Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Bonds

-

vand

- Lemon Slice

- Posts: 834

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 193 times

- Been thanked: 392 times

Re: Bonds

Duration mismatching is what caused SVB and other banks to collapse last year. We've seen it before.

Bonds are very simple, and people over-complicate them - the current yield on the note is the return you should expect over the life of that note. If you buy 30yr bonds at 4% you should expect that to return 4% on average over those 30 years. People get themselves into trouble by buying longer duration bonds than their intended holding period, exposing themselves to interest rate risk when they may need to cash in on that investment.

Bonds are very simple, and people over-complicate them - the current yield on the note is the return you should expect over the life of that note. If you buy 30yr bonds at 4% you should expect that to return 4% on average over those 30 years. People get themselves into trouble by buying longer duration bonds than their intended holding period, exposing themselves to interest rate risk when they may need to cash in on that investment.

-

Newroad

- Lemon Quarter

- Posts: 1138

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 356 times

Re: Bonds

Hi GS and Dealtn.

I learn from both your contributions on this and other topics - thanks

On this topic, I think your lenses are fairly easily squared (and compatible)

Both seem reasonable perspectives to consider.

Regards, Newroad

I learn from both your contributions on this and other topics - thanks

On this topic, I think your lenses are fairly easily squared (and compatible)

- GS's lens looks at (options to) match duration to need

Dealtn's lens looks at the propensity of need to change (and consequently, duration to move to some degree of mismatch)

Both seem reasonable perspectives to consider.

Regards, Newroad

-

dealtn

- Lemon Half

- Posts: 6142

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 449 times

- Been thanked: 2370 times

Re: Bonds

GoSeigen wrote:dealtn wrote:

This is Bond 101 so apologies if it's obvious to anyone, but I'm struggling to see how dealtn is taking this on board.

GS

I speak of someone that worked in the Fixed Income markets for a quarter of a century.

Unfortunately many people don't do as you suggest. They don't recognise they have a 10 year need and consider the choices of a 10 year gilt, and an alternative of a barbell of 2/3 cash and 1/3 30 year gilt.

Sadly in the real world many see bonds/gilts as a single asset class, and within it look for the most attractive return - often through lack of knowledge.

It is far too common to see people invest (close to) 100% (of their bond allocation) at the long end - which worked for many years, only to suffer from the twin routs of inflation and the price collapse. The income on the way was minimal. Being human, facing an investment choice that is now 50% loss, they act in the same way that many with equity or alternative assets, often take the loss - get out when they can etc.

Far too many take the human and emotional "behavioural" choice, rather than sit out the next 10-20 years.

Very few investors, retail or institutional, reach Bond 101, let alone go past it.

Then you have the other scenarios of people with a 30 year duration that get divorced, get a medical diagnosis etc. who - through no fault of their own - might now need a duration of 5 years. Similarly some have shorter durations that get married, or children/grandchildren and have a duration extension that was unanticipated. Durations aren't fixed, and with not just long durations available in the bond market, but significant price movements in both nominal and real terms too, these changes can be massive.

It is far too common for lazy cliches that Bonds are "safe" and Equities (and other asset classes) to be "risky". In the real world Bonds also have "risk".

-

GoSeigen

- Lemon Quarter

- Posts: 4520

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1642 times

- Been thanked: 1649 times

Re: Bonds

dealtn wrote:GoSeigen wrote:

I speak of someone that worked in the Fixed Income markets for a quarter of a century.

Unfortunately many people don't do as you suggest. They don't recognise they have a 10 year need and consider the choices of a 10 year gilt, and an alternative of a barbell of 2/3 cash and 1/3 30 year gilt.

Sadly in the real world many see bonds/gilts as a single asset class, and within it look for the most attractive return - often through lack of knowledge.

It is far too common to see people invest (close to) 100% (of their bond allocation) at the long end - which worked for many years, only to suffer from the twin routs of inflation and the price collapse. The income on the way was minimal. Being human, facing an investment choice that is now 50% loss, they act in the same way that many with equity or alternative assets, often take the loss - get out when they can etc.

Far too many take the human and emotional "behavioural" choice, rather than sit out the next 10-20 years.

