Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

Huge losses going on in Bonds right now!

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Huge losses going on in Bonds right now!

In the few months I've been on Lemonfool it's clear that the forum is dominated by discussion of stocks, which is great.

However we need to take a sidestep and talk the Bond market - because there are huge losses going on in bonds right now as interest rates have been rising, the value of long duration bond funds are in the midst of a huge drawdown.

It's rare to hear talking heads on financial TV talking about plainly about losses in the bond market, because they always talk about bonds in terms of yields, rather than the value of the bond. When they say that the 10yr has rising from 2% to 2.5% in the last month (or whatever) they never talk about the ~15% drop in the value of the bonds that bond holders just suffered!

Bond prices are just the other side of the coin of interest rates - as rates have risen off the record lows since in response to the rampant inflation. The long duration funds like TLT, ZROZ & EDV are down 25-35% from peak in summer 2020 (sorry for using US bond funds, but the same will be largely true of any bond fund). When you add in 9-10% inflation since then, real losses in those funds are currently running anything up to 40%.

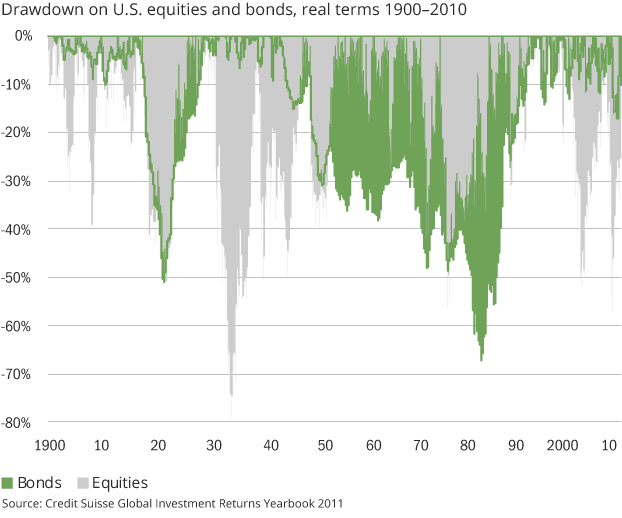

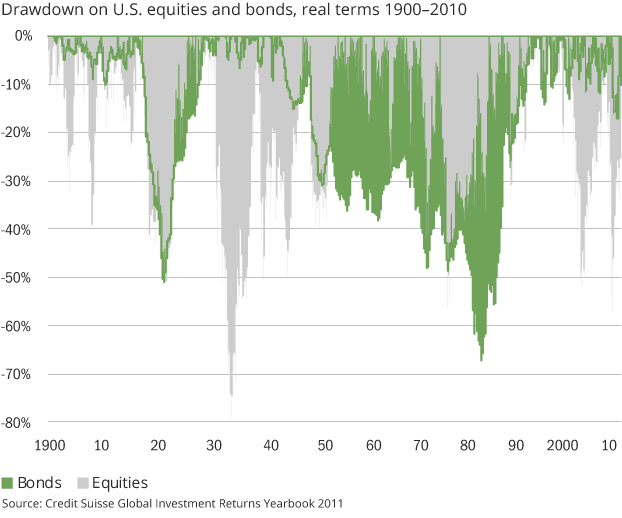

People have a perception that (government) bonds are safer than stocks... but this is not really true. It's only true in the sense that governments have a printing press and so never have to "hard default" on making payments on their debt... but they cannot gaurantee the purchasing power of those payments. There have been episodes of horrendous real losses in the bond market - in the 2nd decade of the 1900s bondholders lost more than half of their purchasing power, and in era after WWII to the bottom of the bond bear market in 1980, bond holders lost 2/3rds of their purchasing power.

It's looking like we're going to have a rerun of that sort of drawdown.

Traditionally, and certainly since the disinflationary era since the 1990s, bonds have worked so well in a stock/bond portfolio because on the ocassions that stocks have sold off, bonds have moved in the opposite direction. This is why the 60/40 has established itself as the de factor benchmark in passive investment portfolios and given the best historic risk/reward balance.

