Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Strategies in case of market correction/crash?

Strategies in case of market correction/crash?

Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

-

tjh290633

- Lemon Half

- Posts: 8267

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4130 times

Re: Strategies in case of market correction/crash?

Cash reserves are intended to guard against sharp reductions in income, rather than bargain hunting. I probably have about 2 year's income in a reserve fund, but it might be drawn on for house repairs, car replacement or holidays. Making off the cuff speculative investments is not an objective. For that, accumulated dividends are a more likely source, plus disposal of the "weakest links".

TJH

TJH

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5358 times

- Been thanked: 2485 times

Re: Strategies in case of market correction/crash?

I typically keep 3% to 7% in cash, though this doubles as my living expenses reserve (1% is roughly 1 year's living expenses). I am prepared to dip into this to buy. I live off my portfolio, which yields 1.9%, so the 0.9% excess income gives me a nice cushion.

I am happy to sell something that has fallen sharply in price to buy something else that has fallen.

Generally I have at least one shareholding earmarked as a holding to sell if I want to raise cash to quickly invest elsewhere.

I am happy to sell something that has fallen sharply in price to buy something else that has fallen.

Generally I have at least one shareholding earmarked as a holding to sell if I want to raise cash to quickly invest elsewhere.

-

torata

- Lemon Slice

- Posts: 523

- Joined: November 5th, 2016, 1:25 am

- Has thanked: 207 times

- Been thanked: 211 times

Re: Strategies in case of market correction/crash?

In my Sipp, I hold the iShares ultra short bond ETF, ERNS, specifically for that reason. It's traditionally been about 4% of portfolio (but just noticed it's now 3.3%)

I chose this route rather than straight cash in the account because

a) it delivers a return (about 0.7% annualized)

and

b) because it's an extra process for me to release the cash, forcing me to say to myself 'do I really want to do this?' OK, this meant that I didn't trigger it in time to load up on shares last March, but I'm fine with that.

Because I live outside the UK, my Sipps and ISAs are effectively locked to new cash.

torata

I chose this route rather than straight cash in the account because

a) it delivers a return (about 0.7% annualized)

and

b) because it's an extra process for me to release the cash, forcing me to say to myself 'do I really want to do this?' OK, this meant that I didn't trigger it in time to load up on shares last March, but I'm fine with that.

Because I live outside the UK, my Sipps and ISAs are effectively locked to new cash.

torata

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1287 times

Re: Strategies in case of market correction/crash?

Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

I think the OP is talking about having some cash reserves as "dry powder" to capitalise on a market correction, not about having cash reserves to subsidise his income in hard times. He has posted on the Investment Strategies board, not the HYP Practical.

I would suggest the type of responses he might get here would be along the lines of it's "time in the market", rather than "timing the market", and is it a good idea to sell shares in order to hold the cash ready to buy shares back again. The only time I would likely think about the latter, would be if I felt a particular holding was priced too high and due for a fall, and I was sitting on a significant profit; thus I might want to take some of that profit off the table, or top slice.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10025 times

Re: Strategies in case of market correction/crash?

Marky72 wrote:

Any thoughts much appreciated.

I think this is perhaps one of those 'very personal things' related to long-term investment that we need to find a solution for that suits our own 'investment personality', rather than trying to find an alternative, perhaps even 'popular', solution that might not particularly align with our own, sometimes broader requirements...

For me, I definitely wanted to find a solution that, first and foremost, meant that I didn't either need to, or even feel the need to, sell down holdings in a falling market. This was and still is a high priority for me, and was where I started from when looking into this particular issue, with a view that any solution needed to primarily satisfy that initial requirement if it was going to suit me personally...

So, with that in mind, I then considered how I'd deal with the strong emotional urge to 'be doing something' during these inevitable periods of market turbulence. I know myself well enough now to understand how difficult such periods have been in the past for me personally, and I needed to come up with a strategy to cope with that, so given that #Rule-1 was that I didn't want to be selling anything, I thought that the obvious strategy for me that could deal with both #Rule-1 (not sell anything) and also 'the urge to do something' would actually be to 'BUY something' during any particularly large downturns in the general markets...

The issue then was clearly to ask myself where, if I wasn't going to sell anything to raise funds for buying, any capital might actually come from that might then be used to do that, and it became quite clear at that point that if I was in a position where I knew my 'investment personality' well enough to know that I needed to satisfy both of the above requirements, then I clearly now needed to make sure there were relatively fluid funds likely to be available when such downturns occurred, and so it was at that point that I decided to try to always 'carry' a modest amount of cash or near-cash-equivalents that would satisfy that particular need...

