Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

A derivation of COGS and Gross Margin for Starbucks SBUX

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

A derivation of COGS and Gross Margin for Starbucks SBUX

After chatting with Simoan on the US shares thread viewtopic.php?p=496575#p496575, I attempted to calculate for myself the GM for SBUX. Actually it's unclear what info to tease out of the income statement in order to derive COGS in my honest opinion. If one assumes all OPEX is not COGS then their GM looks like almost 70%, whereas if "store operating expenses" are also considered then this values shrinks dramatically to about 29%.

This is the relevant section of SBUX's 2021 Income statement, with my two attempts at calculation of COGS and GM. The first attempt assumes that COGS is derived only from line 1, (P and D costs), whereas the second attempt assumes that both lines 1 and 2 comprise COGS.

Can of the more accountancy adept members shed any light on this dilemma?

thanks Matt

This is the relevant section of SBUX's 2021 Income statement, with my two attempts at calculation of COGS and GM. The first attempt assumes that COGS is derived only from line 1, (P and D costs), whereas the second attempt assumes that both lines 1 and 2 comprise COGS.

Can of the more accountancy adept members shed any light on this dilemma?

thanks Matt

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

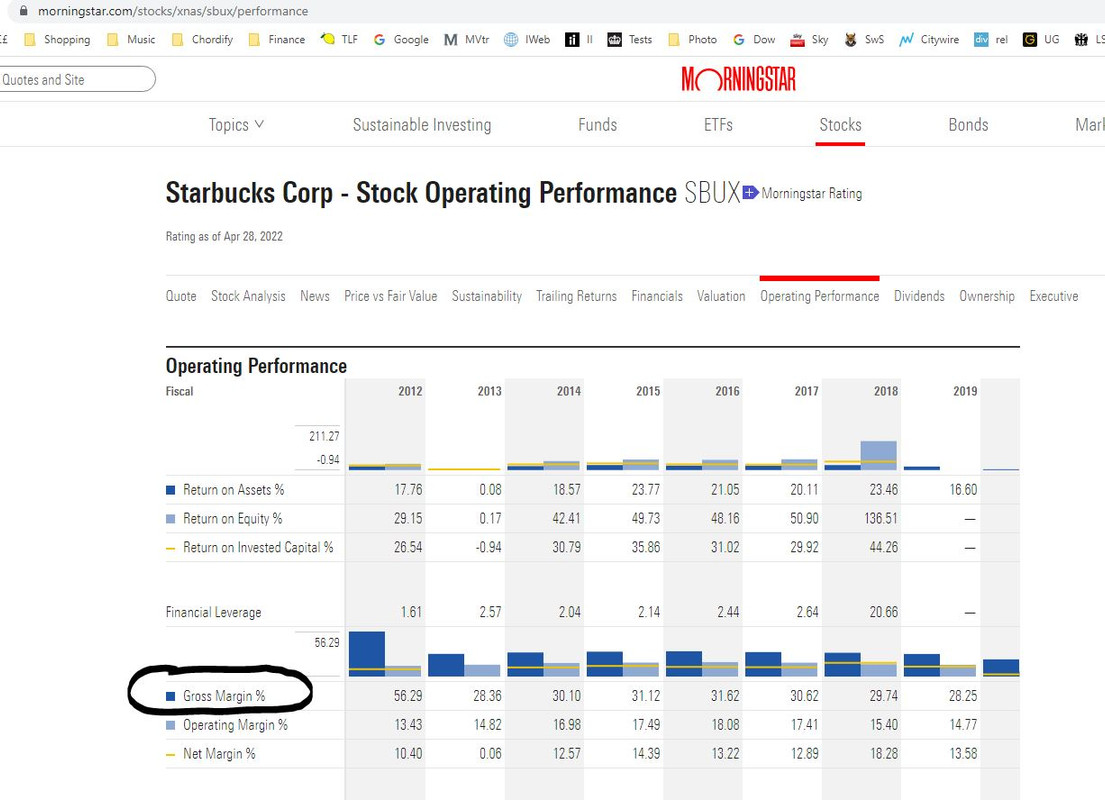

