mid range .65% with £50,000 of assets to .35% with £500,000 plus the underlying fund charges approx .2% and then around .1% transaction costs ( spread between buying and selling assets rather than explicit transaction charges ) so .95% to .65%. There are some other potential charges and personal financial advice is available at a cost.

They have 7 portfolio risk levels, 1 and 2 are low risk , 3 is desired as Cautious, broadly global bonds.

Level 4 is described as Balanced asset when using a benchmark. Levels 5 & 6 uses as a benchmark described as Steady Growth and Level 7 uses Equity Risk as a benchmark.These are from ARC,( Asset Risk Consultants)

Levels 4 to 7 are very, very crudely equivalent to Vanguard Life Strategy 20,40,60, and 80 ( the numbers represent the percentage of equities, roughly split 3 parts unhedged global equities and 1 part UK equities, the remaining holding being a mix of global bonds hedged to sterling and Uk bonds). The costs of these Vanguard funds are .22% pa, a broker such as iWeb or Halifax Share Dealing do not charge a platform % fee and other costs are nominal.

Personally I have always the thought that holding the passive assets by Netwealth was sensible, but the human strategic asset allocation was questionable.... they avoid the the active stock allocation of an active manager but still play the active allocation game.

They don't publish the actual portfolios or performance figures but were helpful when I asked a few questions by email a few years ago.

I am not a customer but manage my own investments (presently largely passive but also hold 4 actively managed but very distinctively managed investment trusts/funds, so pot calling kettle black when I question their active asset allocation!!) My costs are around .14% plus brokerage of .05% on a 7 figure portfolio.

The figures for 4 years to 31/5/2020 are

Level 1 and 2 4.6% and 13.2% total return after fees.(using the lower .35% fee, from the .35% to .65% range)

Level 3 was 19% total return after fees.

Level 4 to 7 were 24.5%, 27%, 28.7% and 31.1% net of fees.

These were about 1% to 1.5% pa better than their benchmarks, which probably represents lower costs against other traditional advised investors

By comparison the DIY approach from Vanguard are;

Vanguard Life Strategy, 20,40,60 and 80 were 24%,31%, 37% and 43% total return net of charges.

For completeness, Vanguard Life Strategy 100 returned a cumulative 50% over the period and a Vanguard Hedged Global Bond Fund produced around 12% over the period.

Given VLS40, ( 40% Equity 60% Bond Vanguard product) gave the same performance as their Level 7 highest risk product, it tends to suggest Vanguard wins over their asset allocation strategy. I was surprised at how compressed the returns were from their Level 3 to Level 7 risk level portfolios.

My own returns were around the level of Vanguard LifeStrategy 80 ( I was involved in several properties around 2016/2017 so not really a direct comparison but I use VLS80 as a personal benchmark)

Reinforces my belief that Vanguard Life Strategy is a good basic strategy.

I have always thought that when I lose interest in investment matters I might use a passive investment product such as Vanguard Life Strategy, or mimic with ETFs a similar policy. The Robo Advisors are interesting, online risk assessment to help in choosing an appropriate portfolio.

The fees from Netwealth are mid range .65% with £50,000 of assets to .35% with £500,000 plus the underlying fund charges approx .2% and then around .1% transaction costs ( spread between buying and selling assets rather than explicit transaction charges ) so .95% to .65%. There are some other potential charges and personal financial advice is available at a cost.

They have 7 portfolio risk levels, 1 and 2 are low risk , 3 is desired as Cautious, broadly global bonds.

Level 4 is described as Balanced asset when using a benchmark. Levels 5 & 6 uses as a benchmark described as Steady Growth and Level 7 uses Equity Risk as a benchmark.These are from ARC,( Asset Risk Consultants)

Levels 4 to 7 are very, very crudely equivalent to Vanguard Life Strategy 20,40,60, and 80 ( the numbers represent the percentage of equities, roughly split 3 parts unhedged global equities and 1 part UK equities, the remaining holding being a mix of global bonds hedged to sterling and Uk bonds). The costs of these Vanguard funds are .22% pa, a broker such as iWeb or Halifax Share Dealing do not charge a platform % fee and other costs are nominal.

