Page 7 of 7

Re: Schroders PLC (SDR)

Posted: July 13th, 2022, 7:40 am

by DelianLeague

simoan wrote:Dod101 wrote:DelianLeague wrote:I have just noticed that SDR has a higher dividend yield than SDRC. In the past, I thought that this was generally the other way around and I assumed that the higher dividend was compensation for the inability to have any say in the company (non-voting). I haven't followed this share for a while but I do have some SDR shares.

D.L.

I do not know the difference between SDR and SDRC. I do wish people would not write in code. The non voting shares have nearly always had a higher yield but that is because they have traded at a lower price than the voting shares. Both lots of shares receive exactly the same dividend.

The effect of the proposals has been to provide an uplift in the price of the non voting shares and a compensating reduction in the value of the voting shares since the overall value of the Company has not changed as a result of this reconstruction of the share structure. When the Voting shareholders get their extra shares, that will bring the values of each class of share to par I am sure.

Dod

I actually “bit my tongue” and removed my previous post for the same reason. I’m getting tired of people using poor data sources for making assertions on these boards and not double checking before posting. It’s just lazy. If two shares have the exact same dividend payment how on earth can the higher priced one have the higher dividend yield? This is basic maths folks.

Apologies, Sorry if your getting tired of people and that you have to bite your tongue. It must be very stressful for you.

Anyway, you are correct. It was the data source that was incorrect. In my defence, I did check another data source before posting but it this was also wrong. It wasn't until later in the day (at work) that I checked yet again using another data source that the numbers looked correct.

I can assure you that I am not lazy, more, time short. I work very long hours, often 7 days a week.

Regards, D.L.

Re: Schroders PLC (SDR)

Posted: July 13th, 2022, 8:09 am

by simoan

DelianLeague wrote:Apologies, Sorry if your getting tired of people and that you have to bite your tongue. It must be very stressful for you.

Anyway, you are correct. It was the data source that was incorrect. In my defence, I did check another data source before posting but it this was also wrong. It wasn't until later in the day (at work) that I checked yet again using another data source that the numbers looked correct.

I can assure you that I am not lazy, more, time short. I work very long hours, often 7 days a week.

Regards, D.L.

I couldn't be less stressed if I tried! Positively horizontal and working zero hours a week. However, I wasn't calling you lazy in general, just that you should have checked your facts properly before posting erroneous information. This is easy to do and means others do not have the opportunity to act on false information, or waste time fact checking the anomaly you claimed you'd found. I'm sorry if I came across as harsh but I removed my original post for that reason and only responded to Dod.

Re: Schroders PLC (SDR)

Posted: July 13th, 2022, 8:28 am

by Dod101

DelianLeague wrote:simoan wrote:Dod101 wrote:DelianLeague wrote:I have just noticed that SDR has a higher dividend yield than SDRC. In the past, I thought that this was generally the other way around and I assumed that the higher dividend was compensation for the inability to have any say in the company (non-voting). I haven't followed this share for a while but I do have some SDR shares.

D.L.

I do not know the difference between SDR and SDRC. I do wish people would not write in code. The non voting shares have nearly always had a higher yield but that is because they have traded at a lower price than the voting shares. Both lots of shares receive exactly the same dividend.

The effect of the proposals has been to provide an uplift in the price of the non voting shares and a compensating reduction in the value of the voting shares since the overall value of the Company has not changed as a result of this reconstruction of the share structure. When the Voting shareholders get their extra shares, that will bring the values of each class of share to par I am sure.

Dod

I actually “bit my tongue” and removed my previous post for the same reason. I’m getting tired of people using poor data sources for making assertions on these boards and not double checking before posting. It’s just lazy. If two shares have the exact same dividend payment how on earth can the higher priced one have the higher dividend yield? This is basic maths folks.

Apologies, Sorry if your getting tired of people and that you have to bite your tongue. It must be very stressful for you.

Anyway, you are correct. It was the data source that was incorrect. In my defence, I did check another data source before posting but it this was also wrong. It wasn't until later in the day (at work) that I checked yet again using another data source that the numbers looked correct.

I can assure you that I am not lazy, more, time short. I work very long hours, often 7 days a week.

Regards, D.L.

Whilst we are about it, can I say to the OP that the best data source is the Company's own website and, in particular, usually its accounts. I use nothing else. Third party data sources are full of errors.

Dod

Re: Schroders PLC (SDR)

Posted: July 28th, 2022, 8:04 am

by idpickering

Half-year results to 30 June 2022 (unaudited).

-

Our business showed resilience in the first six months of 2022 with net operating income increasing by 3% to £1,240.3 million.

