Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Buying gold & silver

-

MrFoolish

- Lemon Quarter

- Posts: 2489

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 594 times

- Been thanked: 1192 times

Buying gold & silver

How do people here hold gold and silver as investments?

I was just casually looking at the Royal Mint who sell these metals and will store it for you. Their fees are:

Buy: 0.33%

Store (p.a.): 0.5% + VAT

Sell: 1%

Thoughts on this?

I was just casually looking at the Royal Mint who sell these metals and will store it for you. Their fees are:

Buy: 0.33%

Store (p.a.): 0.5% + VAT

Sell: 1%

Thoughts on this?

-

MrFoolish

- Lemon Quarter

- Posts: 2489

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 594 times

- Been thanked: 1192 times

Re: Buying gold & silver

scotview wrote:If you don't hold it, you don't own it.

What exactly does that mean? Do you think the Royal Mint would rip you off?

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: Buying gold & silver

The long-term gold and silver bullion holdings in my portfolio are physical metal stored where hopefully nobody will find it and with no counterparty risk. See topic linked below for storage ideas.

viewtopic.php?f=8&t=34773&start=40#p520035

The bullion was purchased many years ago, mostly from Baird & Co and Chards, with the most recent purchases being several years ago near the bottom of the post-2011 precious metals crash. The earliest purchases being two decades ago. Link below to Baird & Co and Chards - more dealers have sprung up over the years but these two were some of the few offering gold coins 20+ years ago:

https://www.bairdmint.com/gold

https://www.chards.co.uk/

The remainder of my gold and silver investments - the 'tradeable' portion which rotates between asset classes - is mostly in PM mining shares which would be awkward for me to invest in due to dealing with US/Canadian/Australian/South African etc tax systems.

They are OEIC/UT type funds: Ninety One Global Gold, Jupiter Gold & Silver, WS Charteris Gold, Blackrock Gold & General, within ISAs or investment accounts administered by companies such as Fidelity or Aviva.

Links below to Fidelity's pages for those OEIC/UT funds:

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

With the challenging times ahead of us and the meltdown in precious metals and their miners recently, I took the opportunity to reshuffle my portfolio which is now extremely overweight PMs, with around 28% gold bullion, 1% silver bullion, 15% precious metal mining funds, for a total of 44% of portfolio invested in PMs.

However, part of this extreme overweight is concern that the substantial income I receive from my UK HYP-ish investments, or even the companies in which I invest, could come under great strain in the challenging times which lie ahead.

In the past it was possible to hold a large cash buffer just in case of dividend shortfalls, but now cash is being devalued at an alarming rate.

viewtopic.php?f=8&t=34773&start=40#p520035

The bullion was purchased many years ago, mostly from Baird & Co and Chards, with the most recent purchases being several years ago near the bottom of the post-2011 precious metals crash. The earliest purchases being two decades ago. Link below to Baird & Co and Chards - more dealers have sprung up over the years but these two were some of the few offering gold coins 20+ years ago:

https://www.bairdmint.com/gold

https://www.chards.co.uk/

The remainder of my gold and silver investments - the 'tradeable' portion which rotates between asset classes - is mostly in PM mining shares which would be awkward for me to invest in due to dealing with US/Canadian/Australian/South African etc tax systems.

They are OEIC/UT type funds: Ninety One Global Gold, Jupiter Gold & Silver, WS Charteris Gold, Blackrock Gold & General, within ISAs or investment accounts administered by companies such as Fidelity or Aviva.

Links below to Fidelity's pages for those OEIC/UT funds:

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

https://www.fidelity.co.uk/factsheet-da ... statistics

With the challenging times ahead of us and the meltdown in precious metals and their miners recently, I took the opportunity to reshuffle my portfolio which is now extremely overweight PMs, with around 28% gold bullion, 1% silver bullion, 15% precious metal mining funds, for a total of 44% of portfolio invested in PMs.

However, part of this extreme overweight is concern that the substantial income I receive from my UK HYP-ish investments, or even the companies in which I invest, could come under great strain in the challenging times which lie ahead.

In the past it was possible to hold a large cash buffer just in case of dividend shortfalls, but now cash is being devalued at an alarming rate.

-

Lootman

- The full Lemon

- Posts: 19356

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6910 times

Re: Buying gold & silver

MrFoolish wrote:scotview wrote:If you don't hold it, you don't own it.

What exactly does that mean? Do you think the Royal Mint would rip you off?

There have always been two schools of thought about investing in gold and other precious metals.

The first is purely as any other investment, assuming that our financial institutions will continue to be sound. In that case you do not need physical custody. You might just as easily own a gold ETF or shares in gold miners. You are investing in this asset for the simple reason that you think it will increase in value at least as much as any other asset.

