Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Alternatives to stocks/shares

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1345 times

Alternatives to stocks/shares

Stocks/shares are public because no private investor(s) sees them as being attractive enough to own (take private).

It seems increasingly that investors are being pushed out of both stocks and bonds, costs/taxes taking too much of a slice (yes stock funds may suggest low costs but the real and quite opaque costs/taxes behind that can be significant, such as 30% US dividend withholding tax rates). Gilts used to be popular and a easy purchase, such as via your local Post Office, but no more (the PO have even more recently lost the right to pay out state pensions). Index Linked Savings options have equally been dropped to new investors.

Spread bets became viable for buy and hold for a while, but again the costs/taxes were revised to dissuade that.

What is/are your preferred alternative(s)? Perhaps peer to peer lending for 'bonds', bit coin for 'stock' alternatives? Personally I've favoured predominately FX (multiple currencies) combined with sub-level leveraged products as part of that for a number of years now, half in 2x stock total return swaps, half in 'cash' type exposure. Or a third in 3x. Zvi Bodie I believes favours Options, scaled/sized to 10x exposure, 5% to 10% weighted (again I believe he prefers inflation bonds for the 90% - 95% remainder). For me, a third each in broad three different non stock (non bond) assets/currencies can broadly negate UK inflation, such that any nominal gains from the assets (stocks/bonds) that currencies are invested in reflect the broad portfolios real (after inflation) gains.

The FX markets are far larger than the stock market and trade more hours, such that there's greater optionality - if for instance some nasty event/situation occurs whilst stock markets are closed and your money can have been moved hours before others who are waiting for the stock market to open.

It seems increasingly that investors are being pushed out of both stocks and bonds, costs/taxes taking too much of a slice (yes stock funds may suggest low costs but the real and quite opaque costs/taxes behind that can be significant, such as 30% US dividend withholding tax rates). Gilts used to be popular and a easy purchase, such as via your local Post Office, but no more (the PO have even more recently lost the right to pay out state pensions). Index Linked Savings options have equally been dropped to new investors.

Spread bets became viable for buy and hold for a while, but again the costs/taxes were revised to dissuade that.

What is/are your preferred alternative(s)? Perhaps peer to peer lending for 'bonds', bit coin for 'stock' alternatives? Personally I've favoured predominately FX (multiple currencies) combined with sub-level leveraged products as part of that for a number of years now, half in 2x stock total return swaps, half in 'cash' type exposure. Or a third in 3x. Zvi Bodie I believes favours Options, scaled/sized to 10x exposure, 5% to 10% weighted (again I believe he prefers inflation bonds for the 90% - 95% remainder). For me, a third each in broad three different non stock (non bond) assets/currencies can broadly negate UK inflation, such that any nominal gains from the assets (stocks/bonds) that currencies are invested in reflect the broad portfolios real (after inflation) gains.

The FX markets are far larger than the stock market and trade more hours, such that there's greater optionality - if for instance some nasty event/situation occurs whilst stock markets are closed and your money can have been moved hours before others who are waiting for the stock market to open.

-

stevensfo

- Lemon Quarter

- Posts: 3485

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3867 times

- Been thanked: 1418 times

Re: Alternatives to stocks/shares

1nvest wrote:Stocks/shares are public because no private investor(s) sees them as being attractive enough to own (take private).

It seems increasingly that investors are being pushed out of both stocks and bonds, costs/taxes taking too much of a slice (yes stock funds may suggest low costs but the real and quite opaque costs/taxes behind that can be significant, such as 30% US dividend withholding tax rates). Gilts used to be popular and a easy purchase, such as via your local Post Office, but no more (the PO have even more recently lost the right to pay out state pensions). Index Linked Savings options have equally been dropped to new investors.

Spread bets became viable for buy and hold for a while, but again the costs/taxes were revised to dissuade that.

