1 IF full reporting is required, HMRC clearly explain what's needed.

2 When full reporting is not required, HMRC seem much more vague.

We don't need a IHT400 or a IHT421.

An IHT207 is not applicable for our case.

So I figured I'd go through the probate form until we get to a page where it demands an IHT form.

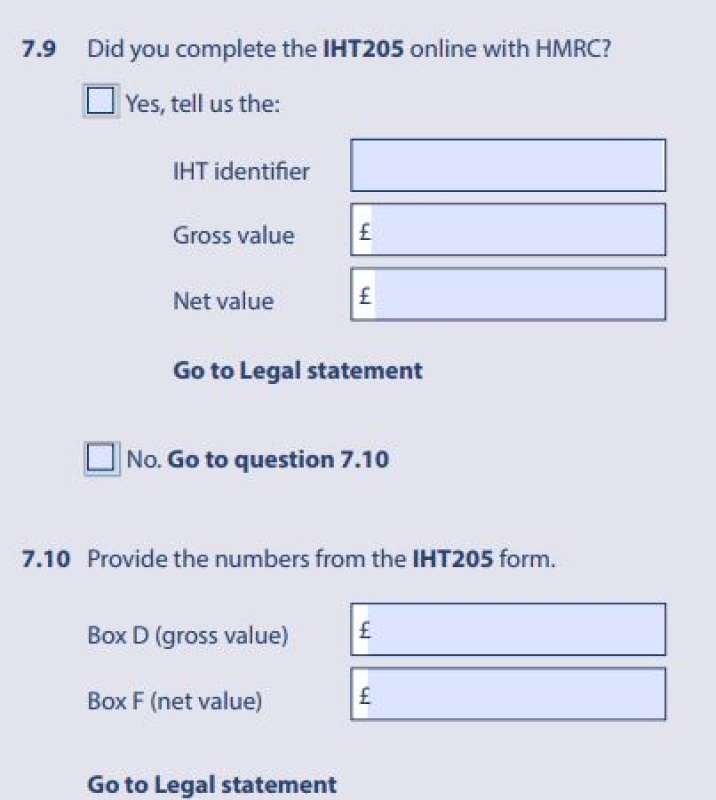

In section 7.9 (below), it asks have we filled in an IHT205.

At the moment, the answer is NO, as at the top of IHT205, it says use this form only for deaths before 1 Jan 2022.

Then section 7.10 asks for the figures from the IHT205 form. That's the form we don't need to fill in for deaths after 1 Jan 2022 !!

Am I to deduce we need to complete an IHT205, despite IHT saying we don't need it ? Effectively calculating the values according to the method in form IHT205, but with no requirement to submit it ?

This job would be a lot easier if they simply told us which form is needed.

[/URL]

[/URL]