Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Investing during a time of high inflation - What are you doing?

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Investing during a time of high inflation - What are you doing?

Numerous studies have shown that equities don't provide good protection against inflation once the inflation rate reaches around 5%.

Counter intuitive, because people think businesses can raise prices and this feeds through into share prices and dividends - but this is not necessarily the case.

Longer term, and once (if?) the inflation rate falls back into the 'normal' 2% territory, it's a different matter - but the time to prepare for inflation is before it happens - however, we are where we are.

Interesting article here: https://citywire.com/funds-insider/news/david-stevenson-where-to-invest-to-protect-against-inflation/a1519744

and here: https://www.schroders.com/en/uk/asset-manager/insights/markets/where-to-find-shelter-from-rising-inflation/

Given that inflation is not transitory (and for anyone who believed central banker's assurances that it was, I have a bridge you can buy from me. It's cheap), what, if anything, are you doing about inflation and its effects on your portfolio?

Please do stick to the question though. I'm not really bothered whether people think inflation is or isn't transitory - it's how you are dealing with it that's the crux of the question here..

Counter intuitive, because people think businesses can raise prices and this feeds through into share prices and dividends - but this is not necessarily the case.

Longer term, and once (if?) the inflation rate falls back into the 'normal' 2% territory, it's a different matter - but the time to prepare for inflation is before it happens - however, we are where we are.

Interesting article here: https://citywire.com/funds-insider/news/david-stevenson-where-to-invest-to-protect-against-inflation/a1519744

and here: https://www.schroders.com/en/uk/asset-manager/insights/markets/where-to-find-shelter-from-rising-inflation/

Given that inflation is not transitory (and for anyone who believed central banker's assurances that it was, I have a bridge you can buy from me. It's cheap), what, if anything, are you doing about inflation and its effects on your portfolio?

Please do stick to the question though. I'm not really bothered whether people think inflation is or isn't transitory - it's how you are dealing with it that's the crux of the question here..

-

GoSeigen

- Lemon Quarter

- Posts: 4430

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1612 times

- Been thanked: 1604 times

Re: Investing during a time of high inflation - What are you doing?

I think inflation is transitory. That said even this short visitation hasn't been kind to gilt-edged stocks priced at close to zero yield, accordingly I sold the last of my gilts a few years back and still hold none, also have no cash to speak of, apart from a cash-like bank bond paying zero interest which I can't do much about. I'm leveraged long FTSE, particularly bank shares, I don't see how they can't make hay in this environment. Also hold a variety of other shares and index trackers and a single-figure % allocation of gold, platinum along with some mining stocks (which I've trimmed over the past two years).

I'll reduce the leverage into market strength and maybe buy gilts again when yields are sensible which is not too far off IMO.

GS

I'll reduce the leverage into market strength and maybe buy gilts again when yields are sensible which is not too far off IMO.

GS

-

OhNoNotimAgain

- Lemon Slice

- Posts: 767

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 71 times

- Been thanked: 147 times

Re: Investing during a time of high inflation - What are you doing?

GoSeigen wrote:I think inflation is transitory.

GS

Wot, like QE was?

-

Urbandreamer

- Lemon Quarter

- Posts: 3191

- Joined: December 7th, 2016, 9:09 pm

- Has thanked: 357 times

- Been thanked: 1052 times

Re: Investing during a time of high inflation - What are you doing?

There is a fairly obvious reason for the 5% cliff. Almost all inflation linking has a cap. Where is it set?

This means that companies are only able to increase linked prices by a proportion of the inflation rate.

What am I doing? Well I'm continuing to invest my surplus cash as I believe that equities will weather the storm better than cash. I recently topped up my holding in Civitas, a currently unpopular REIT. Their income has some inflation linking. I might top up Deagio, people will still drink.

I'm dabbling with bitcoin, though I don't hold enough for it to make any difference.

I have not bought any gold, though in the past I have held gold etf's.

I also have a holding in Ruffer, who do such thinking as where to invest to preserve capital for me.

