idpickering wrote:HSBC's top shareholder calls for banking giant's break-up - FT.

HSBC’s largest shareholder, Chinese insurance company Ping An, has called for the UK bank to break itself up, according to people familiar with the matter.

The rupture with the biggest insurer in China marks a further escalation of HSBC’s geopolitical woes, with the bank squeezed between China and the west.

Ping An has set out its plan for a break-up to HSBC’s board, led by chair Mark Tucker and chief executive Noel Quinn, according to people familiar with the matter.

The intensifying criticism will pile pressure on management, which has been struggling to reverse share price declines in recent years and navigate the increased geopolitical tension between China, where it makes most of its profits, and the west.

Ping An has argued that an independent Asia business listed in Hong Kong would have higher profitability, lower capital requirements and greater local management control and autonomy to make decisions.

A demerger would also give shareholders more choice on what parts of the sprawling lender — which has 40m customers, more than 200,000 staff and operations in 64 countries — they want to own, the insurer has said.

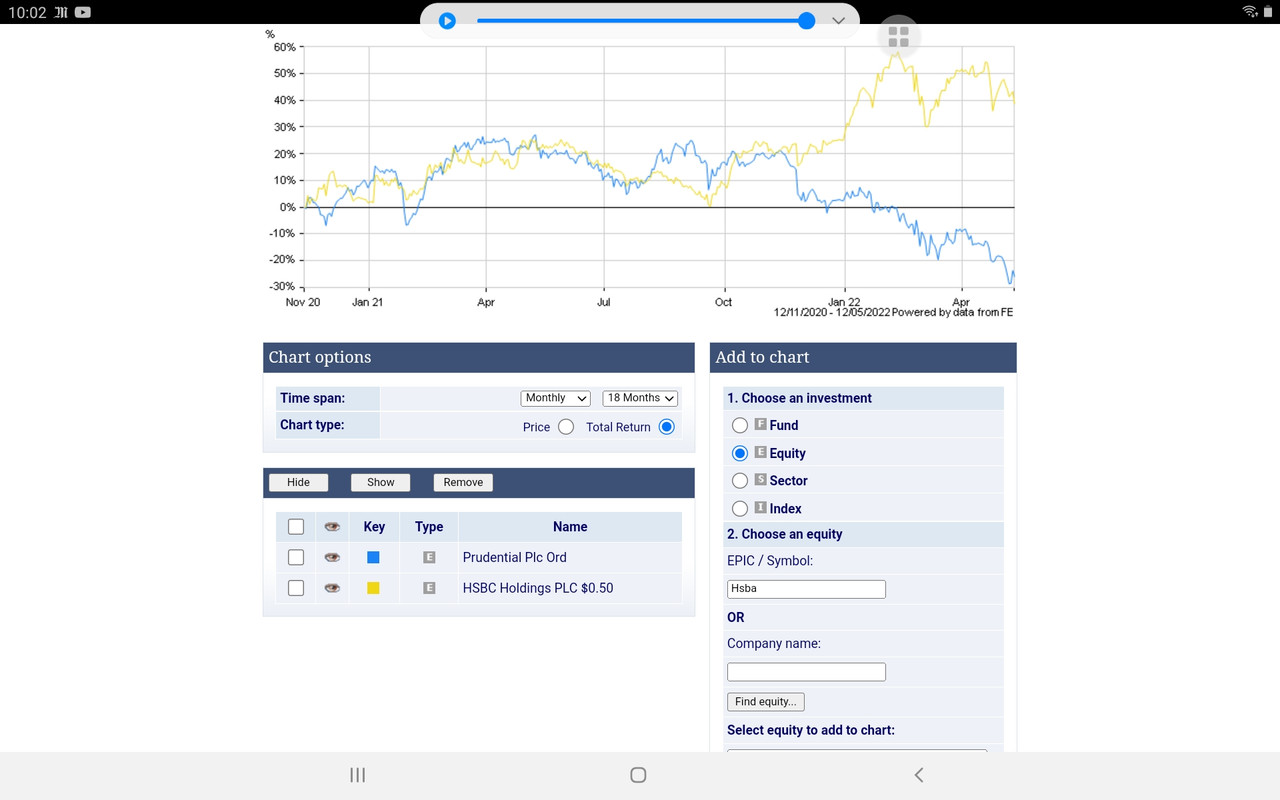

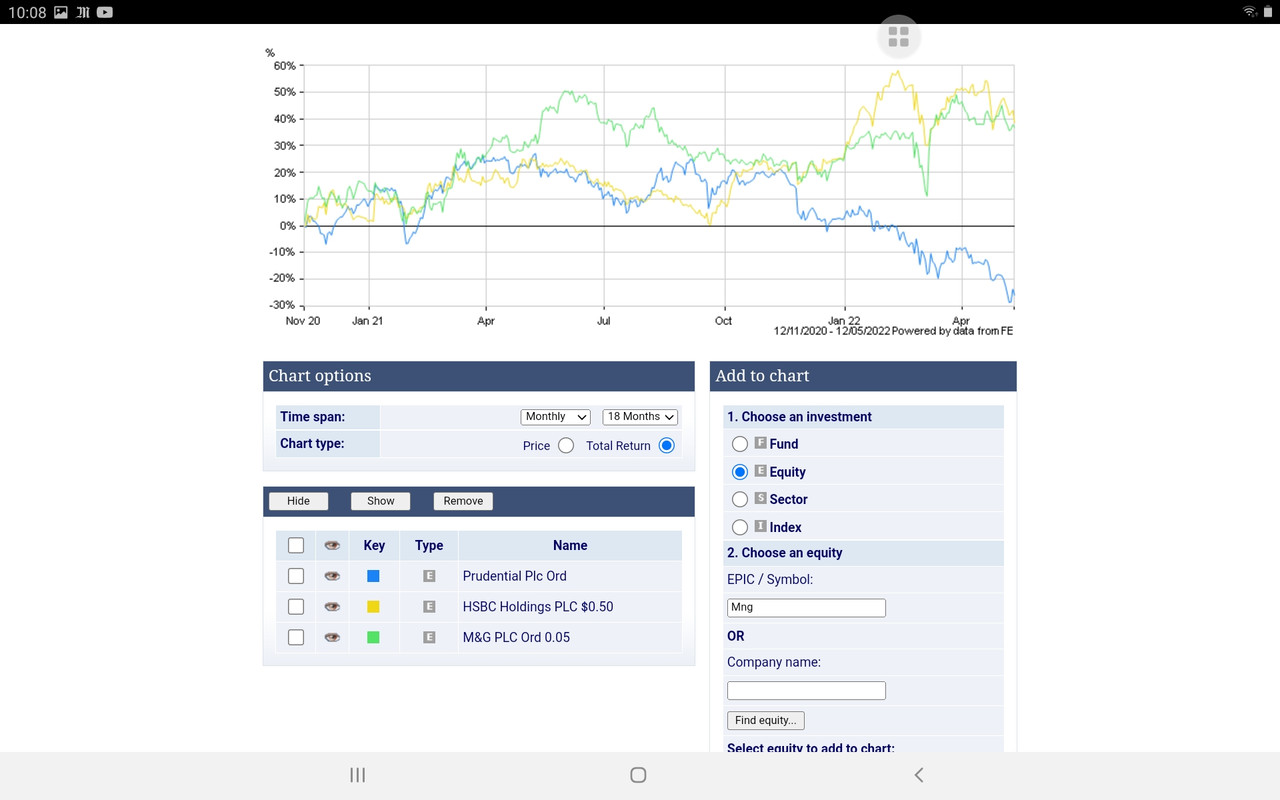

In the discussions with the board, it has used the break-up of fellow insurer Prudential as a model, claiming its three independent units — Jackson National, Prudential Plc and M&G — are now worth $5bn more separately than when as part of one group in 2019.

In 2015, HSBC conducted a review of whether London was the right place for its headquarters. It concluded it was and has not revisited the decision since.

Tucker has rebuffed calls for a break-up of the group, saying at the bank’s annual meeting in London on Friday that he is happy with the group’s strategy and performance.

Ping An owns 9.2 per cent of HSBC, according to two people familiar with the matter. The latest publicly disclosed shareholdings show Ping An at 8 per cent, just behind BlackRock at 8.3 per cent.

Ping An declined to comment. HSBC did not immediately provide a comment.

https://www.ft.com/content/63e7df2e-6d2 ... 8af902a83a

Ian.

As a long time shareholder in HSBC I cannot help thinking that Ping An has got a point and with the size of shareholding it has, they cannot be ignored. Watch this space.

Dod