The above then morphed into a fairly simple and robust strategy that I've found has suited me tremendously-well over many years now, which I've incorporated into my overall investment strategy whilst still working and building my portfolio -

1. Carry a cash or near-cash float of around 2-3% of overall portfolio size, to be used for purchasing 'cheaper' investments during large market downturns.

2. Once the above float is achieved in cash or near-cash terms, then any new portfolio-related income or fresh investment capital from wages can be used for more regular investments during 'normal' markets

3. If the above 'market downturn' funds get used, then new portfolio income or fresh investment capital from wages is directed towards topping up that cash float again, before more 'regular' investments resume.

The above approach suits me in a number of areas, and after being 'lucky' enough to have used it through both the 2007 financial crisis and also the 2020 COVID-induced market rout, I know that it delivers on my primary goal, which is for that strategy to act as a well rehearsed 'Fire Drill' that enables me to act sensibly during a crisis in a way that ruffles my own feathers in as little a way as possible...

Of course it's absolutely clear that maintaining cash or near-cash floats will carry both inflation and 'opportunity' costs by doing so, and I'm not kidding myself at all that this isn't the case, but this is one of those personal-investment areas where I've decided that any particular 'benefits' that suit me personally and highly likely to have some sort of costs one way or another anyway, and I think it's just important to make sure that where any such costs are borne in such a way, that any benefits coming from those costs are useful to us personally, and I know well that in this case they really are...

A caveat with the above approach is that I've only really proved to myself that I'm very happy with it whilst I'm still working, and I know in the back of my mind that there will be further 'stress-tests' of this approach if and when I'm lucky enough to retire, that may introduce slightly different personal responses than I've known during an investment lifetime where up to now I've always had that 'backstop' of a working wage to cushion some of the inevitable emotional blows that we endure when markets sneeze in a big way, and I'm quite open to the possibility that things might need to be tweaked again slightly once a future 'retirement-phase' might kick in, but I'm very happy to cross that bridge when I get to it, and I'll continue to take the above approach that I know suits me very well personally at the moment, even if there's clearly an 'opportunity-cost' in taking it....

A second caveat with the above approach is that this 'market-rout' capital is completely separate from what I consider to be my 'emergency fall-back' cash funds, such as a pot of capital available to fund a two or three-year 'emergency wages' period, but whilst I would never countenance using those 'emergency wages' funds for such 'market-rout' purchases, I do consider that the separate 'market-rout' funds might well come in useful the other way under some 'sky falling in' circumstances, so that also provides me with some contentment regarding any inflation or 'opportunity costs' related to such 'market-rout' funds as well...

Cheers,

Itsallaguess

-

Gerry557

- Lemon Quarter

- Posts: 2041

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 557 times

Re: Strategies in case of market correction/crash?

I put dividends into a pot for reinvestment and some is marked for a market downturns. The levels vary depending on what is happening. If the market is doing well it tends to build up.

Brexit and covid have depleted most but its building back up again. Generally I'm looking to grow my investments and an ever increasing dividend. So I tend to keep most deployed. So its a small percentage. Most of my covid buys are flashing sell now but I might lock in the higher dividends as a correction will still likely leave me looking OK.

There are several ways to keep surplus funds but most mean your cash is not really working so its finding a balance that you are happy with and how flexible you are. Other income also plays a part, if its steady and secure. Pension rather than job possibly. Even dividends can be cancelled or reduced so relying on them might not work either. Your outgoings also play a part how much can you survive on a medium term.

You might be able to have larger amounts available at lowish cost by using a flexible or offset mortgage and or personal loans. This involves some leverage and has a cost but this might work for some. Can you get an advance of pay? Borrowing is currently relatively cheap and for some it's probably not worth paying down a mortgage so taking some back might workout.

You might be able to borrow from yourself. Your car, kids uni funds and holiday savings, assuming you can build them back up before you really need them.

I think the hardest bit is knowing when to deploy and how much to keep back. Your favourite share drops 15%, you buy and two days later its dropped another 10%. Also most people get scared out of the markets when it's dire.

The next thing is knowing when the next market fall will be. It might be just around the corner or a decade away. If the latter, its a long time to hold useless cash and that's a lot of missed dividends that might cover any falls in a temporary situation.