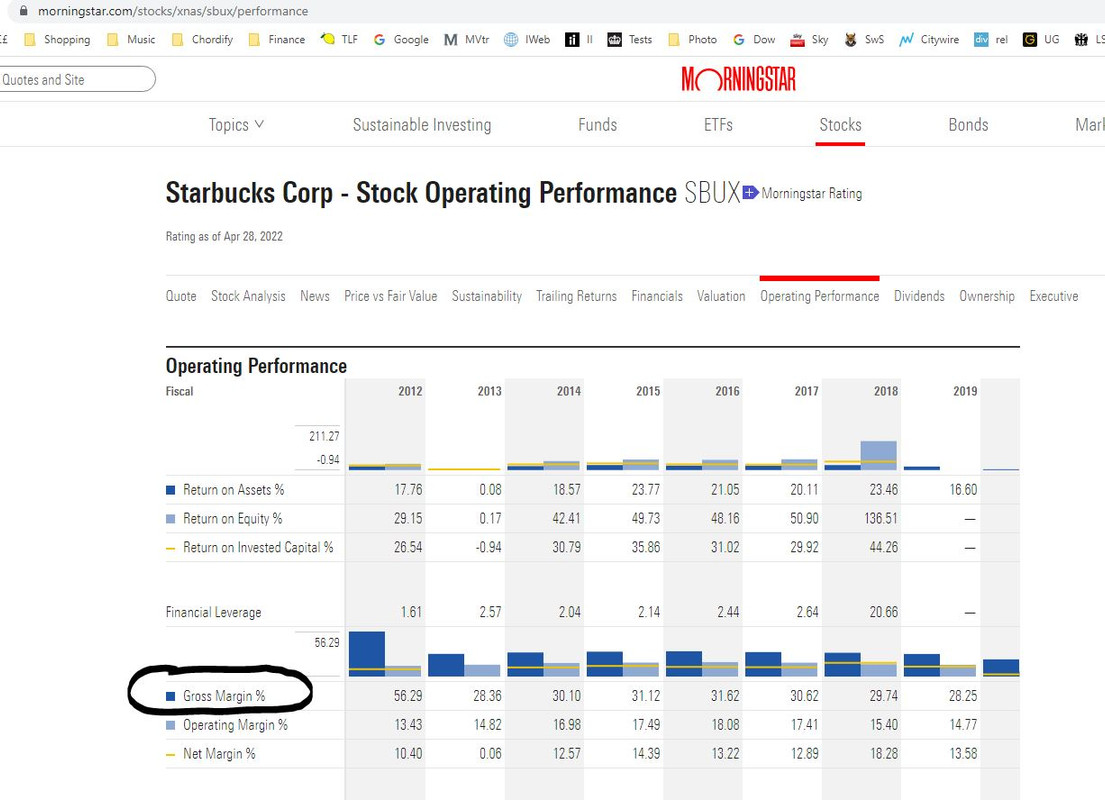

source: https://www.morningstar.com/stocks/xnas ... erformance

The GM figure quoted by MorningStar is ~30%

The GM figure quoted by MorningStar is ~30%

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

FWIW I've seen plenty of folks on the intertubes saying that SBUX's GM is <30%. However given what I've read from the firm's own 10k filings I'm curious as to how exactly they arrived at that value. As such I'm not massively interested in the fact that online suppliers of KPIs say one thing or another. I'm more interested in what those numbers really imply.

My view was that GM = (revenue - COGS)/revenue

and that COGS is based on product costs (in SBUX's case that would be that of coffee, milk, cookie dough etc.). COGS (apparently) doesn't include operating expenses (worker's wages, rent, etc.)

https://www.investopedia.com/terms/c/cogs.asp

So the only way I can imagine that Morningstar (and others) arrive at less than 30% for SBUX's GM is that their "analyst" has added the figure in the Income statement described as "Store operating expenses" (see the item I've denoted by the numeral 2 in my OP) into the overall value of COGS. Which from my very limited knowledge (i.e. that COGS is related to raw material costs) seems dubious.

Of course I've not meticulously analysed the exact composition of every line of SBUXs statements (!) so I could well be way out of line here!

