https://www.thetimes.co.uk/article/you- ... -8pdtwhbgm

Don''t tell anyone in the other place lest they start frothing...

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

A middle ground — known as dynamic spending — could help. In this method, you set a target for your annual income and adjust it depending on how well your portfolio performs.

moorfield wrote:It's about TR now!

88V8 wrote:moorfield wrote:It's about TR now!

Well I don't 'do' TR, but I'm edging that way.

It's all about tax.....

Not so long ago, CGT was at 40% and divis were untaxed. TR at 40% tax??? Pfft.

Now, divis will be taxed at 33.75%, and if I buy bonds it will be 40%, but CGT is just 20%. Unless of course that gets increased.

So the balance is presently tipped in favour of some TR.

I suppose one has to pay heed to the temporary times.

V8

88V8 wrote:Well I don't 'do' TR

dealtn wrote:88V8 wrote:Well I don't 'do' TR

How do you avoid it then?

simoan wrote:dealtn wrote:88V8 wrote:Well I don't 'do' TR

How do you avoid it then?

I guess if you never sell anything you can maybe claim that you are an income investor, rather than a TR investor? I don't know because I find the idea of investing based on dividend yield bizarre. Personally, I don't see the point of following a losing strategy with my money just to enrich my relatives when I die. If they end up with a large amount of my money I will have failed in my mission i.e. I will have worked for too long before retiring and not giving myself enough time to spend it!

All the best, Si

JohnnyCyclops wrote:simoan wrote:dealtn wrote:

How do you avoid it then?

I guess if you never sell anything you can maybe claim that you are an income investor, rather than a TR investor? I don't know because I find the idea of investing based on dividend yield bizarre. Personally, I don't see the point of following a losing strategy with my money just to enrich my relatives when I die. If they end up with a large amount of my money I will have failed in my mission i.e. I will have worked for too long before retiring and not giving myself enough time to spend it!

All the best, Si

That's you and your goals (and possibly similar to mine) but there are many types of investors and many reasons for investing. I know parents of a child who will likely need care and income long after they are gone. Your strategy would not suit their needs. Being narrowly focused on 'self' can be helpful to the individual, but I've often gained most in TLF from some give & take of different positions people find themselves in.

Dod101 wrote: I understand the sentiments expressed by simoan but the difficulty as always is knowing how long we are going to live.

Dod

dealtn wrote:Dod101 wrote: I understand the sentiments expressed by simoan but the difficulty as always is knowing how long we are going to live.

Dod

Agreed. So presumably the issue is knowing how much capital to release, and when, to avoid the otherwise unavoidable problem of leaving all that capital for others, and not yourself, to enjoy once you die. Or are those income only investors happy with such an outcome?

dealtn wrote:Dod101 wrote: I understand the sentiments expressed by simoan but the difficulty as always is knowing how long we are going to live.

Dod

Agreed. So presumably the issue is knowing how much capital to release, and when, to avoid the otherwise unavoidable problem of leaving all that capital for others, and not yourself, to enjoy once you die. Or are those income only investors happy with such an outcome?

JohnB wrote:I mentally think of markets returning 3% dividends and 1% capital gain over inflation to get me a 4% "return", inflation proofed. With 2% inflation included, then . . . .

Lootman wrote:What you are really describing there is a 6% average annual return, of which 3% is capital gain and 3% is dividends. Then of that 6%, you take off 2% to get the real return of 4% a year.

JohnB wrote:1) Not touching anything for too long is a bad idea, but then so is monthly fiddling

2) If you chose to focus on either dividends or capital growth, not only do you cut yourself out of segments of the market, but you also open yourself to missing out on tax-free allowances and differential tax rates.

I mentally think of markets returning 3% dividends and 1% capital gain over inflation to get me a 4% "return", inflation proofed. With 2% inflation included, then the personal and cg allowances cover roughly the same amount, and the tax rates are similar too. So I want gains to come in both forms.

dealtn wrote:88V8 wrote:Well I don't 'do' TR...

How do you avoid it then?

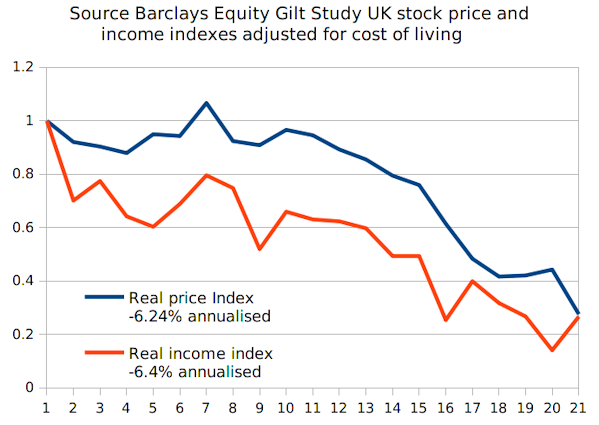

1nvest wrote:'Want' and getting are two different things. Consider a UK historic bad 20 year case ...

88V8 wrote:dealtn wrote:88V8 wrote:Well I don't 'do' TR...

How do you avoid it then?

By not needing to.

Our divi/coupon interest more than suffices for our needs & wants and funds two full annual ISA subs.

So I don't, in practice. do TR. Other than using the annual limit.

Return to “Investment Strategies”

Users browsing this forum: No registered users and 42 guests