You could invest in something that might not fall as much such as bonds which you could sell in a market downtown to fund your shares and then restock at a later date from the increased dividends or profit. Some people also use premium bonds as a reserve.

Alternatively you might have a family member who is willing to help out. Borrowing their cash stash and paying them a higher rate than the building society.

Whatever you do, it will be wrong in hindsight. The pot will be to small if the market drops and too big if it doesn't. If only I knew when the next market drop will be.

Brexit and covid have depleted most but its building back up again. Generally I'm looking to grow my investments and an ever increasing dividend. So I tend to keep most deployed. So its a small percentage. Most of my covid buys are flashing sell now but I might lock in the higher dividends as a correction will still likely leave me looking OK.

There are several ways to keep surplus funds but most mean your cash is not really working so its finding a balance that you are happy with and how flexible you are. Other income also plays a part, if its steady and secure. Pension rather than job possibly. Even dividends can be cancelled or reduced so relying on them might not work either. Your outgoings also play a part how much can you survive on a medium term.

You might be able to have larger amounts available at lowish cost by using a flexible or offset mortgage and or personal loans. This involves some leverage and has a cost but this might work for some. Can you get an advance of pay? Borrowing is currently relatively cheap and for some it's probably not worth paying down a mortgage so taking some back might workout.

You might be able to borrow from yourself. Your car, kids uni funds and holiday savings, assuming you can build them back up before you really need them.

I think the hardest bit is knowing when to deploy and how much to keep back. Your favourite share drops 15%, you buy and two days later its dropped another 10%. Also most people get scared out of the markets when it's dire.

The next thing is knowing when the next market fall will be. It might be just around the corner or a decade away. If the latter, its a long time to hold useless cash and that's a lot of missed dividends that might cover any falls in a temporary situation.

You could invest in something that might not fall as much such as bonds which you could sell in a market downtown to fund your shares and then restock at a later date from the increased dividends or profit. Some people also use premium bonds as a reserve.

Alternatively you might have a family member who is willing to help out. Borrowing their cash stash and paying them a higher rate than the building society.

Whatever you do, it will be wrong in hindsight. The pot will be to small if the market drops and too big if it doesn't. If only I knew when the next market drop will be.

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Strategies in case of market correction/crash?

Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

Hard cash, currency - very little nowadays as I mostly use a debit/credit card for spending. Cash as in just currency in a account earning 0%, a modest amount as that makes up 20% of what I more broadly consider to be 'cash' from a investing perspective. That others might define as being 'bonds'. So we're into semantics.

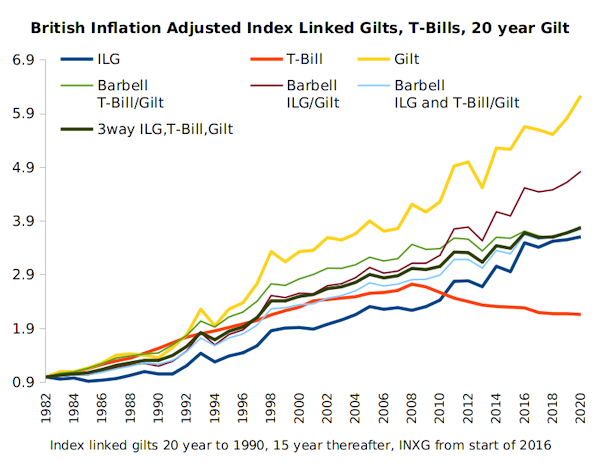

For investment 'cash' (bonds), I consider a equal 5 way split of stock/gold/Index Linked Gilts/short dated Gilts/long dated gilts ... to be my reserves and from where spending can be drawn. And if you set a target weightings for stock/cash then rebalancing back to that target weighting periodically will tend to have to add-low/reduce-high trade/time the market reasonably well. 60/40 target stock/cash, 50/50 current, then rebalance back to 60/40 (reduce cash to add to stock).

