Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Revenge of the FTSE

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Revenge of the FTSE

UK was the best performing developed stock market in 2022

Over the last year the FTSE100 crushed the Nasdaq by 38%. I wonder how many investors were lured into the attractive US techs at the peak post-pandemic boom and now regretting their bandwagoning. In fact, it was one of the greatest years on record for value in comparison to growth.

While I doubt that 2023 will be a replica, it just shows once again that hopping from strategy to strategy only during the good times is usually a recipe for disaster.

Over the last year the FTSE100 crushed the Nasdaq by 38%. I wonder how many investors were lured into the attractive US techs at the peak post-pandemic boom and now regretting their bandwagoning. In fact, it was one of the greatest years on record for value in comparison to growth.

While I doubt that 2023 will be a replica, it just shows once again that hopping from strategy to strategy only during the good times is usually a recipe for disaster.

-

DelianLeague

- 2 Lemon pips

- Posts: 102

- Joined: September 15th, 2020, 11:44 am

- Has thanked: 54 times

- Been thanked: 70 times

Re: Revenge of the FTSE

Luckily my complete portfolio is about equal.

My SIPP is invested in World index Equity Trackers and some bonds. This is down but my ISA that's invested mainly in the FTSE 100 is up.

My trading account is a mix of opportunistic equity buys and fixed income/bonds. This is about equal.

D.L.

My SIPP is invested in World index Equity Trackers and some bonds. This is down but my ISA that's invested mainly in the FTSE 100 is up.

My trading account is a mix of opportunistic equity buys and fixed income/bonds. This is about equal.

D.L.

-

mc2fool

- Lemon Half

- Posts: 7894

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: Revenge of the FTSE

vand wrote:UK was the best performing developed stock market in 2022

Over the last year the FTSE100 crushed the Nasdaq by 38%.

Well, yeah, but it did so by going sideways while the NASDAQ bombed. Unfortunately the FTSE 250 didn't do as well as the 100.

https://uk.advfn.com/stock-market/FTSE/UKX/chart/real-time

For a TR (ish) GBP practical investors' view this is iShares FTSE 100 ACC ETF (CUKX) vs iShares NASDAQ 100 ACC ETF GBP class (CNX1)

https://uk.advfn.com/stock-market/london/ish-ftse100-acc-CUKX/chart/real-time

-

swill453

- Lemon Half

- Posts: 7991

- Joined: November 4th, 2016, 6:11 pm

- Has thanked: 991 times

- Been thanked: 3659 times

Re: Revenge of the FTSE

The FTSE All Share Total Return index was pretty much flat over the year - 8363 to 8391 (sorry no chart).

Scott.

Scott.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

Sometimes its not about how much you make, it's about how much you don't lose, and if you are able to go sideways while everything else around you is tanking it pretty good place to be.

Berkshire Hathaway went sideways through the dotcom crash which set them up to outperform the market over the following 20 years.

RIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

Playing a good defense may not be very glamorous, but its just as important for your long term results.

Berkshire Hathaway went sideways through the dotcom crash which set them up to outperform the market over the following 20 years.

RIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

Playing a good defense may not be very glamorous, but its just as important for your long term results.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

Thinking about this some more, it's arguably more important that you can play a good defense doing tough times, which is why going nowhere in the last year should be seen as major achievement.

Under which scenario would you rather underperform by 40% as Index B?

Scenario 1:

Index A beats Index B by delivering a +40% return while Index B delivers 0%.

Scenario 2:

Index A beats Index B by delivering 0% while Index B delivers -40%.

Clearly Scenario 2 is more difficult to recover from, as we know the bigger the fall the larger the following increase is required to get catch up.

Under Scenario 1, Index B will just need replicate Index A's performance (ie return +40%) in order to catch up. Under Scenario 2, Index B now needs to deliver a 66.67% return in order to catch up to Index A that hasn't even gone anywhere!

Under which scenario would you rather underperform by 40% as Index B?