What is/are your preferred alternative(s)? Perhaps peer to peer lending for 'bonds', bit coin for 'stock' alternatives? Personally I've favoured predominately FX (multiple currencies) combined with sub-level leveraged products as part of that for a number of years now, half in 2x stock total return swaps, half in 'cash' type exposure. Or a third in 3x. Zvi Bodie I believes favours Options, scaled/sized to 10x exposure, 5% to 10% weighted (again I believe he prefers inflation bonds for the 90% - 95% remainder). For me, a third each in broad three different non stock (non bond) assets/currencies can broadly negate UK inflation, such that any nominal gains from the assets (stocks/bonds) that currencies are invested in reflect the broad portfolios real (after inflation) gains.

The FX markets are far larger than the stock market and trade more hours, such that there's greater optionality - if for instance some nasty event/situation occurs whilst stock markets are closed and your money can have been moved hours before others who are waiting for the stock market to open.

I'm surprised to hear you say we're being pushed out of owning shares and bonds. The impression I have is that it's never been easier to invest.

However, I admit to being angry and nostalgic about the changing role of the Post Office. I still have my old PO account and Investment account books. It was a brilliant way to teach kids about saving. 10p per savings stamp, then pay it in when it reached a quid.

I didn't know that gilts could be bought there as well. That would be soooo convenient today!

Steve

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Alternatives to stocks/shares

1nvest wrote:Stocks/shares are public because no private investor(s) sees them as being attractive enough to own (take private)

I'm sorry but that's a really silly statement. Most companies are publicly listed because it gives them access to capital for investment without going cap in hand to their bank manager. And if the public market doesn't recognise the value of the company it is not unusual for management or private equity to take it from the market. It's difficult to answer your question when it is based on a false premise.

All the best, Si

-

Gerry557

- Lemon Quarter

- Posts: 2041

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 557 times

Re: Alternatives to stocks/shares

I think you are incorrect. My Morrisions MRW shares were sold against my better judgement and taken private. Unfortunately they had more cash than me and saw the merits of buying it all.

As for costs of shares, £5 to trade, no holding fees and 0.5% stamp, which isn't always payable I don't think that is that expensive in the grand scheme of things.

I not sure if this counts but a Mr Buffet tried to buy Ulvr for £44 a share for his own company recently too.

There are many alternatives for investment depending on your bent. Gold, diamonds and copper come to mind. Property either BTL or something like a woodland.

You've mentioned bitcoin and the like or even old fashioned buildings societies but you could invest in wine, classic cars or even toys.

There are several options but I think stocks n shares are probably the easiest to buy and sell quickly. Usually come with a dividend to match inflation over time and have little in running and storage costs. Even wht can be reduced by signing a form.

Costs don't seem that much when you compare with letting a property, which seem more like squeezing out the little man.

As for costs of shares, £5 to trade, no holding fees and 0.5% stamp, which isn't always payable I don't think that is that expensive in the grand scheme of things.

I not sure if this counts but a Mr Buffet tried to buy Ulvr for £44 a share for his own company recently too.

There are many alternatives for investment depending on your bent. Gold, diamonds and copper come to mind. Property either BTL or something like a woodland.

You've mentioned bitcoin and the like or even old fashioned buildings societies but you could invest in wine, classic cars or even toys.

There are several options but I think stocks n shares are probably the easiest to buy and sell quickly. Usually come with a dividend to match inflation over time and have little in running and storage costs. Even wht can be reduced by signing a form.

Costs don't seem that much when you compare with letting a property, which seem more like squeezing out the little man.

-

TerraJones

- Posts: 3

- Joined: December 13th, 2021, 7:10 pm

Re: Alternatives to stocks/shares

have you tried trading options? The US options are pretty good, ive been only trading spy calls and making a good return

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5359 times

- Been thanked: 2485 times

Re: Alternatives to stocks/shares

Having bought my first shares back in 1981, at the age of 18, I can say that it's ridiculously easy to buy and sell shares today compared to back then.

It's a lot cheaper and the spreads on the more liquid shares have narrowed. Getting information today is vastly more easy than in the 1980s. Back in 1985 when I wanted to get a price on my first American shareholding I had to get the weekend Financial Times! Try getting an annual report on a Canadian company in 1986; it took months.

If you're paying 30% US withholding tax, you haven't completed your W-8BEN form which reduces it to 15%.