Operating profit increased by 2% to £406.9 million. ¹

Our investment performance ² remained strong with 77% of client assets outperforming their relevant comparator over three years and 79% over five years.

We generated net new business of £8.4 billion, which helped increase assets under management to £773.4 billion. Excluding joint ventures and associates, we generated net new business of £4.4 billion and assets under management reached £637.5 billion. ³

We have maintained our interim dividend of 37 pence per share.

And later;

The Board has declared an interim dividend of 37.0 pence per share (interim dividend 2021: 37.0 pence), amounting to £100.6 million (H1 2021: 101.3 million) in total. The dividend will be paid on 25 August 2022 to shareholders on the register at 5 August 2022.

The Group paid £2.5 million of dividends to holders of non-controlling interests in subsidiaries of the Group during the six months ended 30 June 2022 (H1 2021: nil), resulting in total dividends paid of £234.0 million (H1 2021: 217.3 million).

The Company's Dividend Reinvestment Plan (DRIP) will be suspended in respect of the interim dividend for both Ordinary Shares and Non-Voting Ordinary Shares. Shareholders will therefore receive the interim dividend as a cash payment.

https://www.investegate.co.uk/schroders ... 00079915T/Ian.

Re: Schroders PLC (SDR)

Posted: September 13th, 2022, 7:17 am

by idpickering

Simplification of the Company's dual class share structure.

Following the declaration of a national bank holiday on 19 September to mark the state funeral of Her Majesty Queen Elizabeth II, Schroders plc hereby confirms that all actions approved at each of the General Meeting of the Company and Class Meeting for Non-Voting Ordinary Shareholders held on 15 August 2022 previously scheduled for the 19 September 2022 will now take place on Tuesday 20 September 2022.

Capitalised terms in this announcement take the meaning given to them in the shareholder circular dated 12 July 2022 (the "Circular") unless otherwise defined.

Accordingly, on Tuesday 20 September 2022 the Company will be:

- enfranchising the Company's 56,505,600 Non-Voting Ordinary Shares by re-designating them into 56,505,600 Ordinary Shares with full voting rights (the "Enfranchisement");

- issuing 39,886,305 Ordinary Shares to existing holders of Ordinary Shares by way of a bonus issue (representing 3 additional Ordinary Shares for every 17 Ordinary Shares held by Ordinary Shareholders at 6.00pm on 16 September 2022) (the "Compensatory Bonus Issue"); and

- subsequently sub-dividing the Company's total resulting 322,414,305 Ordinary Shares of £1 each into 1,612,071,525 New Ordinary Shares of 20 pence each (the "Sub-Division").

https://www.investegate.co.uk/schroders ... 00081797Z/Ian.

Re: Schroders PLC (SDR)

Posted: October 20th, 2022, 7:36 am

by idpickering

Q3 2022 update.

Schroders plc today confirms its total assets under management (AUM) at 30 September 2022 of £752.4 billion.

Full details here;

https://www.investegate.co.uk/schroders ... 00034632D/Ian.

Re: Schroders PLC (SDR)

Posted: March 2nd, 2023, 8:05 am

by idpickering

Full-year results.

Net operating revenue, excluding performance related fees, increased by 1% demonstrating the strength of our business.

-

Operating profit, a key performance indicator (KPI), was robust at £723.0 million. These results were achieved in the face of challenging markets and lower performance fees.

-

Statutory pre-tax profit of £586.9 million was impacted by mark-to-market movements on balance sheet items and acquisition related costs including amortisation.

-

Our three-year investment performance ¹ KPI remained strong, with 73% of assets outperforming.

-

Schroders Capital, our private assets business, achieved record fundraising of £17.5 billion. Similarly, our wealth management advice businesses delivered strong organic growth of 6.6%.

-

Net new business (NNB) was resilient at £(1.6) billion (excluding joint ventures and associates) given the volatile fourth quarter. 2023 has started positively, particularly in Schroders Solutions.

-

The Board has recommended a final dividend of 15.0 pence per share, making a total dividend of 21.5 pence per share.

And later;

Dividends of £12.6 million (2021: 9.1 million) on shares held by employee benefit trusts have been waived and dividends may not be paid on treasury shares. The Board has recommended a 2022 final dividend of 15.0 pence per share (2021 restated final dividend: 14.9 pence), amounting to £232.8 million (2021 final dividend: £231.5 million). The dividend will be paid on 4 May 2023 to shareholders on the register at 24 March 2023 and will be accounted for in 2023.