For me, from a 'cash' bucket perspective a stock/gold 50/50 barbell is a form of global currency inflation bond bullet. A barbell of short and long dated gilts barbell also is a form of central 10 year bullet. A barbell of inflation bonds (index linked gilts) and conventional gilts has one or the other doing OK if there's unexpected inflation or deflation ...etc. As a collective 'cash' pot that does OK, betters for instance just holding inflation bonds alone and their current negative real yields. More like a 4% real 'bond' and when your cash is earning that sort of return its 'good enough'. Partnered with stocks for growth and as cash gets drawn-down/spent, so broadly stock gains tend to offset and more those withdrawals. In the current low interest rate era I'm not inclined to add to long dated gilts, instead prefer to shorten down the duration/maturity, so migrating more towards stock/gold/5 year bond ladder/index linked gilts 20/20/40/20 type weightings. For a visualisation of how that might work out then for a 50/50 stock/cash choice historically using US data see here where P1 is 'cash' P2 is stock and P3 is 50/50 of the two.

For actual withdrawals for spending I have a ii account that includes a free trade each month, login a few days before the money is needed (T+3) and sell some of the asset that has the highest value at the time. Then a few days later transfer that to my linked bank account. So not quite instant access cash. For shorter term emergency cash I'm inclined to just leave that to my credit cards.

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: Strategies in case of market correction/crash?

Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

Mark,

I like the idea of "keeping some powder dry" for opportunities, but feel uncomfortable with bonds - they feel like return free risk waiting to get a pummelling if inflation takes off.

I am building my cash reserve in my SIPP by accumulating dividends and not reinvesting, but this is primarily about creating a risk reduction buffer for when I start drawing on it next tax year.

What I did do in March 2020, was rotate out of some defensive positions to buy a couple of things that I felt were over sold.

I keep several % of my total portfolio in a physical gold ETF (PHAU), I sold a chunk of this, and also sold a chunk of a defensive utility (Pennon). Both of these dropped a little in the market crash, but much less than the targets I bought - L&G was the major play, with a minor stake in BT.

In my GIA, I used a bunch of cash reserve to acquire FCIT & MNKS ITs.

My ISA stayed fully invested through the crash.

With new funds, I rebuilt my position in the gold ETF, and have also started a stake in SPGP an ETF in gold miners shares, which is a 'leveraged' position on the gold price.

I think having a position in gold is a good insurance policy, and one that can be used to rotate coverage into shares when opportunities present. It is also there if something really major hits the fan which makes the COVID pandemic seem like small beer (the scenario I think of as a possible example involves N. Korea using nukes on Seoul or Tokyo).

While being in cash for a couple of years expenditure is good from a risk reduction point of view, and counterintuitively cash is a good place to be as one transitions form low inflation to high inflation (as bonds and other assets get repriced), I don't want to have too much in cash over a long period in case inflation surges and endures. As noted earlier, I don't feel comfortable in bonds.

hope this helps

tuk020

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Strategies in case of market correction/crash?

TUK020 wrote:I like the idea of "keeping some powder dry" for opportunities, but feel uncomfortable with bonds - they feel like return free risk waiting to get a pummelling if inflation takes off.

I am building my cash reserve in my SIPP by accumulating dividends and not reinvesting, but this is primarily about creating a risk reduction buffer for when I start drawing on it next tax year.

What I did do in March 2020, was rotate out of some defensive positions to buy a couple of things that I felt were over sold.

I keep several % of my total portfolio in a physical gold ETF (PHAU), I sold a chunk of this, and also sold a chunk of a defensive utility (Pennon). Both of these dropped a little in the market crash, but much less than the targets I bought - L&G was the major play, with a minor stake in BT.

In my GIA, I used a bunch of cash reserve to acquire FCIT & MNKS ITs.

My ISA stayed fully invested through the crash.

With new funds, I rebuilt my position in the gold ETF, and have also started a stake in SPGP an ETF in gold miners shares, which is a 'leveraged' position on the gold price.

I think having a position in gold is a good insurance policy, and one that can be used to rotate coverage into shares when opportunities present. It is also there if something really major hits the fan which makes the COVID pandemic seem like small beer (the scenario I think of as a possible example involves N. Korea using nukes on Seoul or Tokyo).

While being in cash for a couple of years expenditure is good from a risk reduction point of view, and counterintuitively cash is a good place to be as one transitions form low inflation to high inflation (as bonds and other assets get repriced), I don't want to have too much in cash over a long period in case inflation surges and endures. As noted earlier, I don't feel comfortable in bonds.

hope this helps

tuk020

Again much depends upon your definition of 'bonds' (or cash). Some stocks are more bond-like than some bonds that are more stock-like.

High to low interest rates have been great for long dated Gilts and sooner or later that might stall, but some have been saying such since the 2009 financial crisis and where its been more a case of short dated (T-Bills) that have so far suffered.

