Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Imperial Brands

-

TUK020

- Lemon Quarter

- Posts: 2046

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 765 times

- Been thanked: 1179 times

Imperial Brands

This is not so much an analysis of a companies accounts, more of a plea to someone more adept at dissecting these statements to help point out what I am missing.

According to HYPTUSS, Imperial Brands is trading at a price giving a PE ratio of 6.6, and a dividend yield of 8.4% which is covered 1.7x in earnings.

Over the last few years, earnings have been depressed by goodwill write offs, capital expenditure is not significant, so free cash flow easily covers dividends. The company is not saddled with debt, runs decent margins and is slowly edging up earnings, and reducing costs.

The growth story is dubious, margins in Next Generation Products are likely to be much reduced, and IMB is behind some of its much bigger competitors in establishing themselves in NGP. Future potential for adjacent markets such as cannabis in vaping machines remains a possible, but low probability payoff.

Regulatory risk is there in terms of increased regulation in developed markets slowly squeezing revenue in core cigarette volume. This is already priced in by the market (priced for terminal decline), but a significant portion of sales will continue in emerging markets where the regulatory threat is much less developed.

Major institutional shareholders regard new investment in tobacco as poisonous PR, and so are looking to reduce their exposure; any market price strength/upside is likely to be met with major institutions unloading their position - this means that the share price is depressed, and is likely to stay that way.

A lot of HYP adherents would describe IMB's yield as in the "Danger Zone" (to use Luni parlance).

But it appears to me that I have an opportunity to buy into a cash generation machine, that at current sp is likely to give me back 40-50% of my money in dividends over the next 5 years, and is still likely to have 85% of that generation machine running at the end of that time.

What am I missing?

According to HYPTUSS, Imperial Brands is trading at a price giving a PE ratio of 6.6, and a dividend yield of 8.4% which is covered 1.7x in earnings.

Over the last few years, earnings have been depressed by goodwill write offs, capital expenditure is not significant, so free cash flow easily covers dividends. The company is not saddled with debt, runs decent margins and is slowly edging up earnings, and reducing costs.

The growth story is dubious, margins in Next Generation Products are likely to be much reduced, and IMB is behind some of its much bigger competitors in establishing themselves in NGP. Future potential for adjacent markets such as cannabis in vaping machines remains a possible, but low probability payoff.

Regulatory risk is there in terms of increased regulation in developed markets slowly squeezing revenue in core cigarette volume. This is already priced in by the market (priced for terminal decline), but a significant portion of sales will continue in emerging markets where the regulatory threat is much less developed.

Major institutional shareholders regard new investment in tobacco as poisonous PR, and so are looking to reduce their exposure; any market price strength/upside is likely to be met with major institutions unloading their position - this means that the share price is depressed, and is likely to stay that way.

A lot of HYP adherents would describe IMB's yield as in the "Danger Zone" (to use Luni parlance).

But it appears to me that I have an opportunity to buy into a cash generation machine, that at current sp is likely to give me back 40-50% of my money in dividends over the next 5 years, and is still likely to have 85% of that generation machine running at the end of that time.

What am I missing?

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: Imperial Brands

Do you remember 1999?

A time when the Fed's easy money was puffing up bubbles, especially in tech and growth companies, causing old economy and value shares to severely fall out of favour.

Also a time when companies like IMB (then IMT) and BATS were relegated to the FTSE 250 index by market darling zero-profit TMT companies and fear of the demise of tobacco companies due to major US legal action and declining trends in tobacco.

Within a few years most of the TMTs joined the 99% club while IMT, BATS and other large mature companies re-took their places in the FTSE 100.

Tobacco looks a decent value sector to me. Worth having as part of a suitably diverse portfolio.

I have a reasonable holding in IMB (about 6% of portfolio) which I've had for so long it only needs to pay another £2.27 per share to have got all my initial investment back. I also once held GLH until they were taken over.

I regularly get tempted to add more IMB, or start a new holding in BATS (which were always a little too pricey when I had cash to burn in the past).

However, I probably won't add any more tobacco but only because I'm more interested in accumulating-on-weakness what most people would consider 'weird' investment options at the moment.

