TwmSionCati wrote:dealtn wrote:Is that Total Return?

No; index value. But I should have included the FTSE 350 (the FTSE 350 Higher Yield isn't comparable with the others, although of interest to HYPistas). Sorry.

The point remains: British is Worst.

... Sometimes!

For end of March years, 5th April fiscal years for TJH accumulation HYP, from April 2008 to end of March 2020 I'm seeing annualised total returns of

FT100 4.38%

FT All Share 4.92%

S&P500 12.23% (for UK investor (£), 8.3% for US investor ($))

TJH Accum 5.20%

4-way 8.16%

i.e. FT100 and FT All Share have compared relatively closely (in practice the FT All Share is pretty much 90% of FT100 + 10% of FT250, so the FT100 and FTAS tend to track each other moderately closely).

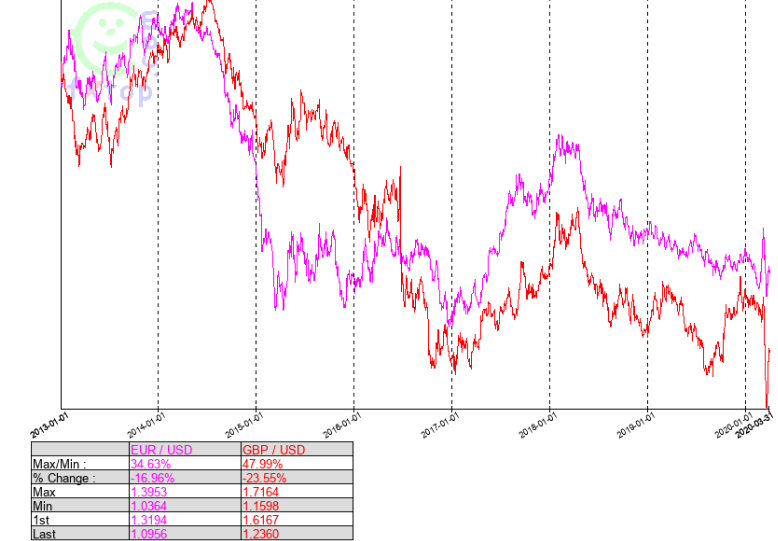

Stronger US gains have around 4% of the gain being a consequence of declines in the Pound, which has fallen from around $2 per £1 in April 2008 down to $1.24 per Pound more recently.

Many firms hedge their foreign currency exposure, to better stabilise reporting in the country/currency they are domiciled. So even though the FT100 might have 70% of earnings from foreign, if that's largely being hedged then any domestic currency decline benefits are lost (as are any losses from domestic currency relative appreciation also hedged away).

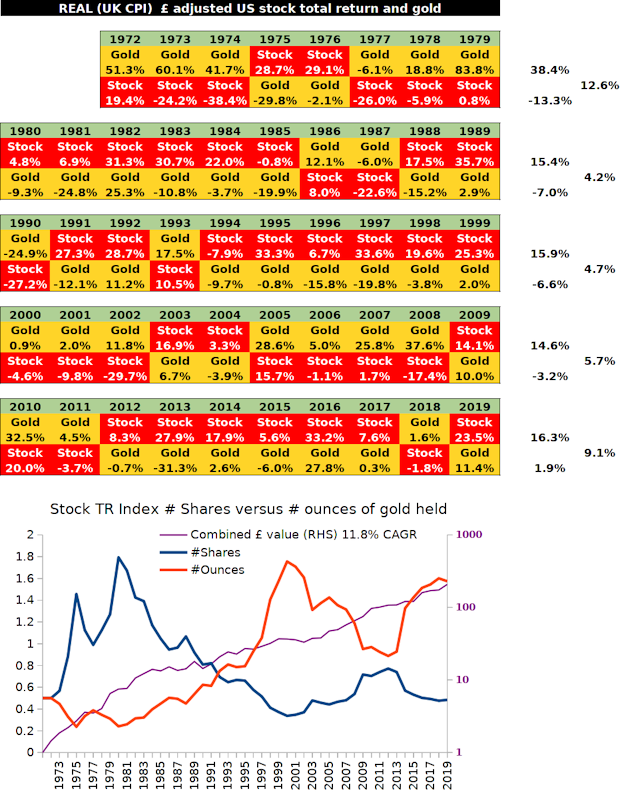

Most will already be familiar with TJH HYP and the accumulation (dividends reinvested) figures Terry reports. The 4-way in the above is a asset allocation of 25% S&P500, 25% gold, 25% FT All Share, 25% UK cash deposits. Fundamentally along the lines of Markowitz ... "I visualised my grief if the stock market went way up and I wasn't in it -- or if it went way down and I was completely in it. My intention was to minimise my future regret." ... 50/50 allocation, but extended to also include ... if the Pound went way up, or down ....

50 50 each of ...

50/50 US stock/gold (gold is a form of global currency)

50/50 UK stock/Pounds (cash)

Murphy's law and quite likely if you opt to overweight US stock based on the above history you'll subsequently see a reversal. Perhaps British listed stocks doing better than US stocks and/or the Pound rising/recovering. Better to just diversify, stick with your asset allocation and accept what the market provides.

Yes over the very long term the £ has tended to decline relative to the US$, however historical fluctuations in the £/$ since 1975 indicate that longer term trend is far from stable/consistent.

Not much of a stretch that in 5 years time the Pound might have rebounded back up to $2 per Pound levels and/or UK stocks might have relatively outperformed others.