The second is more a doomsday "Mad Max" scenario where our institutions fail and cease to operate, currencies become worthless, and you will need physical gold, diamonds etc to barter for food, energy, ammo etc.

For this second group, if you don't own it physically and directly then it could be worthless to you when Armageddon arrives.

-

MrFoolish

- Lemon Quarter

- Posts: 2489

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 594 times

- Been thanked: 1192 times

Re: Buying gold & silver

Lootman wrote:The second is more a doomsday "Mad Max" scenario where our institutions fail and cease to operate, currencies become worthless, and you will need physical gold, diamonds etc to barter for food, energy, ammo etc.

For this second group, if you don't own it physically and directly then it could be worthless to you when Armageddon arrives.

Who'd want a heavy lump of metal in such circumstances? You'd be better off investing in a wheelbarrow, as it would give you the means of moving around your food, coal, ammo etc.

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: Buying gold & silver

If you're planning on holding gold for a very long time - maybe a 'Harry Browne Permanent Portfolio' strategy - it could well work out cheaper to accept paying 4% above spot for physical rather than paying an annual fee to an ETF plus a fee to your trading platform provider.

Physical in the form of Sovereigns or Britannias is exempt from CGT. Other forms of gold, such as ETFs or even Krugerrands, aren't exempt from CGT.

So there could be a long-term CGT advantage from holding Sovereigns or Britannias - and the higher inflation goes and the longer the holding period, the more likely CGT will be an issue.

If gold were to repeat what happened in just the first half of the 1970s, £10k invested now would reach £60k within four years, potentially generating £20k of CGT liability. The same was true for the second half of the 1970s.

I don't expect gold to be quite as strong in the years ahead as it was in the 1970s but I suspect people in 1970 had no idea how high it would ultimately go and wouldn't have believed that it would rise from under $50 to over $800 in a decade.

Physical in the form of Sovereigns or Britannias is exempt from CGT. Other forms of gold, such as ETFs or even Krugerrands, aren't exempt from CGT.

So there could be a long-term CGT advantage from holding Sovereigns or Britannias - and the higher inflation goes and the longer the holding period, the more likely CGT will be an issue.

If gold were to repeat what happened in just the first half of the 1970s, £10k invested now would reach £60k within four years, potentially generating £20k of CGT liability. The same was true for the second half of the 1970s.

I don't expect gold to be quite as strong in the years ahead as it was in the 1970s but I suspect people in 1970 had no idea how high it would ultimately go and wouldn't have believed that it would rise from under $50 to over $800 in a decade.

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

I prefer Britannia's. Consider someone with £1M of liquid wealth, invested 67/33 stocks/gold, and at recent prices that's around 222 one ounce gold coins, that stack around 0.6m high (less than 40mm diameter). A large O ring 1.5 inch curtain rail tubing above/spanning even a smallish 0.6m width window has the capacity to store the 22 odd ten coin tubes.