A time when the Fed's easy money was puffing up bubbles, especially in tech and growth companies, causing old economy and value shares to severely fall out of favour.

Also a time when companies like IMB (then IMT) and BATS were relegated to the FTSE 250 index by market darling zero-profit TMT companies and fear of the demise of tobacco companies due to major US legal action and declining trends in tobacco.

Within a few years most of the TMTs joined the 99% club while IMT, BATS and other large mature companies re-took their places in the FTSE 100.

Tobacco looks a decent value sector to me. Worth having as part of a suitably diverse portfolio.

I have a reasonable holding in IMB (about 6% of portfolio) which I've had for so long it only needs to pay another £2.27 per share to have got all my initial investment back. I also once held GLH until they were taken over.

I regularly get tempted to add more IMB, or start a new holding in BATS (which were always a little too pricey when I had cash to burn in the past).

However, I probably won't add any more tobacco but only because I'm more interested in accumulating-on-weakness what most people would consider 'weird' investment options at the moment.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Imperial Brands

I do not think you are missing anything. It is those who bought in when the price was about double the current price that are struggling. I have held both of the tobaccos for at least 20 years and my gripe is (and nothing to do with them) that the price fell through the floor two or three years ago. Now it seems to have stabilised and in fact is gently increasing as the factors that the OP mentions are coming in to focus for new investors presumably.

I have held both tobaccos for more than 20 years and have long since extracted my initial investment from at least Imperial and probably BAT as well.

I think the OP is now on the money again.

Dod

I have held both tobaccos for more than 20 years and have long since extracted my initial investment from at least Imperial and probably BAT as well.

I think the OP is now on the money again.

Dod

-

BT63

- Lemon Slice

- Posts: 432

- Joined: November 5th, 2016, 1:22 pm

- Has thanked: 59 times

- Been thanked: 121 times

Re: Imperial Brands

Dod101 wrote:I do not think you are missing anything. It is those who bought in when the price was about double the current price that are struggling.

When IMB were £40 a few years ago I was very tempted to sell or take profits.

I didn't sell because they're part of a 'try not to tinker' portion of my portfolio designed to provide a reliable stream of income.

Although IMB shares have fallen significantly, the income dependability in Covid times was excellent, as were most of the other shares I hold in that part of my portfolio.

For similar 'no tinker' reasons I didn't sell AZN at £100 last year when I probably should at least have taken profits.

-

MrFoolish

- Lemon Quarter

- Posts: 2375

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 574 times

- Been thanked: 1160 times

Re: Imperial Brands

TUK020 wrote:But it appears to me that I have an opportunity to buy into a cash generation machine, that at current sp is likely to give me back 40-50% of my money in dividends over the next 5 years, and is still likely to have 85% of that generation machine running at the end of that time.

What am I missing?

It depends how quickly smoking drops off over those 5 years. Your 85% figure may be too optimistic. If their revenue and dividend distributions start to drop off quite quickly, the share price (which is forward looking) will drop off even more quickly. You will then have the dilemma of sitting on a capital loss in a company in a potentially terminal market. Do you then sell?

Of course, if they are successful in getting enough people in developing nations addicted to their life-limiting products then you may get away with it.

-

vand

- Lemon Slice

- Posts: 760

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 351 times

Re: Imperial Brands

People always seem to underestimate Tobacco companies... that's why it's been one of the greatest performing sectors of the stock market for as long as anyone can remember. Sure, the number of smokers in the world is probably past its peak, but there is going to be a very long and very fat tail that can be exploited.

You can't uninvent something.. and I'm pretty confident that nicotine products are going to be with us 10 years and 100 years from now.

You can't uninvent something.. and I'm pretty confident that nicotine products are going to be with us 10 years and 100 years from now.

-

Paultry

- 2 Lemon pips

- Posts: 137

- Joined: November 4th, 2016, 11:09 am

- Has thanked: 36 times

- Been thanked: 41 times

Re: Imperial Brands

Is it also the case that many ethical institutional investment groups are obliged to avoid tobacco companies, even more so in recent years.

If that is true, the exceptional dividend yield, although in Luni's danger zone, could explain why the shares are unloved.