Very few investors, retail or institutional, reach Bond 101, let alone go past it.

Then you have the other scenarios of people with a 30 year duration that get divorced, get a medical diagnosis etc. who - through no fault of their own - might now need a duration of 5 years. Similarly some have shorter durations that get married, or children/grandchildren and have a duration extension that was unanticipated. Durations aren't fixed, and with not just long durations available in the bond market, but significant price movements in both nominal and real terms too, these changes can be massive.

It is far too common for lazy cliches that Bonds are "safe" and Equities (and other asset classes) to be "risky". In the real world Bonds also have "risk".

I couldn't disagree with any of that and I doubt JohnW would either. I take it you and he were at cross purposes ^^^ back there.

It is far too common to see people invest (close to) 100% (of their bond allocation) at the long end -

I was this guy for some 10-12 years, the last of my long gilts disappearing when the Treasury bought in the undated consols and war bond, or soon after. I can't say I was disappointed to have my long gilts taken off me at 2.5% yield.

GS

-

Alaric

- Lemon Half

- Posts: 6147

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 21 times

- Been thanked: 1431 times

Re: Bonds

GoSeigen wrote:, the last of my long gilts disappearing when the Treasury bought in the undated consols and war bond, or soon after. I can't say I was disappointed to have my long gilts taken off me at 2.5% yield.

After QE drove Gilt yields down to next to nothing, the undateds became anomalies. They couldn't go too far over par because of the possibility or even high probability of beimg called. Equally they couldn't drop that far below par when the coupons were attractive in yield terms against cash.

Back in the 1970s I think there had been a period when the yield on War Loan was about the same as the price.

-

Lootman

- The full Lemon

- Posts: 19368

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6923 times

Re: Bonds

Alaric wrote:GoSeigen wrote:the last of my long gilts disappearing when the Treasury bought in the undated consols and war bond, or soon after. I can't say I was disappointed to have my long gilts taken off me at 2.5% yield.

After QE drove Gilt yields down to next to nothing, the undateds became anomalies. They couldn't go too far over par because of the possibility or even high probability of being called. Equally they couldn't drop that far below par when the coupons were attractive in yield terms against cash.

Back in the 1970s I think there had been a period when the yield on War Loan was about the same as the price.

The problem with bonds is that they do not grow, but merely oscillate around a fixed point. So the longer your time horizon, the less sense it makes to have anything in bonds. If you really want to balance out equities then shares plus cash can do that.

And for the last 15 years, despite rates going to zero or less, bond investors have still done worse than equity investors, as they nearly always do. Just look at how bond funds have done, it is quite pitiful.

You can trade bonds short-term and you might get lucky if rates decline, usually due to a major and unpredictable geopolitical event, although even then those bonds had better be in the right currency, which typically is not sterling. And from the right issuer. But why take all that risk and expend all that effort, when equities give you 8% to 10% annually for the last century?

-

GoSeigen

- Lemon Quarter

- Posts: 4520

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1642 times

- Been thanked: 1649 times

Re: Bonds

Alaric wrote:GoSeigen wrote:, the last of my long gilts disappearing when the Treasury bought in the undated consols and war bond, or soon after. I can't say I was disappointed to have my long gilts taken off me at 2.5% yield.

After QE drove Gilt yields down to next to nothing, the undateds became anomalies. They couldn't go too far over par because of the possibility or even high probability of beimg called. Equally they couldn't drop that far below par when the coupons were attractive in yield terms against cash.

Back in the 1970s I think there had been a period when the yield on War Loan was about the same as the price.

Gilt yields down to nothing drove QE.

EOM

GS

Re: Bonds

GeoffF100 wrote:Gpop321 wrote:Our only inidications of how the markets might weather that come from how they weathered the rather hellish previous 100 years. If we don't use that as some sort of guide then we are in effect guessing/hoping, are we not?

Why pick 100 years? Why not 200? Why pick one market and not another? We are guessing/hoping whatever we do.

Indeed, and of course 200 years is better, and 500 even better.

It's all about edging the "guess" slider bar away from "wild" and towards "informed".

-

Newroad

- Lemon Quarter

- Posts: 1138

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 356 times

Re: Bonds

Hi All.

