Highlights

· New investment commitments of c.£850m:

- On 17 November 2021, 3i Infrastructure agreed to invest c.£376 million to acquire 100% of Global Cloud Xchange ('GCX'). GCX is a leading global data communications service provider and owns one of the world's largest private subsea fibre optic networks

- On 3 December 2021, the Company agreed to acquire the 50% stake in ESVAGT owned by its co-investor AMP Capital for c.£258 million. 3i Infrastructure will hold 100% of the equity in ESVAGT upon completion which is expected to take place on 1 February 2022

- On 14 December 2021, 3i Infrastructure completed the c.£191 million acquisition of a 92% stake in SRL Traffic Systems ('SRL'), the market leading traffic management equipment rental company in the UK

- On 16 December 2021, the Company agreed to invest a further c.£21 million into Valorem through a capital increase to fund its growth, raising the Company's stake in Valorem to c.33%

· Successful realisation of Oystercatcher's four European terminals: On 29 October 2021, the Company completed the sale of its 45% stakes in four European liquid storage terminals for proceeds of c.€55 million after debt repayment. 3i Infrastructure continues to hold a 45% stake in Oiltanking Singapore

· Portfolio performing well against the expectations we set in September 2021

· Income as expected in the Period: Total income and non-income cash was in line with expectations at £26 million. This compares with £24 million of income and non-income cash received in the same period last year

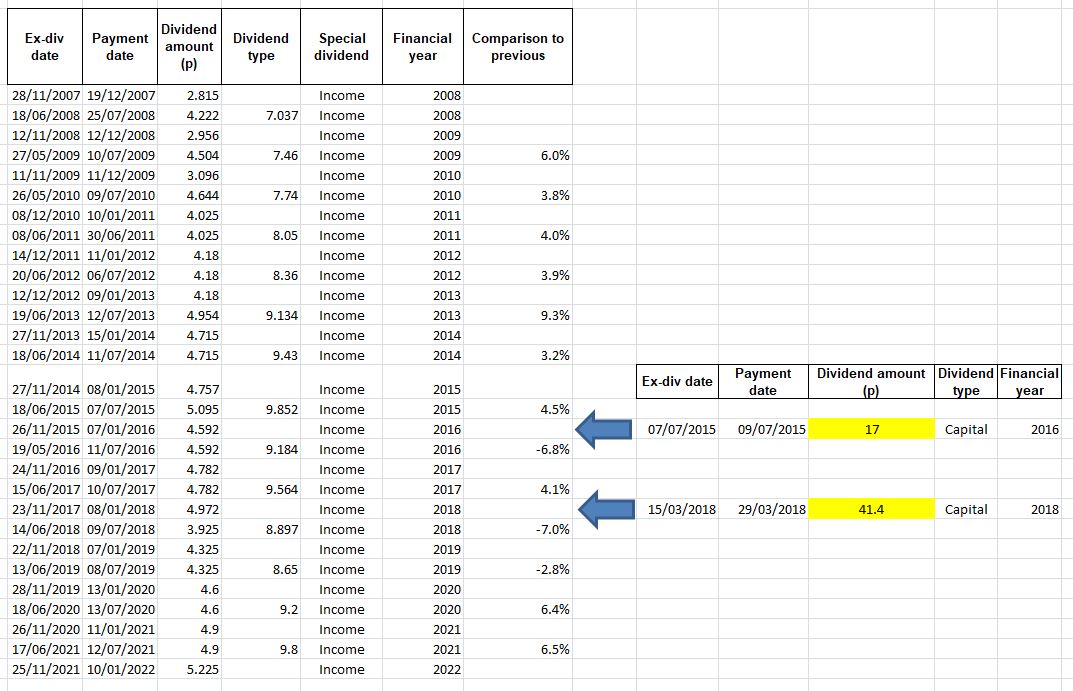

· On-track to meet FY22 dividend target of 10.45 pence per share, a year-on-year increase of 6.6%

https://www.investegate.co.uk/3i-infras ... 00042272A/