Page 1 of 1

Schiehallion Fund

Posted: October 5th, 2021, 9:55 pm

by diy12751

Hi, Just wondering if anyone knows much or has invested in the Schiellion fund. Established 2 years ago and run by Baillie Gifford with two primary aims:

- Investing in companies privately and benefiting from value creation up to the point where those businesses choose to list.

- Continuing to own those businesses once they list and in so doing, enjoy the benefit of further growth and compounding returns.

BG argue that companies are now waitng longer to offer IPO and thus are giving access to regular investors to invest in these companies in an earlier stage. OCF of 0.77% for private equity is certainly competitive. Performance has been impressive as well:

2 years 112.77%

1 year 90.11%

6 months 38.89%

3 months 32.98%

1 month 10.62%

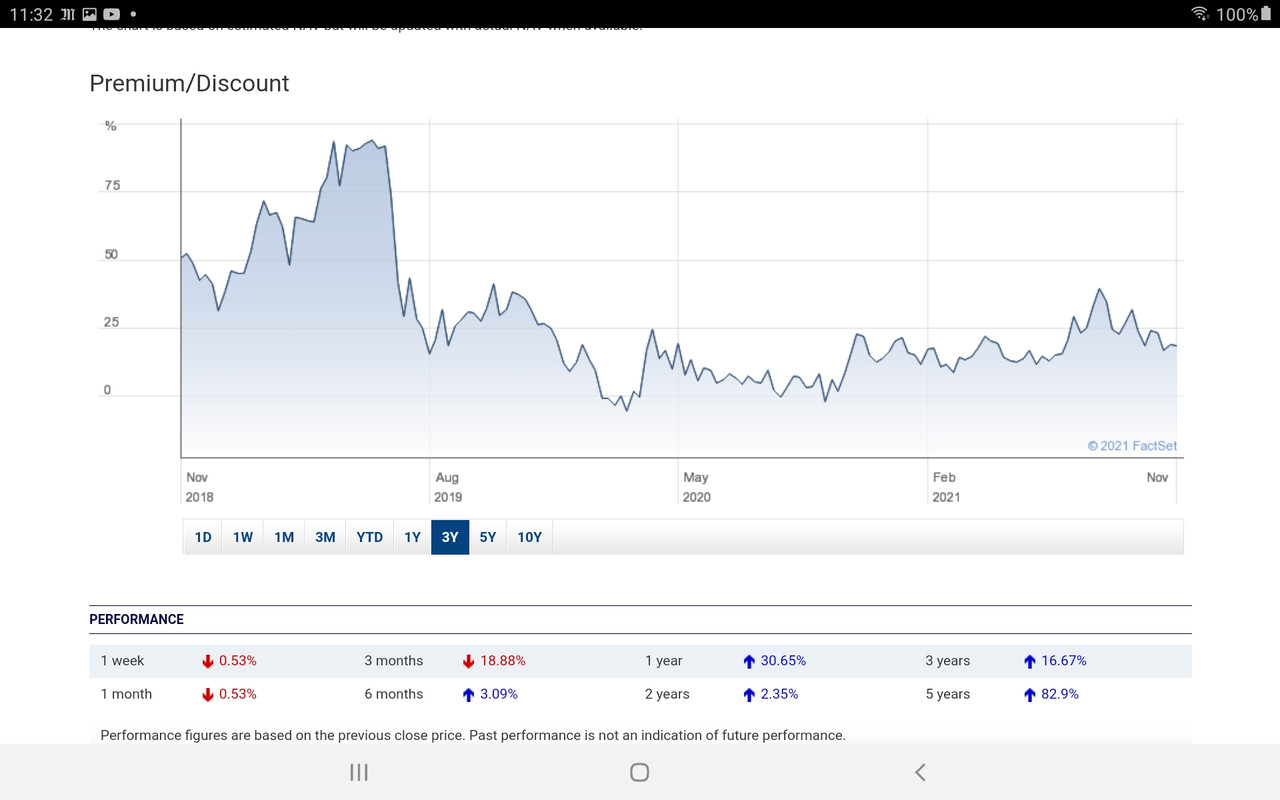

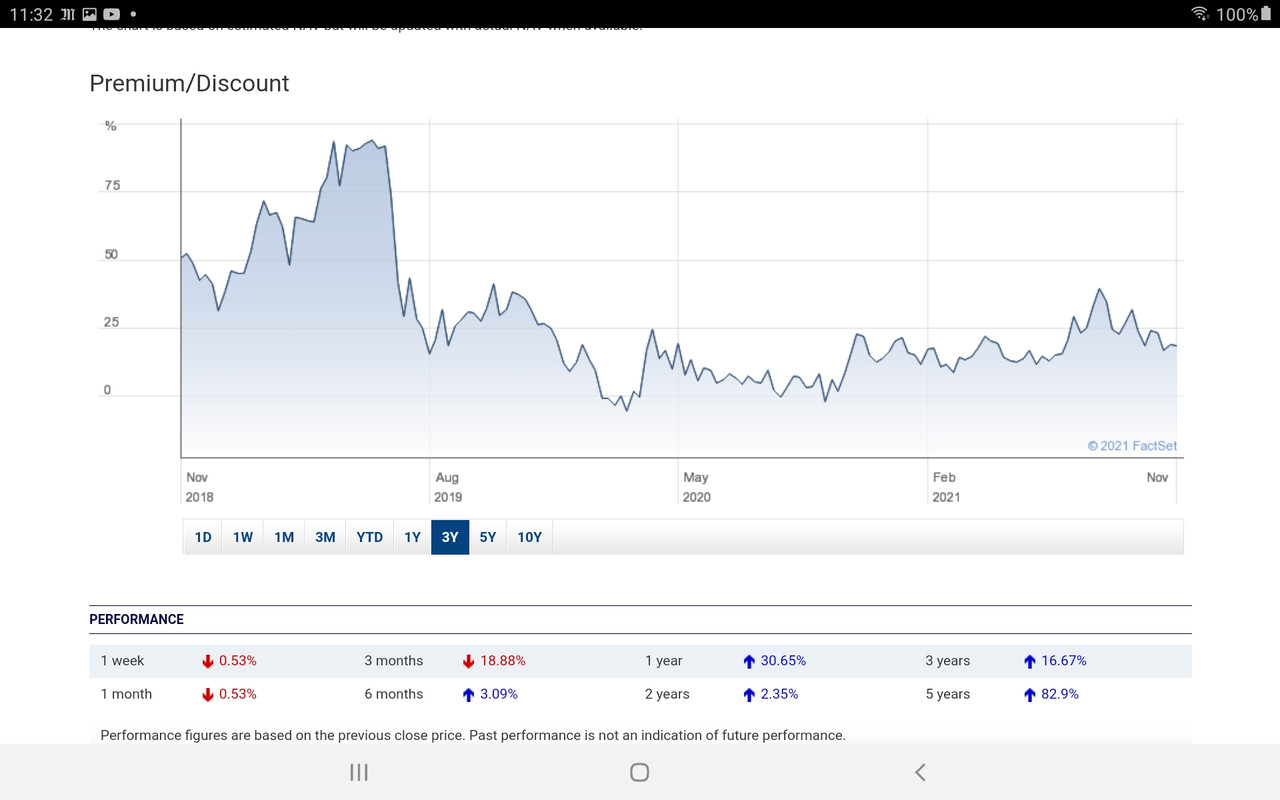

However has a ridiculous premium in my opinion of 37.42%. Any thoughts?

Re: Schiehallion Fund

Posted: October 5th, 2021, 10:00 pm

by Dod101

When you say 'regular investors' do you mean retail investors? There was a thread on this fund last year I think and at that time it was open only to institutional investors. You could try to find it.

Certainly as you say the premium looks ridiculous but with results like these..........

Dod

Re: Schiehallion Fund

Posted: October 5th, 2021, 10:14 pm

by diy12751

Hi thanks for the reply. I will try and find that thread. Yes ordinary share now available for retail investors on interactive investor! Premium appears steep IMHO but as you said maybe thats the price you have to pay if you want in. Certainly theres been no shortage of money influx with Schiehallion Fund Ord raising the most amount of money in secondary funding, totalling £503 million this year.

Re: Schiehallion Fund

Posted: October 7th, 2021, 10:13 am

by TUK020

diy12751 wrote:Hi, Just wondering if anyone knows much or has invested in the Schiellion fund. Established 2 years ago and run by Baillie Gifford with two primary aims:

- Investing in companies privately and benefiting from value creation up to the point where those businesses choose to list.

- Continuing to own those businesses once they list and in so doing, enjoy the benefit of further growth and compounding returns.

BG argue that companies are now waitng longer to offer IPO and thus are giving access to regular investors to invest in these companies in an earlier stage. OCF of 0.77% for private equity is certainly competitive. Performance has been impressive as well:

2 years 112.77%

1 year 90.11%

6 months 38.89%

3 months 32.98%

1 month 10.62%

However has a ridiculous premium in my opinion of 37.42%. Any thoughts?

Question: If a significant portion of the fund is in pre-listed companies, how is the NAV determined? Does this mean that the premium/discount figure does not necessarily reflect reality?

Re: Schiehallion Fund

Posted: October 7th, 2021, 10:19 am

by Dod101

TUK020 wrote:diy12751 wrote:Hi, Just wondering if anyone knows much or has invested in the Schiellion fund. Established 2 years ago and run by Baillie Gifford with two primary aims:

- Investing in companies privately and benefiting from value creation up to the point where those businesses choose to list.

- Continuing to own those businesses once they list and in so doing, enjoy the benefit of further growth and compounding returns.

BG argue that companies are now waitng longer to offer IPO and thus are giving access to regular investors to invest in these companies in an earlier stage. OCF of 0.77% for private equity is certainly competitive. Performance has been impressive as well:

2 years 112.77%

1 year 90.11%

6 months 38.89%

3 months 32.98%

1 month 10.62%

However has a ridiculous premium in my opinion of 37.42%. Any thoughts?

Question: If a significant portion of the fund is in pre-listed companies, how is the NAV determined? Does this mean that the premium/discount figure does not necessarily reflect reality?

That did strike me as well. Presumably the declared NAV is considered very conservative by the market (as we would expect from Baillie Gifford) and the market is putting a value on the assets based on some assessment of the likely price on listing. Not one for widows and orphans by the sound of it.

Dod

Re: Schiehallion Fund

Posted: October 8th, 2021, 8:53 am

by JohnnyCyclops

Interesting. Guernsey registered, denominated in dollars possibly.

https://www.trustnet.com/factsheets/t/q ... ed-ord-npv

Re: Schiehallion Fund

Posted: November 3rd, 2021, 11:42 am

by monabri

Current premium on MNTN ~28%.

source :

https://www.hl.co.uk/shares/shares-sear ... ed-ord-npvI was reminded of Lindsell Train Investment ( LTI) which traded at very high premiums (~90%) at one time (and a hefty premium persists today).

source:

https://www.hl.co.uk/shares/shares-sear ... st-ord-75p ( 5 year view )

Edit. I note from the Trusnet factsheet ( see post by JC above) that MNTN's gearing is 80%. That's pretty high!