Another option to consider is spending any surplus now rather than later. Sure it doesn't qualify as investing, but may be a valid response to high inflation.

This means that companies are only able to increase linked prices by a proportion of the inflation rate.

What am I doing? Well I'm continuing to invest my surplus cash as I believe that equities will weather the storm better than cash. I recently topped up my holding in Civitas, a currently unpopular REIT. Their income has some inflation linking. I might top up Deagio, people will still drink.

I'm dabbling with bitcoin, though I don't hold enough for it to make any difference.

I have not bought any gold, though in the past I have held gold etf's.

I also have a holding in Ruffer, who do such thinking as where to invest to preserve capital for me.

Another option to consider is spending any surplus now rather than later. Sure it doesn't qualify as investing, but may be a valid response to high inflation.

-

1nvest

- Lemon Quarter

- Posts: 4446

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 696 times

- Been thanked: 1362 times

Re: Investing during a time of high inflation - What are you doing?

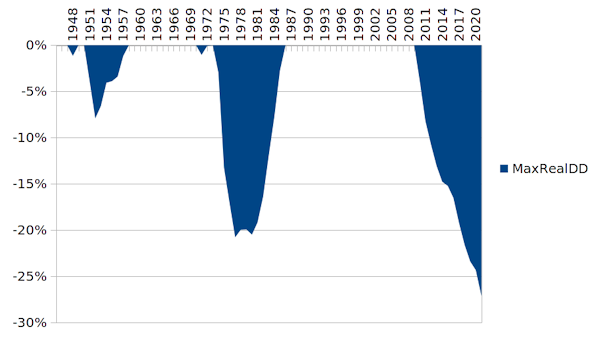

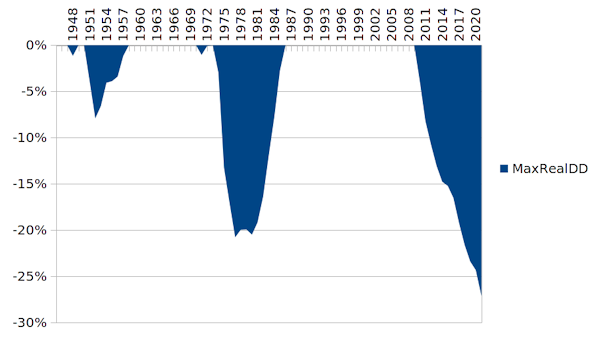

Too late. Rolling 'cash' between T-Bills or Building society rates whichever yielded more at the time and ...

... the drawdown in real (after inflation) terms have been worse than that seen in the 1970's

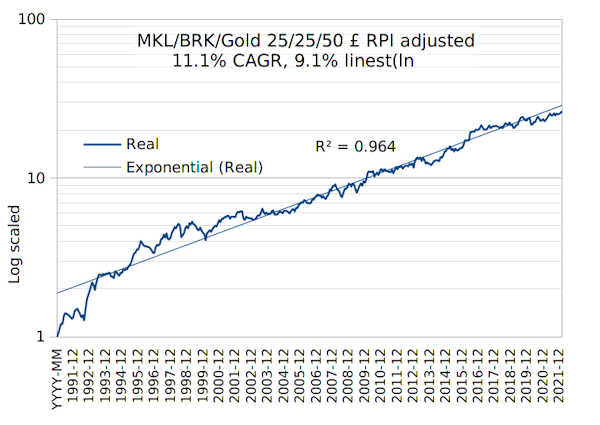

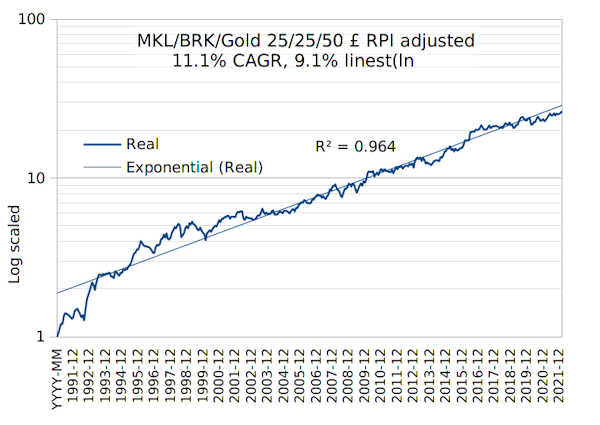

Personally I like a zero coupon stock/gold barbell that combines to a central inflation bond type bullet