But what if all that is now changing? As inflation becomes entrenched and rates continue to rise, stock market selloffs are being accompanied by further losses in bonds. This is why some are arguing that the 60/40 is going to work much less well going forward than it has in the past.. and I tend to agree with them.

So what? why should I care about bonds if I only invest in stocks?

But you should care, because stocks don't exist in a vacuum, and they are priced with the knowledge of the returns on offer in the bond market. Bonds are the base of the investing pyramid because their (nominal) returns are gauranteed - the higher return they offer, the higher forward returns stocks also have to offer to justify the risk premium of owning stocks, so the lower stock prices have to be to meet those expected returns. Understanding and paying attention to the bond market makes you a better stock investor, imo.

However we need to take a sidestep and talk the Bond market - because there are huge losses going on in bonds right now as interest rates have been rising, the value of long duration bond funds are in the midst of a huge drawdown.

It's rare to hear talking heads on financial TV talking about plainly about losses in the bond market, because they always talk about bonds in terms of yields, rather than the value of the bond. When they say that the 10yr has rising from 2% to 2.5% in the last month (or whatever) they never talk about the ~15% drop in the value of the bonds that bond holders just suffered!

Bond prices are just the other side of the coin of interest rates - as rates have risen off the record lows since in response to the rampant inflation. The long duration funds like TLT, ZROZ & EDV are down 25-35% from peak in summer 2020 (sorry for using US bond funds, but the same will be largely true of any bond fund). When you add in 9-10% inflation since then, real losses in those funds are currently running anything up to 40%.

People have a perception that (government) bonds are safer than stocks... but this is not really true. It's only true in the sense that governments have a printing press and so never have to "hard default" on making payments on their debt... but they cannot gaurantee the purchasing power of those payments. There have been episodes of horrendous real losses in the bond market - in the 2nd decade of the 1900s bondholders lost more than half of their purchasing power, and in era after WWII to the bottom of the bond bear market in 1980, bond holders lost 2/3rds of their purchasing power.

It's looking like we're going to have a rerun of that sort of drawdown.

Traditionally, and certainly since the disinflationary era since the 1990s, bonds have worked so well in a stock/bond portfolio because on the ocassions that stocks have sold off, bonds have moved in the opposite direction. This is why the 60/40 has established itself as the de factor benchmark in passive investment portfolios and given the best historic risk/reward balance.

But what if all that is now changing? As inflation becomes entrenched and rates continue to rise, stock market selloffs are being accompanied by further losses in bonds. This is why some are arguing that the 60/40 is going to work much less well going forward than it has in the past.. and I tend to agree with them.

So what? why should I care about bonds if I only invest in stocks?

But you should care, because stocks don't exist in a vacuum, and they are priced with the knowledge of the returns on offer in the bond market. Bonds are the base of the investing pyramid because their (nominal) returns are gauranteed - the higher return they offer, the higher forward returns stocks also have to offer to justify the risk premium of owning stocks, so the lower stock prices have to be to meet those expected returns. Understanding and paying attention to the bond market makes you a better stock investor, imo.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

Needs updating, but this is one of my favourite charts: the historic real drawdown in stocks & bonds:

taken from: https://seekingalpha.com/article/402871 ... tion-cycle

taken from: https://seekingalpha.com/article/402871 ... tion-cycle

-

tjh290633

- Lemon Half

- Posts: 8286

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4137 times

Re: Huge losses going on in Bonds right now!

Back in the 1970s and 80s, I was buying Gilts for my mother-in-law. Initially I only bought stock at below-par prices, like Treasury 93, 13.75% at £94.75 in 1975. The RPI was 119.9. Sold in 1986 at £126 when the RPI was 379.5, giving her an IRR of 16.7%. The rate of increase of the RPI was 11%.

The proceeds went into stock standing above par, like Treasury 98 15.5%, at £144.87, sold in 1993 when she went into care at £137.75, the RPI now being 559.8 on the same basis. The IRR was 9.62%, compared with the RPI at 5.71%.