I hold BATS and IMB. Paul

If that is true, the exceptional dividend yield, although in Luni's danger zone, could explain why the shares are unloved.

I hold BATS and IMB. Paul

-

bluedonkey

- Lemon Quarter

- Posts: 1811

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1418 times

- Been thanked: 655 times

-

vand

- Lemon Slice

- Posts: 760

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 351 times

Re: Imperial Brands

Yes, many fund managers just won't touch them now, and oil/miners either for ESG reasons (and "reputation").

No problem at all with that - it's their choice. It's worth noting that Neil Woodford stuffed his fund full of baccies in an attempt to return to his basics and turn things around just before it got closed.

No problem at all with that - it's their choice. It's worth noting that Neil Woodford stuffed his fund full of baccies in an attempt to return to his basics and turn things around just before it got closed.

-

Bouleversee

- Lemon Quarter

- Posts: 4657

- Joined: November 8th, 2016, 5:01 pm

- Has thanked: 1195 times

- Been thanked: 903 times

Re: Imperial Brands

vand wrote:People always seem to underestimate Tobacco companies... that's why it's been one of the greatest performing sectors of the stock market for as long as anyone can remember. Sure, the number of smokers in the world is probably past its peak, but there is going to be a very long and very fat tail that can be exploited.

You can't uninvent something.. and I'm pretty confident that nicotine products are going to be with us 10 years and 100 years from now.

The s.p. was 4053p in 2016 and is 1769p now. I don't call that great performance. We have effectively been paying our own dividends out of capital. Might as well keep our dosh under the bed and help ourselves when needed. It had fallen a lot before Covid hit and I should have thought the pandemic would have turned off a lot of smokers. I inherited mine from my husband and I wish I had sold immediately instead of topping up.

-

vand

- Lemon Slice

- Posts: 760

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 351 times

Re: Imperial Brands

Bouleversee wrote:vand wrote:People always seem to underestimate Tobacco companies... that's why it's been one of the greatest performing sectors of the stock market for as long as anyone can remember. Sure, the number of smokers in the world is probably past its peak, but there is going to be a very long and very fat tail that can be exploited.

You can't uninvent something.. and I'm pretty confident that nicotine products are going to be with us 10 years and 100 years from now.

The s.p. was 4053p in 2016 and is 1769p now. I don't call that great performance. We have effectively been paying our own dividends out of capital. Might as well keep our dosh under the bed and help ourselves when needed. It had fallen a lot before Covid hit and I should have thought the pandemic would have turned off a lot of smokers. I inherited mine from my husband and I wish I had sold immediately instead of topping up.

Here's the thing about investing. You can't help what investors were paid for something in the past. Your only option is to decide if you want to own the business on the numbers its putting in today, and what its likely to do in the future. If you rule out buying anything based on the premise that it is lower than it has been in the past then you are going to let an awful lot of opportunities pass you by.

2016

£27.6bn turnover

£5.9bn gross

£0.6bn net

2021

£32.7bn turnover

£6bn gross

£2.8bn net

Personally I wasn't a holder in 2016. Those valuations wouldn't have made a lot of sense to me. I started accumulating IMB and BATS in 2019, because it looked a bargain to me at that point. I think they're still good value and am not anchored to a past price.

-

pennypunter

- Posts: 4

- Joined: February 8th, 2022, 4:15 pm

- Has thanked: 4 times

- Been thanked: 4 times

Re: Imperial Brands

IMB is one of these companies, mainly in the UK that have a clientele effect, the board's job is to cater to the high yield crowd. However the dividends are being funding partly by debt accumulation, and the debt level at IMB has been elevated for sometime. IMB has sold off assets to manage the debt, like the cigars and the distribution arm, but this merely kept the debt manageable - debt has not come down from operational cash flow but by divestments.

IMB is very lop sided with major markets in Germany, France, Spain (the former Altadis areas) UK and a product range catering primarily to ageing smokers. These are not growth markets. IMB is a long way behind in next gen areas such as vaping. There is also a fair bit of exposure to menthols which has been hit hard. Combustible markets (traditional cigarettes) is losing its social licence globally and if the US implements regulations on nicotine levels, reducing their addictiveness that would cause other countries to follow suit.

