Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Lloyds (LLOY)

Forum rules

No penny shares or promotional posts

No penny shares or promotional posts

-

idpickering

- The full Lemon

- Posts: 11415

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2479 times

- Been thanked: 5816 times

Re: Lloyds (LLOY)

Heads up! The Lloyds CEO is being interviewed on Bloomberg TV about 0810hrs (UK) today.

Ian.

Ian.

-

idpickering

- The full Lemon

- Posts: 11415

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2479 times

- Been thanked: 5816 times

Re: Lloyds (LLOY)

2023 Results

https://www.investegate.co.uk/announcem ... s-/8050061

Ian (No holding).

"In 2023 the Group remained focused on proactively supporting people and businesses through persistent cost-of-living pressures, whilst financing their ambitions and growth. This has come alongside strong progress on our strategy and delivering increased shareholder returns, guided as always by our core purpose of Helping Britain Prosper.

The Group delivered a robust financial performance, meeting our 2023 guidance, driven by income growth, cost discipline and strong asset quality. This performance enabled strong capital generation and increased shareholder distributions.

2023 was a critical year in building towards the ambitious strategy we announced two years ago, as we look to grow our business and deepen relationships with our customers. As demonstrated in our recent strategic seminars, we have made significant progress and are on track to meet our 2024 and 2026 strategic outcomes, helping us build towards higher and more sustainable returns.

Our strategy is purpose-driven. Building a more sustainable and inclusive future is central to this, including our commitment to supporting the environmental transition, social housing and broader purpose-aligned objectives. We are excited about the opportunities that lie ahead as we continue to deliver for all of our stakeholders."

Charlie Nunn, Group Chief Executive

And later;

Dividends on ordinary shares and share buyback

The directors have recommended a final dividend, which is subject to approval by the shareholders at the annual general meeting on 16 May 2024, of 1.84 pence per ordinary share (2022: 1.60 pence per ordinary share), equivalent to £1,169 million, before the impact of any cancellations of shares under the Company's buyback programme (2022: £1,059 million, following cancellations of shares under the Company's 2023 buyback programme up to the record date), which will be paid on 21 May 2024. These financial statements do not reflect the recommended dividend.

Shareholders who have already joined the dividend reinvestment plan will automatically receive shares instead of the cash dividend. Key dates for the payment of the recommended dividend are outlined on page 81.

Share buyback

The Board has announced its intention to implement an ordinary share buyback of up to £2.0 billion. This represents the return to shareholders of capital, surplus to that required to provide capacity to grow the business, meet current and future regulatory requirements and cover uncertainties. The share buyback programme will commence as soon as is practicable and is expected to be completed, subject to continued authority from the PRA, by 31 December 2024.

https://www.investegate.co.uk/announcem ... s-/8050061

Ian (No holding).

-

idpickering

- The full Lemon

- Posts: 11415

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2479 times

- Been thanked: 5816 times

Re: Lloyds (LLOY)

Share Buyback Programme Commences

https://www.investegate.co.uk/announcem ... es/8053215

Ian (No holding).

Lloyds Banking Group plc (the "Company") is today launching a share buyback programme to repurchase up to £2 billion of ordinary shares. The Company previously announced its intention to commence the programme on 22 February 2024.

The Company has entered into an agreement with Morgan Stanley & Co. International plc (the "Broker") to conduct the share buyback programme on its behalf and to make trading decisions under the programme independently of the Company. Under the terms of the programme, the maximum consideration is £2 billion. The programme will commence on 23 February 2024 and will end no later than 31 December 2024. The sole purpose of the programme is to reduce the ordinary share capital of the Company.

https://www.investegate.co.uk/announcem ... es/8053215

Ian (No holding).

-

daveh

- Lemon Quarter

- Posts: 2217

- Joined: November 4th, 2016, 11:06 am

- Has thanked: 416 times

- Been thanked: 813 times

Re: Lloyds (LLOY)

idpickering wrote:Share Buyback Programme CommencesLloyds Banking Group plc (the "Company") is today launching a share buyback programme to repurchase up to £2 billion of ordinary shares. The Company previously announced its intention to commence the programme on 22 February 2024.

https://www.investegate.co.uk/announcem ... es/8053215

Ian (No holding).

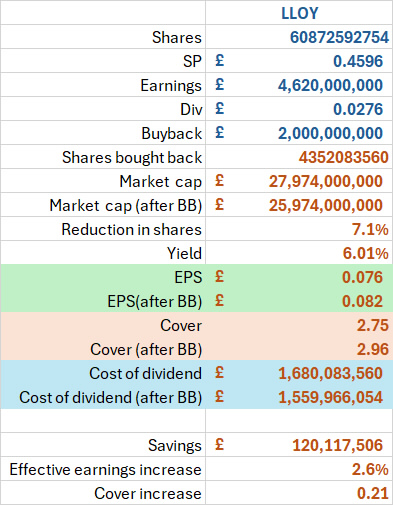

With a market cap of £29B a £2B share back at todays prices is going to remove 6.8% of the companies shares. That's a pretty big reduction in the share count and is going to make a big difference in the EPS and in the cost of the ongoing dividends.

-

monabri

- Lemon Half

- Posts: 8437

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: Lloyds (LLOY)

daveh wrote:idpickering wrote:Share Buyback Programme Commences

https://www.investegate.co.uk/announcem ... es/8053215

Ian (No holding).

