#426522

Postby 1nvest » July 10th, 2021, 6:49 pm

90/10 Buffett style has a good chance of being OK, but historic events such as -75% declines in real terms for both price index and income index (dividends) as occurred 1910-1920 along with also drawing a income!!!

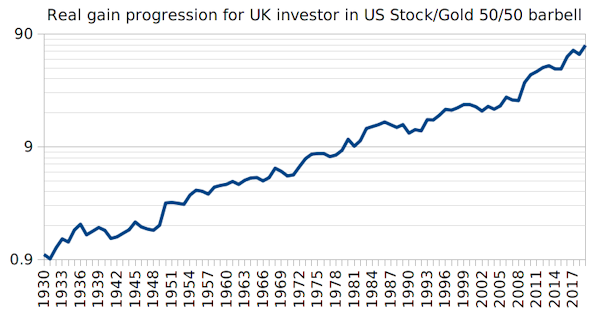

My other primary preference is a Talmud style, third each in land (UK home), commerce (US stocks), reserves (gold). Get's tricky to backtest due to the likes of money being pegged to gold pre 1932 so in practice holding money deposited and earning interest was better.

Owing a home avoids having to find/pay rent, historically worth around 4.2% average 'imputed rent benefit'. Drawing 2% SWR from that, or 3% SWR from just US stock/gold historically worked OK whilst providing a inflation adjusted regular income. Which when supplemented with proportioned imputed rent of 1.4% = 3.4%. And where the home value is a form of late life care costs cover.

At times those in power/control can make odd decisions. Roy Jenkings/Dennis Healey for instance imposing 130% retrospective tax on the richest, that naturally resulted in a out flight of capital such that instead of pulling in more taxes as expected it had the reverse effect. Near all in stock still has a single concentrated risk factor, geopolitical/taxation risk. A UK home (£), US stocks (primary reserve currency), gold (global currency), diversified across land, stock and commodity (gold) assets bears less concentration risk, and concentration risk is a major risk factor especially when the investment horizon spans many decades.

Gold can be horrible, multiple decades of seemingly in perpetual decline, repeated taking some stock gains to buy more ounces of gold as part of rebalancing only to see the price of gold continue on further down. But equally that can accumulate multiple more ounces of gold such that when prices do soar, typically as stocks do poorly, then the accumulation of gold cost averaged into at relatively low prices can yield massive dividends, where it provides not only the source of income over such times but also reduces ounces held to buy more stock shares at relatively low prices/valuations.

From your OP however it sounds that you'd be better served with stock heavy - as you are. 90/10 Buffett advocated type style. The 10 part however is variable, according to ones comfort and needs. Asymmetric rebalanced, never sell reserves to add to depressed stock shares, use that to float you through bad stock times, along with having enough to cover unexpected expenses such as the cost of a new roof being needed at a time when stocks were down a lot. Multi £M portfolio value and 5% might be more than enough, factoring in that cash might even have halved in real terms i.e. inflation was the driver of lower stock prices and declines in 'cash' purchase power levels. Loss of purchase power is less of a issue if reserves/cash are invested in index linked gilts, whilst they 'cost' around 2%/year at recent levels, relative to 5% or 10% of total portfolio value, 0.1% to 0.2% is a relatively mild 'insurance' premium to pay.

A factor to consider is that no matter what asset allocation you hold, at times that could significantly decline in real terms especially when income was also being drawn. A low SWR based withdrawal approach is relatively safe whilst providing regular inflation adjusted income. The cost for that benefit is that the capital value of the portfolio is volatile, may at times have fallen to a third or even less of former inflation adjusted value, where in effect a 2% SWR rises to being 6% of the ongoing portfolio value, but where from such low valuations a 6% SWR still worked out OK overall. Mentally treat the capital value as though a annuity had been bought, i.e. 'all spent' but where in practice you still have control/access to the capital.

There is always the halfway house, 50/50 Talmud and 90/10, historically the worst cases for each of those didn't coincide, a form of risk reduction via style diversification.

Many say only use SWR as a guide, however I do like actually applying that in practice. 2% of initial portfolio value, uplift that £ amount by inflation as the amount drawn in subsequent years, and if drawn monthly that's a nice regular/reliable 'wage'. With ii I get a free trade/month as part of its monthly fee, so that can be used to sell some shares a few days before transferring the proceeds (T+3) into my regular spending account. I'm more at the opposite Talmud end to your stock-heavy preference. (Nearly) all in stock instates a sense of discomfort with how I'd feel if stocks were to drop a lot to potentially see £1M of former portfolio value reduced to a third or less. Or if a more extreme Labour government rose to power that 'heavily taxed the rich' but where the real rich had already flown the country to leave the 'rich' being more Joe Average individuals having to fill the hole (and more). Old Money, generational wealth, likes physical in hand assets, paintings that can be rolled up into a tube and moved to less punitive regimes. Transporting physical gold is a risk, however some offer backed by physical gold options where you can 'move' where your gold is securely stored at the press of a button, or if actually in-hand you can liquidate it, electronic transfer the capital and repurchase again at the target destination. Or simply bury it and deny having any until such times less punitive times are restored.