Personally I have always the thought that holding the passive assets by Netwealth was sensible, but the human strategic asset allocation was questionable.... they avoid the the active stock allocation of an active manager but still play the active allocation game.

They don't publish the actual portfolios or performance figures but were helpful when I asked a few questions by email a few years ago.

I am not a customer but manage my own investments (presently largely passive but also hold 4 actively managed but very distinctively managed investment trusts/funds, so pot calling kettle black when I question their active asset allocation!!) My costs are around .14% plus brokerage of .05% on a 7 figure portfolio.

The figures for 4 years to 31/5/2020 are

Level 1 and 2 4.6% and 13.2% total return after fees.(using the lower .35% fee, from the .35% to .65% range)

Level 3 was 19% total return after fees.

Level 4 to 7 were 24.5%, 27%, 28.7% and 31.1% net of fees.

These were about 1% to 1.5% pa better than their benchmarks, which probably represents lower costs against other traditional advised investors

By comparison the DIY approach from Vanguard are;

Vanguard Life Strategy, 20,40,60 and 80 were 24%,31%, 37% and 43% total return net of charges.

For completeness, Vanguard Life Strategy 100 returned a cumulative 50% over the period and a Vanguard Hedged Global Bond Fund produced around 12% over the period.

Given VLS40, ( 40% Equity 60% Bond Vanguard product) gave the same performance as their Level 7 highest risk product, it tends to suggest Vanguard wins over their asset allocation strategy. I was surprised at how compressed the returns were from their Level 3 to Level 7 risk level portfolios.

My own returns were around the level of Vanguard LifeStrategy 80 ( I was involved in several properties around 2016/2017 so not really a direct comparison but I use VLS80 as a personal benchmark)

Reinforces my belief that Vanguard Life Strategy is a good basic strategy.

Re: Netwealth 4 year returns.

[align=][/align]

I agree that vanguard LifeStrategy funds are good funds for any style/level of experience investor, but in what way do you think what Netwealth do in terms of human asset allocation is different to vanguard? Out of interest why is it questionable when Netwealth do it but not vanguard?

Granted vanguard are more hands off in their allocations but they are still reviewed and changed in the same way as other multi asset passive funds and MPSs are. Vanguard made a good call on the US when everyone else (pretty much) thought the US was expensive. That’s why they are ahead of most, but that’s still an allocation call.

Hariseldon58 wrote:

Personally I have always the thought that holding the passive assets by Netwealth was sensible, but the human strategic asset allocation was questionable.... they avoid the the active stock allocation of an active manager but still play the active allocation game.

.

I agree that vanguard LifeStrategy funds are good funds for any style/level of experience investor, but in what way do you think what Netwealth do in terms of human asset allocation is different to vanguard? Out of interest why is it questionable when Netwealth do it but not vanguard?

Granted vanguard are more hands off in their allocations but they are still reviewed and changed in the same way as other multi asset passive funds and MPSs are. Vanguard made a good call on the US when everyone else (pretty much) thought the US was expensive. That’s why they are ahead of most, but that’s still an allocation call.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 514 times

Re: Netwealth 4 year returns.

The allocation of Vanguard is pretty strictly defined by a % to bond/equities and rebalanced daily. Life Strategy reduced the home bias from 33% to 25% a few years ago, but don't make any other judgements, it's just a cap based tracker.

Netwealth have a view on allocation that is far from the World Equity market, I saw a few sample portfolios a while ago and they had definite views on global allocation, their website states they respond to market valuations, adopt cyclical positions, thematic etc. Some info here on the drop down sections https://www.netwealth.com/investmentapproach

I don't think its an inherently bad thing, hence my interest in the four year performance figures. The potential upside is they the call the markets well and make excess returns, conversely they don't do so good and lag a simpler and much cheaper alternative in Vanguard or similar, given they have a cost disadvantage of around .4% to .7%, they have a handicap...