In addition, the Group paid £9.3 million of dividends to holders of non-controlling interests in subsidiaries of the Group during 2022 (2021: 9.8 million), resulting in total dividends paid of £341.4 million (2021: 328.4 million).

The Company offers a dividend reinvestment plan (DRIP). The last date for shareholders to elect to participate in the DRIP for the purposes of the 2022 final dividend is 12 April 2023. Further details are contained on the Group's website.

https://www.investegate.co.uk/schroders ... 00065973R/Ian (I hold).

Re: Schroders PLC (SDRC)

Posted: March 2nd, 2023, 8:46 am

by monabri

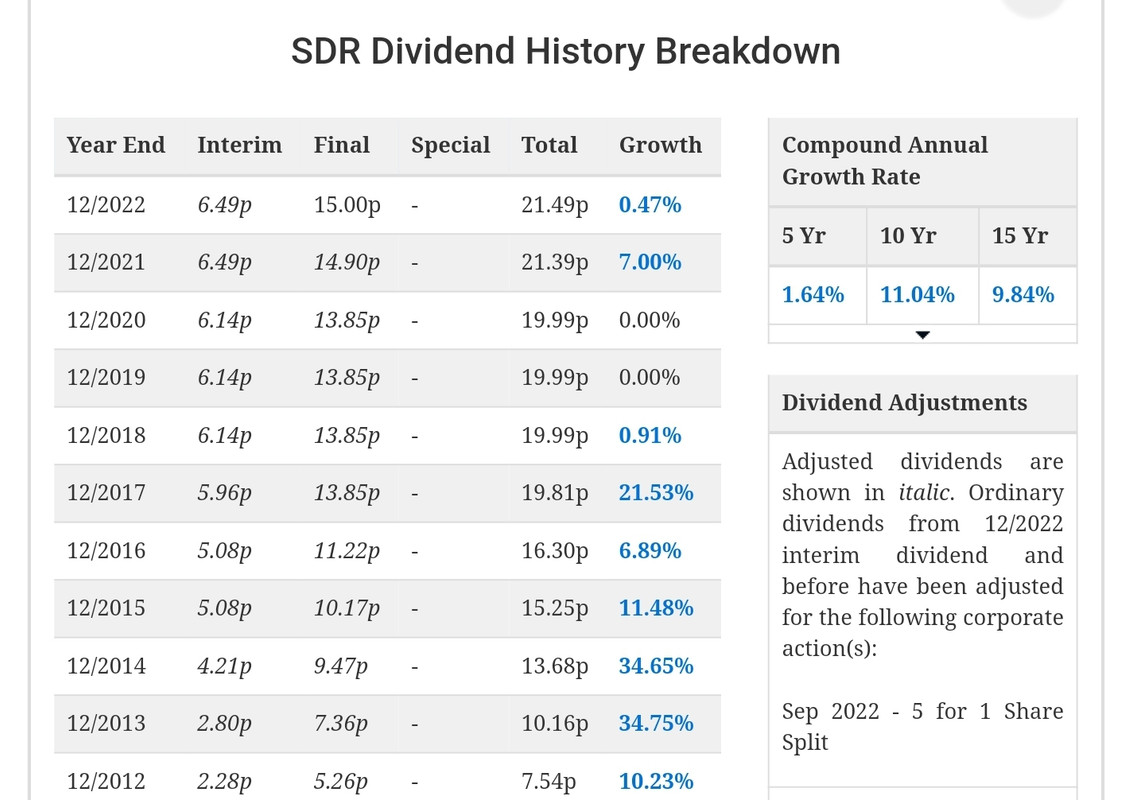

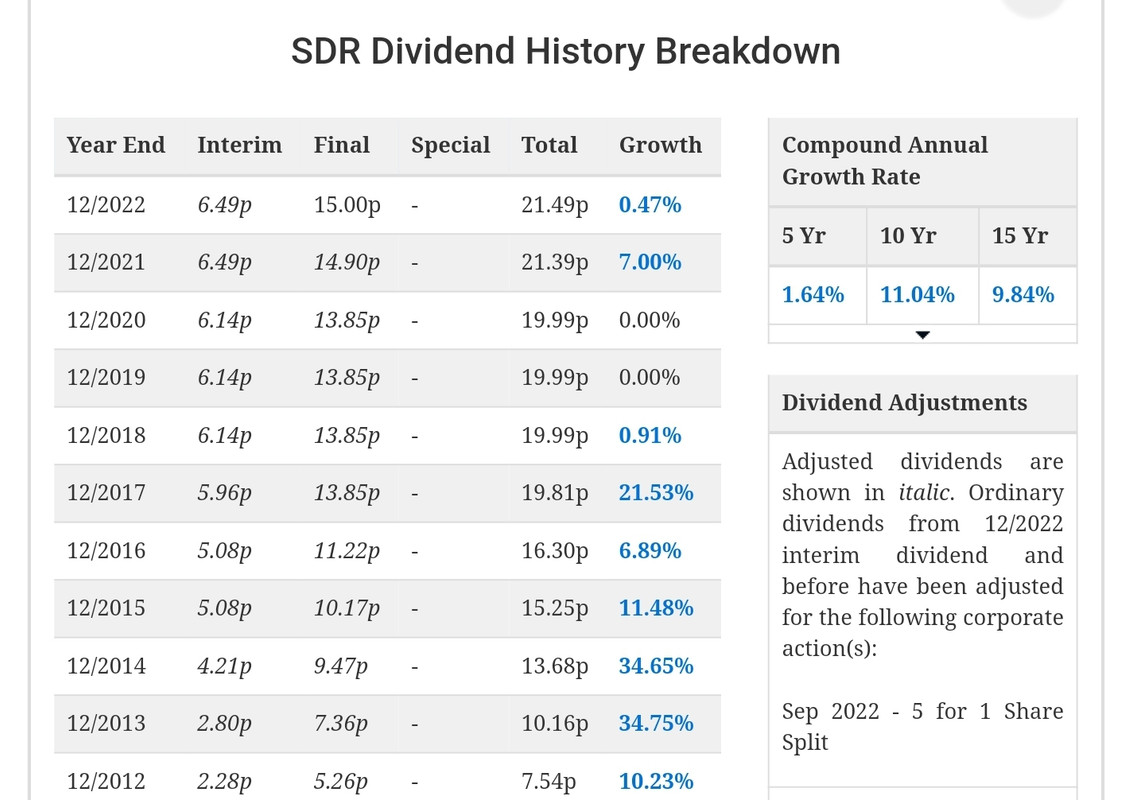

Less than half a percent increase in dividend on the year. Looking back at previous years dividend growth rates there has been a definite slowdown in dividend growth.

Source:

https://www.dividenddata.co.uk/dividend ... y?epic=SDR

Re: Schroders PLC (SDRC)

Posted: March 2nd, 2023, 8:50 am

by Dod101

LIke all active fund managers they are struggling to retain AUM. Just look at abrdn. The rise of the index funds.

Dod

Re: Schroders PLC (SDR)

Posted: April 12th, 2023, 10:44 pm

by Steveam

This from today’s FT:

“Lloyd’s of London sets up first fund in Schroders tie-up

Ian Smith in London

Lloyd’s of London has launched a £250mn private impact fund, the first in a tie-up with asset manager Schroders, as it seeks to present itself as “the insurer of the transition to net zero”.

The fund will invest funds held in the insurance market in areas such as private equity, infrastructure and property, hunting assets that contribute towards climate adaptation, social inclusion and other themes.