All opinions welcome,

Matt

My view was that GM = (revenue - COGS)/revenue

and that COGS is based on product costs (in SBUX's case that would be that of coffee, milk, cookie dough etc.). COGS (apparently) doesn't include operating expenses (worker's wages, rent, etc.)

https://www.investopedia.com/terms/c/cogs.asp

So the only way I can imagine that Morningstar (and others) arrive at less than 30% for SBUX's GM is that their "analyst" has added the figure in the Income statement described as "Store operating expenses" (see the item I've denoted by the numeral 2 in my OP) into the overall value of COGS. Which from my very limited knowledge (i.e. that COGS is related to raw material costs) seems dubious.

Of course I've not meticulously analysed the exact composition of every line of SBUXs statements (!) so I could well be way out of line here!

All opinions welcome,

Matt

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

TheMotorcycleBoy wrote:

and that COGS is based on product costs (in SBUX's case that would be that of coffee, milk, cookie dough etc.). COGS (apparently) doesn't include operating expenses (worker's wages, rent, etc.)

https://www.investopedia.com/terms/c/cogs.asp

All opinions welcome,

Matt

Yet, the link says

"Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs."

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

I note in the link that

"The value of COGS will change depending on the accounting standards used in the calculation."

It is the case, though, that all "hangers on * " need to be paid for regardless of accounting method

*our finance manager referred indirect labour as "hangers on" ( even though he himself was indirect!). The company looked at moving to Activity Based Accounting but it was deemed too difficult so indirect labour costs were amortised into a single hourly labour rate.

"The value of COGS will change depending on the accounting standards used in the calculation."

It is the case, though, that all "hangers on * " need to be paid for regardless of accounting method

*our finance manager referred indirect labour as "hangers on" ( even though he himself was indirect!). The company looked at moving to Activity Based Accounting but it was deemed too difficult so indirect labour costs were amortised into a single hourly labour rate.

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

monabri wrote:TheMotorcycleBoy wrote:

and that COGS is based on product costs (in SBUX's case that would be that of coffee, milk, cookie dough etc.). COGS (apparently) doesn't include operating expenses (worker's wages, rent, etc.)

https://www.investopedia.com/terms/c/cogs.asp

All opinions welcome,

Matt

Yet, the link says

"Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs."

However my interest in this quest was driven by Simoan's earlier reply viewtopic.php?p=496575#p496575 in the US shares thread, i.e.

simoan wrote:You piqued my interest, so I just took a quick look at SBX, even though I'm trying to avoid any further exposure to the Consumer Discretionary sector currently. What I don't understand is why the Gross Margin is so low? In an input cost inflation environment I'm not sure a consumer facing company with a GM of 30% is something I feel comfortable holding. I assume the price of coffee has increased along with other commodities recently? If that's the case, then even a 5% percent increase in COGS would really hit gross profit.

All the best, Si

I inferred that his post implies a belief that raw material costs consume a whopping 70% of SBUXs revenue (i.e. 100% - 30% GM).

However, from my perusal of SBUX's 2021 income statement this does not seem to be the case. See my OP where

Product and distribution costs=8738.70 vs Revenues=29060.60 are stated. In other words the costs of purchasing the raw materials and getting them to the Starbucks stores, in my naive view would be appear to have represented 30% of their revenue.

The only conclusion I can confidently make is that the terms COGS, GM, Gross profit are confusing and open to interpretation!

Matt

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

I'm not sure what others here think, but considering Starbucks as an investment idea some more in our current inflationary environment, I think what will affect their sales (not their profits per se) will be reduction in foot fall in city and town centres.

Despite being a bit of boring old git, I do from time to time go into town with Mel of a weekend afternoon, and I frequently spend a Saturday up in my eldest kid's University city (or close by). The days out typically comprise at least one "coffee and snack sit down". Not necessarily in a Starbucks! But whatever is nearby, could be a Caffe Nero, or an independent cafe. However this is an almost essential part of a town visit. I suspect this to be the case for many. So combined with threats from competitors, town center footfall reduction would seem (to me at least) to be the biggest possible risk to the likes of SBUX. I assume that they and their competition will do their best to pass on their costs to their customers.