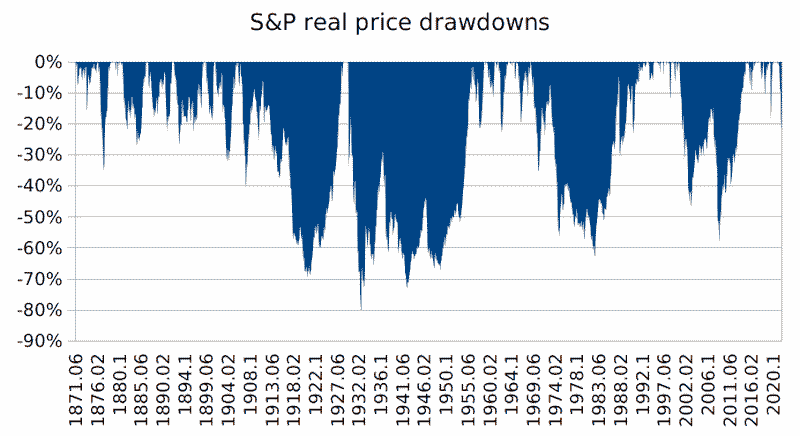

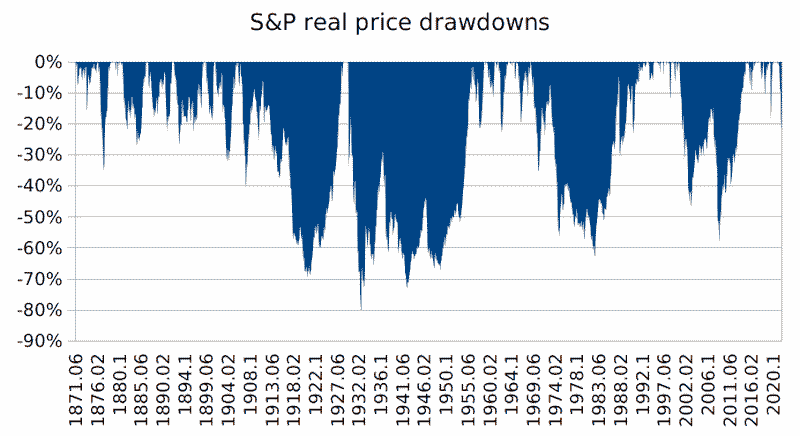

In the scale of things a 4% one-off coin cost spread, 1.3% to 'insure' a portfolio could prove to be relatively trivial. Stocks halve in real terms, gold doubles, to leave you holding 33/67 stock/gold, and sell the gold to treble up the number of shares you hold and you'll be fine.

That 'insurance' might never be called upon, the initial 33% gold weighting might decline over years to being less than 7% of the portfolio value. The difference between having averaged 80/20 stock/gold over those years will still tend to have rewarded a decent return (started with 67/33, ended with 93/7, averaged 80/20).

Warren Buffett likes all-stock, but equally suggests you average into stocks over time and when asked about lump sums proposed you drip fed that into the market over a period of years rather than risk having lumped all in at the worst possible time. But that's a paradox, as buy and hold is no different to the cost-less lumping in every day.

Since 1972 to recent and (US data) 67/33 stock/gold yearly rebalanced has yielded near-as the same total return reward as 100% stock. But there have been opportunities to have seen 67/33 stock/gold transition to 33/67 and if you'd dumped all of gold into stocks when those opportunities arose you'd have done well. 2000 start year and in 2009 67/33 original stock/gold had seen a reversal to be holding 33/67 stock/gold, in inflation adjusted terms you still had around the same portfolio value as at the start, but where selling gold to buy stocks in effect had you holding three times more shares than had you lumped all into shares at the start of 2000. On that basis I'd suggest not rebalancing yearly, but instead just rebalancing (or selling totally out of gold) as-and-when you deem it appropriate to do so, which also helps keeps costs down.

Be more creative than the above, store coins in a old upright hover dustbag with the hover stashed at the back on a under-stairs cupboard. In hollowed out top of doors compartments, within fake plumbing, behind electrical sockets ...etc. Together with having a safe within which maybe £3K cash and a few gold coins and even if held hostage a thief may be content that they'd stolen your stash.

Of course if you're in the £10M+ liquid wealth league then paying for storage becomes more appropriate, but then you have sufficient wealth to comfortably cover such fees.

Royal seals of approval tend to come priced at a premium as they don't want to be seen to be competitors to others (broader market), so the Royal Mint offerings will naturally tend to be on the 'expensive' side. The mint in effect sell to dealers at a lower price than what they sell at directly.

In the scale of things a 4% one-off coin cost spread, 1.3% to 'insure' a portfolio could prove to be relatively trivial. Stocks halve in real terms, gold doubles, to leave you holding 33/67 stock/gold, and sell the gold to treble up the number of shares you hold and you'll be fine.

That 'insurance' might never be called upon, the initial 33% gold weighting might decline over years to being less than 7% of the portfolio value. The difference between having averaged 80/20 stock/gold over those years will still tend to have rewarded a decent return (started with 67/33, ended with 93/7, averaged 80/20).

Warren Buffett likes all-stock, but equally suggests you average into stocks over time and when asked about lump sums proposed you drip fed that into the market over a period of years rather than risk having lumped all in at the worst possible time. But that's a paradox, as buy and hold is no different to the cost-less lumping in every day.

Since 1972 to recent and (US data) 67/33 stock/gold yearly rebalanced has yielded near-as the same total return reward as 100% stock. But there have been opportunities to have seen 67/33 stock/gold transition to 33/67 and if you'd dumped all of gold into stocks when those opportunities arose you'd have done well. 2000 start year and in 2009 67/33 original stock/gold had seen a reversal to be holding 33/67 stock/gold, in inflation adjusted terms you still had around the same portfolio value as at the start, but where selling gold to buy stocks in effect had you holding three times more shares than had you lumped all into shares at the start of 2000. On that basis I'd suggest not rebalancing yearly, but instead just rebalancing (or selling totally out of gold) as-and-when you deem it appropriate to do so, which also helps keeps costs down.

Be more creative than the above, store coins in a old upright hover dustbag with the hover stashed at the back on a under-stairs cupboard. In hollowed out top of doors compartments, within fake plumbing, behind electrical sockets ...etc. Together with having a safe within which maybe £3K cash and a few gold coins and even if held hostage a thief may be content that they'd stolen your stash.