Combination of US$ primary reserve fiat currency and global non-fiat currency (gold), where the US$ are invested in stocks (Berkshire Hathaway (BRK) and baby BRK (MKL Markel) - neither of which pay any dividends so no US dividend withholding taxes).

Define/draw dividends at the times and to the amounts that best matches ones needs.

... the drawdown in real (after inflation) terms have been worse than that seen in the 1970's

Personally I like a zero coupon stock/gold barbell that combines to a central inflation bond type bullet

Combination of US$ primary reserve fiat currency and global non-fiat currency (gold), where the US$ are invested in stocks (Berkshire Hathaway (BRK) and baby BRK (MKL Markel) - neither of which pay any dividends so no US dividend withholding taxes).

Define/draw dividends at the times and to the amounts that best matches ones needs.

-

SalvorHardin

- Lemon Quarter

- Posts: 2065

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5386 times

- Been thanked: 2492 times

Re: Investing during a time of high inflation - What are you doing?

Not making any major adjustments.

Farmland. A difficult sector for investors to access. Fortunately there are two quoted REITs in America (Farmland Partners and Gladstone Land). IMHO Gladstone is seriously overvalued so I've been buying Farmland Partners.

Berkshire Hathaway

Quality commercial property. I've recently been buying the central London specialists, notably Great Portland Estates, and some New York property companies (SL Green, Empire State Realty). Granted, big city real estate has a few problems, notably in America that the Democrats have been encouraging arson and burglary (shoplifting) in city centres, but that's already in the price and people are pushing back against policies such as effectively legalising shoplifting in San Francisco.

North American Railroads. Stuff has to be moved and short of cheap and reliable teleportation being invented, North American railroads have a huge advantage over trucks over longer distances. Furthermore it's almost impossible for a competitor to come up with another railroad, if only due to the difficulty in obtaining the land. My portfolio is currently 20% railroads (mostly Canadian Pacific and Union Pacific, both of which have recently been hitting all-time highs).

Don't think that British and European railway companies are similar, that's HYP's anti-foreign share bias at work. Back in 2009-10 this attitude led lots of people to buy First Group after Warren Buffett bought the Burlington Northern Santa Fe railroad. Back then I topped up Union Pacific, which is up by about 900% since then whilst First Group is down by something like 70%.

Farmland. A difficult sector for investors to access. Fortunately there are two quoted REITs in America (Farmland Partners and Gladstone Land). IMHO Gladstone is seriously overvalued so I've been buying Farmland Partners.

Berkshire Hathaway

Quality commercial property. I've recently been buying the central London specialists, notably Great Portland Estates, and some New York property companies (SL Green, Empire State Realty). Granted, big city real estate has a few problems, notably in America that the Democrats have been encouraging arson and burglary (shoplifting) in city centres, but that's already in the price and people are pushing back against policies such as effectively legalising shoplifting in San Francisco.

North American Railroads. Stuff has to be moved and short of cheap and reliable teleportation being invented, North American railroads have a huge advantage over trucks over longer distances. Furthermore it's almost impossible for a competitor to come up with another railroad, if only due to the difficulty in obtaining the land. My portfolio is currently 20% railroads (mostly Canadian Pacific and Union Pacific, both of which have recently been hitting all-time highs).

Don't think that British and European railway companies are similar, that's HYP's anti-foreign share bias at work. Back in 2009-10 this attitude led lots of people to buy First Group after Warren Buffett bought the Burlington Northern Santa Fe railroad. Back then I topped up Union Pacific, which is up by about 900% since then whilst First Group is down by something like 70%.

-

Alaric

- Lemon Half

- Posts: 6068

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1419 times

Re: Investing during a time of high inflation - What are you doing?

