Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

At a Crossroads

-

kiehugh

- Posts: 2

- Joined: March 30th, 2021, 10:53 am

At a Crossroads

I am not sure whether this is a rant or a question but here goes.

I feel that I am at an investing crossroads, I appreciate that there is no one solution fits all but I am not sure what my next step is.

2020 was a a good year for taking a positive step forward with my finances. I purchased a rental property with my friend as a Ltd company and put a pension strategy in place through my work.

The good news is that I still have circa 120k to invest but I am not sure what the next step is. Do I continue down the traditional property rental market? Maybe look at a holiday let/air bnb type investment, do I go for purely high yield and have it managed, do I go into partnership with a property investment firm. Do I look at a business (however no idea what that would be), or there are shares and other investments.

Financially I am in good shape, I have circa 2k per month left over from salary and other benefits, in my mind I want to make sure I am investing for the future but have a good life now.

I have dabbled with shares and investments in the past, made some good moves and some not so good - but not enough to write home about.

Any ideas or thoughts?

I feel that I am at an investing crossroads, I appreciate that there is no one solution fits all but I am not sure what my next step is.

2020 was a a good year for taking a positive step forward with my finances. I purchased a rental property with my friend as a Ltd company and put a pension strategy in place through my work.

The good news is that I still have circa 120k to invest but I am not sure what the next step is. Do I continue down the traditional property rental market? Maybe look at a holiday let/air bnb type investment, do I go for purely high yield and have it managed, do I go into partnership with a property investment firm. Do I look at a business (however no idea what that would be), or there are shares and other investments.

Financially I am in good shape, I have circa 2k per month left over from salary and other benefits, in my mind I want to make sure I am investing for the future but have a good life now.

I have dabbled with shares and investments in the past, made some good moves and some not so good - but not enough to write home about.

Any ideas or thoughts?

-

Steveam

- Lemon Slice

- Posts: 978

- Joined: March 18th, 2017, 10:22 pm

- Has thanked: 1767 times

- Been thanked: 536 times

Re: At a Crossroads

Obvious questions include your age, your future plans and ambitions, and current or likely responsibilities.

Slow and steady into broadly based passives (ITs or ETFs) until you’ve secured the future then perhaps a bit more ambition. Don’t “risk” everything on any view - however good an investment looks it can go wrong.

Make very sure you enjoy life while you can. Shrouds have no pockets.

Best wishes,

Steve

Slow and steady into broadly based passives (ITs or ETFs) until you’ve secured the future then perhaps a bit more ambition. Don’t “risk” everything on any view - however good an investment looks it can go wrong.

Make very sure you enjoy life while you can. Shrouds have no pockets.

Best wishes,

Steve

-

xeny

- Lemon Slice

- Posts: 450

- Joined: April 13th, 2017, 11:37 am

- Has thanked: 235 times

- Been thanked: 154 times

Re: At a Crossroads

Look at your finances holistically - I aim for some UK exposure, some whole world, some in property, some in equities.

Similarly, I have investments in ISA wrappers (so available now with no penalty) and in pension wrappers (so more beneficial tax treatment, but not accessible until I've aged a little).

Once you've looked at the whole lot, consider their relative proportions (I literally have a spreadsheet that totals estimated values for everything and then calculates a % of total by each asset) and put money where you feel you're under-represented.

Similarly, I have investments in ISA wrappers (so available now with no penalty) and in pension wrappers (so more beneficial tax treatment, but not accessible until I've aged a little).

Once you've looked at the whole lot, consider their relative proportions (I literally have a spreadsheet that totals estimated values for everything and then calculates a % of total by each asset) and put money where you feel you're under-represented.

-

dealtn

- Lemon Half

- Posts: 6087

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2335 times

Re: At a Crossroads

kiehugh wrote:... do I go for purely high yield ...

Financially I am in good shape, I have circa 2k per month left over from salary and other benefits, in my mind I want to make sure I am investing for the future but have a good life now.

No. Don't invest for yield. You have no need for present income so why should that be a priority? You recognise you are investing for the future. You won't be doing that going purely for high yield.

-

kiehugh

- Posts: 2

- Joined: March 30th, 2021, 10:53 am

Re: At a Crossroads

Thanks for the input.

@ Steve - I'm 37, I remortaged last summer - didn't want to take any equity out was and had a target to complete my mortgage by the age of 55. The money I am saving each month (old rate to new) whilst only circa £50 I am putting in a EFT as opposed to paying down the capital.

