Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Keeping drawdown below tax threshold?

-

Darka

- Lemon Slice

- Posts: 773

- Joined: November 4th, 2016, 2:18 pm

- Has thanked: 1819 times

- Been thanked: 705 times

Keeping drawdown below tax threshold?

Seeing the recent dividend drawdown question from Gilgongo made me want to ask a question that's been on my mind as I consider what to do when I can access my SIPP in September 2024.

Gilongo's post:

viewtopic.php?f=30&t=38993

If we don't care about leaving an inheritance (no kids), apart from leaving what is left to a museum or whatever after we both die; is it worth reducing your drawdown amount to prevent paying tax?

For instance, my SIPP's income will be above the personal allowance, I could reduce this by taking the 25% and reinvesting in ISA's but even after taking the 25% the income will be above the personal allowance, or I could take higher UFPLS payments and only a small upfront 25% for a new kitchen.

Going forwards, I could then reduce my drawdown to stick to the personal allowance, thus avoiding tax but I can't see the point as that money would be stuck in the SIPP instead of being available to spend/invest in ISA's as I choose.

So, is there any advantage that I am missing of deliberately avoiding tax or is maximising income (and paying some tax) more important (as I believe)?

Obviously, I'd prefer to pay zero income tax, as I have since I retired but it seems obvious to take as much income as you can, especially as this would be the natural yield.

Gilongo's post:

viewtopic.php?f=30&t=38993

If we don't care about leaving an inheritance (no kids), apart from leaving what is left to a museum or whatever after we both die; is it worth reducing your drawdown amount to prevent paying tax?

For instance, my SIPP's income will be above the personal allowance, I could reduce this by taking the 25% and reinvesting in ISA's but even after taking the 25% the income will be above the personal allowance, or I could take higher UFPLS payments and only a small upfront 25% for a new kitchen.

Going forwards, I could then reduce my drawdown to stick to the personal allowance, thus avoiding tax but I can't see the point as that money would be stuck in the SIPP instead of being available to spend/invest in ISA's as I choose.

So, is there any advantage that I am missing of deliberately avoiding tax or is maximising income (and paying some tax) more important (as I believe)?

Obviously, I'd prefer to pay zero income tax, as I have since I retired but it seems obvious to take as much income as you can, especially as this would be the natural yield.

-

kempiejon

- Lemon Quarter

- Posts: 3650

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1221 times

Re: Keeping drawdown below tax threshold?

I'd work out how much I wanted as an income then work out a tax efficient way of extracting it. Deliberately curtailing income and the experiences and things that could come with that money to avoid paying tax on it seems a hair shirt.

I'm still a bit off drawing on my portofoio but when I do and before taking state pension, I'll extract the full 25% from the SIPP first year and invest that perhaps into a move or at least clearing the mortgage and topping up ISAs. I'd also draw an annual income from the SIPP to keep me out of paying any tax (£12570 or equivalent) and take the balance of what I needed from the ISA or unsheltered investments there by avoiding tax. The state pension would lead to a rethink but that's a still a way off when tax seems more likely but will probaly leave me more money that I currently think I need.

I'm still a bit off drawing on my portofoio but when I do and before taking state pension, I'll extract the full 25% from the SIPP first year and invest that perhaps into a move or at least clearing the mortgage and topping up ISAs. I'd also draw an annual income from the SIPP to keep me out of paying any tax (£12570 or equivalent) and take the balance of what I needed from the ISA or unsheltered investments there by avoiding tax. The state pension would lead to a rethink but that's a still a way off when tax seems more likely but will probaly leave me more money that I currently think I need.

-

SebsCat

- 2 Lemon pips

- Posts: 229

- Joined: July 22nd, 2022, 12:09 pm

- Has thanked: 112 times

- Been thanked: 117 times

Re: Keeping drawdown below tax threshold?

As you've gathered, not taking cash from the SIPP merely so you don't pay income tax is pointless - there's no benefit to you if you don't ever access it! I would just look at it is seeking to minimise the tax paid rather than avoid it. So it makes sense to withdraw up to any unused personal allowance regardless of whether you need it or not. If you're going to want to withdraw a significant amount then split it over two (or more) years if you can so you don't end up paying 40% on some of it. That sort of thing.

