simoan wrote:Dod101 wrote:DelianLeague wrote:I have just noticed that SDR has a higher dividend yield than SDRC. In the past, I thought that this was generally the other way around and I assumed that the higher dividend was compensation for the inability to have any say in the company (non-voting). I haven't followed this share for a while but I do have some SDR shares.

D.L.

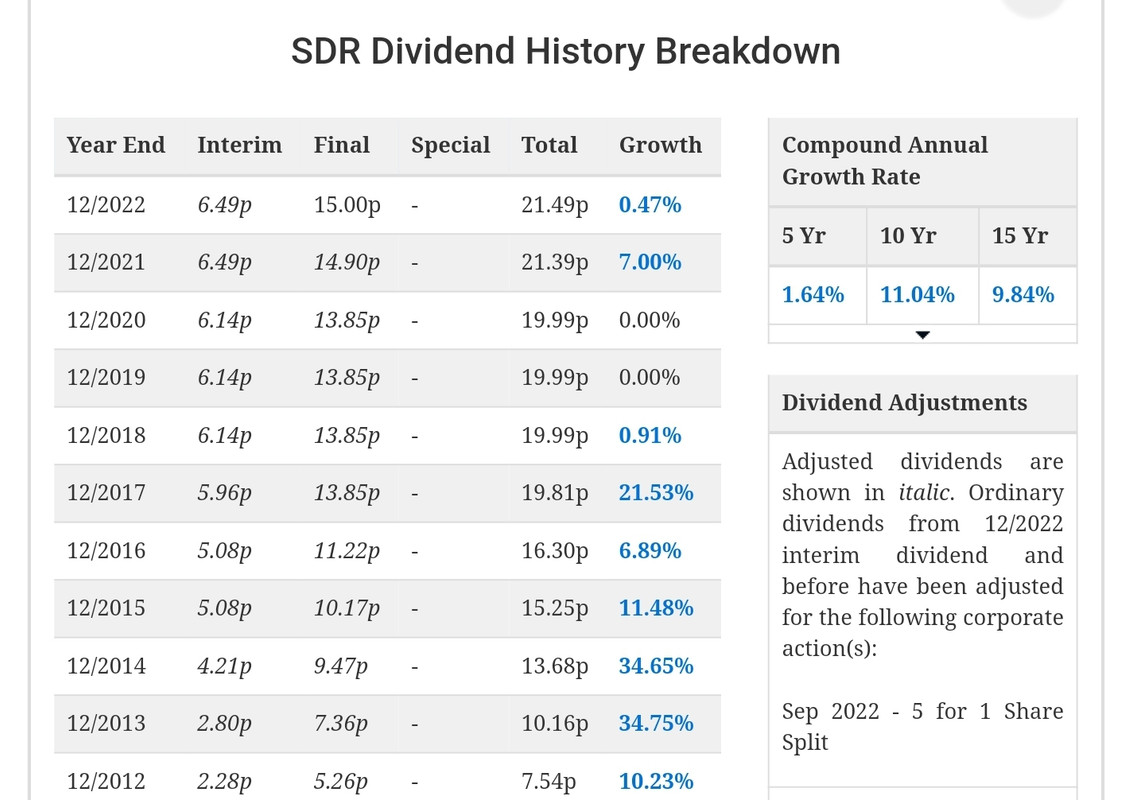

I do not know the difference between SDR and SDRC. I do wish people would not write in code. The non voting shares have nearly always had a higher yield but that is because they have traded at a lower price than the voting shares. Both lots of shares receive exactly the same dividend.

The effect of the proposals has been to provide an uplift in the price of the non voting shares and a compensating reduction in the value of the voting shares since the overall value of the Company has not changed as a result of this reconstruction of the share structure. When the Voting shareholders get their extra shares, that will bring the values of each class of share to par I am sure.

Dod

I actually “bit my tongue” and removed my previous post for the same reason. I’m getting tired of people using poor data sources for making assertions on these boards and not double checking before posting. It’s just lazy. If two shares have the exact same dividend payment how on earth can the higher priced one have the higher dividend yield? This is basic maths folks.

Apologies, Sorry if your getting tired of people and that you have to bite your tongue. It must be very stressful for you.

Anyway, you are correct. It was the data source that was incorrect. In my defence, I did check another data source before posting but it this was also wrong. It wasn't until later in the day (at work) that I checked yet again using another data source that the numbers looked correct.

I can assure you that I am not lazy, more, time short. I work very long hours, often 7 days a week.

Regards, D.L.