Page 1 of 5

Income portfolio opinions

Posted: November 26th, 2022, 3:28 pm

by ukmtk

Hi All,

The following is my SIPP portfolio.

I'm hoping to start collecting the dividends as income in a couple of years.

I'd appreciate any opinions on its composition.

It is solely intended to generate income (current yield is 6.5% due to the negative valuation).

What else should I consider adding?

Code: Select all

Ticker % Description

API 7.6 Commercial Property

CLI 5.0 Commercial Property

HDIV 9.1 Global Income

HFEL 9.1 Far East High Yield

IUKD 33.3 FTSE 350 Divs

RGL 8.4 Commercial Property

VUKE 12.2 FTSE 100

VHYL 9.2 World High Yield

VFEM 6.1 Emerging MarketsThe portfolio is currently down 16% (mainly IUKD, API & RGL).

I dumped HMCH (at a 30% loss) to switch to CLI (just last week).

I estimate that 37% is non-UK.

It has been put together over a few years.

I overbought IUKD when it was high - sigh.

I have held oil and gold in the past - I have made a few mistakes along the way.

I changed strategy after the pension reforms.

Many Thanks in Advance, Mark

Re: Income portfolio opinions

Posted: November 27th, 2022, 11:09 am

by Itsallaguess

ukmtk wrote:

I'd appreciate any opinions on its composition.

I've never understood the attraction of IUKD as a UK-facing income-investment option, so are you able to highlight why there's such a large position?

As an interested long-term observer of it, the headline yield is something that I can see might be attractive, but the long-term overall performance has been poor, both on the income and capital front.

When I've looked at it's underlying holdings over the years, it's always looked to be quite heavily weighting it's portfolio towards what I'd consider to be 'outlier UK yields', which is an approach that I've always suspected to be playing a big role in it's volatile dividends and poor overall performance.

If there's broader benefits that I've missed then I'd be interested to hear about them.