With a market cap of £29B a £2B share back at todays prices is going to remove 6.8% of the companies shares. That's a pretty big reduction in the share count and is going to make a big difference in the EPS and in the cost of the ongoing dividends.

The earliest Annual Reports (AR) I can find on the Lloyds Investors website are for FY 2009 - there were 63.7bn Ordinary shares. The 2023 AR indicates 63.5bn Ordinaries. I wish I had the share information (quantity) for when the annual dividend was 20p+ for comparison.

-

csearle

- Lemon Quarter

- Posts: 4845

- Joined: November 4th, 2016, 2:24 pm

- Has thanked: 4869 times

- Been thanked: 2129 times

Re: Lloyds (LLOY)

daveh wrote:idpickering wrote:Share Buyback Programme Commences

https://www.investegate.co.uk/announcem ... es/8053215

Ian (No holding).

With a market cap of £29B a £2B share back at todays prices is going to remove 6.8% of the companies shares. That's a pretty big reduction in the share count and is going to make a big difference in the EPS and in the cost of the ongoing dividends.

I make it this(ish)...

I own (or am legally permitted to post) the content of the image above.

C.

-

scrumpyjack

- Lemon Quarter

- Posts: 4879

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 618 times

- Been thanked: 2714 times

Re: Lloyds (LLOY)

I think that calculation ignores the £2 bn no longer earning anything for the company. As a minimum £2 bn less capital means a loss of perhaps £100 mn of income which comes off the pre tax profit. A small adjustment but not to be ignored?

-

monabri

- Lemon Half

- Posts: 8437

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: Lloyds (LLOY)

The reduction in the number of share is one thing but the main driver of the dividend will simply be how the company does.

-

daveh

- Lemon Quarter

- Posts: 2217

- Joined: November 4th, 2016, 11:06 am

- Has thanked: 416 times

- Been thanked: 813 times

Re: Lloyds (LLOY)

Some one was asking either here or on the HYP board about the number of shares in issue pre GFC. Ive just posted a link to the 2006 AR which states an EPS of 49.9p and 5667m shares in issuance at the end of 2006, compared to 60b now. Wow more than 10x more shares now than in 2006

-

monabri

- Lemon Half

- Posts: 8437

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: Lloyds (LLOY)

daveh wrote:Some one was asking either here or on the HYP board about the number of shares in issue pre GFC. Ive just posted a link to the 2006 AR which states an EPS of 49.9p and 5667m shares in issuance at the end of 2006, compared to 60b now. Wow more than 10x more shares now than in 2006

It was I !

I managed to find the 2006 report filed as a pdf online. https://assets.lloyds.com/media/d91cae4 ... AR2006.pdf

From the 2006 and 2023 Annual Reports (2023 available from their Investors pages) it does indeed look as if the number of Lloyds shares has increased substantially. from 5.6bn to 63bn. I think the road to a 20p annual dividend will be very (very) long.

-

Gerry557

- Lemon Quarter

- Posts: 2077

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 177 times

- Been thanked: 575 times

Re: Lloyds (LLOY)

I'll look down the back of the sofa to see if I can find a few more.

I don't know if all the banks have finished reporting now but from my observations it looking like lloy was one of the better ones.

I don't know if all the banks have finished reporting now but from my observations it looking like lloy was one of the better ones.

-

idpickering

- The full Lemon

- Posts: 11415

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2479 times

- Been thanked: 5816 times

Re: Lloyds (LLOY)

2024 Q1 Interim Management Statement.

https://www.investegate.co.uk/announcem ... nt/8153209

Ian (No holding).

Financial performance in line with expectations1

• Statutory profit after tax of £1.2 billion (three months to 31 March 2023: £1.6 billion) with net income down 9 per cent on the prior year and operating costs up 11 per cent, partly offset by the benefit of a lower impairment charge

• Return on tangible equity of 13.3 per cent (three months to 31 March 2023: 19.1 per cent)

• Underlying net interest income of £3.2 billion down 10 per cent, with a lower banking net interest margin, as expected, of 2.95 per cent and average interest-earning banking assets of £449.1 billion

• Underlying other income of £1.3 billion, 7 per cent higher, driven by continued recovery in customer and market activity and the benefits of strategic initiatives

• Operating lease depreciation of £283 million, up on the prior year reflecting a full quarter of depreciation from Tusker, alongside growth in fleet size and declines in used car prices; the charge is lower than the fourth quarter which included an additional c.£100 million residual value provision to offset developments in used car prices

• Operating costs of £2.4 billion, up 11 per cent, including c.£0.1 billion relating to the sector-wide change in the charging approach for the Bank of England levy (excluding this levy, operating costs were up 6 per cent) and elevated severance charges (£0.1 billion higher year to date). The Bank of England levy will have a broadly neutral impact on profit in 2024 with an offsetting benefit recognised through net interest income over the course of the year

• Remediation costs of £25 million (three months to 31 March 2023: £19 million), in relation to pre-existing programmes

• Underlying impairment charge of £57 million and asset quality ratio of 6 basis points. Excluding the impact of improvements to the economic outlook, the asset quality ratio was 23 basis points. The portfolio remains well-positioned with stable credit trends and strong asset quality

https://www.investegate.co.uk/announcem ... nt/8153209

Ian (No holding).

Return to “Company Share news (LSE Main Market)”

Who is online

Users browsing this forum: Bing [Bot] and 20 guests