SalvorHardin wrote:Don't think that British and European railway companies are similar,

Aew American companies srill verucally integrated in a manner that British and European railway companies are not? The EU demanded separation of infrastructure from operations, so a European rreight operation , which is what the American companies specialise in , would have no ownership of the tracks , signals etc.

-

SalvorHardin

- Lemon Quarter

- Posts: 2065

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5386 times

- Been thanked: 2492 times

Re: Investing during a time of high inflation - What are you doing?

Alaric wrote:SalvorHardin wrote:Don't think that British and European railway companies are similar,

Aew American companies srill verucally integrated in a manner that British and European railway companies are not? The EU demanded separation of infrastructure from operations, so a European rreight operation , which is what the American companies specialise in , would have no ownership of the tracks , signals etc.

Yes. American and Canadian railroads own their infrastructure.

European freight is much less profitable because it's hauled over much shorter distances and the trains have to compete for space with passenger trains (which generally have priority). Also American trains have a huge advantage over trucks (their main competitor) in that they travel much further and use roughly 25% of the fuel that a truck would use to carry a similar load over the same distance. The typical American freight train is about 1.5 miles long, there's no way that European rail networks could cope with trains of that size. From last November:

"All of the Class I systems regularly operate trains that reach or exceed 12,000 feet. Systemwide averages on the big six systems range from a low of 6,900 feet at BNSF Railway to a high of 9,359 feet at Union Pacific, according to recent data.

UP’s train length is up about 30% since late 2018, when it adopted a Precision Scheduled Railroading operating model. UP aims to get its average train length beyond 10,000 feet and over the past three years has been extending sidings to 15,000 feet on its single-track routes in Texas and on main lines leading to and from the Lone Star State."

https://www.trains.com/trn/news-reviews/news-wire/railroads-use-of-long-trains-to-go-under-the-microscope/

American railroads use a hub and spoke system like the airlines. Rail moves freight over long distances with trucks picking up most of the freight from the rail yards to deliver to the end user (increasingly these loads are freight containers, what the industry calls "intermodal").

The Economist published an interesting article on American railroads' advantages back in July 2010, in particular how effective they became once laws were passed that no longer required them to carry passengers.

"Their good run started with deregulation at the end of Jimmy Carter's administration. Two years after the liberalisation of aviation gave rise to budget carriers and cheap fares, the freeing of rail freight, under the Staggers Rail Act of 1980, started a wave of consolidation and improvement. Staggers gave railways freedom to charge market rates, enter confidential contracts with shippers and run trains as they liked. They could close passenger and branch lines, as long as they preserved access for Amtrak services. They were allowed to sell lossmaking lines to new short-haul railroads. Regulation of freight rates by the Interstate Commerce Commission was removed for most cargoes, provided they could go by road."

https://www.economist.com/briefing/2010/07/22/high-speed-railroading

-

simoan

- Lemon Quarter

- Posts: 2103

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1465 times

Re: Investing during a time of high inflation - What are you doing?

FWVLIW I am doing nothing that I wouldn't normally be doing, other than buying a physical gold ETF for the first time ever the day the invasion started. As it turns out that has worked out well so far but if I'm being brutally honest with myself, I don't know why I did it other than it seemed a good idea at the time...

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: Investing during a time of high inflation - What are you doing?

Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

-

simoan

- Lemon Quarter

- Posts: 2103

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1465 times

Re: Investing during a time of high inflation - What are you doing?

absolutezero wrote:Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

Interesting. I've owned Cameco and Nutrien for ages and they are finally coming good! I'm probably nearer selling them than buying more though. If you're prepared to look in the AIM100 there are some quality, cash generative midcaps starting to look cheap on a long-term basis. I've bought more RWS Holdings and Gamma Communications this week.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Investing during a time of high inflation - What are you doing?