Cheers,

Itsallaguess

Re: Income portfolio opinions

Posted: November 27th, 2022, 12:31 pm

by monabri

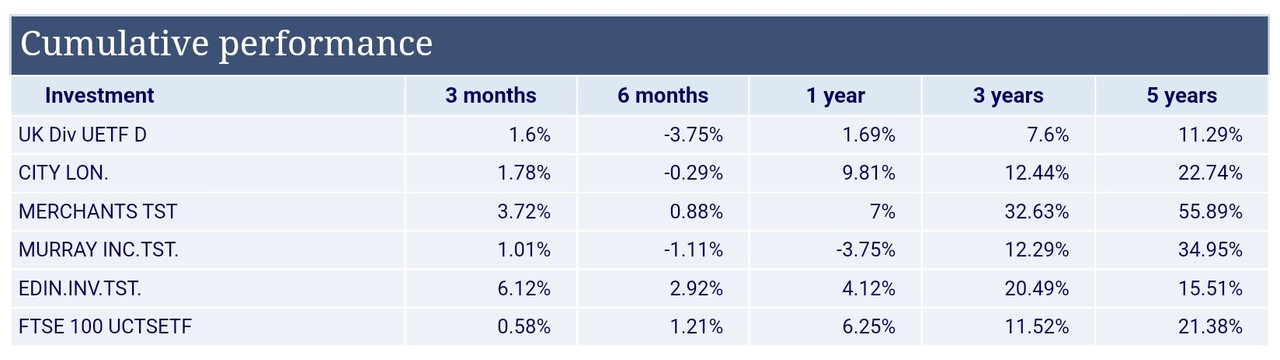

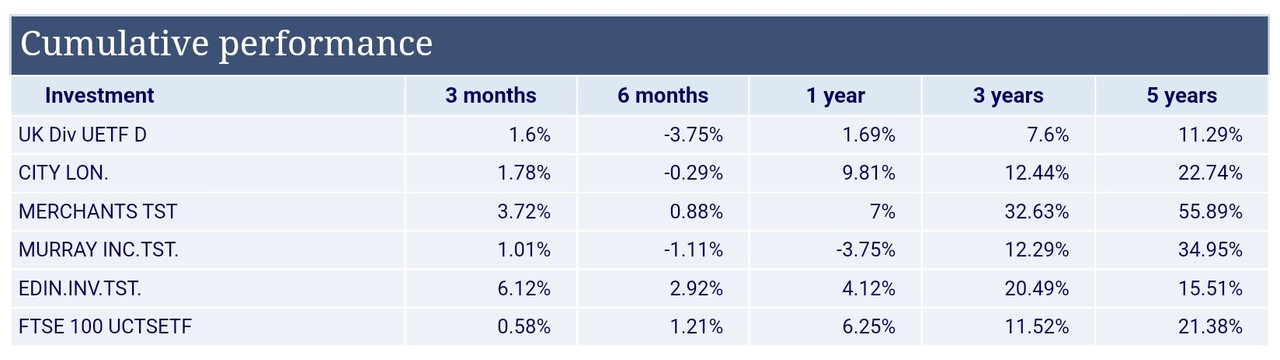

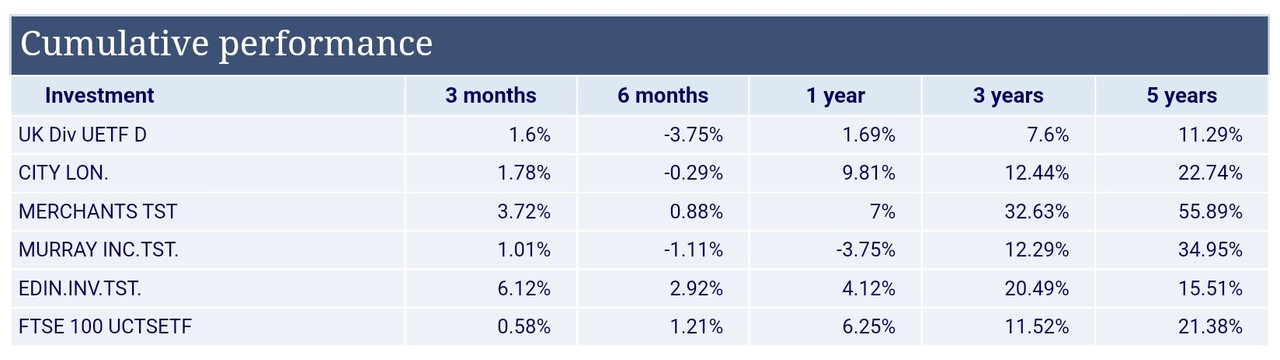

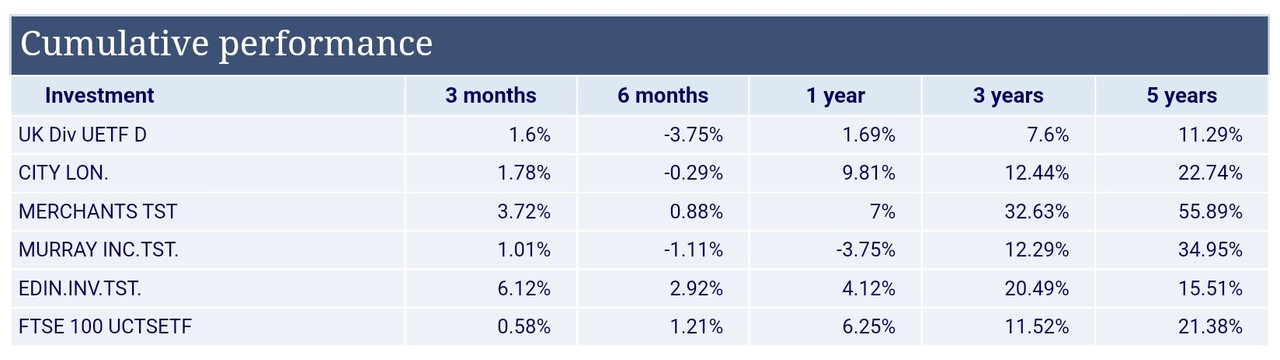

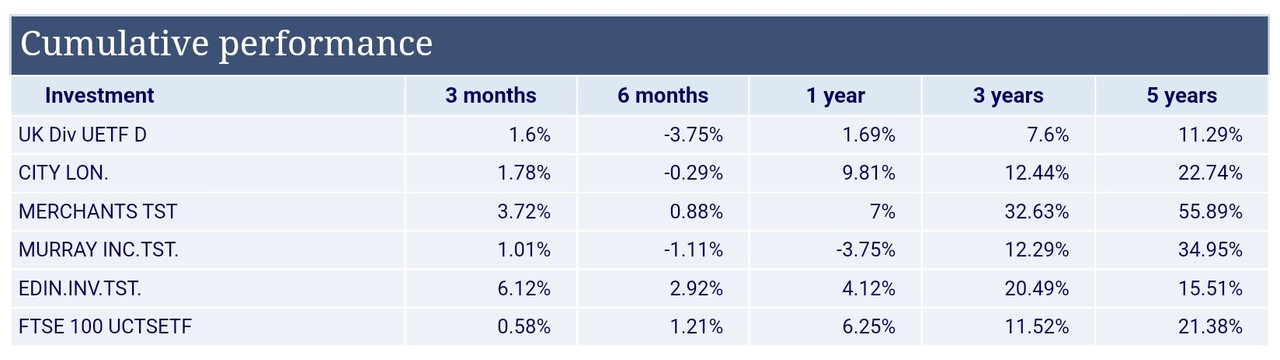

A comparison of several ETFs and ITs in terms of total returns over the last 5 years.The first in the list being IUKD, the last being Vanguard's VUKE. There's enough in the descriptions to identify each IT.

I'm not sure what is meant by "current yield is 6.5% due to the negative valuation".

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:08 pm

by tacpot12

I would suggest having a look at the iShares UK Dividend ETF. It's relatively cheap at the moment, and my average return from dividends over the last 4.5 years is 5.5%.

I bought more when the price dropped and now have about 8% of my portfolio invested in it, but won't be buying any more as it would move my asset allocation away from where I want it.

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:28 pm

by monabri

tacpot12 wrote:I would suggest having a look at the iShares UK Dividend ETF. It's relatively cheap at the moment, and my average return from dividends over the last 4.5 years is 5.5%.

I bought more when the price dropped and now have about 8% of my portfolio invested in it, but won't be buying any more as it would move my asset allocation away from where I want it.

Isn't "iShares UK Dividend ETF" = "IUKD" ? ( The first entry in the table above with a total return of just over 11% over 5 years).

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:34 pm

by simoan

monabri wrote:A comparison of several ETFs and ITs in terms of total returns over the last 5 years.The first in the list being IUKD, the last being Vanguard's VUKE. There's enough in the descriptions to identify each IT.

I'm not sure what is meant by "current yield is 6.5% due to the negative valuation".

I’m not sure this is a fair comparison since IT’s can use gearing to juice returns and ETF’s cannot. Even if you assume it is fair, you be comparing with the NAV return of the IT’s, not their share price performance.

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:42 pm

by monabri

Over 10 years

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:47 pm

by monabri