A couple of years ago, IMB flattered its profits by including the gain on a sale of a property included in the final number, that gave the appearance the profits from the business had been stronger than they actually were.

IMB has shirked making the major acquisitions in next gen that it needs to make to catch up. Fact is they do not have much of an M&A budget, they have to fund debt and a large dividend, hence there has been corporate stagnation.

Final problem, investing for dividends, especially when it is being funded by the co taking out loans (the Carillion approach) has been widely and rightly discredited as a means of delivering investment returns. It is not sustainable and will lead to many years of share underperformance. Vodafone is in the same boat, has amassed significant debt in the last 5-6 years due to an M&A strategy and unaffordable dividend. Debt at VOD now exceeds market cap, a sign of right issue risk. The IMB price has gone down because investors have withdrawn the co's value in the form of dividends.

Having said all that, there are grounds for optimism this year as inflation takes off and tobacco is seen as inflation linked. However the improved macro environment is a short term environmental help, it does not make this a good co, in and of itself.

IMB is very lop sided with major markets in Germany, France, Spain (the former Altadis areas) UK and a product range catering primarily to ageing smokers. These are not growth markets. IMB is a long way behind in next gen areas such as vaping. There is also a fair bit of exposure to menthols which has been hit hard. Combustible markets (traditional cigarettes) is losing its social licence globally and if the US implements regulations on nicotine levels, reducing their addictiveness that would cause other countries to follow suit.

A couple of years ago, IMB flattered its profits by including the gain on a sale of a property included in the final number, that gave the appearance the profits from the business had been stronger than they actually were.

IMB has shirked making the major acquisitions in next gen that it needs to make to catch up. Fact is they do not have much of an M&A budget, they have to fund debt and a large dividend, hence there has been corporate stagnation.

Final problem, investing for dividends, especially when it is being funded by the co taking out loans (the Carillion approach) has been widely and rightly discredited as a means of delivering investment returns. It is not sustainable and will lead to many years of share underperformance. Vodafone is in the same boat, has amassed significant debt in the last 5-6 years due to an M&A strategy and unaffordable dividend. Debt at VOD now exceeds market cap, a sign of right issue risk. The IMB price has gone down because investors have withdrawn the co's value in the form of dividends.

Having said all that, there are grounds for optimism this year as inflation takes off and tobacco is seen as inflation linked. However the improved macro environment is a short term environmental help, it does not make this a good co, in and of itself.

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1213 times

-

MDW1954

- Lemon Quarter

- Posts: 2368

- Joined: November 4th, 2016, 8:46 pm

- Has thanked: 527 times

- Been thanked: 1013 times

Re: Imperial Brands

BullDog wrote:Bargepole company. Avoid.

Why, might I ask? I've been buying. Low P/E, attractive yield. Why not?

Incidentally, here on TLF, we usually go beyond 3-word replies, as they don't really add much value.

MDW1954 (as you're new, also a moderator)

PS: A belated welcome to TLF!

-

pennypunter

- Posts: 4

- Joined: February 8th, 2022, 4:15 pm

- Has thanked: 4 times

- Been thanked: 4 times

Re: Imperial Brands

the approach IMB has taken, borrowing to fund a large dividend is wrong and selling assets to fund dividends is wrong. But this has been IMB strategy for over a decade.

Co year end debt £9.4bn only went down marginally because IMB sold its cigar business for EUR1.2bn. The banks had asked IMB to get its debt down after years of it being ratcheted up.

the board think the co will be acquired and the debt will be problem for another co. But M&A in tobacco is very difficult because there are only 4 major tobacco co's and any acquisition is likely to break market share rules in multiple countries.

IMB shareholders think they are getting paid with cash profits. The reality is the co is being mortgaged and s/h are receiving mortgage proceeds. Sorry but who is fooling who?

Co year end debt £9.4bn only went down marginally because IMB sold its cigar business for EUR1.2bn. The banks had asked IMB to get its debt down after years of it being ratcheted up.

the board think the co will be acquired and the debt will be problem for another co. But M&A in tobacco is very difficult because there are only 4 major tobacco co's and any acquisition is likely to break market share rules in multiple countries.