Matt

Despite being a bit of boring old git, I do from time to time go into town with Mel of a weekend afternoon, and I frequently spend a Saturday up in my eldest kid's University city (or close by). The days out typically comprise at least one "coffee and snack sit down". Not necessarily in a Starbucks! But whatever is nearby, could be a Caffe Nero, or an independent cafe. However this is an almost essential part of a town visit. I suspect this to be the case for many. So combined with threats from competitors, town center footfall reduction would seem (to me at least) to be the biggest possible risk to the likes of SBUX. I assume that they and their competition will do their best to pass on their costs to their customers.

Matt

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10025 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

TheMotorcycleBoy wrote:

So combined with threats from competitors, town center footfall reduction would seem (to me at least) to be the biggest possible risk to the likes of SBUX.

It's really quite difficult to think of a business that's likely to face more multi-directional headwinds in the future than something like Starbucks -

- Footfall reducing from embedded working from home culture

- Footfall reducing due to general high-street / on-line shopping trends

- Squeeze on discretionary spending from multiple consumer-related fronts - broad inflation, higher energy costs, increases in petrol cost, higher interest rates etc...

- High and on-going rise in raw-material input-costs

- High and on-going rise in store-based energy costs

- Rise in employee wage-costs due to higher demand in customer-facing workers

Faced with a question of where personal consumer-based savings might be made over the coming difficult years, it's hard to think that the daily coffee won't be an early victim of personal belt-tightening.

In today's tik-tok and twitter-based world, the fad for coffee might quickly turn into a fad for coffee-less savings if it means that other, more 'essential' personal comforts might be maintained...

Cheers,

Itsallaguess

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

How does SBUX GM figures compare with similar? ( a cross check).

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

Itsallaguess wrote:TheMotorcycleBoy wrote:

So combined with threats from competitors, town center footfall reduction would seem (to me at least) to be the biggest possible risk to the likes of SBUX.

It's really quite difficult to think of a business that's likely to face more multi-directional headwinds in the future than something like Starbucks -

- Footfall reducing from embedded working from home culture

- Footfall reducing due to general high-street / on-line shopping trends

- Squeeze on discretionary spending from multiple consumer-related fronts - broad inflation, higher energy costs, increases in petrol cost, higher interest rates etc...

- High and on-going rise in raw-material input-costs

- High and on-going rise in store-based energy costs

- Rise in employee wage-costs due to higher demand in customer-facing workers

Faced with a question of where personal consumer-based savings might be made over the coming difficult years, it's hard to think that the daily coffee won't be an early victim of personal belt-tightening.

In today's tik-tok and twitter-based world, the fad for coffee might quickly turn into a fad for coffee-less savings if it means that other, more 'essential' personal comforts might be maintained...

Cheers,

Itsallaguess

Hi mate,

Whilst we could probably debate social trends for yonks, I agree that you make some very good points. I assume that this "information" is somewhat already reflected in the price which is why the stock is down quite considerably from it's previous highs. Conversely several less discretionary sectors e.g. energy again are priced accordingly (I guess) and as such presumably are some somewhat overpriced. Similarly other sectors like mining, commodities and defence for example, seem also to have quite high valuations.

All of which make me wonder whether it might be simpler to just invest in a World All Equity tracker fund!

thanks Matt

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3245

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2222 times

- Been thanked: 587 times

Re: A derivation of COGS and Gross Margin for Starbucks SBUX

So I did buy a small holding of SBUX in April and I'm looking at a 35% gain. (Some is FX related).

However comparing MCD Q3 (sales down 5% EBIT down 7%). But for SBUX we upsettingly have Sales up 3% EBIT down 19%!!!.

So you guys were right, that they'd be exposed by an inflationary environment

Share price wise MCD is up 10% and SBUX by about 31%.

Given the differences in the fundamentals and my current upside position I'm tempted to sell my SBUX, or at least topslice heavily.

However comparing MCD Q3 (sales down 5% EBIT down 7%). But for SBUX we upsettingly have Sales up 3% EBIT down 19%!!!.

So you guys were right, that they'd be exposed by an inflationary environment

Share price wise MCD is up 10% and SBUX by about 31%.

Given the differences in the fundamentals and my current upside position I'm tempted to sell my SBUX, or at least topslice heavily.

Who is online

Users browsing this forum: No registered users and 16 guests