Re the IHT aspect, if you die before 75 then the SIPP can be taken tax free by whoever you leave it to. That's a potentially useful aspect for couples even if childless. That said, IHT treatment of SIPPs is bound to come under scrutiny at some point.

Re the IHT aspect, if you die before 75 then the SIPP can be taken tax free by whoever you leave it to. That's a potentially useful aspect for couples even if childless. That said, IHT treatment of SIPPs is bound to come under scrutiny at some point.

-

BullDog

- Lemon Quarter

- Posts: 2504

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2026 times

- Been thanked: 1223 times

Re: Keeping drawdown below tax threshold?

Personally, I absolutely would not compromise my standard of living or do without something just to avoid paying tax. You don't know how long you are going to be around able to enjoy retirement.

On the other hand if there's other means of financing lifestyle then minimising tax take is a perfectly sensible decision to make.

On the other hand if there's other means of financing lifestyle then minimising tax take is a perfectly sensible decision to make.

-

Darka

- Lemon Slice

- Posts: 773

- Joined: November 4th, 2016, 2:18 pm

- Has thanked: 1819 times

- Been thanked: 705 times

Re: Keeping drawdown below tax threshold?

Thanks all,

Backs up what I was thinking, will obviously reduce tax as much as possible but can't avoid it, trying to by reducing income is a pointless thing to do.

Good point on the inheritance of SIPP before 75.

Backs up what I was thinking, will obviously reduce tax as much as possible but can't avoid it, trying to by reducing income is a pointless thing to do.

Good point on the inheritance of SIPP before 75.

-

Alaric

- Lemon Half

- Posts: 6126

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 21 times

- Been thanked: 1427 times

Re: Keeping drawdown below tax threshold?

kempiejon wrote: take the balance of what I needed from the ISA or unsheltered investments there by avoiding tax.

CGT permitting, it probably makes sense to run down the unsheltered investments in preference to withdrawing from the tax shelter of the ISA. It's a an implicit Bed and ISA if instead of taking dividends out of the ISA, you leave them in there and take an equivalent amount from taxable investments.

-

nmdhqbc

- Lemon Slice

- Posts: 634

- Joined: March 22nd, 2017, 10:17 am

- Has thanked: 112 times

- Been thanked: 226 times

Re: Keeping drawdown below tax threshold?

if you don't care about inheritance tax and you have a lot in the SIPPs where it's unlikely you'd empty them not paying tax then it's really a balancing act. avoiding basic rate tax in the earlier years has 2 possible results - you never spend any of what's left over or you need to spend it and you have to take it all out hitting higher rates in those latter years. no upside there to either. so maybe it's best to take the hit all the way with basic rate tax if the numbers and projections dictate it. hard to predict the optimum levels though without a crystal ball telling you what markets do. I suppose you could at least put the lower expected long term returns investments in the SIPPs so they stand the best chance of staying smaller while the ISAs grow more. only if you planned on holding those investments anyway. don't let the tax tail wag the investment dog. so if you have a certain bond allocation in retirement maybe put most of it in the SIPPs.

-

1nvest

- Lemon Quarter

- Posts: 4591

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 730 times

- Been thanked: 1453 times

Re: Keeping drawdown below tax threshold?