Quick question on duration. Imagine that a given person

In broad terms and all things being equal, to match, do they need a duration of 20 years (75 being the average of 60-90: 75-55=20) either actual or synthetic, e.g. 2/3 30 year gilts, 1/3 cash?

Regards, Newroad

Quick question on duration. Imagine that a given person

- Is currently 55

Plans to retire at 60

Expects/hopes to live to 90

In broad terms and all things being equal, to match, do they need a duration of 20 years (75 being the average of 60-90: 75-55=20) either actual or synthetic, e.g. 2/3 30 year gilts, 1/3 cash?

Regards, Newroad

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Bonds

Gpop321 wrote:GeoffF100 wrote:Why pick 100 years? Why not 200? Why pick one market and not another? We are guessing/hoping whatever we do.

Indeed, and of course 200 years is better, and 500 even better.

It's all about edging the "guess" slider bar away from "wild" and towards "informed".

200 years is available for the US market, but people nearly always choose the last 100 years which is more favourable for equities. We do not have 500 years of stock market data anywhere, but economic growth was much slower before the industrial revolution. Climate change alone will force profound economic changes. People nearly always ignore the markets that had really serious misadventures.

-

Lootman

- The full Lemon

- Posts: 19368

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6923 times

Re: Bonds

GeoffF100 wrote:Gpop321 wrote:200 years is better, and 500 even better.

It's all about edging the "guess" slider bar away from "wild" and towards "informed".

200 years is available for the US market, but people nearly always choose the last 100 years which is more favourable for equities. We do not have 500 years of stock market data anywhere, but economic growth was much slower before the industrial revolution. Climate change alone will force profound economic changes. People nearly always ignore the markets that had really serious misadventures.

Also a lot of markets have not operated continuously for even 100 years. In fact it may only be the US and UK markets which have seen continual operation over that kind of time period. Wars, revolutions, nations merging and demerging, being colonised or gaining independence, and so on.

The 100 year records at least cover a major world war and the great depression. If equities hold up over that kind of time period, and they do, then that is surely good enough. The kind of catalysmic event that would massively disrupt equity markets would probably destroy most other forms of wealth as well, and so should not really be factored in.

In fact even 50 years is enough to show that equities do far better than bonds, as you would surely expect.

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Bonds

Newroad wrote:Quick question on duration. Imagine that a given personIs currently 55

Plans to retire at 60

Expects/hopes to live to 90

In broad terms and all things being equal, to match, do they need a duration of 20 years (75 being the average of 60-90: 75-55=20) either actual or synthetic, e.g. 2/3 30 year gilts, 1/3 cash?

Currently, there is little extra reward for 20 years over 10 years, and almost nothing extra beyond that. There is not much point in going for a long duration unless you fear big reductions in interest rates.

The global aggregate bond fund VAGP has a duration of 6.5 years and a YTM of 4.4%. The gilt fund VGOV has a duration of 9.4 years and a YTM of 4.5%. Both have the same credit quality. Most passive investors buy a multi-asset fund that uses similar bond funds to those. The passive investment philosophy is to "buy the haystack" rather than look for the "needle in the haystack", as Bogle put it. Nothing about duration matching there. Nonetheless, it would not be sensible to buy one of those funds if you have a very short timescale.

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Bonds

Lootman wrote:In fact even 50 years is enough to show that equities do far better than bonds, as you would surely expect.

That was not always true even for the US market, where we now have reliable numbers dating back to 1820. Bonds have out performed equities for several decades in a row. You can say that times have changed, but times will also change in the future.

-

Lootman

- The full Lemon

- Posts: 19368

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6923 times

Re: Bonds

GeoffF100 wrote:Newroad wrote:Quick question on duration. Imagine that a given personIs currently 55

Plans to retire at 60

Expects/hopes to live to 90

In broad terms and all things being equal, to match, do they need a duration of 20 years (75 being the average of 60-90: 75-55=20) either actual or synthetic, e.g. 2/3 30 year gilts, 1/3 cash?

Currently, there is little extra reward for 20 years over 10 years, and almost nothing extra beyond that. There is not much point in going for a long duration unless you fear big reductions in interest rates.

