Page 2 of 3

Re: Growth Focussed Investment Trusts & Funds

Posted: October 7th, 2019, 4:35 pm

by SoBo65

Dod101 wrote:The trouble with the Conviction 5 is that three of them are firmly in the wealth preservation camp rather than being growth focussed which is what this Board is about.

Independent IT might be worth a look by jonesa1. It is definitely a 'one off' being run by Max Ward and filled with his 'conviction' shares. It is quite volatile but has done well over a long period. Max Ward and the Chairman Douglas McDougall each have a large holding in the trust. If investing for the long term my only concern would be that Ward is getting on a bit and there is no obvious successor that I have heard of.

Dod

I hold this, but got my timing wrong and have currently have a sizeable to loss, but decided to stick with it and have added further. My concern was similar to yours about succession, but took the view that given the Baillie Gifford link (who I value highly), they would come up with the answer.

Re: Growth Focussed Investment Trusts & Funds

Posted: October 7th, 2019, 4:41 pm

by SoBo65

Just been reading about Blue Whale Growth Fund, Has got off to a good start, backed by Peter Hargreaves with £40m invested. Normally prefer IT’s, only exception so far is Fundsmith, but might make another.

https://bluewhale.co.uk/blue-whales-2nd ... gI7A_D_BwE

Re: Growth Focussed Investment Trusts & Funds

Posted: October 7th, 2019, 7:00 pm

by richfool

SoBo65 wrote:Just been reading about Blue Whale Growth Fund, Has got off to a good start, backed by Peter Hargreaves with £40m invested. Normally prefer IT’s, only exception so far is Fundsmith, but might make another.

https://bluewhale.co.uk/blue-whales-2nd ... gI7A_D_BwE

I am wary of new products. Whilst I like the name, I do hope this doesn't turn out to be the Damp Squid fund.

Excuse my indulgence.

Re: Growth Focussed Investment Trusts & Funds

Posted: October 9th, 2019, 8:36 am

by SoBo65

SoBo65 wrote:jonesa1 wrote:Other than Scottish Mortgage, Smithson Finsbury and Lindsell Train, are there any ITs which hold a concentrated / conviction portfolio? One similar to Lindsell Train Global Equity (without the LTI premium) would be useful.

One that I hold is Manchester and London Investment Trust MNL, does not get much publicity (maybe a low marketing budget!), came to my attention when mentioned in the Daily telegraph a few year back when on a larger discount than now.

A rare bit of media comment:

https://citywire.co.uk/investment-trust ... r/jcarthew

Re: Growth Focussed Investment Trusts & Funds

Posted: October 28th, 2019, 10:59 pm

by midgesgalore

Re: Growth Focussed Investment Trusts & Funds

Posted: December 28th, 2019, 10:09 pm

by johnstevens77

Nobody has mentioned smaller companies IT's. I bought Blackrock Throgmorton Trust for growth and it has doubled in the less than 3 years since I purchased. Other contenders could be Blackrock Smaller Companies, (BRSC) and Henderson Smaller Companies, (HSL).

john

Re: Growth Focussed Investment Trusts & Funds

Posted: December 29th, 2019, 7:53 am

by jackdaww

johnstevens77 wrote:Nobody has mentioned smaller companies IT's.

john

=======================

also invesco smaller IPU , standard life SLS , montanaro MTU and aberforth ASL .

these being more medium sized .

Re: Growth Focussed Investment Trusts & Funds

Posted: January 8th, 2020, 11:08 am

by richfool

Other UK growth trusts focusing on mid caps should include: Mercantile and JP Morgan Mid Cap (JMF).

From the smaller coy stable SLS looks favourite.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 12:52 pm

by scotia

OK - How did Global Growth Funds Trusts & Funds fare during the recent downturn? I have had a look at my collection (most of which are shared by some of the other contributors), and I have also added Mid Wind which I am considering. I was interested was to see how they have coped over the past 3 months , and check this volatility against the 5 year record. I have copied over the total return numbers below from Hargreaves Lansdown today (hopefully without making any errors). The order is alphabetical.

My first thoughts are of relief - the high performers stood up well to the downturn. However the numbers would have been a bit more worrying around mid-March, when drops of around 30% were experienced. So there may be more trouble ahead - but so far, so good

In such downturns, I usually am more concerned with smaller company investments - but Edinburgh WorldWide which is biased towards the mid to smaller end global companies (market cap less than $5B) seems to have coped well.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 1:21 pm

by Dod101

You could have added Finsbury Growth & Income, where the share price did not change between end of January and the end of April.

Dod

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 1:57 pm

by Aminatidi

ReallyVeryFoolish wrote:The high performing growth trusts/funds have done remarkably well. In the main, the formerly high risk tech stocks (Amazon, Microsoft, Facebook, Apple etc) seem to be morphing into the 21st century version of virtual monopoly utilities. Much to my frustration, I spent much of the last two years or so moving about half my money out of the growth/TR sectors into a small what I percieved to be, good quality income stocks. The result? I would have been much, much better off (I mean MUCH better off) if I hadn't bothered and simply generated a pseudo income from a fully growth/TR portfolio. A saultory lesson that means I have had to move beyond Plan B into Plan C for my upcoming retirement. Had I done nothing, I would still be on Plan A.