Totally agree about including some gold, but that's best hedged 50/50 with stock IMO. Could be considered as a form of undated zero coupon inflation bond and as such having high price volatility, a polar opposite to stocks, and as such best held as a barbell of stock/gold.

-

LooseCannon101

- Lemon Slice

- Posts: 255

- Joined: November 5th, 2016, 2:12 pm

- Has thanked: 310 times

- Been thanked: 148 times

Re: Strategies in case of market correction/crash?

I keep very little in cash - about 1%, with the rest in a highly diversified global equity fund.

When there is a drop of 10% in a share or the overall market, how do you know that it won't go down another 10%? The same thing can happen on the way up.

I feel most comfortable re-investing dividends and topping up when I have spare cash. My experience of investing over the past 20 years is that both the professional fund manager and the average pundit are often wrong and that the market moves in unexpected ways.

When there is a drop of 10% in a share or the overall market, how do you know that it won't go down another 10%? The same thing can happen on the way up.

I feel most comfortable re-investing dividends and topping up when I have spare cash. My experience of investing over the past 20 years is that both the professional fund manager and the average pundit are often wrong and that the market moves in unexpected ways.

Re: Strategies in case of market correction/crash?

TUK020 wrote:Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

Mark,

I like the idea of "keeping some powder dry" for opportunities, but feel uncomfortable with bonds - they feel like return free risk waiting to get a pummelling if inflation takes off.

I am building my cash reserve in my SIPP by accumulating dividends and not reinvesting, but this is primarily about creating a risk reduction buffer for when I start drawing on it next tax year.

What I did do in March 2020, was rotate out of some defensive positions to buy a couple of things that I felt were over sold.

I keep several % of my total portfolio in a physical gold ETF (PHAU), I sold a chunk of this, and also sold a chunk of a defensive utility (Pennon). Both of these dropped a little in the market crash, but much less than the targets I bought - L&G was the major play, with a minor stake in BT.

In my GIA, I used a bunch of cash reserve to acquire FCIT & MNKS ITs.

My ISA stayed fully invested through the crash.

With new funds, I rebuilt my position in the gold ETF, and have also started a stake in SPGP an ETF in gold miners shares, which is a 'leveraged' position on the gold price.

I think having a position in gold is a good insurance policy, and one that can be used to rotate coverage into shares when opportunities present. It is also there if something really major hits the fan which makes the COVID pandemic seem like small beer (the scenario I think of as a possible example involves N. Korea using nukes on Seoul or Tokyo).

Thanks for this ... How would I go about investing in a bit of gold please? What is the ticker of a common gold stock that people generally purchase?

While being in cash for a couple of years expenditure is good from a risk reduction point of view, and counterintuitively cash is a good place to be as one transitions form low inflation to high inflation (as bonds and other assets get repriced), I don't want to have too much in cash over a long period in case inflation surges and endures. As noted earlier, I don't feel comfortable in bonds.

hope this helps

tuk020

Re: Strategies in case of market correction/crash?

richfool wrote:Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

I think the OP is talking about having some cash reserves as "dry powder" to capitalise on a market correction, not about having cash reserves to subsidise his income in hard times. He has posted on the Investment Strategies board, not the HYP Practical.

I would suggest the type of responses he might get here would be along the lines of it's "time in the market", rather than "timing the market", and is it a good idea to sell shares in order to hold the cash ready to buy shares back again. The only time I would likely think about the latter, would be if I felt a particular holding was priced too high and due for a fall, and I was sitting on a significant profit; thus I might want to take some of that profit off the table, or top slice.

Yes you are right, that was what I was asking - thanks for the clarity and your thoughts.

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Strategies in case of market correction/crash?

Marky72 wrote:TUK020 wrote:Marky72 wrote:Hi guys,

Hope everyone is well. I was just wondering how many of you guys keep money aside to invest in case of a stock market crash/correction with the aim to go hunting for "bargain" shares or simply top up existing ones that you feel are good value/potential? Also, if so what % do you keep in reserve ready to use if and when the market tanks? I am only asking as I have used up all my allowance this year and was contemplating selling a few shares to have a reserve? I am going to be invested for the medium/long term and don't need the money anytime soon (at least 8-10 years)

Any thoughts much appreciated.

Thanks,

Mark

Mark,

I like the idea of "keeping some powder dry" for opportunities, but feel uncomfortable with bonds - they feel like return free risk waiting to get a pummelling if inflation takes off.