Another bought in 1975 was Treasury 98 8.75%, at £64.50. That was sold in 1993 at £108.72, giving an IRR of 15.83%, the RPI change over that period being 8.93%.

The yields are a bit mouthwatering by today's standards, but that is inflation for you.

TJH

The proceeds went into stock standing above par, like Treasury 98 15.5%, at £144.87, sold in 1993 when she went into care at £137.75, the RPI now being 559.8 on the same basis. The IRR was 9.62%, compared with the RPI at 5.71%.

Another bought in 1975 was Treasury 98 8.75%, at £64.50. That was sold in 1993 at £108.72, giving an IRR of 15.83%, the RPI change over that period being 8.93%.

The yields are a bit mouthwatering by today's standards, but that is inflation for you.

TJH

-

scrumpyjack

- Lemon Quarter

- Posts: 4859

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2706 times

Re: Huge losses going on in Bonds right now!

In 55 years of investing I have never had any fixed interest, other than indexed linked. I viewed it as far too risky due to inflation. OK the interest rates usually compensated for inflation but then you paid income tax at up to 98% on that. I'm not sure I agree about bonds and gilts being a baseline for returns. Equity in a good profitable business is likely to continue to prosper over the years as it more than keeps its value in real terms. That has been my experience over the decades. Of course the best return historically has come from taking out a large mortgage (nominal liability) to buy a house (real asset), the very opposite of holding bonds! I have never had a '60/40' mindset and have always been 100% equity. I do hold a lot of cash also now i am retired but would not put any of it into bonds.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

tjh290633 wrote:Back in the 1970s and 80s, I was buying Gilts for my mother-in-law. Initially I only bought stock at below-par prices, like Treasury 93, 13.75% at £94.75 in 1975. The RPI was 119.9. Sold in 1986 at £126 when the RPI was 379.5, giving her an IRR of 16.7%. The rate of increase of the RPI was 11%.

The proceeds went into stock standing above par, like Treasury 98 15.5%, at £144.87, sold in 1993 when she went into care at £137.75, the RPI now being 559.8 on the same basis. The IRR was 9.62%, compared with the RPI at 5.71%.

Another bought in 1975 was Treasury 98 8.75%, at £64.50. That was sold in 1993 at £108.72, giving an IRR of 15.83%, the RPI change over that period being 8.93%.

The yields are a bit mouthwatering by today's standards, but that is inflation for you.

TJH

Yes, it was possible to get 16-17% return from fixed income back in the 1970s because inflation was much higher, we had no idea that the bottom of the bond market would be put in in the early 1980s, or that we would be entering a disinflationary period which would suck future returns forward. Fixed income was priced for a world that was expected to see inflation remain high with a correspondingly high cost of capital.

Today.. we are very much at the opposite of that. Bonds are priced with the expectation that inflation is going to stay low (which already isn't really happening), and the cost of capital will remain low. If those assumptions prove to be wrong then the losses we've seen so far may well look small compared to what likes ahead..

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

scrumpyjack wrote:In 55 years of investing I have never had any fixed interest, other than indexed linked. I viewed it as far too risky due to inflation. OK the interest rates usually compensated for inflation but then you paid income tax at up to 98% on that. I'm not sure I agree about bonds and gilts being a baseline for returns. Equity in a good profitable business is likely to continue to prosper over the years as it more than keeps its value in real terms. That has been my experience over the decades. Of course the best return historically has come from taking out a large mortgage (nominal liability) to buy a house (real asset), the very opposite of holding bonds! I have never had a '60/40' mindset and have always been 100% equity. I do hold a lot of cash also now i am retired but would not put any of it into bonds.

It's not atypical for many stock investors to totally ignore fixed income.

The research is compelling, however, that, at least over the last 50 years or so, a balanced portfolio has delivered more return for the amount of risk taken on than a straightforward all-stock portfolio.

Even if you are comfortable with a 100% stock portfolio, you should not dismiss the concept of how much risk your portfolio carries, and strive to reduce risk to the minimum possible for the level of (expected) return that you hope to generate.