simoan wrote:monabri wrote:A comparison of several ETFs and ITs in terms of total returns over the last 5 years.The first in the list being IUKD, the last being Vanguard's VUKE. There's enough in the descriptions to identify each IT.

I'm not sure what is meant by "current yield is 6.5% due to the negative valuation".

I’m not sure this is a fair comparison since IT’s can use gearing to juice returns and ETF’s cannot. Even if you assume it is fair, you be comparing with the NAV return of the IT’s, not their share price performance.

I'm only comparing total returns. The ITs are not trading at much mark up to their NAVs (CTY <2% premium, MRCH <1% premia).

The argument might be, if you're interested in TR , why invest in these collectives..I've no answer to that one other than I wouldn't! But if one is "interested " in income, why not keep one eye on capital as well ( expensive bought income).

Re: Income portfolio opinions

Posted: November 27th, 2022, 1:54 pm

by simoan

monabri wrote:simoan wrote:monabri wrote:A comparison of several ETFs and ITs in terms of total returns over the last 5 years.The first in the list being IUKD, the last being Vanguard's VUKE. There's enough in the descriptions to identify each IT.

I'm not sure what is meant by "current yield is 6.5% due to the negative valuation".

I’m not sure this is a fair comparison since IT’s can use gearing to juice returns and ETF’s cannot. Even if you assume it is fair, you be comparing with the NAV return of the IT’s, not their share price performance.

I'm only comparing total returns. The ITs are not trading at much mark up to their NAVs (CTY <2% premium, MRCH <1% premia).

But that may not be clear to people reading your post. It’s important to include any assumptions made. In general you can’t compare ETF’s with IT’s like this. They are two completely different investment vehicles. In particular, IUKD tracks the FTSE High Dividend Yield Index, and as everyone knows, that is a recipe for disaster!

Re: Income portfolio opinions

Posted: November 27th, 2022, 2:17 pm

by ukmtk

Many thanks for the comments.

I have to admit that I was fairly stupid placing so much money in IUKD.

I stupidly assumed that it saved me looking for high yielding shares.

The constituents do have high yields but some of them just disappear (e.g. INTU).

I'm slightly annoyed that IUKD invests in the top 50 yielders of the FTSE 350 but does NOT place a limit on what it can hold in a particular company.