Of course if you're in the £10M+ liquid wealth league then paying for storage becomes more appropriate, but then you have sufficient wealth to comfortably cover such fees.

Royal seals of approval tend to come priced at a premium as they don't want to be seen to be competitors to others (broader market), so the Royal Mint offerings will naturally tend to be on the 'expensive' side. The mint in effect sell to dealers at a lower price than what they sell at directly.

-

scotview

- Lemon Quarter

- Posts: 1523

- Joined: November 5th, 2016, 9:00 am

- Has thanked: 612 times

- Been thanked: 937 times

Re: Buying gold & silver

Lootman wrote:

The second is more a doomsday "Mad Max" scenario.

Thanks Lootman for drawing the distinction, nice. Could I just elaborate on the Mad Max bit though.

Investors in physical will be reserved, cautious, private and discrete. They will not generally be hysterical, Mad Max preppers.

Furthermore, descriptors like "Mad Max" tend to drive folkies from physical gold into paper gold instruments. There is an unknown, growing ratio between tradable, physical gold and paper gold instruments. Is it 10 times, 100 times 1000 times. The problem may come if there is a call on these paper instruments to deliver with the physical metal, especially in the volatile times we might be approaching. Paper gold Instruments could collapse and physical could drive higher, that's risk. (subprime anyone?)

At the time of the crafting of King Tutenkamun's gold death mask, physical trading of gold was the only means possible. As recent history has progressed, technology has introduced a manipulative, multiplier effect on gold which will probably get more exaggerated with increased tech, like AI based trading. Do you really trust Auditors and Government Regulators, have they the required competencies or the will ?

So, yes, for me it's, "if you don't hold it you don't own it", as Billy Connolly says, "that's the fellow for me!"

Of course, all of the above is just my opinion and I could just be very, very (and probably) wrong.

-

MrFoolish

- Lemon Quarter

- Posts: 2489

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 594 times

- Been thanked: 1192 times

Re: Buying gold & silver

Thanks for all the replies. Interesting stuff.

To add to the mix, does anyone favour gold and silver miners? If so, which companies?

To add to the mix, does anyone favour gold and silver miners? If so, which companies?

-

Padders72

- Lemon Slice

- Posts: 328

- Joined: November 8th, 2016, 7:53 pm

- Has thanked: 130 times

- Been thanked: 182 times

Re: Buying gold & silver

@1nvest

A creative hiding place but you want to add 67kg to your curtain rail? I foresee a domestic disaster next time the curtains are thrown wide as per Elbow’s instruction. Possibly a concussion also. Being coshed for your coin is ages old. Being coshed by it a new one on me.

A creative hiding place but you want to add 67kg to your curtain rail? I foresee a domestic disaster next time the curtains are thrown wide as per Elbow’s instruction. Possibly a concussion also. Being coshed for your coin is ages old. Being coshed by it a new one on me.

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: Buying gold & silver

1nvest wrote:.....Since 1972 to recent and (US data) 67/33 stock/gold yearly rebalanced has yielded near-as the same total return reward as 100% stock. But there have been opportunities to have seen 67/33 stock/gold transition to 33/67 and if you'd dumped all of gold into stocks when those opportunities arose you'd have done well. 2000 start year and in 2009 67/33 original stock/gold had seen a reversal to be holding 33/67 stock/gold, in inflation adjusted terms you still had around the same portfolio value as at the start, but where selling gold to buy stocks in effect had you holding three times more shares than had you lumped all into shares at the start of 2000. On that basis I'd suggest not rebalancing yearly, but instead just rebalancing (or selling totally out of gold) as-and-when you deem it appropriate to do so, which also helps keeps costs down......

I've been doing a similar thing since the early 2000s, with gold allocation varying between 10% and 50% and being rebalanced when I felt either gold or shares had moved too far.

I was a large buyer of precious metals in the early 2000s, then a large seller a decade later, and recently I've been shuffling the other way again, although the additions have been vastly more mining shares rather than metal because I already had some physical metal retained from the early 2000s.

In the early 2000s, precious metal miners traded on very high P/Es (Newmont I recall usually trading at 40 - 60x) and the value investor in me couldn't stomach those prices so bullion was preferred due to it clearly being undervalued.

After precious metals crashed in 2011, their miners began to look much better value, with low P/E ratios and relatively high dividend yields. With a recent bout of extreme weakness, lowly valuations combined with what I think could be a strong several years for precious metals, has set up the miners for some potentially amazing upside given their leverage to the gold price.

Here's an example of their leverage:

The average gold miner has a total cost per ounce of around $1200 (operating costs plus exploration/replacement of resource costs) and with gold at $1800 that's $600/oz profit.