A 60/40 portfolio has historically returned about 1%pa less than a 100/0 but with about 40% less risk. If you want the expected return of a 100% stock portfolio then you can get that by leveraging a balanced portfolio and still keeping the risk below that of an all-stock portfolio.

I understand the Warren Buffett mindset of "I'd rather own as much stock as possible in outstanding companies over bonds, gold, or anything else..." but none of us are Warren Buffett - we don't run a fund and we're just trying to do the best for ourselves, not build the greatest amount of wealth over our lifetime.

-

scrumpyjack

- Lemon Quarter

- Posts: 4859

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2706 times

Re: Huge losses going on in Bonds right now!

But there is no reason to hold fixed interest. Cash deposits, perhaps where the interest rate is fixed for a year, are fine for me in providing certainty of cash for living expenses for many years. It is a delusion to regard fixed interest as low risk (in real terms which is what matters). Cash deposits are not going to lose nominal capital value as interest rates rise.

-

Newroad

- Lemon Quarter

- Posts: 1096

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 343 times

Re: Huge losses going on in Bonds right now!

Hi Vand.

I hold VAGP in most of my sub-portfolios. It is roughly a proxy for mid-duration global bonds. It looks to me roughly 10.4% down from it's peak.

The issues you will have trying to discuss the idea of bonds on this forum include

Doesn't make anyone wrong or right, but my guess (in part, based on observation) is that it will be difficult to get any sort of balanced discussion. To do so, you'd need to get enough posters to consider more general cases (as opposed to "it works for me" or "I prefer to do it this way"). The latter are fine in themselves, but not helpful in broader terms.

Regards, Newroad

I hold VAGP in most of my sub-portfolios. It is roughly a proxy for mid-duration global bonds. It looks to me roughly 10.4% down from it's peak.

The issues you will have trying to discuss the idea of bonds on this forum include

- Members who have enough that they can risk 100% or near 100% stocks, and/or

Survivorship bias

Doesn't make anyone wrong or right, but my guess (in part, based on observation) is that it will be difficult to get any sort of balanced discussion. To do so, you'd need to get enough posters to consider more general cases (as opposed to "it works for me" or "I prefer to do it this way"). The latter are fine in themselves, but not helpful in broader terms.

Regards, Newroad

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

Newroad wrote:Hi Vand.

I hold VAGP in most of my sub-portfolios. It is roughly a proxy for mid-duration global bonds. It looks to me roughly 10.4% down from it's peak.

The issues you will have trying to discuss the idea of bonds on this forum includeMembers who have enough that they can risk 100% or near 100% stocks, and/or

Survivorship bias

Doesn't make anyone wrong or right, but my guess (in part, based on observation) is that it will be difficult to get any sort of balanced discussion. To do so, you'd need to get enough posters to consider more general cases (as opposed to "it works for me" or "I prefer to do it this way"). The latter are fine in themselves, but not helpful in broader terms.

Regards, Newroad

Thanks, yes point taken about how it will be difficult to get a balanced discussion going.

VAGP is a total bond fund, I guess fulfilling a similar function to the BND ETF for the US. If you overlay them they have almost 1:1 correlation except that VAGP has held up better overall since peak, I suspect due to a weaker GBP.

When looking at the drawdowns, in bonds you have to also factor in the depreciating power of the currency. Add in the inflation and its fair to say that your holding in VAGP is now down around 20% in real purchasing power. Of course this is true in stocks or anything else too, but stocks have the power to grow their earnings over time, whereas bonds don't, so inflation is like kryptonite to regular (nominal) bonds.

A 20% fall in purchasing power doesn't sound terrible, but the reason people buy bonds is because they are considered safer than stocks... but they're not safe if they can lose a fifth of their purchasing power or more so easily!

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

scrumpyjack wrote:But there is no reason to hold fixed interest. Cash deposits, perhaps where the interest rate is fixed for a year, are fine for me in providing certainty of cash for living expenses for many years. It is a delusion to regard fixed interest as low risk (in real terms which is what matters). Cash deposits are not going to lose nominal capital value as interest rates rise.