TBH I don't expect my currently or future responsibilities to change greatly, not planning on moving or having any more children. I have maxed out my ISA contributions for the last year (obviously the new tax year starts next week so will be looking at that option).

I am circling the right questions, just not sure what that next step is.

Another property seems to be the path of least resistance.

For some reason I have this feeling of urgency at the moment and I don't know why.

@ Steve - I'm 37, I remortaged last summer - didn't want to take any equity out was and had a target to complete my mortgage by the age of 55. The money I am saving each month (old rate to new) whilst only circa £50 I am putting in a EFT as opposed to paying down the capital.

TBH I don't expect my currently or future responsibilities to change greatly, not planning on moving or having any more children. I have maxed out my ISA contributions for the last year (obviously the new tax year starts next week so will be looking at that option).

I am circling the right questions, just not sure what that next step is.

Another property seems to be the path of least resistance.

For some reason I have this feeling of urgency at the moment and I don't know why.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 513 times

Re: At a Crossroads

I’d take the investment route, pick a few international Investment Trusts, nothing too clever. Here’s a few ideas

Foreign and Colonial

Monks

Bankers

Scottish and American

Alliance Trust

Mid Wynd

Scottish Mortgage

Smithson

Edinburgh Worldwide

Throw in a a passive World Tracker, say Vanguard All World or Developed World.

Invest monthly’s much as you can afford, throw in your lump sum, put it into the market over a period of time, to prevent regret if the market falls heavily after you start.

Do so tax efficiently and then sit back and do nothing at all, absolutely nothing !

I started a bit younger than you and forgot the do nothing bit.. despite that it worked out very, very well and I retired at 49.

(My initial lump sum was £2,000 and 8 trusts at £25 month (in 1990))

Property investing is ok but the equity investments have been brilliant, you need do nothing at all !!

Foreign and Colonial

Monks

Bankers

Scottish and American

Alliance Trust

Mid Wynd

Scottish Mortgage

Smithson

Edinburgh Worldwide

Throw in a a passive World Tracker, say Vanguard All World or Developed World.

Invest monthly’s much as you can afford, throw in your lump sum, put it into the market over a period of time, to prevent regret if the market falls heavily after you start.

Do so tax efficiently and then sit back and do nothing at all, absolutely nothing !

I started a bit younger than you and forgot the do nothing bit.. despite that it worked out very, very well and I retired at 49.

(My initial lump sum was £2,000 and 8 trusts at £25 month (in 1990))

Property investing is ok but the equity investments have been brilliant, you need do nothing at all !!

-

forrado

- 2 Lemon pips

- Posts: 221

- Joined: May 16th, 2017, 7:41 pm

- Has thanked: 4 times

- Been thanked: 242 times

Re: At a Crossroads

Hariseldon58 wrote:Property investing is ok but the equity investments have been brilliant, you need do nothing at all !!

Which has also been my experience over the past 35 years. Though, when I look back, I can’t help but think that many of my post World War II generation fortuitously found themselves in the right place at the right time to take advantage of favourable economic conditions, in tandem with such tax-efficient vehicles to do so, thanks to falling inflation and rising asset prices. Say what you will about central bankers and their coordinated actions, but for the likes Hariseldon58, myself and I daresay a good few others who occasionally contribute to the content of this site, we have been the beneficiaries for more than a quarter of a century of by-and-large doing very little other than maintain adequate funding levels then standing back as our holdings compounded in value.

On the basis of the maxim that Trees Don’t Grow To The Sky, my nagging concerns for the cohort of so-called Generation X investors, who are now entering a critical phase of their accumulation cycle, is that they will find the going a lot harder than the investors of my Baby Boomer generation found it to be.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

forrado wrote:Hariseldon58 wrote:Property investing is ok but the equity investments have been brilliant, you need do nothing at all !!

Which has also been my experience over the past 35 years. Though, when I look back, I can’t help but think that many of my post World War II generation fortuitously found themselves in the right place at the right time to take advantage of favourable economic conditions, in tandem with such tax-efficient vehicles to do so, thanks to falling inflation and rising asset prices. Say what you will about central bankers and their coordinated actions, but for the likes Hariseldon58, myself and I daresay a good few others who occasionally contribute to the content of this site, we have been the beneficiaries for more than a quarter of a century of by-and-large doing very little other than maintain adequate funding levels then standing back as our holdings compounded in value.