I am building my cash reserve in my SIPP by accumulating dividends and not reinvesting, but this is primarily about creating a risk reduction buffer for when I start drawing on it next tax year.

What I did do in March 2020, was rotate out of some defensive positions to buy a couple of things that I felt were over sold.

I keep several % of my total portfolio in a physical gold ETF (PHAU), I sold a chunk of this, and also sold a chunk of a defensive utility (Pennon). Both of these dropped a little in the market crash, but much less than the targets I bought - L&G was the major play, with a minor stake in BT.

In my GIA, I used a bunch of cash reserve to acquire FCIT & MNKS ITs.

My ISA stayed fully invested through the crash.

With new funds, I rebuilt my position in the gold ETF, and have also started a stake in SPGP an ETF in gold miners shares, which is a 'leveraged' position on the gold price.

I think having a position in gold is a good insurance policy, and one that can be used to rotate coverage into shares when opportunities present. It is also there if something really major hits the fan which makes the COVID pandemic seem like small beer (the scenario I think of as a possible example involves N. Korea using nukes on Seoul or Tokyo).

Thanks for this ... How would I go about investing in a bit of gold please? What is the ticker of a common gold stock that people generally purchase?

SGLN - gold

INXG - index linked gilts

IGLS - short dated gilts

IGLT - long dated gilts

A 50/50 blend of short and long (20 year) dated conventional gilts/bonds will tend to reflect a central 10 year 'bullet'. Which tends to reflect changes in nominal yields. Index Linked Gilts (inflation bond) tend to reflect changes in real (after inflation) yields, as does gold but where gold is more like a undated zero coupon inflation bond. Blending some/all reduces being all in one type of risk/reward factor and better diversifies across unexpected changes in nominal/real yields. A bit like diversifying across multiple stocks rather than being exposed to a single stock alone. And as a collective set ... "bonds" combined with stocks tends to be less risky than all in bonds or all in stocks alone.

Re: Strategies in case of market correction/crash?

Gerry557 wrote:I put dividends into a pot for reinvestment and some is marked for a market downturns. The levels vary depending on what is happening. If the market is doing well it tends to build up.

Brexit and covid have depleted most but its building back up again. Generally I'm looking to grow my investments and an ever increasing dividend. So I tend to keep most deployed. So its a small percentage. Most of my covid buys are flashing sell now but I might lock in the higher dividends as a correction will still likely leave me looking OK.

Could I ask what made you come to the conclusion that most your Covid stocks are flashing sell now and which ones in particular are you referring to if you dont mind ?

Last edited by tjh290633 on June 13th, 2021, 10:05 pm, edited 1 time in total.

Reason: Missing tag restored - TJH

Reason: Missing tag restored - TJH

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: Strategies in case of market correction/crash?

1nvest wrote:Marky72 wrote:

Thanks for this ... How would I go about investing in a bit of gold please? What is the ticker of a common gold stock that people generally purchase?

SGLN - gold

INXG - index linked gilts

IGLS - short dated gilts

IGLT - long dated gilts

A 50/50 blend of short and long (20 year) dated conventional gilts/bonds will tend to reflect a central 10 year 'bullet'. Which tends to reflect changes in nominal yields. Index Linked Gilts (inflation bond) tend to reflect changes in real (after inflation) yields, as does gold but where gold is more like a undated zero coupon inflation bond. Blending some/all reduces being all in one type of risk/reward factor and better diversifies across unexpected changes in nominal/real yields. A bit like diversifying across multiple stocks rather than being exposed to a single stock alone. And as a collective set ... "bonds" combined with stocks tends to be less risky than all in bonds or all in stocks alone.

PHAU https://markets.ft.com/data/etfs/tearsh ... AU:LSE:USD

Physical gold in USD, on London exchange.

SPGP https://markets.ft.com/data/etfs/tearsh ... GP:LSE:GBX

ETF Gold Producers

Re: Strategies in case of market correction/crash?

If it is still available, I found the Capital Gearing Trust quarterly report from the Covid dip an interesting read.

They were quite active rotating their wide range of assets, of which cash to stocks is just one option.

Worth a look at what the professionals do, and I seem to recall, the speed and assertiveness with which they do it.

I was hopeless.

W.

They were quite active rotating their wide range of assets, of which cash to stocks is just one option.

Worth a look at what the professionals do, and I seem to recall, the speed and assertiveness with which they do it.

I was hopeless.

W.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 35 guests