- Have some significant exposure to gold, other real assets, and alternatives (eg renewables)

- Avoid high multiple growth stocks in favour of value stocks

- Minimal exposure to government bonds

- Cash is Trash

- Don't pay off my very large mortgage (inflation will do the heavy lifting for you over time)

- Avoid high multiple growth stocks in favour of value stocks

- Minimal exposure to government bonds

- Cash is Trash

- Don't pay off my very large mortgage (inflation will do the heavy lifting for you over time)

-

GoSeigen

- Lemon Quarter

- Posts: 4430

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1612 times

- Been thanked: 1604 times

Re: Investing during a time of high inflation - What are you doing?

OhNoNotimAgain wrote:GoSeigen wrote:I think inflation is transitory.

GS

Wot, like QE was?

Strange comment. Care to elaborate?

GS

P.S. To be clear when I wrote inflation above I meant this present occurrence of inflation, I was not making a more general statement about all inflation everywhere. Perhaps that's the source of the weird reply.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: Investing during a time of high inflation - What are you doing?

simoan wrote:absolutezero wrote:Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

Interesting. I've owned Cameco and Nutrien for ages and they are finally coming good! I'm probably nearer selling them than buying more though. If you're prepared to look in the AIM100 there are some quality, cash generative midcaps starting to look cheap on a long-term basis. I've bought more RWS Holdings and Gamma Communications this week.

I'm adding to my uranium holdings. I see this as highly asymmetric. Massive potential upside. Small potential downside.

There isn't actually a normal free market in uranium. A user can't just roll up and buy it like you could with a barrel of oil or a tonne of iron ore.

It works on a weird sort of bidding futures contracts type thing.

-

simoan

- Lemon Quarter

- Posts: 2103

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1465 times

Re: Investing during a time of high inflation - What are you doing?

absolutezero wrote:simoan wrote:absolutezero wrote:Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

Interesting. I've owned Cameco and Nutrien for ages and they are finally coming good! I'm probably nearer selling them than buying more though. If you're prepared to look in the AIM100 there are some quality, cash generative midcaps starting to look cheap on a long-term basis. I've bought more RWS Holdings and Gamma Communications this week.

I'm adding to my uranium holdings. I see this as highly asymmetric. Massive potential upside. Small potential downside.

There isn't actually a normal free market in uranium. A user can't just roll up and buy it like you could with a barrel of oil or a tonne of iron ore.

It works on a weird sort of bidding futures contracts type thing.

Yes, I know. I've held Cameco since before Fukushima happened. I wish I'd sold at that point tbh. Although there are sound fundamentals these have been present for many years and yet the price has gone nowhere. I think we're now maybe seeing something bordering on speculation, so I'm more likely to sell than buy more. The nature of the market means the price could more easily be manipulated than other commodities, so that's something to bear in mind with regard to the asymmetry you describe.

-

simoan

- Lemon Quarter

- Posts: 2103

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1465 times

Re: Investing during a time of high inflation - What are you doing?

Should also mention I am long pawnbroker H&T. Very cheap (only small premium to NTAV), a well covered 4% dividend, correlated to the gold price and growing the pledge book at what appears to be an opportune time.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: Investing during a time of high inflation - What are you doing?

simoan wrote:absolutezero wrote:simoan wrote:absolutezero wrote:Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

Interesting. I've owned Cameco and Nutrien for ages and they are finally coming good! I'm probably nearer selling them than buying more though. If you're prepared to look in the AIM100 there are some quality, cash generative midcaps starting to look cheap on a long-term basis. I've bought more RWS Holdings and Gamma Communications this week.

I'm adding to my uranium holdings. I see this as highly asymmetric. Massive potential upside. Small potential downside.

There isn't actually a normal free market in uranium. A user can't just roll up and buy it like you could with a barrel of oil or a tonne of iron ore.

It works on a weird sort of bidding futures contracts type thing.

Yes, I know. I've held Cameco since before Fukushima happened. I wish I'd sold at that point tbh. Although there are sound fundamentals these have been present for many years and yet the price has gone nowhere. I think we're now maybe seeing something bordering on speculation, so I'm more likely to sell than buy more. The nature of the market means the price could more easily be manipulated than other commodities, so that's something to bear in mind with regard to the asymmetry you describe.