RVF.

If you don't mind me asking why did you do that?

I know Terry Smith is a bit marmite for some people but he's always been very vocal around investing for income versus investing for total return and drawing when you need to.

Sad to say for those who have done the former the latter appears to be the more fruitful route looking at current events around dividends.

Incidentally I did wonder if Scottish American should be in the table above? Reasonably mix of growth and income.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 2:13 pm

by Aminatidi

ReallyVeryFoolish wrote:Aminatidi wrote:ReallyVeryFoolish wrote:The high performing growth trusts/funds have done remarkably well. In the main, the formerly high risk tech stocks (Amazon, Microsoft, Facebook, Apple etc) seem to be morphing into the 21st century version of virtual monopoly utilities. Much to my frustration, I spent much of the last two years or so moving about half my money out of the growth/TR sectors into a small what I percieved to be, good quality income stocks. The result? I would have been much, much better off (I mean MUCH better off) if I hadn't bothered and simply generated a pseudo income from a fully growth/TR portfolio. A saultory lesson that means I have had to move beyond Plan B into Plan C for my upcoming retirement. Had I done nothing, I would still be on Plan A.

RVF.

If you don't mind me asking why did you do that?I know Terry Smith is a bit marmite for some people but he's always been very vocal around investing for income versus investing for total return and drawing when you need to.

Sad to say for those who have done the former the latter appears to be the more fruitful route looking at current events around dividends.

Incidentally I did wonder if Scottish American should be in the table above? Reasonably mix of growth and income.

My bold emphasis. Well, it seemed like a good idea at the time to generate an income from my SIPP/ISA portfolio using what I perceived as high quality company dividends. It seemed I had pretty much won the game from a growth/TR perspective.

FWIW, yes I am a huge Smith fan. I still hold almost half my total portfolio in

Fundsmith and Smithson plus

Blue Whale fund which is rather Smith-esque but complimentary in a number of ways (Amazon in Blue Whale for example).

RVF.

Yes I'm very much battling my own greed v fear instincts in where to position myself during all of this

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 3:51 pm

by scotia

Dod101 wrote:You could have added Finsbury Growth & Income, where the share price did not change between end of January and the end of April.

Dod

Yes - that table had the Global Investments. My purely UK investments have not performed nearly as well. I must get round to drawing up a relevant table.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 4:00 pm

by scotia

ReallyVeryFoolish wrote:The high performing growth trusts/funds have done remarkably well. In the main, the formerly high risk tech stocks (Amazon, Microsoft, Facebook, Apple etc) seem to be morphing into the 21st century version of virtual monopoly utilities. Much to my frustration, I spent much of the last two years or so moving about half my money out of the growth/TR sectors into a small what I percieved to be, good quality income stocks. The result? I would have been much, much better off (I mean MUCH better off) if I hadn't bothered and simply generated a pseudo income from a fully growth/TR portfolio. A saultory lesson that means I have had to move beyond Plan B into Plan C for my upcoming retirement. Had I done nothing, I would still be on Plan A.

RVF.

The problem is that successful investing requires a very accurate forward predictor - i.e. an infallible crystal ball. Alternatively it requires a lot of luck. Your reasoning seemed sound, and certainly would have been in the dot-com boom, but this time it was a different set of unseen circumstances. I'm still very wary over what happens in the next five years, with major disruptions to the operation of world economies, and huge government debts.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 5:07 pm

by scotia

Following on from my earlier (personal) Global Growth Table, I have now had a look at my UK-based growth investments. I have tended to lean heavily on Smaller Companies for growth, but have gradually moved more into larger Caps - feeling (i.e. guessing) that they may be safer in this part of the investment cycle. So here are a few of my eclectic mix - with a couple of trackers as a reference. I also have included some mixed Income & Growth ITs which I possess. As previously I have copied over the total return numbers from Hargreaves Lansdown today (hopefully without making any errors). The order is alphabetical.

Over the 5 year period, the Small Cap investments have performed best - but at a cost of recent substantial falls. The Finsbury and the Lindsell Train investments are effectively IT and OEIC versions of the same funds - which I have built up separately for historical reasons. In the current circumstance I think they are probably my best choices. The defensive Troy Income & Growth has provided some volatility protection and better growth than the trackers. But in summary - I have not discovered any purely UK funds to match the performance of a number of the Global Growth Funds listed in my previous table. Other UK Growth recommendations are welcome!