The global aggregate bond fund VAGP has a duration of 6.5 years and a YTM of 4.4%. The gilt fund VGOV has a duration of 9.4 years and a YTM of 4.5%. Both have the same credit quality. Most passive investors buy a multi-asset fund that ctober 2023. uses similar bond funds to those. The passive investment philosophy is to "buy the haystack" rather than look for the "needle in the haystack", as Bogle put it. Nothing about duration matching there. Nonetheless, it would not be sensible to buy one of those funds if you have a very short timescale.

If you want a sense of the risk involved at the long end of the yield curve take a look at a 5 year chart of the iShares US Treasury long bond (20 years plus) ETF. Ticker is TLT.

Its price went from around 170 in July 2020 to around 83 in October 2023. You lost more than half your money in a little over 3 years. And bonds are considered "safe"?

Re: Bonds

GeoffF100 wrote:Gpop321 wrote:Indeed, and of course 200 years is better, and 500 even better.

It's all about edging the "guess" slider bar away from "wild" and towards "informed".

200 years is available for the US market, but people nearly always choose the last 100 years which is more favourable for equities. We do not have 500 years of stock market data anywhere, but economic growth was much slower before the industrial revolution. Climate change alone will force profound economic changes. People nearly always ignore the markets that had really serious misadventures.

Yeah I was being facetious about 500 years - my point being the longer lens, the better.

Fair point about being selective and focussing on the last 100 years tho.

Climate change is a disaster, but it might actually drive positive - or even era changing - market evolution (new tech to combat CC, or space tech to accelerate colonisation beyond earth)

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Bonds

Lootman wrote:[If you want a sense of the risk involved at the long end of the yield curve take a look at a 5 year chart of the iShares US Treasury long bond (20 years plus) ETF. Ticker is TLT.

Its price went from around 170 in July 2020 to around 83 in October 2023. You lost more than half your money in a little over 3 years. And bonds are considered "safe"?

Why would people buy that? Not for liability matching. They may be taking a punt on long term interest rates, but that is not low risk. Alternatively, they may be believers in something like the golden butterfly:

https://portfoliocharts.com/portfolios/ ... allocation

The faithful may believe that is low risk, others may differ. I would likely rattle on about data mining. Patterns that occurred by chance it the past are not likely to be repeated in the future... Rather them than me.

-

Lootman

- The full Lemon

- Posts: 19368

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 657 times

- Been thanked: 6923 times

Re: Bonds

GeoffF100 wrote:Lootman wrote:In fact even 50 years is enough to show that equities do far better than bonds, as you would surely expect.

That was not always true even for the US market, where we now have reliable numbers dating back to 1820. Bonds have out performed equities for several decades in a row. You can say that times have changed, but times will also change in the future.

You can probably find a time period that makes any asset class look good. But I assume there that you are starting around 1980 when yields and inflation peaked. And of course bonds had been totally wiped out in the previous decade or so.

So yes, that 15.5% 1998 gilt I bought in the 1980s worked out great. But how many people rode bond yields to zero and then got out at exactly the right time before losing half the value? You don't have to be that lucky with equities.

-

Newroad

- Lemon Quarter

- Posts: 1138

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 356 times

Re: Bonds

Hi Lootman and GeoffF100.

You both answered a different (theoretic) question than was asked - in fairness, I expected GS or dealtn to be the most likely to answer.

[GeoffF100] You may well know this, but my family's actual bond holdings are in

of which only BIPS is not passive.

[Lootman] I'm not specifically interested in long US bonds. Rather, I'm trying to confirm my understanding of matching duration to retirement in various forms. People talk about "matching" duration - what I was more specifically on about was whether it made sense to match duration to the start of retirement vs the whole/average of expected retirement.

Regards, Newroad

You both answered a different (theoretic) question than was asked - in fairness, I expected GS or dealtn to be the most likely to answer.

[GeoffF100] You may well know this, but my family's actual bond holdings are in

- ISA: AGBP, EMHG & GHYG

SIPP: VAGP & BIPS

JISA: VAGP & BIPS

of which only BIPS is not passive.