Companies going private, or staying private, is a lot to do with reporting rules and the large number of bureaucratic hoops that quoted companies have to jump through for little or no benefit.

It's a lot cheaper and the spreads on the more liquid shares have narrowed. Getting information today is vastly more easy than in the 1980s. Back in 1985 when I wanted to get a price on my first American shareholding I had to get the weekend Financial Times! Try getting an annual report on a Canadian company in 1986; it took months.

If you're paying 30% US withholding tax, you haven't completed your W-8BEN form which reduces it to 15%.

Companies going private, or staying private, is a lot to do with reporting rules and the large number of bureaucratic hoops that quoted companies have to jump through for little or no benefit.

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5359 times

- Been thanked: 2485 times

Re: Alternatives to stocks/shares

A few thoughts on investments other than shares or bonds.

Antiques, jewellery, stamps, wines, whisky and collectibles are a very different asset class. The problem is that they are highly illiquid assets and have large transaction costs. Commissions of around 20% are typical for auction purchases, both as a buyer and seller, whilst spreads are big). It also helps to have specialist knowledge.

Gold and precious metals are quite liquid, though they can have higher transaction costs than shares, plus storage costs if you're dealing in reasonable sizes.

Futures and options on financial assets. Highly volatile investments which can be lethal to inexperienced investors because they create lots of leverage.

Cryptocurrencies. I'm with Charlie Munger on these ("disgusting and contrary to the interests of civilization."). The Tulip Mania of the 21st century, but the bubble/con could go on for years. I don't go near them.

Residential Property. The government has screwed buy-to-let investors in recent years with tax changes. Owners are helped by strict planning laws which restrict supply, though political pressure may cause future governments to increase the supply thus reducing prices.

Hotel rooms, timeshares, unquoted loans and similar investments are extremely illiquid, with a high risk of "investors" being stitched up.

BTW. The 0.5% stamp duty on shares is trivial if, like me, you tend to hold your British shares for a long time. But it's painful if you're one of these traders who likes to turn your portfolio over several times a year. And it's crippling for day traders (most of whom lose money without stamp duty making it worse).

Antiques, jewellery, stamps, wines, whisky and collectibles are a very different asset class. The problem is that they are highly illiquid assets and have large transaction costs. Commissions of around 20% are typical for auction purchases, both as a buyer and seller, whilst spreads are big). It also helps to have specialist knowledge.

Gold and precious metals are quite liquid, though they can have higher transaction costs than shares, plus storage costs if you're dealing in reasonable sizes.

Futures and options on financial assets. Highly volatile investments which can be lethal to inexperienced investors because they create lots of leverage.

Cryptocurrencies. I'm with Charlie Munger on these ("disgusting and contrary to the interests of civilization."). The Tulip Mania of the 21st century, but the bubble/con could go on for years. I don't go near them.

Residential Property. The government has screwed buy-to-let investors in recent years with tax changes. Owners are helped by strict planning laws which restrict supply, though political pressure may cause future governments to increase the supply thus reducing prices.

Hotel rooms, timeshares, unquoted loans and similar investments are extremely illiquid, with a high risk of "investors" being stitched up.

BTW. The 0.5% stamp duty on shares is trivial if, like me, you tend to hold your British shares for a long time. But it's painful if you're one of these traders who likes to turn your portfolio over several times a year. And it's crippling for day traders (most of whom lose money without stamp duty making it worse).

-

stevensfo

- Lemon Quarter

- Posts: 3485

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3867 times

- Been thanked: 1418 times

Re: Alternatives to stocks/shares

SalvorHardin wrote:A few thoughts on investments other than shares or bonds.

Antiques, jewellery, stamps, wines, whisky and collectibles are a very different asset class. The problem is that they are highly illiquid assets and have large transaction costs. Commissions of around 20% are typical for auction purchases, both as a buyer and seller, whilst spreads are big). It also helps to have specialist knowledge.

Gold and precious metals are quite liquid, though they can have higher transaction costs than shares, plus storage costs if you're dealing in reasonable sizes.

Futures and options on financial assets. Highly volatile investments which can be lethal to inexperienced investors because they create lots of leverage.