On the basis of the maxim that Trees Don’t Grow To The Sky, my nagging concerns for the cohort of so-called Generation X investors, who are now entering a critical phase of their accumulation cycle, is that they will find the going a lot harder than the investors of my Baby Boomer generation found it to be.

Paradigm shift. In a negative real world/era you're in effect paid to hold a mortgage. Pre-gen-X had to find money to pay/pay-down mortgages, at times severely so (I recall times when interest rates on my mortgage was north of 15%).

Including home value as part of your 'portfolio' is better than not IMO. Say you have 400K of liquid wealth, 200K home value of which half is outstanding mortgage value. Drawing 12K/year from that collective 600K capital base = 2% SWR that would require a 3% SWR from just the liquid wealth to provide the same 'income'. Yes you have mortage payments to meet also, perhaps at a fixed 5 year term cost of 2%, 2K/year which increases the SWR to 2.3%, but equally you have more capital (including loan) that will typically grow more in total £ terms.

In a low interest rate, negative real era, holding debt can actually be a asset.

Consider for instance someone who bought a house in 1989 and at the end of 1998 a decade later they'd paid 1.5 times more in interest than what the house price had risen by. Yes house prices had risen ahead of inflation so as a investment seemed good, but at a cost of perhaps struggling at times to 'maintain adequate funding levels'. I got caught up in that era myself having bought in 1989 only to them shortly see house prices decline and mortgage interest rates soar to 15%+ levels where maintaining adequate funding was a struggle that many failed to achieve, negative equity, insufficient income to cover the mortgage - repossession at a time when the house price/value was significantly lower than the price paid. Personally I avoided repossession by moving back into mum/dad's and renting (unofficially) along with working massive amounts of overtime.

Similarly for equities. Declines in real terms when you are saving/accumulating is a good thing, cost-averaging-in works better than having lumped-in at the start. But for those in drawdown that can be a nightmare. 4% SWR when investment total returns with dividends/interest reinvested falling at 4% annualised real (after inflation) across a decade can become critical, see much of prior wealth vanish over a relatively short (decade) long period. Stock accumulation since the 1970's was great when accumulated, for others in drawdown/retirement it may have led to the poor house, a lifetime of saving lost/spent over a relatively short period of time.

Broadly washes and 'on average' works out (very) well, but its the localised points where the risk lays and if your circumstances at the time conflict then for you the 'average' may prove to have been most illusive and the choice having been financially fatal.

What for instance if the next decade was dreadful for retirees/drawdown, but great for those accumulating/cost-averaging-in, a newly retired 60 year old (as a tail-end baby boomer that's me again), could perhaps see lifetime savings wiped out after a decade. Whilst gen X who were saving for their retirement might see such having worked out great by the time they retire. With that in mind my policy is to have accumulated more and looking to draw-down less (low SWR) that should see me through, but for others with less and needing to use a higher SWR, perhaps 4%, then it could turn out nasty. But then again it might not.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

kiehugh wrote:Do I continue down the traditional property rental market?

You've taken steps to generate a pension = bonds. You already have quite high exposure to properties. Concentration risk is one of the greatest risks and as such I'd be inclined to diversify i.e. add stocks. A global index tracker fund is guaranteed that it wont fail and adds in a degree of £ hedging.

Which is much like what the ancient Talmud advocated millennia ago, a third in land (home/properties), commerce (stocks) and reserves (that your 'bond' like pension might be considered as being).

Old money, generational wealth advocate similar, a-third, a-third, a-third ... land, art, gold. A study of Keynes' art collection over a long period of time (value compared up to 2019) found that the accumulated art collection value compared in total return terms to that of stock accumulation rewards.

Fundamentally both of the above say the same, don't put all eggs in one basket.

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: At a Crossroads

1nvest wrote:Fundamentally both of the above say the same, don't put all eggs in one basket.

As someone once said on this site, Diversification is the only free lunch in this game

-

kempiejon

- Lemon Quarter

- Posts: 3556

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1172 times

Re: At a Crossroads

Diversification is the only free lunch in investing

This phrase was coined in 1952 by Nobel Prize winner Harry Markowitz, one of the grandfathers of modern portfolio theory.

https://forbesbooks.com/diversification ... ree-lunch/

-

MyNameIsUrl

- Lemon Slice

- Posts: 478

- Joined: November 4th, 2016, 1:56 pm

- Has thanked: 1307 times

- Been thanked: 108 times

Re: At a Crossroads

kiehugh wrote: ... I purchased a rental property with my friend as a Ltd company...

