gryffron wrote:Wizard wrote:I have assumed for a while now that the UK markets were pricing in a serious cock up at the end of the transition period, given recent performance by the Govt. that must surely be a very high probability.

The problem with that is that UK equities bear very little relation to the UK economy. With 75% of FTSE100 earnings now coming from abroad. So even if the UK economy tanks utterly, the effect on the UK stock market should be relatively small. Indeed, perversely, since most FTSE companies report in UKP, a collapse of the UK economy (and stering) should push the FTSE up.

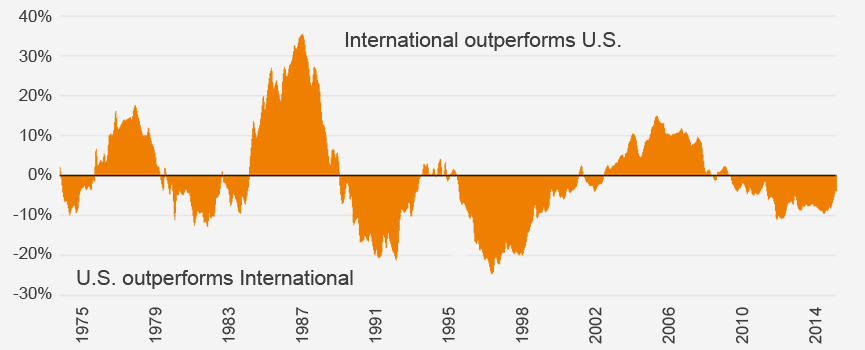

So this obviously begs the question, exactly why is the UK stock market doing so poorly compared to RoTW? Pure sentiment?

Gryff

My bold.

Which is why I went on in the post you part quoted to say...

Wizard wrote:..whatever their exposure to the UK itself there will be a further general hit to all UK listed companies if we do end up with no transition period agreement. Another good reason not to put all of ones investment eggs into the UK basket.

Maybe that equates to what you refer to as sentiment.