http://warrenbuffettoninvestment.com/ho ... -investor/The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. It makes no difference to a widow with her savings in a 5% passbook account whether she pays 100% income tax on her interest income during a period of zero inflation, or pays no income taxes during years of 5% inflation. Either way, she is “taxed” in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 120% income tax, but doesn’t seem to notice that 6% inflation is the economic equivalent.

UK stocks with a retiree drawing a 4% SWR across 1973 and 1974 went into the start of 1975 with less than 25% of their inflation adjusted start date portfolio remaining and would have to drawn over 20% of that at the start of 1975 for that years spending, a year when there was also 25% inflation. And that's just pure mathematical based. In practice taxation had also soared, the Beatles for instance were singing 'Taxman' ... in reflection of 95% tax rates, even for Joe Average taxes were up at 40% type levels.

In the early 1980's Inflation Linked Gilts were introduced, however if such were available in those 1970's years I very much suspect that methods would be employed to dilute down the Treasury having to pay 25% type interest rates. Majors such as the UK don't default openly, so I suspect it would have been via taxation, 25% inflation, 40% taxation, -10% net real. Under present era conditions I guess ISA rules might be revised to only exempt capital gains from taxation, the path to potential taxation of ISA income sources was somewhat indicated in a budget some years back, can't recall exactly which, but where something along the lines of "ISA dividends continue to remain tax exempt" was said, which pricked my ears at that time as being a pointer to that removal of tax exemption of ISA income streams had been considered.

If you managed to get through those 1970's years with a reasonable amount of capital still intact then good gains followed, 1980's/1990's could be considered as 'compensation' years, but only for those who had capital. For some they might have seen the equivalent of a £1M portfolio value in todays money terms quickly reduced down to very low levels, more so if a unexpected expense occurred such as having to replace your roof. Returning to work would have been difficult given that many had been reduced to three day weeks and strikes were rife, with regular power cuts etc.

In other even earlier cases of receding tides real (inflation factored in) outcomes have seen both price and dividends declining more than 80%, that when combined with also drawing a income and paying taxes could have wiped retirement investors out relatively quickly. Such periods repeat across time, where some totally avoid stocks as being 'pure speculative' due to either personal or family past experiences. Groucho Marx for instance was a keen stock investor in his earlier years, lost a absolute fortune and thereafter remained in bonds in his later life.

A factor is that even a decent reserve might be harshly hit, enough spending for a year or two under high inflation, high taxation along with a unexpected expense could be all spent much quicker than anticipated.

Such bad cycles can and do occur, the question is when. Nobody knows but present day circumstances/valuations/interest rates etc. are perhaps more indicative of a potential cycle repeat being sooner rather than later. And when your horizon is perhaps 30 years there is a risk that many of today's "stocks have served me well, I'm near all-in" may get caught out as others have in the past.

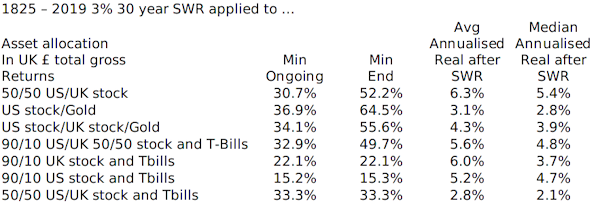

Key is to get through those often relatively short periods, perhaps just 5 or 10 years, with enough capital still intact to benefit from the pre or post compensation/good-times. For accumulators that's a breeze as such declines can actually enhance your overall outcome/rewards. For retirees its a case of having enough that a low SWR/withdrawal rate has you near no different to being a accumulator. Plan for the worst, such as using a 2% SWR, hope for the best - where the portfolio value might grow well ahead of inflation such that additional periodic discretionary spending might be drawn/spent.

Being very pessimistic here, I'm not a doomster, rather just highlighting what can/does occur at times and forewarned is forearmed. We've just been through a era where central banks all around the world having been printing money to buy up bonds, where with such a big buyer on the block who has no regard for what return they achieve prices of bonds have risen to levels where negative real yields are apparent. With bond prices/values so high so pension funds rebalance out of bonds into stocks, that has pushed stocks to high valuations. In the US over the last 12 years stocks have rewarded around 14% annualised real gains and even if they paid just 0% for the next 12 years investors over those 24 years would still have achieved 7% annualised real rewards. But for a investor drawing perhaps 4% across a period of 0% real, well they're eating capital, see the income drawn rising as a percentage of ongoing portfolio value, perhaps half their portfolio value spent after 10 years. The reality is that each/any asset allocation during retirement/drawdown can dip to being down at 25% of former start date inflation adjusted value and you have to be prepared for that. Where a initial 4% may be up at being the equivalent of a 16% withdrawal rate relative to ongoing portfolio value and borderline sustainable. The best defence is having more than enough baseline capital, instead of 25 times yearly spending having 50 times such that a 2% SWR is enough. Better still is having enough in other sources of income to see you through. A retiree with a £10K/year state pension, another £10K/year index linked occupational pension or annuity, £25K/year spending, only needs £5K of yearly income from investments which if 2% = £250K portfolio value. For the next gen for whom inflation linked state/occupational pensions are perhaps no longer available, well they'll have to accumulate their own personal pots of around £1.25M to compare, and bear the risk of poor management/errors/circumstances of those funds, along with other higher expenses such as the transition towards self funding of their own health care etc.