Netwealth have a view on allocation that is far from the World Equity market, I saw a few sample portfolios a while ago and they had definite views on global allocation, their website states they respond to market valuations, adopt cyclical positions, thematic etc. Some info here on the drop down sections https://www.netwealth.com/investmentapproach

I don't think its an inherently bad thing, hence my interest in the four year performance figures. The potential upside is they the call the markets well and make excess returns, conversely they don't do so good and lag a simpler and much cheaper alternative in Vanguard or similar, given they have a cost disadvantage of around .4% to .7%, they have a handicap...

Re: Netwealth 4 year returns.

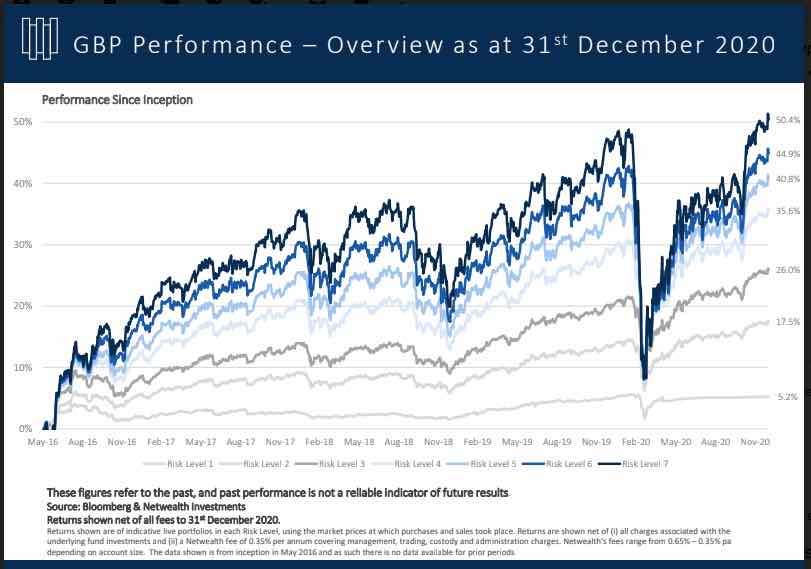

I've been researching Netwealth over the last couple of weeks. Their 4-year performance figures (net of all charges and Netwealth fees) to 31st January '21 show:

Risk Level 4 - 34.8%

(ARC Balanced Asset 27%)

Risk Level 5 - 40.0%

Risk Level 6 - 44.1%

(ARC Steady Growth 37.2%)

Risk Level 7 - 49.8%

(ARC Equity Risk 46.7%)

Their Risk Level 5 Portfolio Allocations (Feb'21) show Fixed Income - 35.3%, Equity - 60.6%, Cash and Money Markets - 4%. One Index fund, the remainder ETFs.

One of their graphs shows the effect of annual fees: "....assuming an annual return of 5% and compare all-in annual fees to 1.65% vs. 0.65%, you would be over £140,000 better off per £1m invested over a period of 10 years".

Interesting? I have no connection with them besides having made enquiries to look at their portfolios in further detail.

Risk Level 4 - 34.8%

(ARC Balanced Asset 27%)

Risk Level 5 - 40.0%

Risk Level 6 - 44.1%

(ARC Steady Growth 37.2%)

Risk Level 7 - 49.8%

(ARC Equity Risk 46.7%)

Their Risk Level 5 Portfolio Allocations (Feb'21) show Fixed Income - 35.3%, Equity - 60.6%, Cash and Money Markets - 4%. One Index fund, the remainder ETFs.

One of their graphs shows the effect of annual fees: "....assuming an annual return of 5% and compare all-in annual fees to 1.65% vs. 0.65%, you would be over £140,000 better off per £1m invested over a period of 10 years".