I agree that it's delusion to regard bonds are low risk, but cash doesn't solve this. The universal law of investing still applies: to earn a return you have to accept risk.

Bonds are just an instrument which promises a stream of cash payments. At the short end of the duration curve you have T-bills and short gilts that behave more like cash than they do long duration bonds.

Swapping long bonds for cash is just transferring risk from one form to another.

With long duration bonds you have higher interest payments but hold more more interest rate risk. With shorter duration bonds you don't hold as much interest rate risk but the interest payments will be lower which in themselves provide less of a defence against the constant ravages of inflation, so you are exchanging interest rate risk for inflation risk.

Despite the higher gyrations of the long duration funds, they will return more over long periods than cash and cash equivilents due to the tailwind of their coupon payouts.

-

scrumpyjack

- Lemon Quarter

- Posts: 4859

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2706 times

Re: Huge losses going on in Bonds right now!

vand wrote:scrumpyjack wrote:But there is no reason to hold fixed interest. Cash deposits, perhaps where the interest rate is fixed for a year, are fine for me in providing certainty of cash for living expenses for many years. It is a delusion to regard fixed interest as low risk (in real terms which is what matters). Cash deposits are not going to lose nominal capital value as interest rates rise.

I agree that it's delusion to regard bonds are low risk, but cash doesn't solve this. The universal law of investing still applies: to earn a return you have to accept risk.

Bonds are just an instrument which promises a stream of cash payments. At the short end of the duration curve you have T-bills and short gilts that behave more like cash than they do long duration bonds.

Swapping long bonds for cash is just transferring risk from one form to another.

With long duration bonds you have higher interest payments but hold more more interest rate risk. With shorter duration bonds you don't hold as much interest rate risk but the interest payments will be lower which in themselves provide less of a defence against the constant ravages of inflation, so you are exchanging interest rate risk for inflation risk.

Despite the higher gyrations of the long duration funds, they will return more over long periods than cash and cash equivilents due to the tailwind of their coupon payouts.

All true of course, but interest rates are still so low and the interest, for me, is then taxed at 45%, I regard the income as irrelevant. Holding cash provides diversification and security. I think if I could be bothered I should take more care in thinking about which currency to hold it in, rather than messing about with fixed interest. The dividends on my holdings such as Rio, BHP, Persimmon, Barratt etc make the interest coupon on the cash inconsequential. Cash has the advantage of being available immediately, which is another aspect where fixed interest is unattractive. Hence the narrative about fixed interest vs equities ignores many issues.

-

dealtn

- Lemon Half

- Posts: 6099

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Huge losses going on in Bonds right now!

vand wrote:In the few months I've been on Lemonfool it's clear that the forum is dominated by discussion of stocks, which is great.

However we need to take a sidestep and talk the Bond market - because there are huge losses going on in bonds right now as interest rates have been rising, the value of long duration bond funds are in the midst of a huge drawdown.

A number in the past, before you joined it would seem, were in denial that Bonds had the potential for large losses and price volatility. Hopefully such lessons, now being learned, weren't expensive ones. Each asset class has its place, and diversification provides positivity to a strategy or portfolio, but consistent claims of how safe bonds are, and the lack of knowledge about them concurrent with views on the risks surrounding equities made no sense.

-

Newroad

- Lemon Quarter

- Posts: 1096

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 343 times

Re: Huge losses going on in Bonds right now!

Hi Vand.

I am under no illusion (I don't think anyway!) re bonds.

What people who are 100% equities need to consider is doing a thought experiment, for example, what their portfolios might have looked like had they been (say) 80-20 equities-bonds and had a set of rules as to how to rebalance. There have been enough sizable falls in equities (even if bonds fell a bit at the same time, in most and perhaps all situations, they would have fallen less) to consider the upside of this approach.

However, even that isn't enough - one needs to consider tax effects etc (including tax harvesting where relevant). It's never truly simple.

