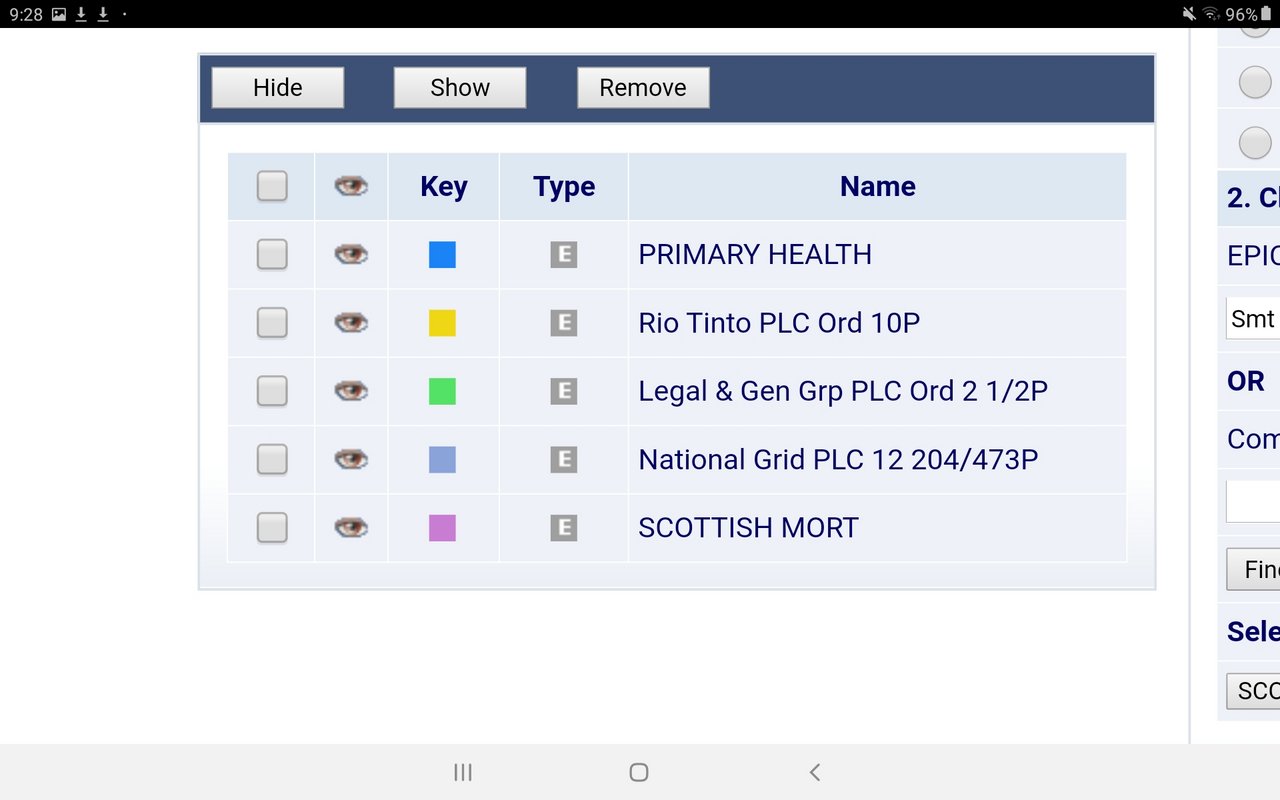

Portfolio acquisition

Primary Health Properties PLC ("PHP" or the "Company"), one of the UK's leading investors in modern primary healthcare facilities, announces that it has acquired a portfolio of 20 purpose-built medical centres, located across England and Wales, for a price of £47.1 million, before costs. As part of the same transaction, PHP has conditionally contracted to acquire a further two medical centres for £6.9 million, before costs.

The acquired properties are leased to GP practices, other NHS healthcare operators and pharmacies, with approximately 91% of the rental income being government backed and substantially all of the leases are reviewed to the open market on a three-yearly cycle.

This acquisition will increase PHP's portfolio in the UK and Ireland to a total of 510 assets with a gross value of just under £2.5 billion and a contracted rent roll of £131 million. Following completion of the portfolio acquisition and capital commitments PHP has undrawn loan facilities and cash totalling £289 million.

https://www.investegate.co.uk/primary-h ... 00103326M/