Cryptocurrencies. I'm with Charlie Munger on these ("disgusting and contrary to the interests of civilization."). The Tulip Mania of the 21st century, but the bubble/con could go on for years. I don't go near them.

Residential Property. The government has screwed buy-to-let investors in recent years with tax changes. Owners are helped by strict planning laws which restrict supply, though political pressure may cause future governments to increase the supply thus reducing prices.

Hotel rooms, timeshares, unquoted loans and similar investments are extremely illiquid, with a high risk of "investors" being stitched up.

BTW. The 0.5% stamp duty on shares is trivial if, like me, you tend to hold your British shares for a long time. But it's painful if you're one of these traders who likes to turn your portfolio over several times a year. And it's crippling for day traders (most of whom lose money without stamp duty making it worse).

The other problem with collectibles, art etc is the attachment you form with it. My Dad always believed that his old stamp collection would be worth millions one day and was quite proud of all the stamps with Hitler on. I spent hours and hours with the Stanley Gibbons catalogues when I was younger and didn't find anything worth more than about 50p!

Steve

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: Alternatives to stocks/shares

SalvorHardin wrote:A few thoughts on investments other than shares or bonds.

Antiques, jewellery, stamps, wines, whisky and collectibles are a very different asset class. The problem is that they are highly illiquid assets and have large transaction costs. Commissions of around 20% are typical for auction purchases, both as a buyer and seller, whilst spreads are big). It also helps to have specialist knowledge.

Gold and precious metals are quite liquid, though they can have higher transaction costs than shares, plus storage costs if you're dealing in reasonable sizes.

Futures and options on financial assets. Highly volatile investments which can be lethal to inexperienced investors because they create lots of leverage.

Cryptocurrencies. I'm with Charlie Munger on these ("disgusting and contrary to the interests of civilization."). The Tulip Mania of the 21st century, but the bubble/con could go on for years. I don't go near them.

Residential Property. The government has screwed buy-to-let investors in recent years with tax changes. Owners are helped by strict planning laws which restrict supply, though political pressure may cause future governments to increase the supply thus reducing prices.

Hotel rooms, timeshares, unquoted loans and similar investments are extremely illiquid, with a high risk of "investors" being stitched up.

BTW. The 0.5% stamp duty on shares is trivial if, like me, you tend to hold your British shares for a long time. But it's painful if you're one of these traders who likes to turn your portfolio over several times a year. And it's crippling for day traders (most of whom lose money without stamp duty making it worse).

Salvor,

do you perceive that ETFs of physical holdings, e.g. PHAU for Gold, overcome the problems you identified for precious metals?

tuk

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5359 times

- Been thanked: 2485 times

Re: Alternatives to stocks/shares

TUK020 wrote:Salvor, do you perceive that ETFs of physical holdings, e.g. PHAU for Gold, overcome the problems you identified for precious metals?

They deal with some of the problems. Such as delegating the costs of buying, storing and insuring the gold which will be paid from the fund. Investors in the fund should benefit from any economies of scale in reducing these costs.

One thing that investors need to check is whether the fund owns physical gold or instead owns "paper gold". Paper gold is where the fund uses futures and options to represent physical gold. Some people are happy with this, others (like me) think that this introduces another element of risk.

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Alternatives to stocks/shares

I would just like to add that I'm completely in agreement with Buffett when it comes to owning unproductive assets like gold. If an asset doesn't produce any cashflow, forget it.

https://www.gurufocus.com/news/220058/s ... tt-on-gold

All the best, Si

https://www.gurufocus.com/news/220058/s ... tt-on-gold

All the best, Si

-

stevensfo

- Lemon Quarter

- Posts: 3485

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3867 times

- Been thanked: 1418 times

Re: Alternatives to stocks/shares

simoan wrote:I would just like to add that I'm completely in agreement with Buffett when it comes to owning unproductive assets like gold. If an asset doesn't produce any cashflow, forget it.

https://www.gurufocus.com/news/220058/s ... tt-on-gold

All the best, Si

I have to, grudgingly, agree with you. I got into gold via my coin collecting hobby and many years ago, aided by the USA forums (don't go there!) decided that a good portfolio deserved 10% precious metals. Over the years and a lot of reading, this has gone to about 2.5%. Silver coins are cheap and look amazing, make good presents if you get the right date, and people generally think that they're worth far more than they actually are. Fortunately the hysterical period where silver reached $40 an ounce with the American forums screaming that the price was being manipulated 'downwards' has gone and good riddance. One of my 'to do' lists when I retire in a year or so is to try my hand at making silver jewellery from the many coins I have. The sovereigns are hidden. Can't remember where but no doubt my wife has already found them and thrown them away.