Lloyd’s has come under criticism from climate campaigners who say the market is moving too slowly to withdraw insurance for carbon-intensive industries.”

I’m not sure I understand this - and if I do it seems pretty small fry stuff. Perhaps I’m misunderstanding.

Best wishes, Steve

Re: Schroders PLC (SDR)

Posted: April 13th, 2023, 7:03 am

by Dod101

Steveam wrote:This from today’s FT:

“Lloyd’s of London sets up first fund in Schroders tie-up

Ian Smith in London

Lloyd’s of London has launched a £250mn private impact fund, the first in a tie-up with asset manager Schroders, as it seeks to present itself as “the insurer of the transition to net zero”.

The fund will invest funds held in the insurance market in areas such as private equity, infrastructure and property, hunting assets that contribute towards climate adaptation, social inclusion and other themes.

Lloyd’s has come under criticism from climate campaigners who say the market is moving too slowly to withdraw insurance for carbon-intensive industries.”

I’m not sure I understand this - and if I do it seems pretty small fry stuff. Perhaps I’m misunderstanding.

Best wishes, Steve

What is there to misunderstand? Like any insurer, Lloyds needs to hold substantial funds against its long term liabilities which I am sure you understand (in just the same way that Buffett built Berkshire) They seem to have decided to go Green by setting up a fund, apparently to be managed by Schroders, which is to invest in assets that contribute towards climate adaptation etc. As you say, at £250 million, very small beer for both parties, but I guess they have to start somewhere.