IMB shareholders think they are getting paid with cash profits. The reality is the co is being mortgaged and s/h are receiving mortgage proceeds. Sorry but who is fooling who?

-

tjh290633

- Lemon Half

- Posts: 8310

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 920 times

- Been thanked: 4150 times

Re: Imperial Brands

pennypunter wrote:the approach IMB has taken, borrowing to fund a large dividend is wrong and selling assets to fund dividends is wrong. But this has been IMB strategy for over a decade.

From https://www.investegate.co.uk/imperial- ... 00085078S/ I do not get any support for your claimed approach. They have a strong cash flow, some of which has been used to reduce their debt, as stated:

· Strong cash flows enabling deleverage progress in line with our plans

Would you like to enlarge on your claim?

TJH

-

dealtn

- Lemon Half

- Posts: 6100

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Imperial Brands

pennypunter wrote:the approach IMB has taken, borrowing to fund a large dividend is wrong and selling assets to fund dividends is wrong. But this has been IMB strategy for over a decade.

Feel free to post links to the (at least) last 10 year's Cashflow Statements to substantiate your claim. This is the "Company Analysis" board after all.

-

monabri

- Lemon Half

- Posts: 8433

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3447 times

Re: Imperial Brands

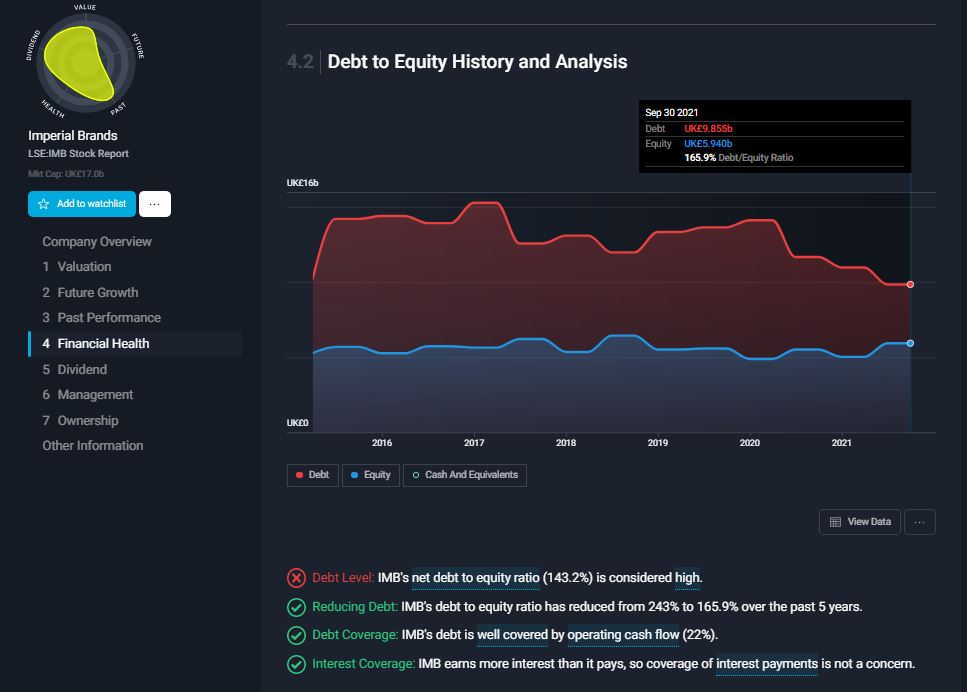

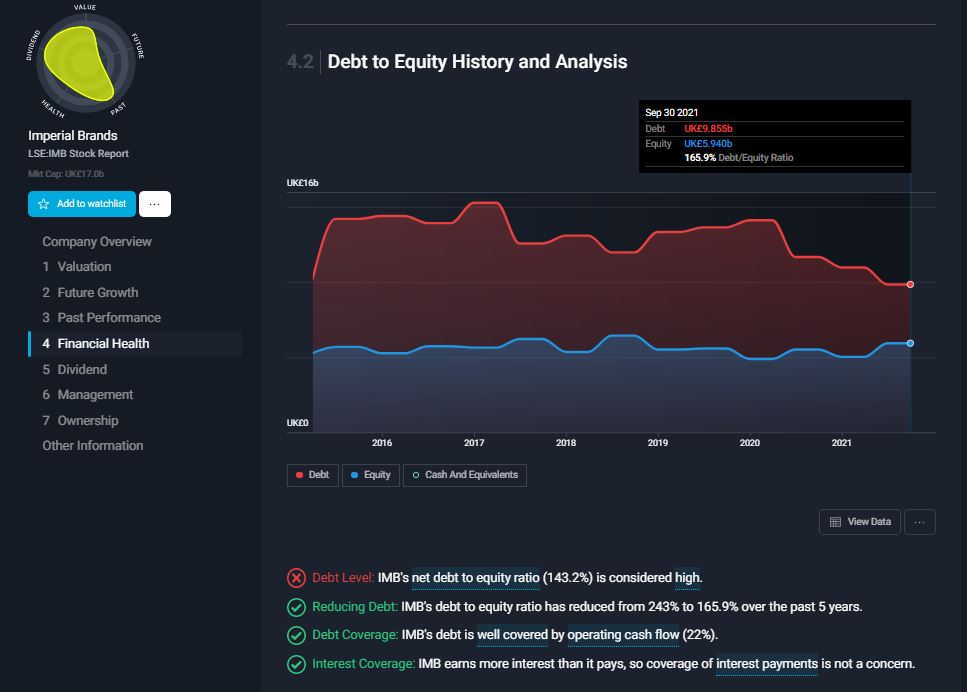

On debt, the levels have been reducing since a recent peak in 2016. There is still a lot of debt though!

source: https://simplywall.st/stocks/gb/food-be ... res#health

At least with BATS, the debt is less than equity (but still "high").

source: https://simplywall.st/stocks/gb/food-be ... res#health

Both companies are "undervalued" based on a calculation of Discounted Cash Flow (with IMB supposedly even cheaper than BATS).

With IMB, the dividend cut from 206.57p to 137.71p & 139.08p over the last 2 years has "saved" £1.28bn. Hopefully, the step down in debt from such savings will continue...perhaps we should expect minimal dividend increases going forward. After years of 10% dividend increases, we see a 0.99% increase on offer.