Interesting? I have no connection with them besides having made enquiries to look at their portfolios in further detail.

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: Netwealth 4 year returns.

I am not questioning Netwealth as I really no nothing about them, but more generally the questions I would want answers to before getting into any kind of managed investments are:

1. How can I trust the published figures? Vanguard LS and similar are regulated funds, marked to market daily with daily published NAVs. This gives me a high degree of confidence that the performance figures are reliable.

2. What are the risk adjusted returns? In particular how did the investments perform during market crashes? A lot of supposedly safer investment strategies show their true colours at such times.

3. How safe is my money from fraud, etc.

1. How can I trust the published figures? Vanguard LS and similar are regulated funds, marked to market daily with daily published NAVs. This gives me a high degree of confidence that the performance figures are reliable.

2. What are the risk adjusted returns? In particular how did the investments perform during market crashes? A lot of supposedly safer investment strategies show their true colours at such times.

3. How safe is my money from fraud, etc.

-

scrumpyjack

- Lemon Quarter

- Posts: 4854

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2705 times

Re: Netwealth 4 year returns.

All these ‘wealth manager’ fees seem absurdly expensive to me. Even at the 0.35% level, that is about what BG charge for actually running SMT, making day to day decisions on companies round the world and generally, so far, coming up with the right answers. All Netwealth are doing is advising, on an automated basis, where to place your money. That’s it.

Also I can’t see the justification for a percentage based fee system and for charging continually rather than a one off fee for advice.

It is all designed to maximise the wealth of the manager as far as I can see.

They may be much better value than, for example St James Place, but still wholly unattractive in my view

Also I can’t see the justification for a percentage based fee system and for charging continually rather than a one off fee for advice.

It is all designed to maximise the wealth of the manager as far as I can see.

They may be much better value than, for example St James Place, but still wholly unattractive in my view

Re: Netwealth 4 year returns.

HiriskPaul - thanks for your comments. I've tried to answer them below, more to convince myself that they may be worth a more though look, and it's seriously useful to have the criticism. I repeat, I have no connection with them besides asking for further information as a potential client:

1. How can I trust the published figures? Vanguard LS and similar are regulated funds, marked to market daily with daily published NAVs. This gives me a high degree of confidence that the performance figures are reliable. They’ve been operating for 4 years, and their published figures are on Bloomberg, and discussed in the financial press regularly. I can’t see any difference from Vanguard LS. Investors are protected (with the obvious limits) by FSCS.