If gold were to move up by 50% in two years, and the miners see 11% annual increase in costs due to inflation, that would put costs around $1500/oz and gold at $2700/oz with profit/oz up to $1200 from the current $600. Profits will be 2x with a 1.5x increase in the gold price. Some of the smaller miners have enormous leverage to the gold price, especially if their 'hole in the ground with the liar standing next to it' is barely profitable at current prices.

Of the larger-capitalisation miners, last time I looked, companies such as Northern Star Resources, Hecla, First Majestic Silver and Pan American Silver (best to do your own research) had profit-margin leverage around 3x relative to precious metal prices, with, of course, proportionate downside risk if precious metals decline.

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

BT63 wrote:1nvest wrote:.....Since 1972 to recent and (US data) 67/33 stock/gold yearly rebalanced has yielded near-as the same total return reward as 100% stock. But there have been opportunities to have seen 67/33 stock/gold transition to 33/67 and if you'd dumped all of gold into stocks when those opportunities arose you'd have done well. 2000 start year and in 2009 67/33 original stock/gold had seen a reversal to be holding 33/67 stock/gold, in inflation adjusted terms you still had around the same portfolio value as at the start, but where selling gold to buy stocks in effect had you holding three times more shares than had you lumped all into shares at the start of 2000. On that basis I'd suggest not rebalancing yearly, but instead just rebalancing (or selling totally out of gold) as-and-when you deem it appropriate to do so, which also helps keeps costs down......

I've been doing a similar thing since the early 2000s, with gold allocation varying between 10% and 50% and being rebalanced when I felt either gold or shares had moved too far.

I was a large buyer of precious metals in the early 2000s, then a large seller a decade later, and recently I've been shuffling the other way again, although the additions have been vastly more mining shares rather than metal because I already had some physical metal retained from the early 2000s.

In the early 2000s, precious metal miners traded on very high P/Es (Newmont I recall usually trading at 40 - 60x) and the value investor in me couldn't stomach those prices so bullion was preferred due to it clearly being undervalued.

After precious metals crashed in 2011, their miners began to look much better value, with low P/E ratios and relatively high dividend yields. With a recent bout of extreme weakness, lowly valuations combined with what I think could be a strong several years for precious metals, has set up the miners for some potentially amazing upside given their leverage to the gold price.

Here's an example of their leverage:

The average gold miner has a total cost per ounce of around $1200 (operating costs plus exploration/replacement of resource costs) and with gold at $1800 that's $600/oz profit.

If gold were to move up by 50% in two years, and the miners see 11% annual increase in costs due to inflation, that would put costs around $1500/oz and gold at $2700/oz with profit/oz up to $1200 from the current $600. Profits will be 2x with a 1.5x increase in the gold price. Some of the smaller miners have enormous leverage to the gold price, especially if their 'hole in the ground with the liar standing next to it' is barely profitable at current prices.

Of the larger-capitalisation miners, last time I looked, companies such as Northern Star Resources, Hecla, First Majestic Silver and Pan American Silver (best to do your own research) had profit-margin leverage around 3x relative to precious metal prices, with, of course, proportionate downside risk if precious metals decline.

Generally when buying into something like 40/40/20 home/stock/gold, left to run as-is, will either present a opportunity to sell gold and buy significantly more stock or home value, or see the weighting of gold fade to insignificant levels to be considered as having been a 'waste', but where the difference between having included/excluded that were relatively trivial (still very good 'portfolio' outcomes).

A imbalanced - still most of the good side, but with considerably better bad side risk/reward profile. And for recent/approaching retirees early years sequence of returns risk is a major risk that including some gold better hedges than not having any gold.

40 in home value collapses to 20, 20 in gold doubles to 40, sell gold to buy a three times more expensive property ... and thereafter you have more scope to downsize in later years should the need to raise liquid capital arise. Or 40 stocks halves to 20, 20 gold doubles to 40, and selling gold to be holding 3 times more stock shares has you comfortable thereafter. Or stock and houses do well, 20 original weighting in gold faded down to 5% of the 'portfolio', maybe having seen 90% of the upside that might otherwise have been achieved with all-stock/home (no gold), and a sensation of gold commonly being seen as a 'waste'.

As you indicate when 'into gold' other options present, such as trading gold/silver ratio, miners ... etc. according to relative valuations. For many that hold no gold the inclination is to just see it as a 'waste' asset. The commonness of that is both broad and intense, many seem to become quite aggressively against gold when gold comes into conversations, so more often its best to avoid such discussions. Also, as they say, rule one of holding gold, is to say you don't hold any gold.