In any case, I'm OK holding my mix of equities/high yield bonds/medium duration investment grade bonds and hoping for the best in context. The main change I have done somewhat recently is getting an accurate view of my combined bond & cash holdings (not bonds alone) and comparing that to my equity "North Star" - which is probably a more accurate way of looking at things. In practise, this meant slightly lowering the JISA equity holdings (little cash outside) but increasing the ISA and SIPP equity holdings (more cash outside).

Regards, Newroad

I am under no illusion (I don't think anyway!) re bonds.

What people who are 100% equities need to consider is doing a thought experiment, for example, what their portfolios might have looked like had they been (say) 80-20 equities-bonds and had a set of rules as to how to rebalance. There have been enough sizable falls in equities (even if bonds fell a bit at the same time, in most and perhaps all situations, they would have fallen less) to consider the upside of this approach.

However, even that isn't enough - one needs to consider tax effects etc (including tax harvesting where relevant). It's never truly simple.

In any case, I'm OK holding my mix of equities/high yield bonds/medium duration investment grade bonds and hoping for the best in context. The main change I have done somewhat recently is getting an accurate view of my combined bond & cash holdings (not bonds alone) and comparing that to my equity "North Star" - which is probably a more accurate way of looking at things. In practise, this meant slightly lowering the JISA equity holdings (little cash outside) but increasing the ISA and SIPP equity holdings (more cash outside).

Regards, Newroad

-

SalvorHardin

- Lemon Quarter

- Posts: 2064

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5386 times

- Been thanked: 2492 times

Re: Huge losses going on in Bonds right now!

Newroad wrote:The issues you will have trying to discuss the idea of bonds on this forum includeMembers who have enough that they can risk 100% or near 100% stocks, and/or

Survivorship bias

Doesn't make anyone wrong or right, but my guess (in part, based on observation) is that it will be difficult to get any sort of balanced discussion. To do so, you'd need to get enough posters to consider more general cases (as opposed to "it works for me" or "I prefer to do it this way"). The latter are fine in themselves, but not helpful in broader terms.

As someone who falls into both categories, there is no way I would consider bonds at the moment. Growing up in the 1970s gave me an appreciation for how inflation plays havoc with your money in a way that most Brits under the age of 40 haven't experienced until the current year.

Locking in at less than 2% yield (long gilts) at a time when inflation is well over 5% and heading for 10% is throwing money away, guaranteeing a real loss. I'll take my chances with real assets and companies which own a lot of real assets.

I reckon that the justification for bonds in large part harks back to conditions before the 2008 financial crisis, where equity yields were lower than fixed interest yields.

Since then equity yields have been greater than bond yields (the yield gap), as it was before the 1950s when the reverse yield gap (equity yields less than bond yields) appeared as the ability of equities to raise their dividends became much more appreciated.

Lots of the theory regarding bonds and their place in private investors' portfolios were developed when equity yields were less than bond yields, which is not the case today.

-

Lootman

- The full Lemon

- Posts: 18938

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6675 times

Re: Huge losses going on in Bonds right now!

dealtn wrote:vand wrote:In the few months I've been on Lemonfool it's clear that the forum is dominated by discussion of stocks, which is great.

However we need to take a sidestep and talk the Bond market - because there are huge losses going on in bonds right now as interest rates have been rising, the value of long duration bond funds are in the midst of a huge drawdown.

A number in the past, before you joined it would seem, were in denial that Bonds had the potential for large losses and price volatility. Hopefully such lessons, now being learned, weren't expensive ones. Each asset class has its place, and diversification provides positivity to a strategy or portfolio, but consistent claims of how safe bonds are, and the lack of knowledge about them concurrent with views on the risks surrounding equities made no sense.

Goseigen is one Lemon who has often touted bonds here. It would be interesting if he were to comment on this topic now that the 40 year bull run in bonds has clearly reversed.

As one wag put it on a markets programme recently: Bonds are now offering return-free risk.

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

Re: Huge losses going on in Bonds right now!

scrumpyjack wrote:But there is no reason to hold fixed interest. Cash deposits, perhaps where the interest rate is fixed for a year, are fine for me in providing certainty of cash for living expenses for many years. It is a delusion to regard fixed interest as low risk (in real terms which is what matters). Cash deposits are not going to lose nominal capital value as interest rates rise.