Scenario 1:

Index A beats Index B by delivering a +40% return while Index B delivers 0%.

Scenario 2:

Index A beats Index B by delivering 0% while Index B delivers -40%.

Clearly Scenario 2 is more difficult to recover from, as we know the bigger the fall the larger the following increase is required to get catch up.

Under Scenario 1, Index B will just need replicate Index A's performance (ie return +40%) in order to catch up. Under Scenario 2, Index B now needs to deliver a 66.67% return in order to catch up to Index A that hasn't even gone anywhere!

-

SalvorHardin

- Lemon Quarter

- Posts: 2067

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5392 times

- Been thanked: 2493 times

-

Adamski

- Lemon Quarter

- Posts: 1122

- Joined: July 13th, 2020, 1:39 pm

- Has thanked: 1502 times

- Been thanked: 574 times

Re: Revenge of the FTSE

Surprising uk markets done so well given doom and gloom in the UK news. Think partly because was better value because the ftse 100 had a rough few years since the brexit vote, then Covid.

A good number of us here been predicting this a long time, my thread Tech correction March 2021, and Rotation into Value by vand in Jan 2022,. The highly inflated PE multiples of Faang, Tesla and China Tech were bound to need correction, was just a matter of when.

Now they're lower would think now good time to get into Tech if you can stomach risk of further falls. Personally I'm going to wait until after interest rates start coming down, so stick with a risk averse portfolio for now.

A good number of us here been predicting this a long time, my thread Tech correction March 2021, and Rotation into Value by vand in Jan 2022,. The highly inflated PE multiples of Faang, Tesla and China Tech were bound to need correction, was just a matter of when.

Now they're lower would think now good time to get into Tech if you can stomach risk of further falls. Personally I'm going to wait until after interest rates start coming down, so stick with a risk averse portfolio for now.

-

mc2fool

- Lemon Half

- Posts: 7894

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: Revenge of the FTSE

vand wrote:Sometimes its not about how much you make, it's about how much you don't lose, and if you are able to go sideways while everything else around you is tanking it pretty good place to be.

Berkshire Hathaway went sideways through the dotcom crash which set them up to outperform the market over the following 20 years.

RIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

Playing a good defense may not be very glamorous, but its just as important for your long term results.

Yeah, agree. I see my "wealth preservers" have been fairly flat over the last year, except for RCP, which isn't properly a wealth preserver although is often mentioned with CGT, PNL and RICA (the PNL share split isn't handled properly by ADVFN and messes up the chart so I haven't included it, but it more or less tracked CGT).

https://uk.advfn.com/stock-market/london/capital-gearing-CGT/chart/real-time

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

mc2fool wrote:vand wrote:Sometimes its not about how much you make, it's about how much you don't lose, and if you are able to go sideways while everything else around you is tanking it pretty good place to be.

Berkshire Hathaway went sideways through the dotcom crash which set them up to outperform the market over the following 20 years.

RIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

Playing a good defense may not be very glamorous, but its just as important for your long term results.

Yeah, agree. I see my "wealth preservers" have been fairly flat over the last year, except for RCP, which isn't properly a wealth preserver although is often mentioned with CGT, PNL and RICA (the PNL share split isn't handled properly by ADVFN and messes up the chart so I haven't included it, but it more or less tracked CGT).

https://uk.advfn.com/stock-market/london/capital-gearing-CGT/chart/real-time

Yes, RCP has been a bit disappointing but it's also trading at a much deeper discount to NAV than usual, so the fall looks worse than it really should

-

1nvest

- Lemon Quarter

- Posts: 4458

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 701 times

- Been thanked: 1373 times

Re: Revenge of the FTSE

Everyone knows that on average stocks are the more rewarding asset ... right?

Less well known is that average is volatile. On a 30 year SWR measure for instance in around 35% of cases all-stock (aggressive) was no better, or worse, than conservative.

The above average measure arises out of a few fantastic cases, more often where the start date followed deep-downs in stock prices. Relatively infrequent, less chance of the average investor actually benefiting from those gains (yes, partake, but not benefit due to riding both the down and up legs).