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 5:48 pm

by jackdaww

ReallyVeryFoolish wrote:The high performing growth trusts/funds have done remarkably well. In the main, the formerly high risk tech stocks (Amazon, Microsoft, Facebook, Apple etc) seem to be morphing into the 21st century version of virtual monopoly utilities. Much to my frustration, I spent much of the last two years or so moving about half my money out of the growth/TR sectors into a small what I percieved to be, good quality income stocks. The result? I would have been much, much better off (I mean

MUCH better off) if I hadn't bothered

and simply generated a pseudo income from a fully growth/TR portfolio

. A saultory lesson that means I have had to move beyond Plan B into Plan C for my upcoming retirement. Had I done nothing, I would still be on Plan A.

RVF.

============

agreed , simple and obvious to me ..

and such a portfolio might include some high yielding stocks - such as legal & general , glaxo etc ..

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 6:50 pm

by Dod101

scotia wrote:

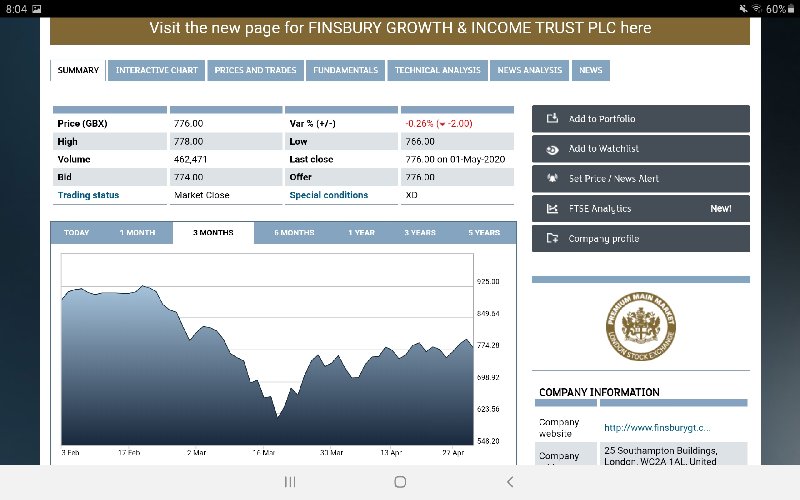

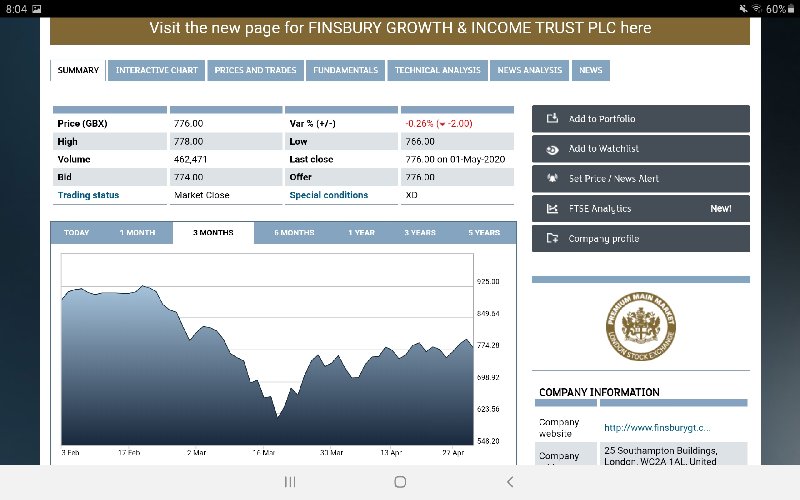

I am surprised that you show Finsbury Growth and Income as -11.7% over the three months because I have recorded the share price as £7.76 at end January and the same at end April with a dip in between. I never really think of it as a UK trust because most of the investments are overseas traders and there are a number of overseas companies as well but I guess it is not a Global Trust, but it is very different from say City of London that is so often quoted.

Dod

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 7:09 pm

by scotia

Dod101 wrote:scotia wrote:

I am surprised that you show Finsbury Growth and Income as -11.7% over the three months because I have recorded the share price as £7.76 at end January and the same at end April with a dip in between. I never really think of it as a UK trust because most of the investments are overseas traders and there are a number of overseas companies as well but I guess it is not a Global Trust, but it is very different from say City of London that is so often quoted.

Dod

I have had a look at a different graph (but still with Hargreaves Lansdown), where the January price seems to be 889p, and the 30th April price seems to be 778p. In between there was an 8p dividend so this gives a drop of 11.6% - in agreement with the total return figure. Are we looking at the same IT? I'm looking at FGT. I'll have a look later at a different source.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 8:03 pm

by monabri

FGT total return , recent data. Dipped to -30%, mid-March , now at -11% (ish). Source Hargreaves Lansdown.

Shareprice only from LSE.

Re: Growth Focussed Investment Trusts & Funds

Posted: May 3rd, 2020, 8:49 pm

by Dod101

scotia

Looking again I think your numbers are correct. I keep weekly records of prices and it held quite firm at around £9 least until 22 February when it began to weaken a bit. At the end of April it was around £7.76 so it look as if I was rambling. Sorry. I think your numbers are about right. Still not a bad result though.

Dod