Any ideas or thoughts?

If this is your first btl property I would suggest giving it a couple of years to see how it goes before buying a second. See how well the profitability offsets the work involved. Also to see how well the partnership with your friend works. If you do decide to buy a second property, make sure that the two of you can extricate yourselves if you decide to split. I don't know much about btl in a ltd co, but maybe having separate ltd cos for the two properties would help the process if required - I suggest doing a bit of research into exit strategies at an early stage.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

kempiejon wrote:Diversification is the only free lunch in investing

This phrase was coined in 1952 by Nobel Prize winner Harry Markowitz, one of the grandfathers of modern portfolio theory.

https://forbesbooks.com/diversification ... ree-lunch/

Thanks for that link.

Assuming your home value is 50% of your total wealth, they by eye from the pie chart in that link the liquid wealth might be divided 45/35/20 stock/bond/gold. Comparing that to all-stock and to a simpler three way equal split (US data).

Whilst to recent the all-stock is ahead measured on a annualised basis, at times it has lagged. Choice of start and end dates makes a difference. Looking at the growth progression line over time is perhaps a better indicator of the broader picture.

In a room of 9 individuals each 6 foot tall, if a 7 foot giant joins them then 90% are below the average height of the people in the room. So it is with stocks, the majority lag the broader average due to the right tails tallest/best extreme. Miss holding the best and you'll lag the broader average. Sometimes that right tail can be gold, in around a third of years. For instance US data 2000 for a decade had stocks losing -3% annualised total real return whilst gold made +11% annualised real return, a 14% spread/difference. Over other decades that swings the other way around.

Do you buy the hackstack in the weightings of the haystack that will tend to have the prior best performing being the more heavily weighted, or equal weight them as equally having the potential to be the next decades best. The latter seems reasonable.

Long dated bonds can be as volatile/rewarding as stocks, some stocks are more bond-like than stock-like. Other than over relatively short periods of time when the two can move opposite to each other they might be clumped together as one. Home (land), stocks (commerce) and gold (reserves) in equal measure is what the ancient Talmud advised. UK home (£), US stock ($) and gold (global) currencies, and where gold is also a commodity. For such a asset allocation you might count 'inflation' as being one third house price increases, two thirds CPI as a third of assets are in home value. Owning a home also avoids having to find/pay rent to others, has imputed rent benefit, historically around 4%, and liability matches that rent (you're both landlord and tenant). Including home value as part of your portfolio expands the capital base, for for the same £ amount of income drawn that's a lower SWR figure, and lowering SWR even a little can make a huge difference (safer).

For many, state/occupational pensions might be counted as 'bonds' in later life. 20K/year pension, 30 years retirement expectancy, 600K effective value of bonds.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

Given 100 stocks (FT100) the standard practice is to predict some more likely doing better than others i.e. cap weighted where considerably more of your £'s are bet on some stocks over others. One or more might for instance have 10% of the total available amount being bet on them. Across the 100 however and the prospects of those few being the best performers over a period of time is relatively low and in having bet big on others there's less being bet on the ones that turn out to have been the best. Equal £ weighted is conceptually the better, but that involves more costs/rebalancing, and sometimes the ones that were more heavily weighted under cap weighted do turn out to be the best (but at other times may be the worst). Equal weighting stocks is expensive. Equal weighting a few assets as collective sets, stocks, bonds, gold, whatever is more viable. You don't need to rebalance every year to realign weightings, could be left for a decade or more, or until any one becomes considered as 'too much concentration risk'. Which is along the lines of how Terry manages his TJH HYP.

-

tjh290633

- Lemon Half

- Posts: 8263

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 917 times

- Been thanked: 4130 times

Re: At a Crossroads

If you start out equally weighted, you will not end up equally weighted. Here is the change in share price of the shares which I hold since January 1st this year:

That is just to illustrate the amount of divergence in 3 months. It is likely to happen, whatever you choose.