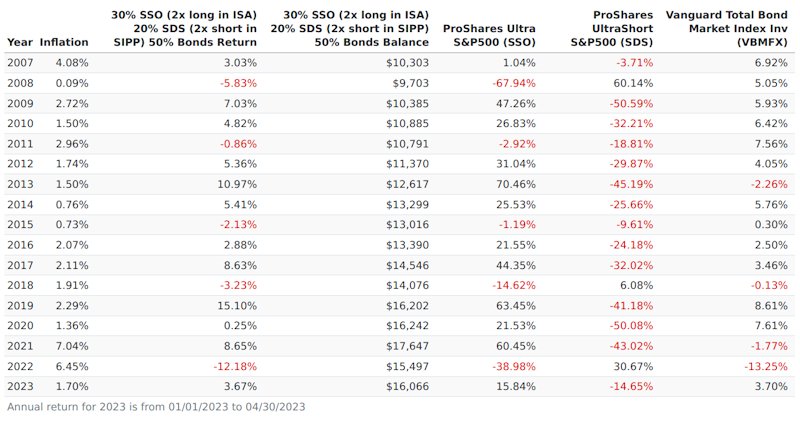

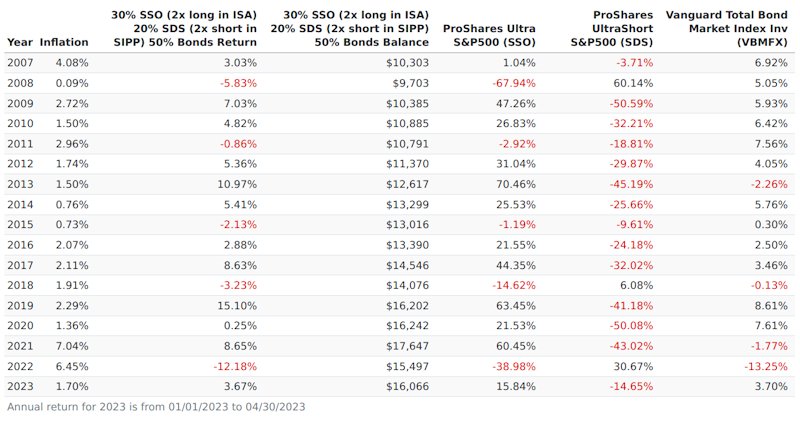

There's always the option of a UK version of this sort of US version

Tax exempt on the way in (SIPP), tax exempt on the way out (ISA)

Can backfire in some years, 2008 for example, SIPP expansion of +60%, but the next couple of years saw that reversed by -50% and -32% (1.0 -> 1.6 -> 0.8 -> 0.5) ... so potentially SIPP value halved in a bad case 3 years. In other cases SIPP value might be halved after just a single year.

Adjust the tilts as you see fit, the above is more for a broadly inflation pacing overall portfolio type choice. You might scale up stock exposure with the likes of 50/20/30 2x long/2x short/bonds ... or whatever you might deem to be appropriate.

2UKL and 2UKS (WisdomTree) for instance as possible ETF's (2UKL in ISA, 2UKS in SIPP).

Tax exempt on the way in (SIPP), tax exempt on the way out (ISA)

Can backfire in some years, 2008 for example, SIPP expansion of +60%, but the next couple of years saw that reversed by -50% and -32% (1.0 -> 1.6 -> 0.8 -> 0.5) ... so potentially SIPP value halved in a bad case 3 years. In other cases SIPP value might be halved after just a single year.

Adjust the tilts as you see fit, the above is more for a broadly inflation pacing overall portfolio type choice. You might scale up stock exposure with the likes of 50/20/30 2x long/2x short/bonds ... or whatever you might deem to be appropriate.

2UKL and 2UKS (WisdomTree) for instance as possible ETF's (2UKL in ISA, 2UKS in SIPP).

-

EthicsGradient

- Lemon Slice

- Posts: 615

- Joined: March 1st, 2019, 11:33 am

- Has thanked: 35 times

- Been thanked: 250 times

Re: Keeping drawdown below tax threshold?

With all due respect, 1nvest, I can't see what that table has to do with a discussion on how to optimise withdrawals from SIPPs and ISAs, keeping an eye on tax. It appears to be an investment strategy (though what the overall suggestion from it is, I can't work out), with nothing about withdrawal, or tax.

-

1nvest

- Lemon Quarter

- Posts: 4591

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 730 times

- Been thanked: 1453 times

Re: Keeping drawdown below tax threshold?

OK to make it even simpler, say at the end of 2020 you had £167K in SIPP, that you could partner with £250K in ISA, and a further £417K in a general account or as a additional amount in ISA (or even SIPP).