The annual report https://www.imperialbrandsplc.com/conte ... t-2021.pdf indicates that

"We prioritise investment and resources in our five most important markets of the USA,Germany, UK, Australia and Spain, which represent more than 70 per cent of our operating profit." ..page 30.

Page 2 of the AR

"We are Imperial Brands, a global consumer organisation and the fourth largest international tobacco

company, operating across 120 markets."

Pages 64 to 70:

2021 Adjusted Profits (£m)

Europe 1670

Americas 1037

AAA 598

Distribution 265

(AAA = Africa, Asia & Australasia).

So, I'd contend that IMB's profits are fairly global but with a bias to Europe (with Germany, UK, Spain being the key countries in decreasing importance (%) of profit).

source: https://simplywall.st/stocks/gb/food-be ... res#health

At least with BATS, the debt is less than equity (but still "high").

source: https://simplywall.st/stocks/gb/food-be ... res#health

Both companies are "undervalued" based on a calculation of Discounted Cash Flow (with IMB supposedly even cheaper than BATS).

With IMB, the dividend cut from 206.57p to 137.71p & 139.08p over the last 2 years has "saved" £1.28bn. Hopefully, the step down in debt from such savings will continue...perhaps we should expect minimal dividend increases going forward. After years of 10% dividend increases, we see a 0.99% increase on offer.

The annual report https://www.imperialbrandsplc.com/conte ... t-2021.pdf indicates that

"We prioritise investment and resources in our five most important markets of the USA,Germany, UK, Australia and Spain, which represent more than 70 per cent of our operating profit." ..page 30.

Page 2 of the AR

"We are Imperial Brands, a global consumer organisation and the fourth largest international tobacco

company, operating across 120 markets."

Pages 64 to 70:

2021 Adjusted Profits (£m)

Europe 1670

Americas 1037

AAA 598

Distribution 265

(AAA = Africa, Asia & Australasia).

So, I'd contend that IMB's profits are fairly global but with a bias to Europe (with Germany, UK, Spain being the key countries in decreasing importance (%) of profit).