A conservative asset allocation has the option to rotate into a aggressive asset allocation after such deep-down events have occurred. It's generally better to hold a conservative asset allocation, and deploy that at opportune moments into aggressive, that over a typical 30 year horizon period will tend to arise sooner or later. Reduce the down-leg losses, partake heavily of the up-leg great gains.

BRK didn't really side step the dot com by design/intent, rather it wasn't heavily invested in dot com's. Similar for HYP1, it did much better than most across the 2001/2/3 down run due to being more equally diversified across stocks/sectors.

Don't know how RIT do their

as timing is a known more-luck-than-skill venture. I guess its more on a asset allocation/diversification basis, conservative, with the capacity to leverage/go-aggressive after deep-downs. But perhaps might include elements of buying Puts as/when the markets look iffy.

I posted a No Yield Portfolio here viewtopic.php?p=558301#p558301 comprised of thirds each BRK, MKL (baby BRK) and Gold. Which is perhaps somewhat along the lines of RIT ??

Less well known is that average is volatile. On a 30 year SWR measure for instance in around 35% of cases all-stock (aggressive) was no better, or worse, than conservative.

The above average measure arises out of a few fantastic cases, more often where the start date followed deep-downs in stock prices. Relatively infrequent, less chance of the average investor actually benefiting from those gains (yes, partake, but not benefit due to riding both the down and up legs).

A conservative asset allocation has the option to rotate into a aggressive asset allocation after such deep-down events have occurred. It's generally better to hold a conservative asset allocation, and deploy that at opportune moments into aggressive, that over a typical 30 year horizon period will tend to arise sooner or later. Reduce the down-leg losses, partake heavily of the up-leg great gains.

BRK didn't really side step the dot com by design/intent, rather it wasn't heavily invested in dot com's. Similar for HYP1, it did much better than most across the 2001/2/3 down run due to being more equally diversified across stocks/sectors.

Don't know how RIT do their

RIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

as timing is a known more-luck-than-skill venture. I guess its more on a asset allocation/diversification basis, conservative, with the capacity to leverage/go-aggressive after deep-downs. But perhaps might include elements of buying Puts as/when the markets look iffy.

I posted a No Yield Portfolio here viewtopic.php?p=558301#p558301 comprised of thirds each BRK, MKL (baby BRK) and Gold. Which is perhaps somewhat along the lines of RIT ??