Year start 2021

SIPP holding £167K invested in 2UKS (20% invested into 2x short stock)

ISA holding £250K invested in 2UKL (30% invested into 2x long stock)

£417K additionally invested in IGLS (50% invested into short term gilt fund)

£834K total

Year end 2021

SIPP 2UKS value £113K

ISA 2UKL value £336K

IGLS value £408K

£857K total

Collectively +2.76% (+£23K), and where SIPP value was down from £167K to £113K (£54K less), whilst ISA 2UKL was up from £250K to £336K (+86K more). Or thereabouts. Year end SIPP value around 66% of its year start value.

Indirectly the same as having withdrawn/migrated £54K from SIPP into ISA and where that ISA money might be drawn/spent without any taxable event being triggered, or just left in ISA and drawing other non taxable 'income' amounts as-and-when.

Year start 2021

SIPP holding £167K invested in 2UKS (20% invested into 2x short stock)

ISA holding £250K invested in 2UKL (30% invested into 2x long stock)

£417K additionally invested in IGLS (50% invested into short term gilt fund)

£834K total

Year end 2021

SIPP 2UKS value £113K

ISA 2UKL value £336K

IGLS value £408K

£857K total

Collectively +2.76% (+£23K), and where SIPP value was down from £167K to £113K (£54K less), whilst ISA 2UKL was up from £250K to £336K (+86K more). Or thereabouts. Year end SIPP value around 66% of its year start value.

Indirectly the same as having withdrawn/migrated £54K from SIPP into ISA and where that ISA money might be drawn/spent without any taxable event being triggered, or just left in ISA and drawing other non taxable 'income' amounts as-and-when.

-

nmdhqbc

- Lemon Slice

- Posts: 634

- Joined: March 22nd, 2017, 10:17 am

- Has thanked: 112 times

- Been thanked: 226 times

Re: Keeping drawdown below tax threshold?

1nvest wrote:OK to make it even simpler

it would help people understand if you actually put in words what you are doing. you've again just jumped in with a load of numbers with no contexts. i think i've deciphered it but in another moment i could well have missed what the point was... you're suggesting a structure/portfolio where the returns might be similar overall but result in the SIPP going down in value over time? is that right? you putting in your own word would help a lot since i'm just guessing here.

-

hiriskpaul

- Lemon Quarter

- Posts: 3963

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 726 times

- Been thanked: 1585 times

Re: Keeping drawdown below tax threshold?

1nvest wrote:There's always the option of a UK version of this sort of US version

Tax exempt on the way in (SIPP), tax exempt on the way out (ISA)

Can backfire in some years, 2008 for example, SIPP expansion of +60%, but the next couple of years saw that reversed by -50% and -32% (1.0 -> 1.6 -> 0.8 -> 0.5) ... so potentially SIPP value halved in a bad case 3 years. In other cases SIPP value might be halved after just a single year.

Adjust the tilts as you see fit, the above is more for a broadly inflation pacing overall portfolio type choice. You might scale up stock exposure with the likes of 50/20/30 2x long/2x short/bonds ... or whatever you might deem to be appropriate.

2UKL and 2UKS (WisdomTree) for instance as possible ETF's (2UKL in ISA, 2UKS in SIPP).

Interesting, but how does it compare with ungeared 20/80 in the SIPP and 80/20 in the ISA?

-

EthicsGradient

- Lemon Slice

- Posts: 615

- Joined: March 1st, 2019, 11:33 am

- Has thanked: 35 times

- Been thanked: 250 times

Re: Keeping drawdown below tax threshold?

1nvest wrote:OK to make it even simpler, say at the end of 2020 you had £167K in SIPP, that you could partner with £250K in ISA, and a further £417K in a general account or as a additional amount in ISA (or even SIPP).

