Lootman wrote:I do not think that anyone seriously doubts that the UK has under-performed over that time period.

FTSE 100 has under-performed, but is comprised of around 70% of its earnings being from foreign. FTSE 250 has compared to others, HYP1, TJH HYP, other broader indexes, where around 50% of its earnings are foreign sourced.

The failing is in the FTSE100's structure. FTSE 250 is more tilted towards equal weighted, rare for any one single stock to be more than 2% of the total weighting, FTSE 100 in contrast has at times had single stocks at the 10% capped limits (above 10% if not otherwise restricted by the index methodology) and where its also had a number of such high individual stock weightings combined in the same sector. Financials pre 2008 financial crash for instance. Whilst the FTSE 250 appears high on financial sector weightings, that includes something like 40 odd Investment Trusts that individually diversify but are factored as being 'financials' within the FTSE 250.

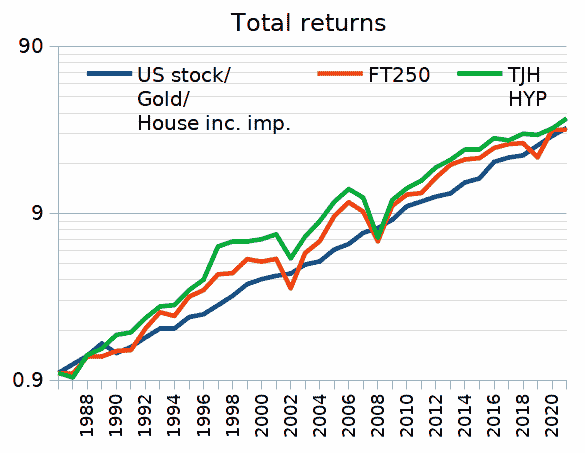

That both HYP1 and TJH HYP (and FTSE 250) have been in the same ballpark for general/broader total returns, whilst the FTSE 100 from which HYP1 and TJH HYP were/are selected has considerably under-performed is indicative of it being less a UK drag factor, more a FTSE 100 index methodology drag factor. High weightings to sectors such as financials across a period of dot com bubble burst, financial crisis, Covid 2000-2021 years not having worked out so well.

The risk card? Seriously?

As it happens I think TJH's method of investing is as good as it gets if you have to restrict yourself to UK equities. He deserves far more credit than Pyad.

HYP1 is a speculative crapshoot that has no place in the portfolio of any rational person.

HYP1 methodology is sound and that methodology has deep/long history of success. There are also instances of implementation failures I suspect mostly from over-reaching on the yield side or insufficient diversity, or simply ditching after a swing low (disappointment in point to point (shorter term) performance resulting in a buy-high/sell-low actual outcome).

Risk wise and having single stocks rise to 33% or more is perceived idiosyncratic risk. Those single high weighted holdings however can/do naturally rotate over time. Tends to induce more yearly volatility (higher standard deviation in yearly rewards), but that is only a real risk if you load all in and all out at single points in time (that could similarly yield a benefit). Most investors add over time, withdraw over time such that it smooths down the paper value risk.

More a case of what one might be comfortable holding. Pyad/TJH like income, personally I'd prefer zero dividends as I can create my own out of total returns to the amount and timing I prefer, and where I can negate the taxation of those with capital losses. As such I prefer a FTSE 250 holding, and, from what I've seen, that's compared to HYP1 and TJH HYP. Whilst there are shorter period drifts (years), more broadly (decades) each/any of those might have served adequately well enough. Textual dick-pic'ing point-to-point, over-analysing shorter (years rather than decades) time periods, is more inclined to induce a poorer/unsatisfactory outcome - a greater inclination to buy-high/sell-low in reflection of a period when a chosen choice relatively lags, for a while. HYP1 of those three was proposed as a good choice for some, the Doris types who are totally disinterested, however in practice splits/changes occur perhaps more frequently than what the disinterested would like, involving actions having to be taken. Again a reason why I prefer a FTSE 250 choice such as VMIG, where dividends are auto-reinvested. If I were to contract dementia and was nursing home bound for perhaps another 10 years of lifetime, where VMIG was just left as-is for those years, then likely the legacy from that would be OK.