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Revenge of the FTSE

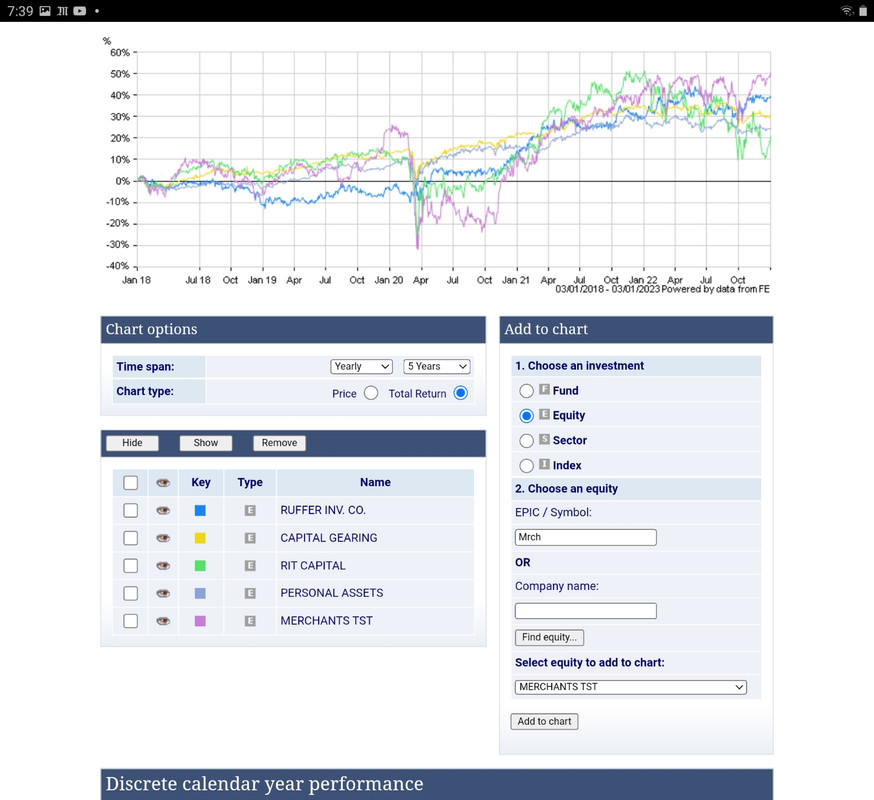

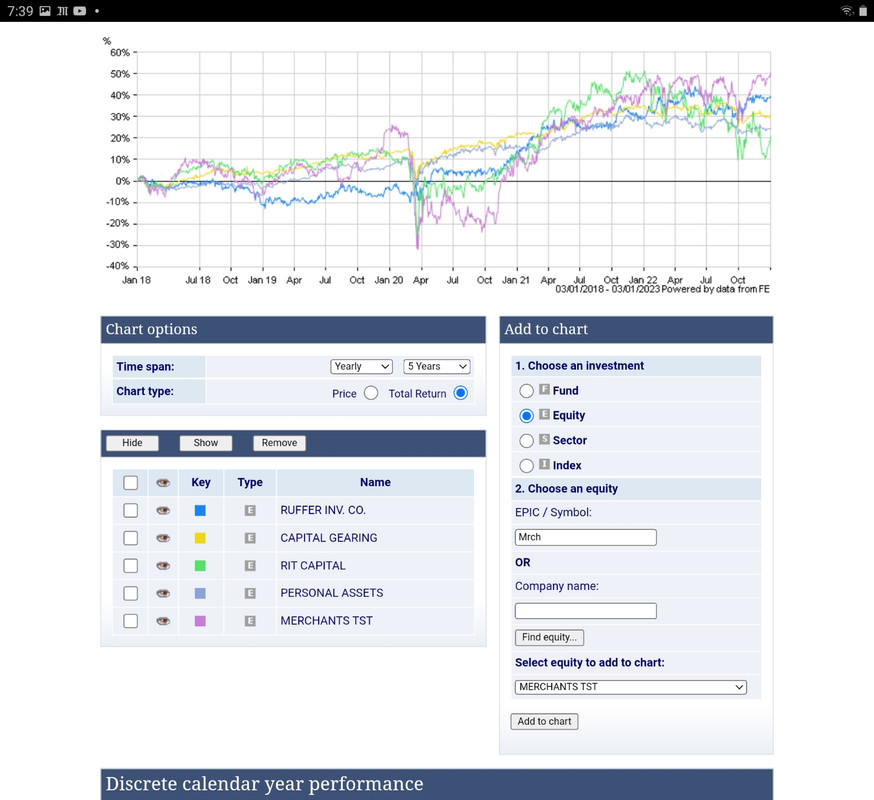

Merchants is holding it's own.....5 year total return