Tend to agree - but I think politics (decarbonisation, deRussification etc) now provides a tailwind for the Uranium price.

-

simoan

- Lemon Quarter

- Posts: 2103

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1465 times

Re: Investing during a time of high inflation - What are you doing?

absolutezero wrote:simoan wrote:absolutezero wrote:simoan wrote:absolutezero wrote:Interesting spread of responses so far.

What am I doing? (I didn't put this in my original post.)

- More addition of money into my SIPP - immediately 25% better off just by doing that.

- More gold that I have owned in the past.

- Bought a REIT - TR Property Investment Trust - Down 12% since purchase. May buy more.

- Lots of oil - BP, Shell and SPOG

- Resources and Commodities - Blackrock Energy and Resources Trust.

- FTSE 100 trackers - Own lots of miners, oils, insurance companies and banks

- Yellow Cake - Physical Uranium owning trust. Nuclear is the only way out of the Net Zero saga. Politicians are just too slow to work that out. I'm faster and will profit from the U238 price going up.

- My usual monthly purchases of trackers - VEVE VUKE VUSA VEUR

Interesting. I've owned Cameco and Nutrien for ages and they are finally coming good! I'm probably nearer selling them than buying more though. If you're prepared to look in the AIM100 there are some quality, cash generative midcaps starting to look cheap on a long-term basis. I've bought more RWS Holdings and Gamma Communications this week.

I'm adding to my uranium holdings. I see this as highly asymmetric. Massive potential upside. Small potential downside.

There isn't actually a normal free market in uranium. A user can't just roll up and buy it like you could with a barrel of oil or a tonne of iron ore.

It works on a weird sort of bidding futures contracts type thing.

Yes, I know. I've held Cameco since before Fukushima happened. I wish I'd sold at that point tbh. Although there are sound fundamentals these have been present for many years and yet the price has gone nowhere. I think we'renow maybe seeing something bordering on speculation, so I'm more likely to sell than buy more. The nature of the market means the price could more easily be manipulated than other commodities, so that's something to bear in mind with regard to the asymmetry you describe.

Tend to agree - but I think politics (decarbonisation, deRussification etc) now provides a tailwind for the Uranium price.

Well, if you’d like my Cameco shares for $35 a pop they’re all yours!

-

OhNoNotimAgain

- Lemon Slice

- Posts: 767

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 71 times

- Been thanked: 147 times

Re: Investing during a time of high inflation - What are you doing?

GoSeigen wrote:OhNoNotimAgain wrote:GoSeigen wrote:I think inflation is transitory.

GS

Wot, like QE was?

Strange comment. Care to elaborate?

GS

P.S. To be clear when I wrote inflation above I meant this present occurrence of inflation, I was not making a more general statement about all inflation everywhere. Perhaps that's the source of the weird reply.

There seems to be a view that inflation has been triggered by war and the recovery from the Covid pandemic.

In my view inflation was always going to happen because of the massive devalauation created by QE that started in 2008 in the wake of the financial crisis. Recent events have just supercharged it.

Furthermore, an ageing and soon to be shrinking working global population is going to fuel wage inflation. This will reverse the deflationary impact that the end of the cold war had by introducing the population of China and the whole of eastern Europe into the global workforce. Who needs a fridge repairman when it is cheaper to buy a new one from China delivered by Amazon?

Central Banks deluded themselves into thinking it was their brilliance that elimanated inflation. It wasn't, it was technology (suddenly, thanks to ebay, old stuff could be sold easily, adding to supply) and geopolitics.

The response is simple. Replace long duration assets with those of short duration. Forget price to hope ratios and go back to traditional stock valuations.

-

absolutezero

- Lemon Quarter

- Posts: 1510

- Joined: November 17th, 2016, 8:17 pm

- Has thanked: 544 times

- Been thanked: 653 times

Re: Investing during a time of high inflation - What are you doing?

simoan wrote:That’s nearly always a sign to keep your eye on the exit door because the price becomes disconnected from the real underlying demand.

But I think the demand is yet to come.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 26 guests