Year start 2021

SIPP holding £167K invested in 2UKS (20% invested into 2x short stock)

ISA holding £250K invested in 2UKL (30% invested into 2x long stock)

£417K additionally invested in IGLS (50% invested into short term gilt fund)

£834K total

Year end 2021

SIPP 2UKS value £113K

ISA 2UKL value £336K

IGLS value £408K

£857K total

Collectively +2.76% (+£23K), and where SIPP value was down from £167K to £113K (£54K less), whilst ISA 2UKL was up from £250K to £336K (+86K more). Or thereabouts. Year end SIPP value around 66% of its year start value.

Indirectly the same as having withdrawn/migrated £54K from SIPP into ISA and where that ISA money might be drawn/spent without any taxable event being triggered, or just left in ISA and drawing other non taxable 'income' amounts as-and-when.

Looking at long-term performance of 2UKL (ie about 10 years), it seems to be no better than the total return of a FTSE 100 ETF, despite both growing - the leverage seems to get swallowed up in the extra costs. See https://www2.trustnet.com/Tools/Chartin ... KSJZ,FKSKB

Long-term investing in both leveraged long and short funds on the same index seems like a way of giving money to investment firms, rather than governments (who at least do some good with it - education, NHS, defence, police etc.).

-

Urbandreamer

- Lemon Quarter

- Posts: 3251

- Joined: December 7th, 2016, 9:09 pm

- Has thanked: 368 times

- Been thanked: 1075 times

Re: Keeping drawdown below tax threshold?

Darka wrote:Backs up what I was thinking, will obviously reduce tax as much as possible but can't avoid it, trying to by reducing income is a pointless thing to do.

Pointless? Well doesn't that rather depend upon your assumptions.

There is the old chestnut about those paying IHT loving the government more than their fellow man. Personally I have ideological issues with taxation.

Not paying tax need not be about picking an optimal financial position for me.

Of course some people feel the reverse. Merryn Sommerset Webb believes that we should not chose where we give our money, but leave that choice to the government. Best illustrated by her decision to not use gift aid and encouraging others not to either.

https://www.google.com/search?q=Merryn+ ... s-wiz-serp

As it happens I do have children who I can leave stuff to (charity begins at home), but were that not the case I'd still rather that the money didn't go to the government.

-

James

- Lemon Slice

- Posts: 296

- Joined: November 4th, 2016, 3:12 pm

- Has thanked: 69 times

- Been thanked: 112 times

Re: Keeping drawdown below tax threshold?

Urbandreamer wrote:Darka wrote:Backs up what I was thinking, will obviously reduce tax as much as possible but can't avoid it, trying to by reducing income is a pointless thing to do.

Pointless? Well doesn't that rather depend upon your assumptions.

As it happens I do have children who I can leave stuff to (charity begins at home), but were that not the case I'd still rather that the money didn't go to the government.

I've never understood this 'don't give money to the government' thing.

Why not just say: I don't give a toss about free healthcare for everyone, or I don't mind what quality the road and rail system is, or I'll take my own bins to the dump?

The 'government' is not taking your money to bolster it's personal or corporate finances. It is taking it to provide the services that we all rely on.

Yes, anyone can point to a number of those services that do not directly impact them. In my case, I don't have children so why should I pay for education but I'm not such a libertarian tosspot that I don't recognise the importance of education being paid for by the 'government'.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Keeping drawdown below tax threshold?

Urbandreamer wrote:Darka wrote:Backs up what I was thinking, will obviously reduce tax as much as possible but can't avoid it, trying to by reducing income is a pointless thing to do.

Pointless? Well doesn't that rather depend upon your assumptions.

There is the old chestnut about those paying IHT loving the government more than their fellow man. Personally I have ideological issues with taxation.

Not paying tax need not be about picking an optimal financial position for me.

Of course some people feel the reverse. Merryn Sommerset Webb believes that we should not chose where we give our money, but leave that choice to the government. Best illustrated by her decision to not use gift aid and encouraging others not to either.

https://www.google.com/search?q=Merryn+ ... s-wiz-serp

As it happens I do have children who I can leave stuff to (charity begins at home), but were that not the case I'd still rather that the money didn't go to the government.

I understand I think, the sentiment behind your comments but I do think that there has to be an input to government taxes from those who can afford it whether we like it or not. Society could not survive otherwise.