Source for both graphs https://www.hl.co.uk/funds/fund-discoun ... ion/charts

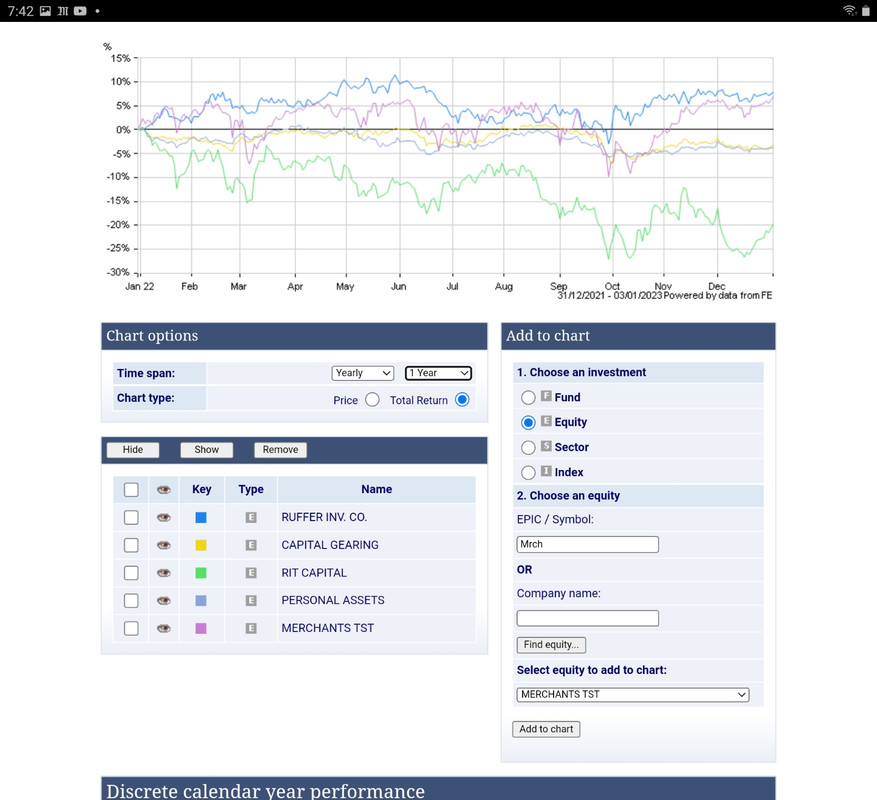

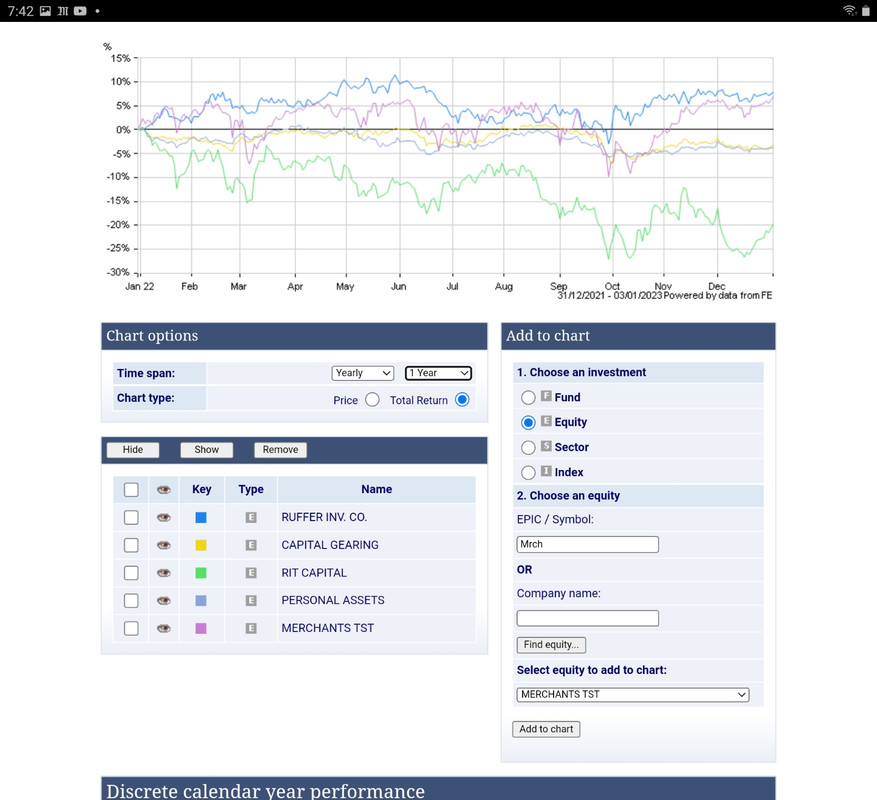

Or, over the last year..