TJH

Epic Change Yield

MARS 30.03% 0.00%

AV. 25.52% 5.09%

KGF 17.71% 2.52%

BT.A 17.05% 0.00%

LLOY 16.73% 1.32%

BP. 15.64% 6.66%

IMI 14.51% 1.69%

TATE 13.76% 3.83%

PSON 13.40% 2.52%

S32 11.97% 1.67%

MKS 10.67% 0.00%

VOD 9.05% 6.01%

SMDS 8.84% 2.91%

TW. 8.84% 4.52%

BHP 8.81% 5.47%

CPG 7.23% 0.00%

ADM 6.71% 5.15%

RDSB 6.00% 3.60%

LGEN 4.85% 6.15%

IGG 4.52% 4.87%

DGE 3.87% 2.32%

UU. 3.44% 4.66%

BA. 3.31% 4.62%

BLND 3.23% 3.22%

BATS 2.44% 7.78%

RIO 1.46% 7.32%

NG. -0.12% 5.72%

RB. -0.67% 2.69%

SGRO -1.06% 2.34%

TSCO -1.10% 4.22%

AZN -1.46% 2.84%

IMB -2.83% 9.20%

SSE -3.00% 5.58%

PHP -3.01% 4.21%

GSK -4.02% 6.12%

ULVR -7.65% 3.65%

That is just to illustrate the amount of divergence in 3 months. It is likely to happen, whatever you choose.

TJH

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

tjh290633 wrote:If you start out equally weighted, you will not end up equally weighted. Here is the change in share price of the shares which I hold since January 1st this year:Epic Change Yield

MARS 30.03% 0.00%

AV. 25.52% 5.09%

KGF 17.71% 2.52%

BT.A 17.05% 0.00%

LLOY 16.73% 1.32%

BP. 15.64% 6.66%

IMI 14.51% 1.69%

TATE 13.76% 3.83%

PSON 13.40% 2.52%

S32 11.97% 1.67%

MKS 10.67% 0.00%

VOD 9.05% 6.01%

SMDS 8.84% 2.91%

TW. 8.84% 4.52%

BHP 8.81% 5.47%

CPG 7.23% 0.00%

ADM 6.71% 5.15%

RDSB 6.00% 3.60%

LGEN 4.85% 6.15%

IGG 4.52% 4.87%

DGE 3.87% 2.32%

UU. 3.44% 4.66%

BA. 3.31% 4.62%

BLND 3.23% 3.22%

BATS 2.44% 7.78%

RIO 1.46% 7.32%

NG. -0.12% 5.72%

RB. -0.67% 2.69%

SGRO -1.06% 2.34%

TSCO -1.10% 4.22%

AZN -1.46% 2.84%

IMB -2.83% 9.20%

SSE -3.00% 5.58%

PHP -3.01% 4.21%

GSK -4.02% 6.12%

ULVR -7.65% 3.65%

That is just to illustrate the amount of divergence in 3 months. It is likely to happen, whatever you choose.

TJH

If you'd started with 50/50 stock/gold in Jan 2000, by the end of the decade with stocks accumulated (dividends reinvested) you'd have been holding 20/80 stock/gold proportions. Which is a form of having accumulated more of the better performing asset. Gold gained +11% annualised, stocks lost -3% annualised (real, after inflation values) over that period. You could approximate that as being 50 at the start, 80 at the end = 65% time weighted average gold, 35% average stock i.e. relatively higher average exposure to the better performing asset - which will naturally tend to yield a better overall reward than had you constantly realigned to 50/50 weights.

Looking at the data/figures you posted Terry and assuming total returns to be the sum of the % price change + a quarter of the % dividend yield for each stock, then 44% of the holdings individually achieved better than the average of the set, most (56%) of the stocks fell short of the average. The majority of the stocks fell short of the average gain. Weight the middle four (as ranked by total gains) at 10% weighting each (which is sort of along the lines of what a cap weighted index does i.e. tilts capital towards some stocks that) leaves less for the others and the weighted gain from that is lower than the gain had they all been equally weighted. 95% of the equal weighted gain in that (your data) particular case. That assumes a middle road average choice of stocks to overweight, in practice the ones you selected to overweight might relatively outperform or underperform the average, but in this case you'd have a 55% chance of picking ones that underperformed, 45% chance of picking ones that outperformed i.e. the odds are against you.

This is all not specific to that particular data set, but is a common feature/characteristic. Just how things typically work out in general.

There's a benefit from letting winners continue to run as-is (not rebalance). Weighting drift is just a natural part of that. You can start with equal weight and possibly even leave that to run for decades, more appropriately however is to de-risk the set when too much concentration risk is evident in single holdings. A factor with initial equal weight seeing a increase in one/a-few of great performers over time, is that risk becomes more concentrated and can backfire i.e. the prior greater performers into which a higher percentage of total portfolio £ value is concentrated faltering/failing has a greater impact upon the whole compared to had that/those stocks been less lightly weighted.