-

Lootman

- The full Lemon

- Posts: 19356

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6910 times

Re: Buying gold & silver

scotview wrote: There is an unknown, growing ratio between tradable, physical gold and paper gold instruments. Is it 10 times, 100 times 1000 times. The problem may come if there is a call on these paper instruments to deliver with the physical metal, especially in the volatile times we might be approaching. Paper gold Instruments could collapse and physical could drive higher, that's risk. (subprime anyone?)

At least some of the ETFs are backed by physical gold. So if there is a concern about such instruments then one can be diligent about which ETFs are chosen. There is also the Canadian-listed Sprott Physcal Gold and Silver closed end fund (CEF) which specifically promotes itself based on the integrity of the underlying:

https://sprott.com/investment-strategie ... rusts/cef/

I would choose those over funds based on derivatives or credit instruments, such as ETNs.

MrFoolish wrote:To add to the mix, does anyone favour gold and silver miners? If so, which companies?

The shares of gold miners are typically more volatile than gold itself, which can be good or bad depending on your motives. The two big miners are Barrick (ABX in Toronto and GOLD in NYSE) and Newmont (NEM), which is the only gold miner in the S&P 500. Both pay dividends which gold does not, if that is important to you. Newmont pays dividends proportionate to the prevailing price of gold, which makes a certain amount of sense.

Silver miners tend to be smaller so you might prefer a fund approach. Fresnillo (FRES) is a Mexican silver mine that is London listed.

Then there are the trading companies that do not have the expense and hassle of mining the gold, but which negotiate to buy gold from the miners. They tend to follow the gold price as well. The big two ones there are Franco-Nevada (FNV) and Wheaton Precious Metals (WPM)

-

Mike4

- Lemon Half

- Posts: 7389

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1713 times

- Been thanked: 3968 times

Re: Buying gold & silver

MrFoolish wrote:scotview wrote:If you don't hold it, you don't own it.

What exactly does that mean? Do you think the Royal Mint would rip you off?

Forgive me from wondering if even the Royal Mint might be tempted when casting 1000 gold bars, to sell 1001 gold bars (when not expected to actually deliver them).

Or 1002 even.... or...

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

Lootman wrote:scotview wrote: There is an unknown, growing ratio between tradable, physical gold and paper gold instruments. Is it 10 times, 100 times 1000 times. The problem may come if there is a call on these paper instruments to deliver with the physical metal, especially in the volatile times we might be approaching. Paper gold Instruments could collapse and physical could drive higher, that's risk. (subprime anyone?)

At least some of the ETFs are backed by physical gold. So if there is a concern about such instruments then one can be diligent about which ETFs are chosen.

A factor is that whilst a bar with serial number xyz123 may be recorded as being held/owned by a fund, so when appraisers/auditors arrive they see that bar listed in the books and also see it present in the safe, but don't see where that bar had also been lent-out/paper-based-swapped or other more complex derivatives that when push comes to shove could have a gold-run, and where in most cases retail investors would be at the back of the queue.

Australia some years back created a law whereby gold within the country could be compulsory purchased, at a price it set, at the stroke of a pen. A single trigger could set off a global physical gold delivery demand and at the recent 112:1 paper-gold to physical-gold ratio https://usdebtclock.org/gold-precious-metals.html not everyone would be able to see their physical delivery requests being met. Which is when it could get interesting, a price disconnect with the price of physical gold perhaps rising to over 100 times the price of paper-gold. Similar to the likes of silver in 1980 where its price spiked six-fold very quickly (but yes, also subsequently quickly reverted back down again once the issues were resolved). Using that as a base, having 16% of a portfolio and seeing its price spike 6-fold ... and the gold would have risen to be comparable to 100% of the pre-jump entire portfolio value. But only if you had the physical gold in-hand and available to be delivered upon sale agreement, at a time when perhaps none of the ETF's value would be trusted as alternatives.

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

Mike4 wrote:MrFoolish wrote:scotview wrote:If you don't hold it, you don't own it.

What exactly does that mean? Do you think the Royal Mint would rip you off?

Forgive me from wondering if even the Royal Mint might be tempted when casting 1000 gold bars, to sell 1001 gold bars (when not expected to actually deliver them).

Or 1002 even.... or...

Much of the smelting is accounted for. In some past quarters the largest export from the UK into the EU was ... gold. Fundamentally imported from the Swiss, as bought/supplied by Asians/China, transported to the UK in order to be 're-cast' into "acceptable" form, and then sent back to Switzerland again for onward delivery. That global recognition/respect is worth far more than a bit of underhand dealing.