Exactly this!

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

Re: Huge losses going on in Bonds right now!

Bonds were also more relevant in the days when SIPPs came with compulsory annuity purchase, now long gone.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

SalvorHardin wrote:Newroad wrote:The issues you will have trying to discuss the idea of bonds on this forum includeMembers who have enough that they can risk 100% or near 100% stocks, and/or

Survivorship bias

Doesn't make anyone wrong or right, but my guess (in part, based on observation) is that it will be difficult to get any sort of balanced discussion. To do so, you'd need to get enough posters to consider more general cases (as opposed to "it works for me" or "I prefer to do it this way"). The latter are fine in themselves, but not helpful in broader terms.

As someone who falls into both categories, there is no way I would consider bonds at the moment. Growing up in the 1970s gave me an appreciation for how inflation plays havoc with your money in a way that most Brits under the age of 40 haven't experienced until the current year.

Locking in at less than 2% yield (long gilts) at a time when inflation is well over 5% and heading for 10% is throwing money away, guaranteeing a real loss. I'll take my chances with real assets and companies which own a lot of real assets.

I reckon that the justification for bonds in large part harks back to conditions before the 2008 financial crisis, where equity yields were lower than fixed interest yields.

Since then equity yields have been greater than bond yields (the yield gap), as it was before the 1950s when the reverse yield gap (equity yields less than bond yields) appeared as the ability of equities to raise their dividends became much more appreciated.

Lots of the theory regarding bonds and their place in private investors' portfolios were developed when equity yields were less than bond yields, which is not the case today.

Taken in standalone isolation, a bond only makes sense as an investment if the interest it is bearing is above the expected rate of future inflation, in order that you earn a real return.

As part of an mixed portfolio of stocks/bonds, it can be easier to justify even if you are not sure about this, because in recent times that stocks have done poorly (economic recession) have also been deflationary periods where aggregate demand falls, and allows inflation to moderate to levels below what the market had priced in, giving fixed income a boost in the process to offset the falls in the equity portion of the portfolio.

The big question, I guess, is will deflationary circuitbreaker repeat in future economic downturns? If so then you can make a case for holding some bonds to act as as crash protection. However, if future downturns are primarily driven by supply side issues then its entirely possible that prices go up during periods of economic turmoil, rasing inflation and pushing bond yields even higher - this behaviour is commonplace today in many less developed countries, where we observe that as their economies go into recession, it is accompanied with rises in inflation pressure on the currency, and rising interest rates.

If this more the shape of the future then Bonds are going to be toast.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Huge losses going on in Bonds right now!

dealtn wrote:vand wrote:In the few months I've been on Lemonfool it's clear that the forum is dominated by discussion of stocks, which is great.

However we need to take a sidestep and talk the Bond market - because there are huge losses going on in bonds right now as interest rates have been rising, the value of long duration bond funds are in the midst of a huge drawdown.

A number in the past, before you joined it would seem, were in denial that Bonds had the potential for large losses and price volatility. Hopefully such lessons, now being learned, weren't expensive ones. Each asset class has its place, and diversification provides positivity to a strategy or portfolio, but consistent claims of how safe bonds are, and the lack of knowledge about them concurrent with views on the risks surrounding equities made no sense.

I see the same disregard of risk with equities today with regard to inflation from people who are either just stock perma bulls, or ignorant of history.

It's simple historical fact that general equities have, on average, done poorly when inflation gets out of control. And yet I commonly see people who claim that equities are the best place to be if you are worried about inflation, because over time equities have the best record of real growth, totally ignoring how equities get derated and struggle when inflation and interest rates are higher.

The reason is quite obvious if you thinkg about it - persistent high inflation is the sign of a weak economy that isn't productive enough to produce the quantity of goods and services to meet demand. Businesses operating in such an economy are generally not maximzing the factors of production at their disposal and operating beneath the potential.

As you say, each asset has its place, but nothing by itself works well in all environments.. otherwise there would never be a need to invest in anything else.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 29 guests