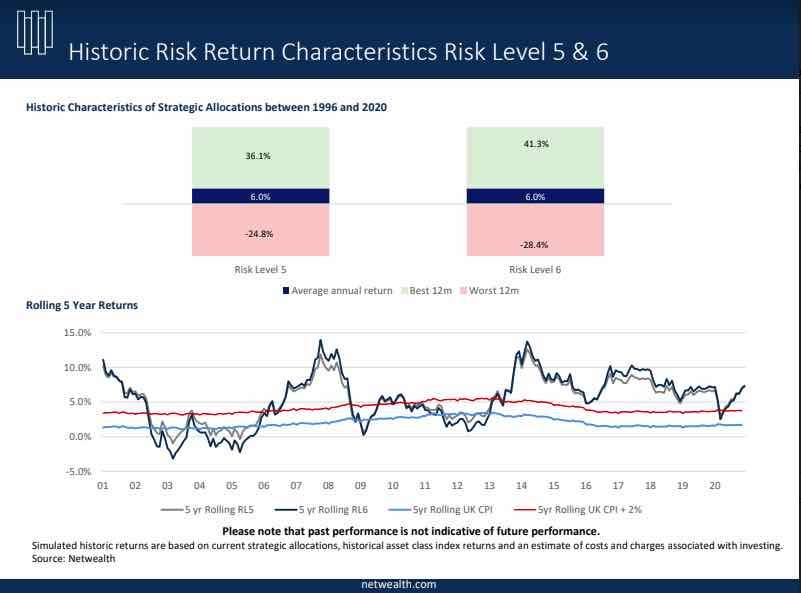

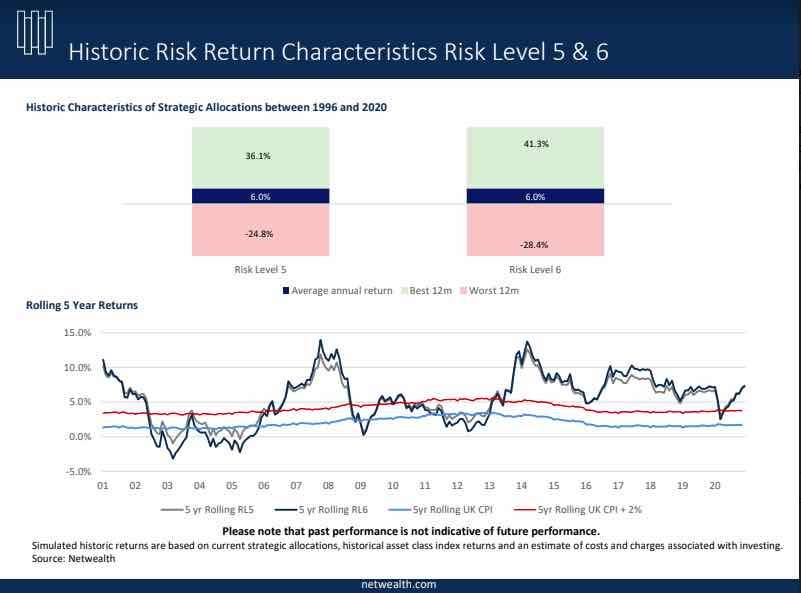

2. What are the risk adjusted returns? In particular how did the investments perform during market crashes? A lot of supposedly safer investment strategies show their true colours at such times. You can get an idea of their recovery from the first quarter of 2020 (see below) together with risk-related returns and drawdown for a Level 4 portfolio. I don’t fully understand why it goes back to 1996 when they've only been operating since 2016.

3. How safe is my money from fraud, etc. Press coverage and current directors help to answer that?

https://www.netwealth.com/aboutnetwealth/press

https://www.netwealth.com/aboutnetwealth#team

1. How can I trust the published figures? Vanguard LS and similar are regulated funds, marked to market daily with daily published NAVs. This gives me a high degree of confidence that the performance figures are reliable. They’ve been operating for 4 years, and their published figures are on Bloomberg, and discussed in the financial press regularly. I can’t see any difference from Vanguard LS. Investors are protected (with the obvious limits) by FSCS.

2. What are the risk adjusted returns? In particular how did the investments perform during market crashes? A lot of supposedly safer investment strategies show their true colours at such times. You can get an idea of their recovery from the first quarter of 2020 (see below) together with risk-related returns and drawdown for a Level 4 portfolio. I don’t fully understand why it goes back to 1996 when they've only been operating since 2016.

3. How safe is my money from fraud, etc. Press coverage and current directors help to answer that?

https://www.netwealth.com/aboutnetwealth/press

https://www.netwealth.com/aboutnetwealth#team

Re: Netwealth 4 year returns.

Scrumpyjack: I've tried to answer your points below:

All these ‘wealth manager’ fees seem absurdly expensive to me. Even at the 0.35% level, that is about what BG charge for actually running SMT, making day to day decisions on companies round the world and generally, so far, coming up with the right answers. All Netwealth are doing is advising, on an automated basis, where to place your money. That’s it. I’m not a sophisticated investor, and I can see a lot of you are. 0.35% compared with north of 1.5% and a hefty initial lump to kick-off doesn’t seem excessive for their results over the last 4 years.