-

pennypunter

- Posts: 4

- Joined: February 8th, 2022, 4:15 pm

- Has thanked: 4 times

- Been thanked: 4 times

Re: Imperial Brands

the main capital events for this co:-

IMB annual report 2007 net debt £4.9bn

IMB 2008 Equity Raise 1 for 2 raising £4.9bn at 1475p

2014 IMB IPO of Logista raising EUR 470m

2017 sale of 10% Logista realising £230m

2018 sale of 10% Logista realising £235m

2021 sale of cigars EUR 1.2bn

sale proceeds c. £1.85bn

2021 YE net debt £9.4bn

hence total debt has still moved up £4.5bn in the last 14 years AFTER disposals of £1.85bn and cash call of £4.9bn

IMB realised its dividend promises were unsustainable and self defeating, causing the shares to crater because no one other than gullible retail shareholders believed it anyway. IMB reduced it from roughly 200p in 2019 to 161.7p in 2020 and to 138.7p in 2021- the dividend was also cut in 2009 from 72p to 63p in 2008

For most of the last decade the co has paid out more in dividends than in profit, in some years amounts very sizeably in excess of profit, hence the payout was not funded by profit but from debt, disposals or reserves.

Co has averaged around £1.1bn in dividends over the last decade hence £11bn outflow of which around £6.3bn has come from debt/ disposals.

% of earnings paid to shareholders data table

Year Payout ratio (%)

2021 46.18

2020 117.46

2019 182.87

2018 122.83

2017 108.63

2016 220.00

2015 74.67

2014 81.03

2013 113.65

2012 145.36

Even now, the co is still staying on the path of £1.3bn annual payout when funds should be used for acquisitions and advancing the business in nextgen products where the co is far behind the peer group or in getting the debt down, which IMB is only doing belatedly post the cigar sale.

IMB annual report 2007 net debt £4.9bn

IMB 2008 Equity Raise 1 for 2 raising £4.9bn at 1475p

2014 IMB IPO of Logista raising EUR 470m

2017 sale of 10% Logista realising £230m

2018 sale of 10% Logista realising £235m

2021 sale of cigars EUR 1.2bn

sale proceeds c. £1.85bn

2021 YE net debt £9.4bn

hence total debt has still moved up £4.5bn in the last 14 years AFTER disposals of £1.85bn and cash call of £4.9bn

IMB realised its dividend promises were unsustainable and self defeating, causing the shares to crater because no one other than gullible retail shareholders believed it anyway. IMB reduced it from roughly 200p in 2019 to 161.7p in 2020 and to 138.7p in 2021- the dividend was also cut in 2009 from 72p to 63p in 2008

For most of the last decade the co has paid out more in dividends than in profit, in some years amounts very sizeably in excess of profit, hence the payout was not funded by profit but from debt, disposals or reserves.

Co has averaged around £1.1bn in dividends over the last decade hence £11bn outflow of which around £6.3bn has come from debt/ disposals.

% of earnings paid to shareholders data table

Year Payout ratio (%)

2021 46.18

2020 117.46

2019 182.87

2018 122.83

2017 108.63

2016 220.00

2015 74.67

2014 81.03

2013 113.65

2012 145.36

Even now, the co is still staying on the path of £1.3bn annual payout when funds should be used for acquisitions and advancing the business in nextgen products where the co is far behind the peer group or in getting the debt down, which IMB is only doing belatedly post the cigar sale.

-

dealtn

- Lemon Half

- Posts: 6100

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Imperial Brands

pennypunter wrote:the main capital events for this co:-

IMB annual report 2007 net debt £4.9bn

IMB 2008 Equity Raise 1 for 2 raising £4.9bn at 1475p

2014 IMB IPO of Logista raising EUR 470m

2017 sale of 10% Logista realising £230m

2018 sale of 10% Logista realising £235m

2021 sale of cigars EUR 1.2bn

sale proceeds c. £1.85bn

Interesting that the $7.1bn total acquisitions of Kool, Winston, Salem and Blu don't appear to be considered "main" by you.

Who is online

Users browsing this forum: No registered users and 3 guests