Dod

Re: Schroders PLC (SDR)

Posted: April 27th, 2023, 7:56 am

by idpickering

Re: Schroders PLC (SDR)

Posted: May 5th, 2023, 7:50 am

by Dod101

Schroders paid its Final Div yesterday for the year to 31 December. Most I assume will find themselves with an actual amount that is about 10% less than for the equivalent dividend for2021. That will be the tangible cost of enfranchising the Non Voting shares that I held because the actual Final was very modestly up. Those holding voting shares were handed some extra shares to compensate for the drop in value of their shares at the time of the reorganisation and so there are more mouths to feed and the div per share dropped a bit.

At least that is what I think has happened.

Dod

Re: Schroders PLC (SDR)

Posted: July 27th, 2023, 7:29 am

by idpickering

Half-year Report.

-

Our diversified business has again delivered resilient results despite the challenging operating environment, generating operating profit of £341.4 million.

Our strategic rebalancing towards higher growth and increased longevity areas enabled us to deliver overall net new business of £5.7 billion, excluding joint ventures and associates. Our three strategic growth areas of wealth management, private assets and solutions generated combined net new business of £11.8 billion.

We aim to provide excellent investment performance¹ to our clients through active asset management. Our key performance indicator, three year investment performance, remains strong with 77% of client assets outperforming their relevant comparator, while 73% outperformed over five years.

We have maintained our interim dividend of 6.5 pence per share.

And later;

The Board has declared an interim dividend of 6.5 pence per share (2022 restated interim dividend: 6.5 pence), amounting to £100.8 million (H1 2022: £100.6 million) in total. The dividend will be paid on 21 September 2023 to shareholders on the register at 18 August 2023.

The Group paid £0.2 million of dividends to holders of non-controlling interests in subsidiaries of the Group during the six months ended 30 June 2023 (H1 2022: £2.5 million), resulting in total dividends paid of £232.4 million (H1 2022: £234.0 million).

The Company offers a dividend reinvestment plan (DRIP). The last date for shareholders to elect to participate in the DRIP for the purposes of the 2023 interim dividend is 31 August 2023. Further details are available on the Group's website.

https://www.investegate.co.uk/announcem ... rt/7657765Ian.

Re: Schroders PLC (SDR)

Posted: October 19th, 2023, 7:05 am

by idpickering

Q3 2023 Update.

Schroders plc today confirms its total assets under management (AUM) at 30 September 2023 of £724.3 billion.

https://www.investegate.co.uk/announcem ... te/7825662Ian (No holding).

Re: Schroders PLC (SDR)

Posted: February 29th, 2024, 7:36 am

by idpickering

Schroders full-year results

Financial highlights

Grew assets under management (AUM) to £750.6 billion, driven by positive net new business (NNB), market movements and investment performance.

Strategic growth areas of Wealth Management, Private Markets and Solutions attracted strong NNB of £23.1 billion. Total NNB was £9.7 billion, excluding joint ventures and associates.

Net operating revenues were £2,334.4 million, as performance-based revenues helped mitigate the headwind from lower average AUM and adverse foreign exchange movements.

Maintained stable operating expenses of £1,758.0 million, as strong discipline on cost management and one-off benefits enabled us to hold costs flat despite the increased scale and complexity of our business following our acquisitions in 2022 and inflationary pressures.

Delivered operating profit of £661.0 million.

Profit before tax and restructuring costs was £573.8 million. Statutory profit before tax was £487.6 million, net of £86.2 million efficiency initiatives to enable further reinvestment in the business.

Final recommended dividend of 15.0 pence per share, bringing the total dividend to 21.5 pence per share.

And later;

Dividends of £13.6 million (2022: £12.6 million) on shares held by employee benefit trusts have been waived. The Board has recommended a 2023 final dividend of 15.0 pence per share (2022: 15.0 pence), amounting to £233.1 million (2022 final dividend: £232.2 million). The dividend will be paid on 2 May 2024 to shareholders on the register at 22 March 2024 and will be accounted for in 2024.

https://www.investegate.co.uk/announcem ... ts/8062191Ian (No holding).

Re: Schroders PLC (SDR)

Posted: February 29th, 2024, 9:32 am

by Steveam

Another held dividend. This share is a bit of a disappointment. I’m not yet ready to cut and run.

Best wishes, Steve

Re: Schroders PLC (SDR)

Posted: April 24th, 2024, 3:19 pm

by idpickering

Future Retirement of Group Chief Executive.

Schroders plc today announces that after a decade on the Board, Peter Harrison has signalled his intention to retire as Group Chief Executive (CEO) next year. A thorough and extensive search for his successor will now be launched. The Board anticipates an orderly transition during 2025 and Peter will remain as a director of the Company throughout this period.

https://www.investegate.co.uk/announcem ... e-/8154627Ian.