Unfortunately I had bought a lot when the price was high and was reluctant to sell when it dropped (especially Covid).

It still pays out a lot of my income.

Yield is currently 6.5% with the portfolio being 16% less than what I paid.

If the portfolio had the same value as I paid then the yield would be 5.45%.

Surprisingly even during Covid the portfolio produced a 5% yield.

Re: Income portfolio opinions

Posted: November 27th, 2022, 7:20 pm

by mc2fool

ukmtk wrote:I'm slightly annoyed that IUKD invests in the top 50 yielders of the FTSE 350 but does NOT place a limit on what it can hold in a particular company.

Yes it does, 5% (at semi-annual review). The index IUKD tracks is the

FTSE UK Dividend+ Index and the index methodology can be found at

https://research.ftserussell.com/products/downloads/FTSE_UK_Dividend_Plus_Index.pdf. See section 5.4 item J.

Not that it's helped though....

Re: Income portfolio opinions

Posted: November 28th, 2022, 9:20 am

by PrefInvestor

IUKDs strategy of investing in the top 50 high yielders in the FTSE 350 whatever they might be (rebalancing every 6 months) results in it making some totally terrible stock picks IMHO. For instance who would be putting their money into Persimmon right now when their dividend is almost certain to be cut drastically next year ?. Not me anyway.

So while I am an income investor IUKD never figures in my thoughts. Personally I tend to prefer Investment Trusts but that’s just a personal view. I do have a few ETFs GBDV & VHYL (for example) chosen to get some geographical diversification as well as income.

ATB

Pref

Re: Income portfolio opinions

Posted: November 28th, 2022, 9:49 am

by mc2fool

PrefInvestor wrote:IUKDs strategy of investing in the top 50 high yielders in the FTSE 350 whatever they might be (rebalancing every 6 months) results in it making some totally terrible stock picks IMHO. For instance who would be putting their money into Persimmon right now when their dividend is almost certain to be cut drastically next year ?. Not me anyway.

So while I am an income investor IUKD never figures in my thoughts. Personally I tend to prefer Investment Trusts but that’s just a personal view. I do have a few ETFs GBDV & VHYL (for example) chosen to get some geographical diversification as well as income.

VHYL tracks the

FTSE All-World High Dividend Yield Index which invests in the top 50% (by mkt cap) high yielders of the FTSE All-World whatever they might be (rebalancing every 6 months), and it currently includes Persimmon.

(Ok, at only 0.02%)

Methodology, constituents, etc, here:

https://www.ftserussell.com/products/indices/high-dividend-yield

Re: Income portfolio opinions

Posted: November 28th, 2022, 9:53 am

by tjh290633

I followed the fortunes of IUKD for several years. It's initial downfall was the high level of banks and financials leading up to 2008. It had 6 banks and 5 insurers, which included the banks:

Lloyds TSB

Alliance & Leicester

Bradford & Bingley

HSBC

Royal Bank of Scotland

Barclays

and as Insurers:

Brit Insurance

Jardine Lloyd Thompson

Legal & General

Royal Sun Alliance

Catlin

There were 9 retailers:

JJB Sports

Woolworth

DSG International

Kingfisher

Carpetright

Topps Tiles

Kesa Electricals

Halfords

HMV Group

They had 8 utilities:

United Utilities

Severn Trent

Drax

Northumbrian Water

Scottisn and Southern

National Grid

Pennon

Centrica

That is 28 out of 52 holdings. The number of changes in the portfolio at semi-annual reviews was enormous.

The methodology changed when the fund changed ownership, which helped a bit, but it never inspired confidence.

TJH

Re: Income portfolio opinions

Posted: November 28th, 2022, 10:19 am

by OhNoNotimAgain

I have explained at length before why yield is a fundamentally flawed measure for stock selection and weighting.

It is backward looking and includes a pricing factor.

If you want income select and weight by income.

Re: Income portfolio opinions

Posted: November 28th, 2022, 10:24 am

by PrefInvestor

mc2fool wrote:VHYL tracks the

FTSE All-World High Dividend Yield Index which invests in the top 50% (by mkt cap) high yielders of the FTSE All-World whatever they might be (rebalancing every 6 months), and it currently includes Persimmon.

(Ok, at only 0.02%)

Well IUKDs portfolio is 50 stocks, VHYL currently holds over 1800 specifically chosen to be the largest companies offering the highest yields. This methodology tends to minimise any contribution from UK companies and I have rarely seen ANY UK stock in its top 10 holdings and indeed there are none in its top 10 today. UK holdings amount to only 6.7% of the portfolio.

