Lootman wrote:The FTSE-100 has doubled since the 2008/2009 low and the S&P 500 has quadrupled. It's even more pronounced when you take FX moves into account.

...

The main reason is surely that the handful of global mega-stocks that dominate the global index are all US. There is no UK share that comes close to the domination of Apple, Amazon, MicroSoft, Google etc in building market cap.

The figures I'm seeing for FT250 total return compared to US stock total return, £ adjusted since 2008 (to year end 2019) are 2.8 gain factor and 4.2 gain factors respectively (9% vs 12.75% annualised).

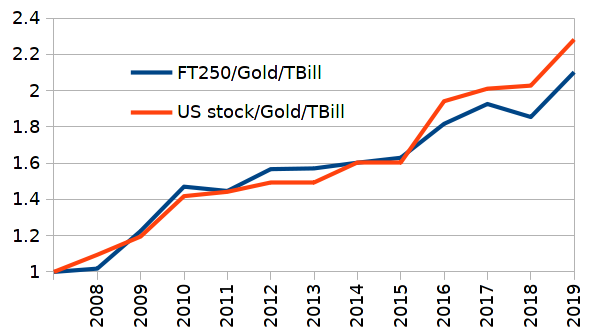

As a UK investors, if you third weighted/yearly rebalanced FT250/gold/UK T-Bills vs US stock/gold/UK T-Bills (calendar years, again in £ adjusted terms) the figures are 6.4% vs 7.1% annualised. Where up to the end of 2015 the two pretty much were comparable. Since the Brexit vote in 2016 however has seen the UK lag, primarily due to relative currency (£) declines (uncertainty).

As such I wouldn't attribute it to being down to the likes of US Mega-caps, rather that the FT100 mega caps (mid caps in US scale) haven't performed well despite dominating the index (Banks etc. post 2008 financial crisis dragging down the FT100), and due to currency factors arising from the Brexit referendum/uncertainties.

On the above relative measure, whilst US/Gold/Cash could continue to pull further ahead, the 'value' play would be in the FT250/Gold/Cash choice (US stock/US$ might be relatively rich which Tobin-Q ..etc. does suggest and pull back some, or the FT250/£ might relatively rebound after Brexit uncertainties fade).