Also I can’t see the justification for a percentage based fee system and for charging continually rather than a one off fee for advice. Maybe you pay for what you get isn’t too unfair? A one-off fee doesn’t make sense – the market changes continually. Getting advice in the first quarter of 2020 wouldn’t have been amiss?

It is all designed to maximise the wealth of the manager as far as I can see.

They may be much better value than, for example St James Place, but still wholly unattractive in my view. I’m not keen on trackers and ETFs myself, but seeing their results made me take another look.

All these ‘wealth manager’ fees seem absurdly expensive to me. Even at the 0.35% level, that is about what BG charge for actually running SMT, making day to day decisions on companies round the world and generally, so far, coming up with the right answers. All Netwealth are doing is advising, on an automated basis, where to place your money. That’s it. I’m not a sophisticated investor, and I can see a lot of you are. 0.35% compared with north of 1.5% and a hefty initial lump to kick-off doesn’t seem excessive for their results over the last 4 years.

Also I can’t see the justification for a percentage based fee system and for charging continually rather than a one off fee for advice. Maybe you pay for what you get isn’t too unfair? A one-off fee doesn’t make sense – the market changes continually. Getting advice in the first quarter of 2020 wouldn’t have been amiss?

It is all designed to maximise the wealth of the manager as far as I can see.

They may be much better value than, for example St James Place, but still wholly unattractive in my view. I’m not keen on trackers and ETFs myself, but seeing their results made me take another look.

-

xeny

- Lemon Slice

- Posts: 450

- Joined: April 13th, 2017, 11:37 am

- Has thanked: 235 times

- Been thanked: 154 times

Re: Netwealth 4 year returns.

Meerkat wrote:SGetting advice in the first quarter of 2020 wouldn’t have been amiss?

I'd say pretty much futile - what would they have advised - "the market has gone down the pan, stay in"?

You can get that for free: https://monevator.com/weekend-reading-do-not-sell/

If they had better advice (magically knowing to sell in advance say), there wouldn't be the drops in those graphs surely?

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: Netwealth 4 year returns.

The market fall figures last year don't look anything special to me. Take the riskiest level 7 fund, which I assume is all in equities? Peak to trough they went from about +49% to +8%. Implying a fall of 1-1.08/1.49 = 28%. The Vanguard accumulating FTSE World Tracker VWRP went from £68.4550

on 19/02/2020 to £51.2700 on 23/03/20, a fall of 25%. If the level fund is geared, or in some way designed to be more risky than the FTSE World (which includes EM), as many ITs are, than a larger fall can be justified. What is in level 7?

on 19/02/2020 to £51.2700 on 23/03/20, a fall of 25%. If the level fund is geared, or in some way designed to be more risky than the FTSE World (which includes EM), as many ITs are, than a larger fall can be justified. What is in level 7?

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: Netwealth 4 year returns.

Just to add to previous comment, the upside from the trough for the level 7 fund to the end of the year was about 39%. Upside for VWRP was 43%. So less downside protection than the market and less of a bounceback on market recovery. Whatever Netwealth are doing, last year's returns do not inspire much confidence, at least for level 7.

Re: Netwealth 4 year returns.

Take the riskiest level 7 fund, which I assume is all in equities?

No, as far as I can see, ETFs and a tracker or two, which I realise, is unusual.

No, as far as I can see, ETFs and a tracker or two, which I realise, is unusual.

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

Re: Netwealth 4 year returns.

This might be worth a look:

IT Investor look at returns over several decades for a selection of global ITs:

https://www.itinvestor.co.uk/2020/06/20 ... -compared/

IT Investor look at returns over several decades for a selection of global ITs:

https://www.itinvestor.co.uk/2020/06/20 ... -compared/

Re: Netwealth 4 year returns.

hiriskpaul - I'm not interested in Level 7 for my current investments, and I don't have their portfolio breakdown. I was wrong (see above) with my comment on equities.