Of all gold coins/bars and storage, the RM is about as trustworthy as you'll get (for which you pay a premium), but perhaps still not as assured as having physical in-hand. Perhaps a situation whereby when you most needed to get your hands on your gold, barriers presented that delayed that until perhaps too late (price of gold had already spiked massively, but then dropped back down again, during which times the RM delivery/collections desk was closed - due to exceptional circumstances).

-

Lootman

- The full Lemon

- Posts: 19356

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6910 times

Re: Buying gold & silver

1nvest wrote:Lootman wrote:scotview wrote: There is an unknown, growing ratio between tradable, physical gold and paper gold instruments. Is it 10 times, 100 times 1000 times. The problem may come if there is a call on these paper instruments to deliver with the physical metal, especially in the volatile times we might be approaching. Paper gold Instruments could collapse and physical could drive higher, that's risk. (subprime anyone?)

At least some of the ETFs are backed by physical gold. So if there is a concern about such instruments then one can be diligent about which ETFs are chosen.

A factor is that whilst a bar with serial number xyz123 may be recorded as being held/owned by a fund, so when appraisers/auditors arrive they see that bar listed in the books and also see it present in the safe, but don't see where that bar had also been lent-out/paper-based-swapped or other more complex derivatives that when push comes to shove could have a gold-run, and where in most cases retail investors would be at the back of the queue.

Australia some years back created a law whereby gold within the country could be compulsory purchased, at a price it set, at the stroke of a pen. A single trigger could set off a global physical gold delivery demand and at the recent 112:1 paper-gold to physical-gold ratio https://usdebtclock.org/gold-precious-metals.html not everyone would be able to see their physical delivery requests being met. Which is when it could get interesting, a price disconnect with the price of physical gold perhaps rising to over 100 times the price of paper-gold. Similar to the likes of silver in 1980 where its price spiked six-fold very quickly (but yes, also subsequently quickly reverted back down again once the issues were resolved). Using that as a base, having 16% of a portfolio and seeing its price spike 6-fold ... and the gold would have risen to be comparable to 100% of the pre-jump entire portfolio value. But only if you had the physical gold in-hand and available to be delivered upon sale agreement, at a time when perhaps none of the ETF's value would be trusted as alternatives.

If you are worried at that level then, for that matter, the government could outlaw the personal ownership of gold, as was the case in the United States for decades (1933 to 1974). So if a government has a mind it can scupper any gold-based strategy.

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

Lootman wrote:the government could outlaw the personal ownership of gold, as was the case in the United States for decades (1933 to 1974).

The very early 1930's gold run in the UK, large scale conversion of money into gold at the fixed pegged rate, was seeing massive outflows of gold. IIRC the chancellor was out of the country, having a break-down at the prospect of breaking money/gold peg and others made that decision, had to as gold reserves were fast vanishing abroad. When the same started happening in the US they compulsory purchased all investment gold within the US at the then fixed peg rate, and as part of that made a law prohibiting holding physical gold within the US, but that didn't extent to investors holding gold abroad (such as in London), or simply swapping compulsory purchased gold proceeds into silver (poor mans gold). In effect the US nationalised all domestic physical investment gold as a means to avoid it otherwise being removed out of the country. As have governments historically at times nationalised other assets - such as water, telecoms, gas, electricity ...etc.

When money and gold were pegged, convertible by law in banks, the tendency was for broad 0% inflation (gold is finite) and investors typically preferred to hold money that they lent to the state in return for interest (treasury bonds) - that broadly on average paid 4%. That 4% was in effect a real rate of return, and was moderately consistent so investors could plan around that with a reasonable amount of reliability. Following that ending of gold/money peg the tendency has been to print/spend money - that devalues all other notes in circulation, induces inflation. And where treasury bond interest more just offsets that inflation rate, investors lost the prior 4% real type benefits from bonds. As such pre 1930's and most investors tended to invest in bonds, saw stocks as purely speculative ventures. Since the 1930's and investor were pushed into stocks in order to potentially yield a real rate of return compared to (broadly) 0% real from bonds. One way to mitigate the fiat-currency (backed by nothing) risk is to combine stocks and gold (non-fiat commodity currency), 50/50 barbell, that combines to a central form of former 4% real type 'bond' bullet, but is more volatile than 4% real 'bonds of old'.

Another choice might be to thirds each small cap value, gold, T-Bills (cash deposits). Which historically as a collective portfolio since the 1930's has also been a consistent 30 year "inflation bond", where 3.33% SWR withdrawals survived all 30 year periods, and more often left a decent 'terminal bonus', often of a comparable amount to the inflation adjusted start date amount. A form of Larry Portfolio, that holds 33% volatile stocks, 67% safe bonds. Shifts less volatile stock 50/50 stock/bond weightings towards holding less stock weighting in more volatile stocks.