Source for both graphs https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Or, over the last year..

-

scotia

- Lemon Quarter

- Posts: 3569

- Joined: November 4th, 2016, 8:43 pm

- Has thanked: 2377 times

- Been thanked: 1949 times

-

hiriskpaul

- Lemon Quarter

- Posts: 3931

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 706 times

- Been thanked: 1567 times

-

hiriskpaul

- Lemon Quarter

- Posts: 3931

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 706 times

- Been thanked: 1567 times

-

scrumpyjack

- Lemon Quarter

- Posts: 4861

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 616 times

- Been thanked: 2706 times

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

1nvest wrote:Everyone knows that on average stocks are the more rewarding asset ... right?

Less well known is that average is volatile. On a 30 year SWR measure for instance in around 35% of cases all-stock (aggressive) was no better, or worse, than conservative.

The above average measure arises out of a few fantastic cases, more often where the start date followed deep-downs in stock prices. Relatively infrequent, less chance of the average investor actually benefiting from those gains (yes, partake, but not benefit due to riding both the down and up legs).

A conservative asset allocation has the option to rotate into a aggressive asset allocation after such deep-down events have occurred. It's generally better to hold a conservative asset allocation, and deploy that at opportune moments into aggressive, that over a typical 30 year horizon period will tend to arise sooner or later. Reduce the down-leg losses, partake heavily of the up-leg great gains.

BRK didn't really side step the dot com by design/intent, rather it wasn't heavily invested in dot com's. Similar for HYP1, it did much better than most across the 2001/2/3 down run due to being more equally diversified across stocks/sectors.

Don't know how RIT do theirRIT Capital beats the market over the long term because they claim to participate in 76% of bull market upside but only 40% of bear market downsides.

as timing is a known more-luck-than-skill venture. I guess its more on a asset allocation/diversification basis, conservative, with the capacity to leverage/go-aggressive after deep-downs. But perhaps might include elements of buying Puts as/when the markets look iffy.

I posted a No Yield Portfolio here viewtopic.php?p=558301#p558301 comprised of thirds each BRK, MKL (baby BRK) and Gold. Which is perhaps somewhat along the lines of RIT ??

It's very little to do with market timing - you think that likes of Buffett are jumping in and out of the market? It's more about judging what the risk/reward on offer is and positioning yourself accordingly. "Luck" can persist for a short run - it can't persist for 25 or 30 years.

Risk is the other side of return - they go hand in hand. If you want to be a great investor you have to understand this relationship, and IMHO you can't be a good stock investor until you do understand it.

One of the best discussions I ever heard on this is from this interview with Howard Marks: so much wisdom rolled up here

https://mebfaber.com/2018/10/03/episode ... nvestment/

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

Take it with a pinch of salt, but FTSE's forward PE is as low as 10. Still compares favourably with S&P's 17ish imo.

https://www.yardeni.com/pub/mscipe.pdf

https://www.yardeni.com/pub/mscipe.pdf

-

hiriskpaul

- Lemon Quarter

- Posts: 3931

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 706 times

- Been thanked: 1567 times

Re: Revenge of the FTSE

vand wrote:Take it with a pinch of salt, but FTSE's forward PE is as low as 10. Still compares favourably with S&P's 17ish imo.

https://www.yardeni.com/pub/mscipe.pdf

The FTSE's PE has been lower than that of the S&P for over 10 years, but the E for the S&P has grown more.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Revenge of the FTSE

hiriskpaul wrote:vand wrote:Take it with a pinch of salt, but FTSE's forward PE is as low as 10. Still compares favourably with S&P's 17ish imo.

https://www.yardeni.com/pub/mscipe.pdf

The FTSE's PE has been lower than that of the S&P for over 10 years, but the E for the S&P has grown more.

The E has grown more yes, but so too did the P!

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 30 guests