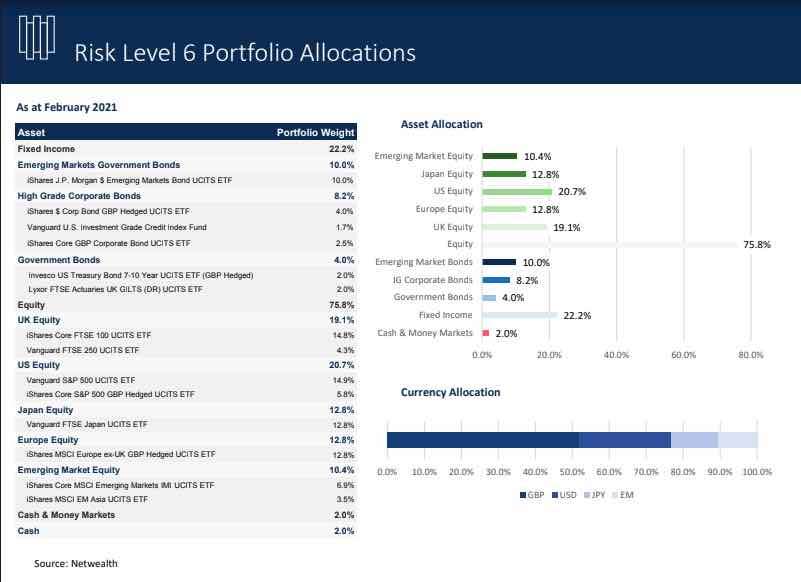

However, here's Level 6:

However, here's Level 6:

-

xeny

- Lemon Slice

- Posts: 450

- Joined: April 13th, 2017, 11:37 am

- Has thanked: 235 times

- Been thanked: 154 times

Re: Netwealth 4 year returns.

Meerkat wrote:

No, as far as I can see, ETFs and a tracker or two, which I realise, is unusual.

But in turn, what are those ETFs and trackers holding, if not equities?

Re: Netwealth 4 year returns.

You're right, and I've tried to correct, above. I assume we were referring to pure equity investment.

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: Netwealth 4 year returns.

The level 7 figures have shown that there equity allocation gave a worst risk adjusted return than the market. Not a good start.

Level 6, currently at 75% equities is closest to Vanguard LS80. I cannot read the peak to trough figures from the chart, but the figures for peak to trough and trough to end of year for LS80 were down 23%, up 34%. For LS60 they were down 18%, up 27%. If you can find the corresponding figures for level 6 the comparison would be interesting. Last year would be an interesting one for comparing various strategies Robo advisers, static daily rebalanced, trend following, etc.

Personally I dislike the home bias in the LS funds and would prefer a DIY managed global equities/bonds/cash approach, but the LS funds make for quick comparisons.

Level 6, currently at 75% equities is closest to Vanguard LS80. I cannot read the peak to trough figures from the chart, but the figures for peak to trough and trough to end of year for LS80 were down 23%, up 34%. For LS60 they were down 18%, up 27%. If you can find the corresponding figures for level 6 the comparison would be interesting. Last year would be an interesting one for comparing various strategies Robo advisers, static daily rebalanced, trend following, etc.

Personally I dislike the home bias in the LS funds and would prefer a DIY managed global equities/bonds/cash approach, but the LS funds make for quick comparisons.

Re: Netwealth 4 year returns.

"....If you can find the corresponding figures for level 6 "

Do you mean Level 6? Or Level 5? I don't understand the question; apologies.

Do you mean Level 6? Or Level 5? I don't understand the question; apologies.

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: Netwealth 4 year returns.

Meerkat wrote:"....If you can find the corresponding figures for level 6 "

Do you mean Level 6? Or Level 5? I don't understand the question; apologies.

Level 6, 75.8% equities you posted above.

Re: Netwealth 4 year returns.

This is Levels 5 and 6, but not sure of the relevance before 2016 when they started; I've never understood 'simulated historic returns':

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 9 guests