IIRC you rebalance in a partial/midway rebalance manner which again is a good choice. A form of half rebalanced, half not rebalanced. If the average £ value of holdings is £10,000 in each and one has risen to £20,000 value then reducing it down to £15,000 (and not the £10,000 average) ... type style.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: At a Crossroads

Diversification should be about lowering concentration risk and selecting assets that individually have positive reward expectancy and that aren't highly correlated (ideally more inclined to have one down the other up rather than both up or down at the same/similar time).

Rather than having preconceptions about a particular asset, look at the averages and correlations.

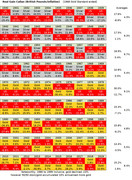

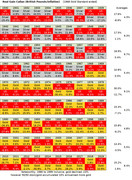

If of two assets you rank them each year best and worst, and the average of the yearly best is greater than the average losses endured by the worst, the average of the best and worst, then you're into positive territory. Here for instance is a Callan table for a British holder of US stocks and Precious Metals 50/50 yearly rebalanced and where for each decade I've shown the average of the decades best and worst, and then averaged those two values (rightmost figure). They're all after inflation values so reflect real gains/losses.

Stocks will tend to do well during prosperity, when more often real yields (base rate minus inflation) are positive. Gold tends to do well when real yields are negative, i.e. the two exhibit a degree of variable multi-year inverse correlation. With 50/50 allocations if one halves and the other doubles then overall you'd be 50% up. In the US since Jan 1972 to the end of 2020, 50/50 yearly rebalanced stock/gold yielded a 10.5% annualised reward compared to 10.65% for all-stock. Gold alone annualised 7.8% so you might say that gold earned a dividend via rebalancing/trading gain where broadly those gains compared to stock dividends.

There are three forms of gains - price appreciation, income (dividends/interest) and volatility capture. All three conceptually are equal as if that were not the case then investors would concentrate into the consistently more productive choice. Instead we have those that target growth (price appreciation), others that target income, yet others that target volatility (typically Options traders). A reasonable approach it to diversify to include elements of all three.

You can select assets with high degrees of correlation but that individually don't have positive reward expectancy and broadly the two will tend to cancel each other out. Such as in this example (or this.that uses 3x long/short). The 2x short has a negative reward expectancy, so pretty much cancels the 2x long positive reward expectancy. Perhaps useful for instance if you wanted to migrate a large amount out of SIPP and into ISA, hold the 2x long in ISA, 2x short in SIPP and time will tend to see migration. Rather than a flat 0% reward from that however you might add in a bias, perhaps into stocks ... like this

Rather than having preconceptions about a particular asset, look at the averages and correlations.

If of two assets you rank them each year best and worst, and the average of the yearly best is greater than the average losses endured by the worst, the average of the best and worst, then you're into positive territory. Here for instance is a Callan table for a British holder of US stocks and Precious Metals 50/50 yearly rebalanced and where for each decade I've shown the average of the decades best and worst, and then averaged those two values (rightmost figure). They're all after inflation values so reflect real gains/losses.

Stocks will tend to do well during prosperity, when more often real yields (base rate minus inflation) are positive. Gold tends to do well when real yields are negative, i.e. the two exhibit a degree of variable multi-year inverse correlation. With 50/50 allocations if one halves and the other doubles then overall you'd be 50% up. In the US since Jan 1972 to the end of 2020, 50/50 yearly rebalanced stock/gold yielded a 10.5% annualised reward compared to 10.65% for all-stock. Gold alone annualised 7.8% so you might say that gold earned a dividend via rebalancing/trading gain where broadly those gains compared to stock dividends.

There are three forms of gains - price appreciation, income (dividends/interest) and volatility capture. All three conceptually are equal as if that were not the case then investors would concentrate into the consistently more productive choice. Instead we have those that target growth (price appreciation), others that target income, yet others that target volatility (typically Options traders). A reasonable approach it to diversify to include elements of all three.

You can select assets with high degrees of correlation but that individually don't have positive reward expectancy and broadly the two will tend to cancel each other out. Such as in this example (or this.that uses 3x long/short). The 2x short has a negative reward expectancy, so pretty much cancels the 2x long positive reward expectancy. Perhaps useful for instance if you wanted to migrate a large amount out of SIPP and into ISA, hold the 2x long in ISA, 2x short in SIPP and time will tend to see migration. Rather than a flat 0% reward from that however you might add in a bias, perhaps into stocks ... like this

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 16 guests