Total return chart comparisons show VHYL is 8% up over 1 year and 35% up over 5 years, whereas IUKD is less than 2% up over 1 year and only 10% up over 5 years.

I am very happy holding VHYL but wouldn’t touch IUKD with a bargepole myself.

ATB

Pref

Re: Income portfolio opinions

Posted: November 28th, 2022, 10:43 am

by mc2fool

PrefInvestor wrote:mc2fool wrote:VHYL tracks the

FTSE All-World High Dividend Yield Index which invests in the top 50% (by mkt cap) high yielders of the FTSE All-World whatever they might be (rebalancing every 6 months), and it currently includes Persimmon.

(Ok, at only 0.02%)

Well IUKDs portfolio is 50 stocks, VHYL currently holds over 1800 specifically chosen to be the largest companies offering the highest yields. This methodology tends to minimise any contribution from UK companies and I have rarely seen ANY UK stock in its top 10 holdings and indeed there are none in its top 10 today. UK holdings amount to only 6.7% of the portfolio.

Total return chart comparisons show VHYL is 8% up over 1 year and 35% up over 5 years, whereas IUKD is less than 2% up over 1 year and only 10% up over 5 years.

I am very happy holding VHYL but wouldn’t touch IUKD with a bargepole myself.

No, VHYL doesn't

choose the largest companies offering the highest yields, it simply sorts the FTSE World by (forecast) yield, but it does

weight by mkt cap, whereas IUKD weights by a mix of historic and forecast yield. In any case, sounds like actually your main preference is the geographic one.

Anyway, I wasn't knocking VHYL, I was just amused by your phrasing ... the proof of the pudding is in the eating:

VHYL vs IUKD

(Although a good chunk [albeit clearly not all] of the outperformance looks to be the GBP:USD Brexit dividend plus covid $ strength

)

Re: Income portfolio opinions

Posted: November 28th, 2022, 12:12 pm

by PrefInvestor

mc2fool wrote:Anyway, I wasn't knocking VHYL, I was just amused by your phrasing ... the proof of the pudding is in the eating:

VHYL vs IUKD

(Although a good chunk [albeit clearly not all] of the outperformance looks to be the GBP:USD Brexit dividend plus covid $ strength

)

Well yes I hold VHYL primarily for globally diversified income. But its methodology would appear to prefer very large cap stocks to large/medium cap stocks whatever their yield. For example I note both AZN & SHEL (the largest stocks in the UK indices by far) only appear on Page 2 of the VHYL holdings list and PSN is on page 69 as you say at a weight of 0.02%.

Another big advantage from my perspective is the large number of holdings and low individual weights, reducing the effect of any major impact of a poor performance from any single holding. Whereas IUKD is all UK based and limited to 50 holdings and because it picks on yield alone it tends to pick munters.

Anyway ATB

Pref

Re: Income portfolio opinions

Posted: November 28th, 2022, 12:39 pm

by mc2fool

PrefInvestor wrote:mc2fool wrote:Anyway, I wasn't knocking VHYL, I was just amused by your phrasing ... the proof of the pudding is in the eating:

VHYL vs IUKD

(Although a good chunk [albeit clearly not all] of the outperformance looks to be the GBP:USD Brexit dividend plus covid $ strength

)

Well yes I hold VHYL primarily for globally diversified income. But its methodology would appear to prefer very large cap stocks to large/medium cap stocks whatever their yield. For example I note both AZN & SHEL (the largest stocks in the UK indices by far) only appear on Page 2 of the VHYL holdings list and PSN is on page 69 as you say at a weight of 0.02%.

Another big advantage from my perspective is the large number of holdings and low individual weights, reducing the effect of any major impact of a poor performance from any single holding. Whereas IUKD is all UK based and limited to 50 holdings and because it picks on yield alone it tends to pick munters.

As I say, both

pick on yield but they

weight differently, IUKD by yield and VHYL by mkt cap, which is why the biguns are at the top.

Re: Income portfolio opinions

Posted: November 28th, 2022, 3:18 pm

by NotSure

I'm wary of veering off topic, but does anyone know much about the Vanguard UK equity income fund? It is a tracker, but clearly a different index to the iShares as it has 116 holdings. I have a small amount and it's done ok over the last year or two (I bought it as as a counterpoint to (what were then at least) very tech-heavy global trackers).

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-uk-equity-income-index-fund-gbp-acc/overview