[Lootman] I'm not specifically interested in long US bonds. Rather, I'm trying to confirm my understanding of matching duration to retirement in various forms. People talk about "matching" duration - what I was more specifically on about was whether it made sense to match duration to the start of retirement vs the whole/average of expected retirement.

Regards, Newroad

-

vand

- Lemon Slice

- Posts: 834

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 193 times

- Been thanked: 392 times

Re: Bonds

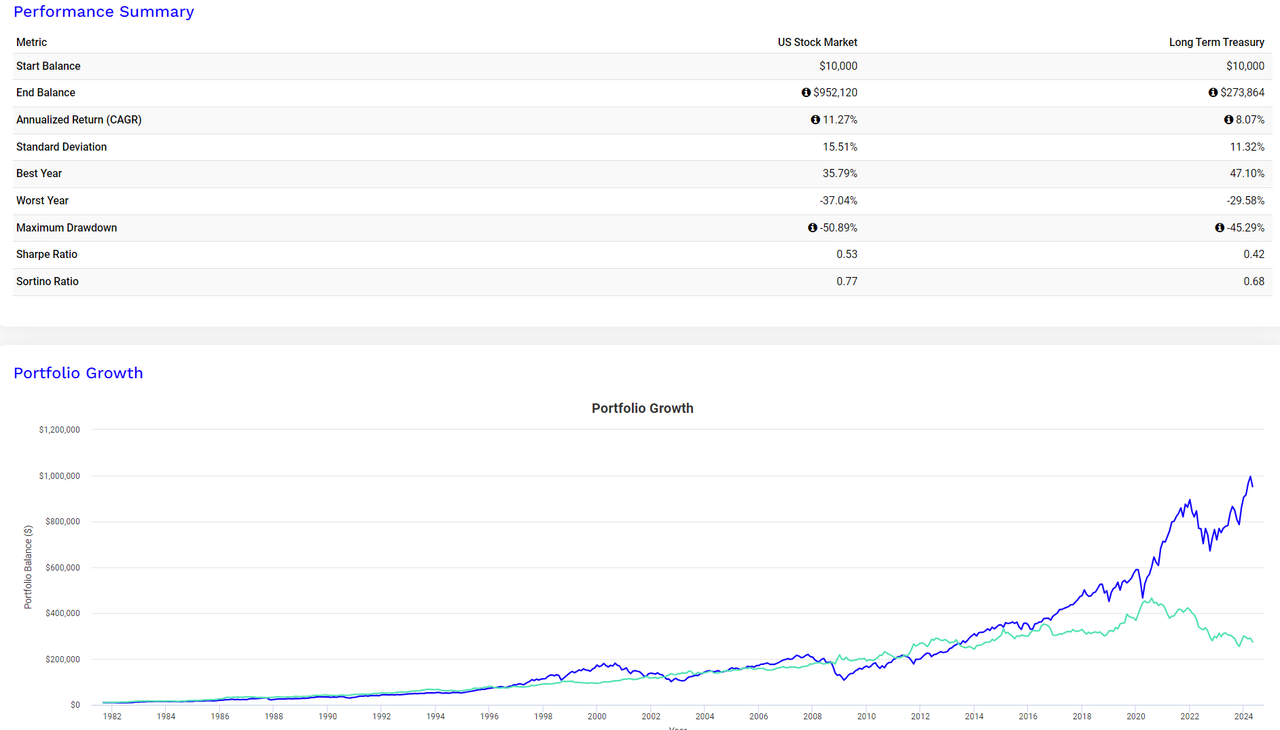

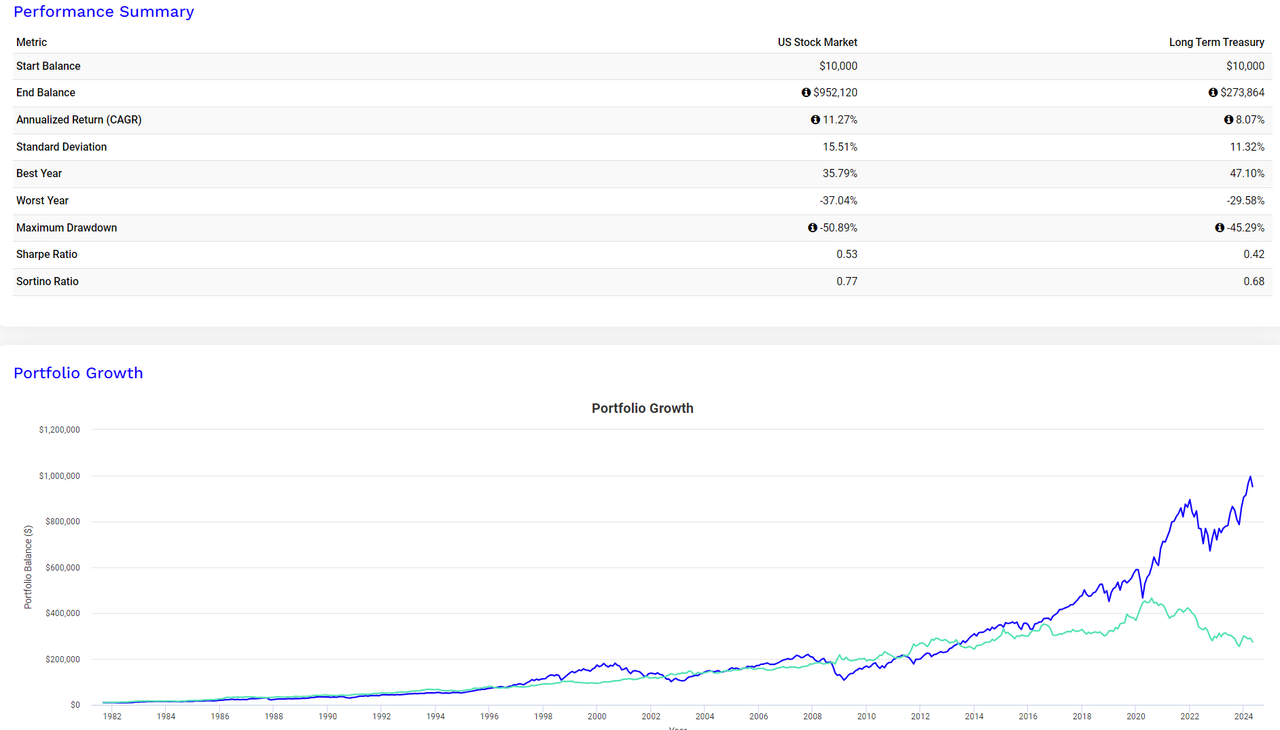

If you want a crazy stat, consider that in the 43 years between Sept-1981 to Apr-2024 the stock market has returned 3.5 times the return of long bonds - 11.27% vs 8.07%. Nothing that unexpect about that.. except that entire outperformance has only happened since March 2020, up to which time both were neck-to-neck:

(source, my capture from portfoliovisualiser)

Yes, stocks should return more than bonds over the long run, but it shows you that if you pick favourable/unfavourable startdates for one or the other, the "long run" trend can take 30 or 40 years to exert itself.

(source, my capture from portfoliovisualiser)

Yes, stocks should return more than bonds over the long run, but it shows you that if you pick favourable/unfavourable startdates for one or the other, the "long run" trend can take 30 or 40 years to exert itself.

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Bonds

Lootman wrote:GeoffF100 wrote:That was not always true even for the US market, where we now have reliable numbers dating back to 1820. Bonds have out performed equities for several decades in a row. You can say that times have changed, but times will also change in the future.

You can probably find a time period that makes any asset class look good. But I assume there that you are starting around 1980 when yields and inflation peaked. And of course bonds had been totally wiped out in the previous decade or so.

So yes, that 15.5% 1998 gilt I bought in the 1980s worked out great. But how many people rode bond yields to zero and then got out at exactly the right time before losing half the value? You don't have to be that lucky with equities.

No, the worst periods for US equities versus bonds were in the nineteenth century. You will have to look at McQuarrie's statistics. Here is a summary "Stocks for the Long Run? Sometimes Yes. Sometimes No.":

https://www.edwardfmcquarrie.com/?p=579

"Intervals where bonds beat stocks have recurred across centuries and countries. Long periods where stocks returned little, nothing, or less than nothing have also recurred."

Who is online

Users browsing this forum: No registered users and 5 guests