I will need a special device for melting the silver but all is available on Amazon or Ebay.

However, I have a rather colourful history when it comes to DIY, so expect to be featured on the tabloids in a few years, under 'Explosion shakes small village!'

Steve

-

GrahamPlatt

- Lemon Quarter

- Posts: 2077

- Joined: November 4th, 2016, 9:40 am

- Has thanked: 1039 times

- Been thanked: 840 times

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1345 times

Re: Alternatives to stocks/shares

simoan wrote:I would just like to add that I'm completely in agreement with Buffett when it comes to owning unproductive assets like gold. If an asset doesn't produce any cashflow, forget it.

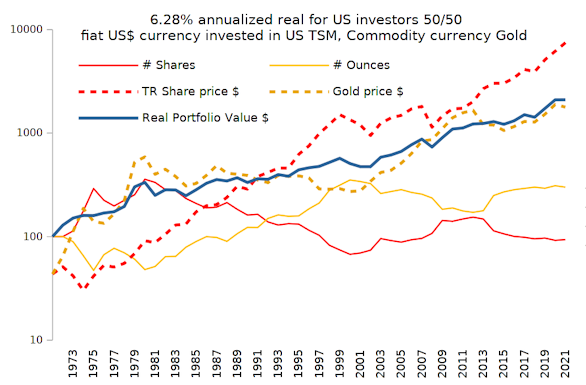

All fiat currencies broadly decline relative to commodity currency gold, forcing investors to invest in order to try and avoid the loss of purchase power over time. Such activities induce cost/tax events. In isolation a single choice alone isn't as good as some of each and trading the volatility - such as via a 50/50 blend of both fiat and commodity currencies rebalanced yearly.

Gold is a preferred commodity currency due to it being one of the most uninteresting elements across the periodic table, doesn't rust ...etc. In prisons fiat and commodity currencies might involve £'s and cigarettes. Having some of both opens up the option of being able to spend whichever is the more highly valued at the time.

PV data/charts

Berkshire Hathaway Chairman letter 1979 ...

One friendly but sharp-eyed commentator on Berkshire has

pointed out that our book value at the end of 1964 would have

bought about one-half ounce of gold and, fifteen years later,

after we have plowed back all earnings along with much blood,

sweat and tears, the book value produced will buy about the same

half ounce. A similar comparison could be drawn with Middle

Eastern oil. The rub has been that government has been

exceptionally able in printing money and creating promises, but

is unable to print gold or create oil.

-

LooseCannon101

- Lemon Slice

- Posts: 255

- Joined: November 5th, 2016, 2:12 pm

- Has thanked: 310 times

- Been thanked: 148 times

Re: Alternatives to stocks/shares

All fiat currencies broadly decline relative to commodity currency gold, forcing investors to invest in order to try and avoid the loss of purchase power over time. Such activities induce cost/tax events. In isolation a single choice alone isn't as good as some of each and trading the volatility - such as via a 50/50 blend of both fiat and commodity currencies rebalanced yearly.

Perhaps I have misinterpreted the above but it seems to imply that buying shares automatically entails cost/tax events. What about buying a world equity fund e.g. a global growth investment trust or ETF inside a tax wrapper e.g. ISA and holding forever? There is no need to trade and one can reap an excellent long-term total return.

Frequent trading of any security e.g. bond, gold, currency or shares will reduce one's returns. Volatility is bad for spread bettors and traders as most retail investors lose. The only people who consistently win are the middle men e.g. stockbrokers and spread-betting companies.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 26 guests