Dod

-

Urbandreamer

- Lemon Quarter

- Posts: 3251

- Joined: December 7th, 2016, 9:09 pm

- Has thanked: 368 times

- Been thanked: 1075 times

Re: Keeping drawdown below tax threshold?

Dod, James.

The local Hospice receives nothing from the state. I'd also point out that the public record shows many instances where our government made choices leading to very many deaths and significant injuries. We could debate the virtues of the Iraq war, but the facts are on record. The dodgy dossier was clearly untrue, yet used as a justification.

If we are to talk income tax, then possibly we should talk about the reasons that it was introduced (war), rather than pretending that income tax is the tax known as National Insurance, which was introduced to pay for the health service.

Look, shall I phrase this differently. During the great depression there was someone who ran a number of soup kitchens in the US, Does it matter if Al Capone demanded money and produce by force to provide those soup kitchens? But it's ok for a government to do the same?

As I said, not everyone agrees with me. Some even think that the government only does good.

Make your own choices.

The local Hospice receives nothing from the state. I'd also point out that the public record shows many instances where our government made choices leading to very many deaths and significant injuries. We could debate the virtues of the Iraq war, but the facts are on record. The dodgy dossier was clearly untrue, yet used as a justification.

If we are to talk income tax, then possibly we should talk about the reasons that it was introduced (war), rather than pretending that income tax is the tax known as National Insurance, which was introduced to pay for the health service.

Look, shall I phrase this differently. During the great depression there was someone who ran a number of soup kitchens in the US, Does it matter if Al Capone demanded money and produce by force to provide those soup kitchens? But it's ok for a government to do the same?

As I said, not everyone agrees with me. Some even think that the government only does good.

Make your own choices.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Keeping drawdown below tax threshold?

This is in danger of being off topic, but how could society work with no central government (because that is the consequence of no taxes) We can of course argue about the level of taxes imposed and what the government should or should not be doing on behalf of society but there must be taxes. In any case there is a lot to be said for the idea of those better off helping those who for reasons outside of their control, cannot help themselves.

As it happens I pay about £400 per annum in direct taxes, and that is Income Tax but, like everyone else who lives a normal life, I pay a lot in indirect taxes, VAT, Excise Duty and the like.

In any case, we have no choice but to pay taxes.

Dod

As it happens I pay about £400 per annum in direct taxes, and that is Income Tax but, like everyone else who lives a normal life, I pay a lot in indirect taxes, VAT, Excise Duty and the like.

In any case, we have no choice but to pay taxes.

Dod

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10033 times

Re: Keeping drawdown below tax threshold?

Dod101 wrote:

This is in danger of being off topic, but how could society work with no central government...

https://y.yarn.co/8c1cd55b-1251-4298-9c59-0772d3661afc_text.gif

:O)

Cheers,

Itsallaguess

-

Urbandreamer

- Lemon Quarter

- Posts: 3251

- Joined: December 7th, 2016, 9:09 pm

- Has thanked: 368 times

- Been thanked: 1075 times

Re: Keeping drawdown below tax threshold?

Itsallaguess wrote:Dod101 wrote:

This is in danger of being off topic, but how could society work with no central government...

https://y.yarn.co/8c1cd55b-1251-4298-9c59-0772d3661afc_text.gif

:O)

Cheers,

Itsallaguess

As said, we are very far off topic. But some ideas of how society could function were set out in "The machinery of Freedom" by Milton Friedman's son.

https://www.amazon.co.uk/Machinery-Free ... 112&sr=1-1

If you are interested the author will be paid a small sum if you buy the book, but there is a pirate copy of the second edition available. He provides the pirate copy on his web site to thumb his nose at the pirate (pirating the pirate).

There are in fact many such speculations and some historical examples. This is not really the thread though for such debate. I'll leave it to you to do the research.

Ps, don't forget your ID card when you go and vote. Also off topic, but I will note that there was debate and consultation about ID cards back in the 90's. While researching, you could research that too.

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 9 guests