Yet another variant is to take that thirds each small cap value stocks, gold, cash/T-Bills and shift T-Bills risk over to the stock side, 50/33/17 small cap value, gold, hard US$ currency. Such that you're holding 50% of the portfolio value in-hand, considerably reduced counter-party risks. A nice feature of the US$ is that not only is it the primary reserve currency, such that say 50% FT250 index tracker, 33% Britannia gold coins, 17% hard US$ currency might be considered as currency neutral/balanced (50/50 £/foreign), but also unlike most other currencies US$ bills always remain legal tender notes. In the UK for instance the old £1 note was given a end date, where all notes had to be submitted or otherwise becoming near valueless (other than collectors value), in the US that isn't the case, so you know that US$ in your safe even if left there for 30/whatever years, will still be legal tender.

For those that may not know, SWR = 'safe withdrawal rate' and a 3.33% SWR means taking 3.33% of the start date portfolio value, and then uplifting that £££ amount each year by inflation as the amount drawn at the start of each subsequent years. i.e. a nice reliable inflation adjusted income stream, such that present day high inflation risks/concerns become trivial matters, as next year the income you draw will have risen in reflection of that.

US data examples Growth of thirds each SCV/Gold/T-Bills and Monte-Carlo 3.33% 30 year SWR sim. Hover the mouse over the CAGR value in that first link and it pops up the inflation adjusted annualised return (5.41% since 1972 to recent at the present time). Note how in the second link that had a 100% success rate of a 3.33% SWR. If you tick the 'inflation adjusted' box in the second links chart and mouse over the extreme right lines, then that suggests in bad cases you were left 122% of the inflation adjusted start date amount at the end of 30 years, and in better/average cases considerably more. I opine that similar characteristics would also apply to holding 50/33/17 small cap value/gold/hard US$ currency.

-

1nvest

- Lemon Quarter

- Posts: 4683

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1518 times

Re: Buying gold & silver

For UK FTSE250 50%, gold 33%, hard US$ 17%, calendar yearly rebalanced since 1987 (FT250 officially didn't start as a fund until 1992, but index data for that was maintained in pre 1992 years).

That compounded total return (accumulation) tallied overall to around half the total accumulation gain of Terry's TJH HYP, so around 2% annualised broad lag of his HYP, where the above yielded 4.4% annualised real/7.9% annualised nominal (suggestive that TJH HYP achieved 6.6% real, 9.9% nominal). But where the above did so with considerably less volatility. The exceptional 1990 -15% bad year was more a case of a high volatility 'blip', spiked down and back up again relatively quickly, but where the down coincided with the calendar year end. Obviously if you're drawing 3.33% SWR from a portfolio that is making 4.4% real, then the prospects are good, and the tendency is towards the actual yearly % SWR figure declining over time (becomes even safer). Or that caters for additional amounts to be top-sliced out of the portfolios gains. Or simply leave a very nice portfolio value for heirs.

A casual glance and it looks like year to date/recent, FT250 is down around -15%, benefit of holding US$ is up +11.5%, gold in Pounds is up 10%, such that overall 55/33/17 is down around -2.2% year to date. Whilst inflation is running up at around 10% I believe. So as a 'inflation bond' its noteworthy that it doesn't track inflation consistently, but does tend to do so on a broader basis.

And all with half of the portfolio value sitting in your hands. No fear of counter-party risks (bank runs etc.).

That compounded total return (accumulation) tallied overall to around half the total accumulation gain of Terry's TJH HYP, so around 2% annualised broad lag of his HYP, where the above yielded 4.4% annualised real/7.9% annualised nominal (suggestive that TJH HYP achieved 6.6% real, 9.9% nominal). But where the above did so with considerably less volatility. The exceptional 1990 -15% bad year was more a case of a high volatility 'blip', spiked down and back up again relatively quickly, but where the down coincided with the calendar year end. Obviously if you're drawing 3.33% SWR from a portfolio that is making 4.4% real, then the prospects are good, and the tendency is towards the actual yearly % SWR figure declining over time (becomes even safer). Or that caters for additional amounts to be top-sliced out of the portfolios gains. Or simply leave a very nice portfolio value for heirs.

A casual glance and it looks like year to date/recent, FT250 is down around -15%, benefit of holding US$ is up +11.5%, gold in Pounds is up 10%, such that overall 55/33/17 is down around -2.2% year to date. Whilst inflation is running up at around 10% I believe. So as a 'inflation bond' its noteworthy that it doesn't track inflation consistently, but does tend to do so on a broader basis.

And all with half of the portfolio value sitting in your hands. No fear of counter-party risks (bank runs etc.).

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 12 guests